Prohibitory sea freights, all the problems for Italian exports

First the pandemic and then the war: sea freight rates (still) increase and Made in Italy pays the price. Here is how much it costs to move a container from one part of the world to another and how much the economy of the sea is worth for our country

"Italian products are out of the market for the price of transport".

Lorenzo Zurino, president of the Italian Export Forum, denounces the situation against Made in Italy on Sole24Ore .

The increase in sea freight rates, i.e. the prices to be paid to transport a container from one part of the world to the other, ranges from 400 to 500% for the Asian routes and from 30 to 40% for the North-South ones and to pay the consequences are, among others, the Italian products that are replaced by cheaper ones.

THE ADVENT OF WAR

The surge in sea freight rates, which began with the pandemic and is now exacerbated by the war in Ukraine, was destined for normalization in the second half of 2022, according to some large shipping companies and companies, according to the economic daily. Europe no longer bodes well, especially the Italian freight forwarders. Zurino himself predicts that with the war there is "the risk that speculations will increase".

"In these days we are all, rightly, attentive to the war that has led to a deadweight loss, in the export of Made in Italy, of 7.7 billion in Russia and about 3.5 billion in Ukraine", said the entrepreneur, who added that "however, it must also be noted that the cost of container freight, which began before the conflict, is so high that today our products are out of the market".

HOW MUCH SEA FREIGHT HAVE INCREASED

The prices of containers, according to Sole24Ore , have in fact increased from 10 to 19 thousand dollars for Australia and from 2 to 8 thousand dollars for the United States. Even the World Container Index by Drewry, which measures the trend of costs incurred for a freight, has long indicated the record increases that follow one another year after year.

"I had a very large customer in Australia – says Zurino – who bought 100% Italian olive oil, and who now no longer buys it because the cost of the freight rate exceeded 19 thousand euros on the Italy-Australia route, while in 2021 was 10 thousand ".

“Similarly – he continues – the installment that was paid from Italy to New York, which ranged from 1,750 to 2,000 euros per container, today has risen 7,400 to 8,000 euros to reach 8,400 euros now, in the peak season. Among other things, you pay a lot and it is not certain that the transport is direct ".

VERY DEARLY AND LATE TRANSPORT

Yes, because as Zurino explained, in addition to strong increases, exports are also affected by serious delays that discourage foreign customers. "The transit time, which previously lasted 20 days, can reach peaks of 47. In short, you pay quadruple and you get even worse service: in addition to the insult to injury", complains Zurino who is founder and CEO of The One Company. first food & beverage exporter in the United States, Israel and Australia.

The cause of this new inconvenience, according to the entrepreneur, is due to the fact that "many ships have been diverted from the Mediterranean and used on the most profitable routes such as China-US", while on the EU-US and EU-Australia note Il Sole24Ore , the companies have raised the freight rates.

THE DATA OF SRM-INTESA SANPAOLO

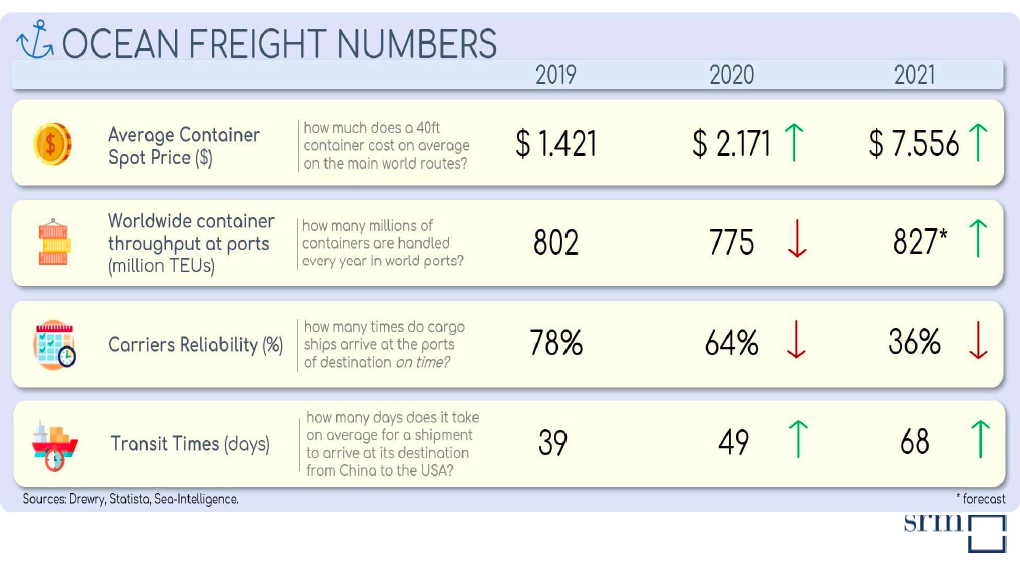

The data processed by Srm, the Study Center connected to the Intesa Sanpaolo group, also show how much container prices and delivery times have changed (for the worse) from 2019 to 2021:

If in 2019 it took 39 days for a container ship to arrive from China to the United States, in 2020 the journey time increased to 49 days and in 2021 to 68.

Then moving a container, in 2019, cost an average of 1,421 dollars, 2,171 in 2020 and 7,556 in 2021.

THE EXAMPLE OF SUEZ AND THE DATA ON THE IMPORT-EXPORT OF ITALY

The Ever Given episode, the Srm report underlines, is significant for understanding how weak the logistics system is in general: 6 months of inconvenience for 6 days of blocking of the container ship in the Suez Canal.

Over 80 billion of Italian imports and exports pass through the sea every year, about 10% of our interchange, the study reports, and 7 of the 10 largest Italian maritime partners are beyond Suez or in proximity. For China, on the other hand, 6 of its 10 strategic partners are not located beyond the gate.

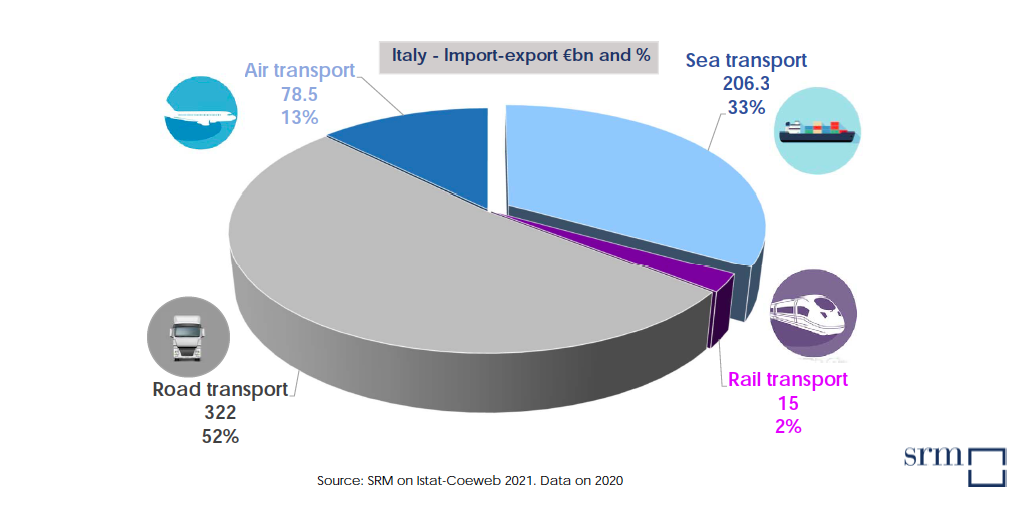

According to Srm, 52% of our country's import-export takes place by land (322 billion euros), 33% by sea (206.3 billion), 13% by air (78.5 billion ) and 2% through the railway (15 billion).

THE DATA OF MARITIME TRANSPORT IN ITALY

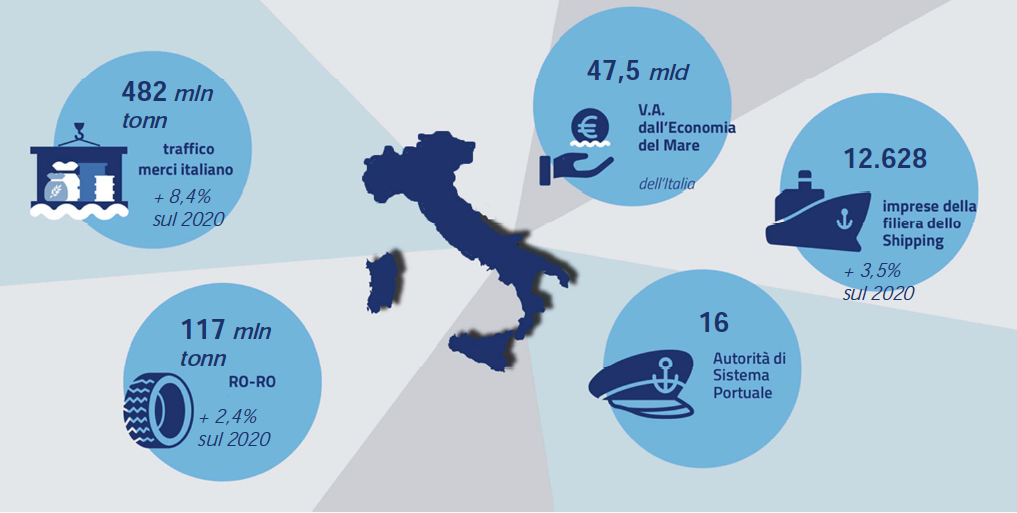

The report also reports that the Italian freight traffic of the maritime economy increased by 8.4% on 2020 (482 million tons), as well as the companies of the shipping sector recorded a + 3.5% on 2020 (12.628 ), and the added value of the maritime economy is equal to 47.5 billion euros.

WHAT CAN BE DONE

For Zurino, Italy could intervene on the increase in sea freight rates, for example, speaking to the Competition Authority "to understand if there is speculation on the part of the large shipping companies […] clarify whether the increase in freight rates is dictated by an increase in actual costs or if there is a willingness on the part of the companies that transport to earn more ".

According to the entrepreneur, moreover, the issue should be addressed in Brussels because "there is no longer any reason to further extend the possibility granted by the EU to shipping companies to join temporary business consortia, to lower fixed costs and have advantageous taxation ".

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/noli-marittimi-proibitivi-la-richiesta-di-mayday-export-italiano/ on Mon, 28 Mar 2022 09:55:19 +0000.