Food Delivery in Italy: who goes up, who goes down

Numbers, comparisons and scenarios for the accounts of the main food delivery companies in Italy (Deliveoo, Just Eat and Glovo)

The pandemic effect on the Italian food delivery market continued last year.

In 2021 – according to the financial statements filed – Deliveroo recorded an increase in revenue of around 90% compared to 2020. Revenues from sales and services amounted to 123 million euros, + 75% the previous year.

A growth that is about double the growth of Just Eat (revenues up 43% to 110 million) and higher than that of Glovo (+63% to 113 million). However, for the latter the red is also widening (in 2021 the company recorded a loss of 40 million euros compared to 16 million in the previous year).

The three big names in food delivery together had a turnover of over 350 million euros in 2021. All this in a food delivery market that has proven to be the most dynamic of e-commerce. According to the latest data from the B2C eCommerce Observatory of the Milan Polytechnic, the sector has reached 1.5 billion euros and a growth of +59% on 2020.

According to Statista data, in 2021 Deliveroo and Just Eat were the most popular food delivery platforms in Italy. Mobile users downloaded the apps of the two food delivery services approximately 1.9 and 1.7 million times, respectively. With around 804,400 downloads, Uber Eats came in third.

All the details.

THE REVENUES OF FOOD DELIVERY PLAYERS IN ITALY GROW

Just Eat, a company founded in 2000 in Denmark with headquarters in London, present in Italy since 2011 with coverage throughout the country, recorded revenues of 110 million euros (up from 73 million in 2020).

Deliveroo Italy Srl, a food delivery company controlled by the British Roofoods Ltd, closed 2021 with solid revenue growth (from 70 million euros in 2020 to 134 million last year) following the geographical expansion and the selection and of the widening of the choice of menus, reads the balance sheet report.

Glovo also closed last year with an increase in turnover (from 70 million in 2020 to 113 million euros in 2021). At the beginning of the year Glovo was acquired by the German Delivery Hero which controls 83.2% of the shares. Delivery Hero has undertaken to provide a loan of 250 million euros, of which 125 million disbursed in April 2022.

DIFFERENT ECONOMIC RESULTS (RED FOR GLOVO)

Positive results for Deliveroo and Just East last year. The first closed the financial statements as at 31 December 2021 with a profit for the year of 1.9 million euros. A positive result compared to the loss recorded in 2020 of 292 thousand euros. Also for Just Eat the result is positive, but far lower than that of Deliveroo: profit equal to 544 thousand euros in 2021, a marked improvement compared to the loss of 15.6 million euros in 2020.

Negative result for Glovo which instead closed the year with a loss (40 million euros in 2021, up compared to the result (again with a loss) of 16 million in 2020). The increase in costs weighs on the company.

STAFF ESCAPE FROM GLOVO WHILE JUST EAT HIRES

In 2021 Glovo had 227 employees, with a turnover of 27.05%, of which 45% voluntary resignations. They also decreased for Deliveroo Italy Srl: from 160 employees in 2020 to 134 in 2021. Employee severance indemnities amounted to Euro 703,986 as at 31 December 2021 (Euro 564,109 in the previous year) and represent the payable to employees accrued since 31 December 2015 reads Deliveroo's financial report.

Reverse course for Just Eat: the company's headcount increased by 44% last year from 134 employees in 2020 to 178 in 2021.

PERSONNEL COSTS FOR JUST EAT INCREASE

Even if personnel costs increase for Just Eat: from 8 million in 2020 to a total of 12 million euros in 2021. They also double for Glovo: the company recorded a total personnel costs of 8.6 million euros in 2021 compared to 4 million in the previous year.

Instead, Deliveroo manages to save money: the company recorded a total personnel costs of 6 million euros in 2021 compared to 7.3 million euros in 2020.

DELIVEROO SURPASSES JUST EAT IN MARKET SHARE

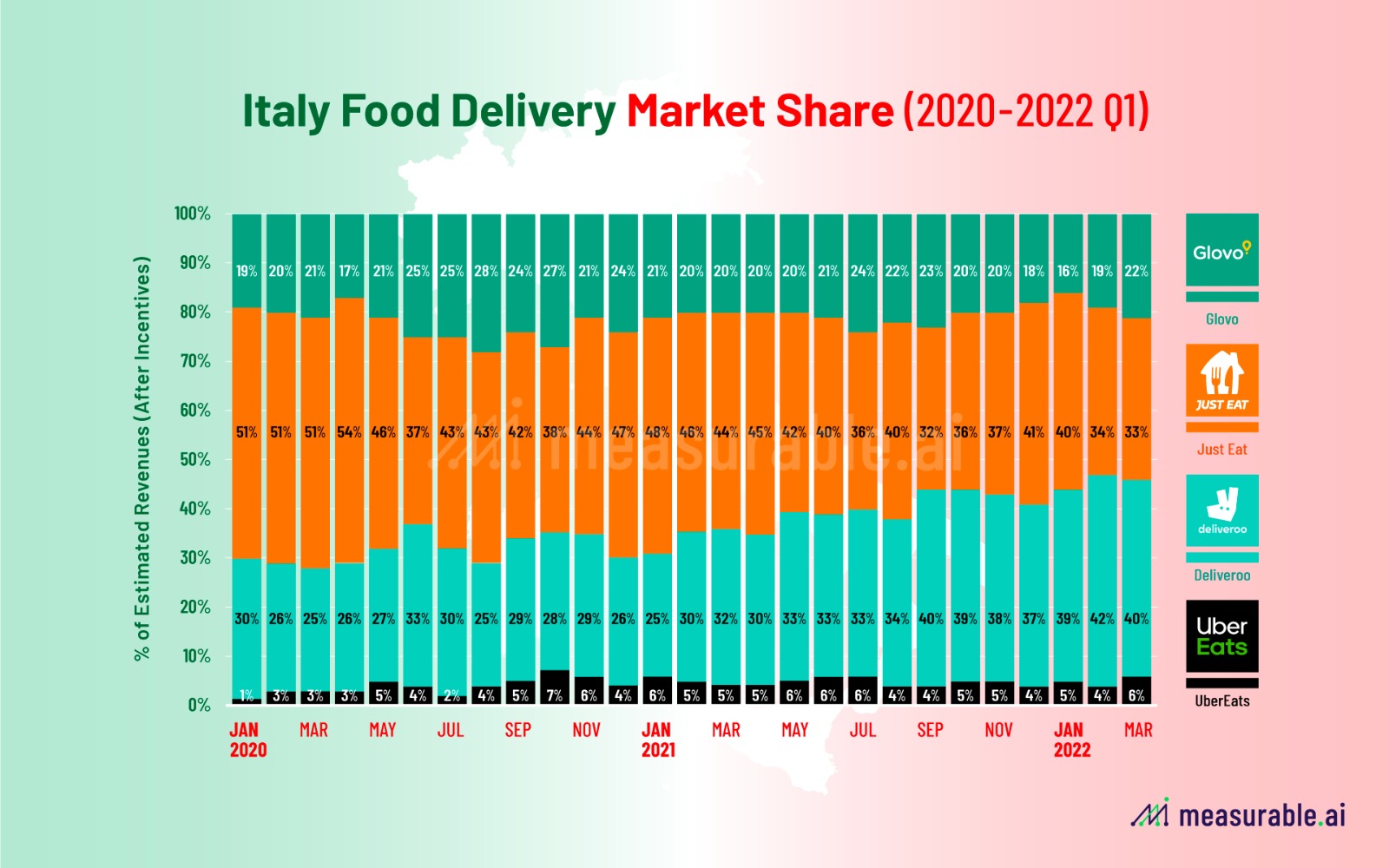

Finally, as regards the market share in Italy, that of Just Eat has progressively decreased over the last three years, reaching 33% last March, positioning itself behind Deliveroo (which has maintained a growth trend of up to 40%). In third place we find Glovo almost stable at 22%. Bottom of the Uber Eats ranking (6%).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia-on-demand/il-food-delivery-in-italia-chi-sale-chi-scende/ on Fri, 25 Nov 2022 09:36:24 +0000.