Here are the taxes (not) paid by Facebook, Google, Amazon, Apple, Microsoft and Netflix

Facebook, Google, Amazon, Apple, Microsoft and Netflix have implemented strategies that erode the tax base, paying less and less taxes in America, Italy and the rest of the world. Agcom report

Agcom takes into account the impact of the Coronavirus in the telecommunications sector: the negative effect produced by the epidemic in the sector is estimated to be between 4 and 6 billion for Italy. Still little money comes from the turnover of big techs (which however do not pay adequate taxes even to America) and digital inequalities are different.

Here are some aspects of the in-depth analysis of the Communications Guarantee Authority, “Communications in 2020”.

THE TAXES OF BIG TECH IN AMERICA

Let's start with one of the most discussed topics of the moment: the tax burden on big techs. According to the Agcom report, “on an international level it has been estimated that six of the main digital platforms in the world, in ten years, have paid a total of only 54% of the taxes they should have paid to the American administration”.

THE FAIR TAX MARK STUDIO

Agcom's words refer to a study carried out in December 2019 by Fair Tax Mark, which analyzes the fiscal conduct over a decade (2010-2019) of the American Facebook, Google, Amazon, Apple, Microsoft and Netflix. Result? All six companies implemented a policy that eroded the tax base.

“The taxes paid were systematically lower than those that would have arisen if they had been calculated on the basis of the theoretical tax rates in force at the time. The effective average tax rate, in fact, was only 16.2%, compared to the theoretical one of the USA, which on average was 28%. Not only that, the taxes paid also turned out to be much lower than those that should have been paid if calculated at the average annual rate of 23.7% of other companies in the Oecd countries ", writes Agcom on data from the Fair study. Tax Mark.

TAXES PAID IN ITALY

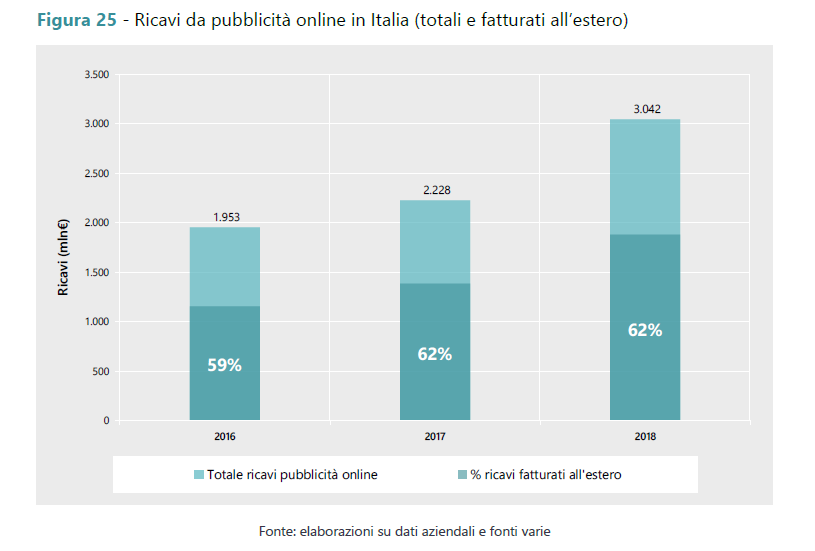

Even in Italy the tech giants pay less than they should. If it is true, as Agcom writes, that in the sector it is "worth highlighting the growing importance of revenue from advertising sales as the main source of financing for the media sector and in particular of online advertising revenue which is now the leading advertising source, far exceeding 3 billion euros per year ”, it is also true that only a small part of the services provided in Italy are billed in our country.

“In the last 3 years, about 60% of online services have been billed by foreign companies, subtracting revenues that did not contribute to the formation of taxable income in Italy for a total of € 4.4 billion”, the Authority specifies.

THE IMPACT OF COVID

The authority, for 2020, forecasts an overall value of the communications sector that could fall below 50 billion euros at the end of 2020, with a loss compared to 2019 from 3 to 5 billion, corresponding to a change between -6% and -10%.

"Looking at what could have been the overall trend of the communications system in 2020 in the absence of the economic event, the negative effect produced by the epidemic is estimated at between 4 and 6 billion", specifies Agcom.

DIGITAL INEQUALITIES

Covid has not only brought in less revenue. The lockdown also brought out the country's digital inequalities. One figure above all: 12.7% of students did not use distance learning during the emergency linked to the coronavirus.

THE COVERAGE

The low demand for digital services should also be underlined. "In the face of territorial coverage levels that potentially allow 88.9% of Italian families to access internet services with speeds greater than or equal to 30 Mbps, only 37.2% of them actually have such a connection", writes AGCOM.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-le-tasse-non-pagate-da-facebook-google-amazon-apple-microsoft-e-netflix/ on Sun, 16 Aug 2020 04:47:07 +0000.