The great successes of the Euro and of the pro-European governments: evolution of real wages in Italy and in Europe

It is useless to deny it: in the last 25 years, since the Prodi governments of the nineties, there has been a succession of pro-European or hyper-European governments. The only very brief exception, in 2018-19, was immediately rendered inert by threats from Brussels, those which led the deficit to fall from 2.40% to 2.04%, as if 0.36% would change anything, if not show submission to the Commission.

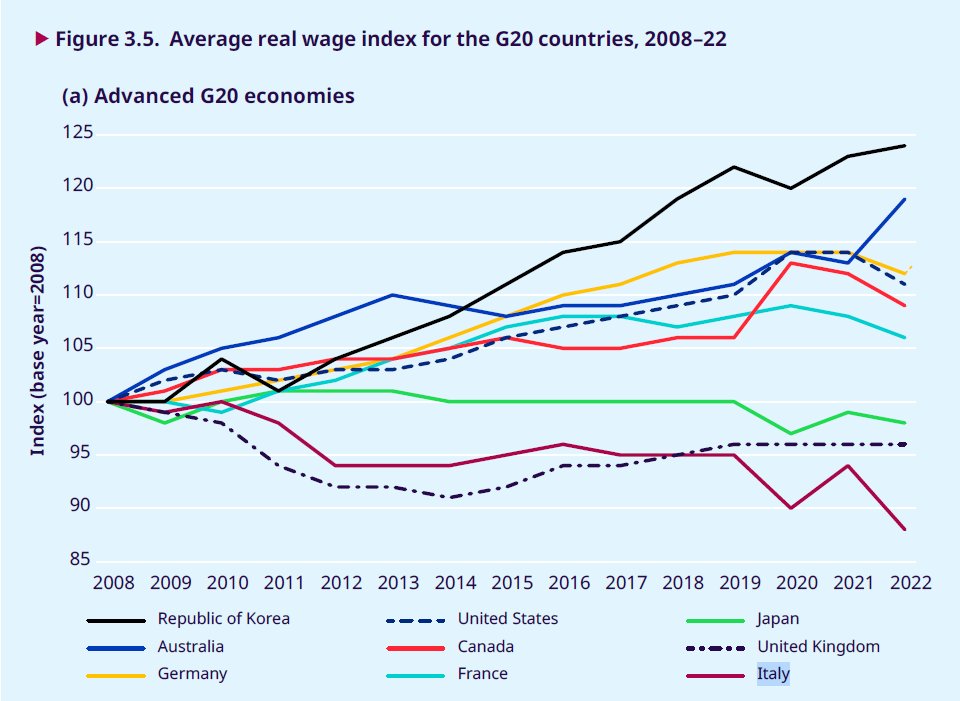

What has this quarter century of blind fidelity brought? Let's see in the following graph the trend of the average real wages of the G20 countries from 2008 to 2022

Italy has been the loser for the last 14 years, from the Great Financial Crisis, to that of the European Debt, to that of Covid. Or rather, the big losers were the Italians, its workers: probably someone has profits, and very well, like the big bureaucrats, the subsidized entrepreneurs, the bad teachers who live only on intellectual income. But the real, normal Italians, those who work and who do business, have been the losers.

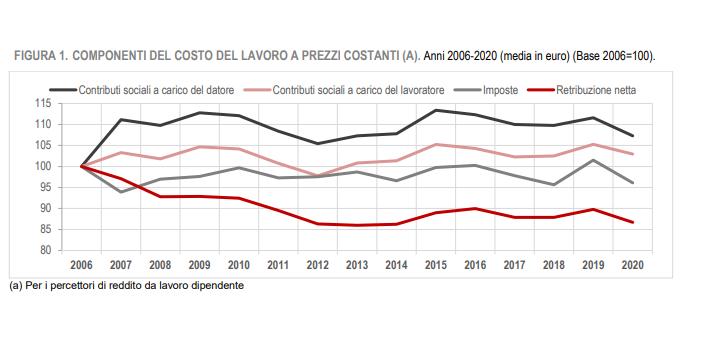

Among other things, the feeling of the workers was certainly even worse than what was seen above because the net salary, the one received, dropped even more, due to an increase in social security contributions, as this ISTAT graph shows.

The Euro and the EU have been a huge anchor sinking the well-being of our citizens. South Korea, a country outside of major global coalitions, with a population slightly smaller than ours and a tiny territory, is the big winner and is now the new independent world production hub, so much so that it exports tanks to the EU itself. Yet on TV they talk to you about "Diktat of the Commission" and "PNRR". As long as we believe we will not escape.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The great successes of the Euro and of the pro-European governments: evolution of real wages in Italy and in Europe comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/i-grandi-successi-delleuro-e-dei-governi-europeisti-evoluzione-degli-stipendi-reali-in-italia-e-in-europa/ on Wed, 21 Dec 2022 21:09:42 +0000.