The dollar is still the problem of the world. China attacks the US currency in its moment of major dominance

A very clear editorial was published in the Global Times, the official organ of the Beijing government, complete with the editorial signature: " The strong dollar cannot be the sharp blade with which to cut the world ".

The day before the Fed's decision to send US rates through the roof again, China accuses the US of using the dollar as a tool to turn its internal problems on to the rest of the world, causing a global slowdown to cure the stars and stripes economy alone. : " A super strong dollar and the collapse of other currencies will alleviate, to some extent, the searing inflation of the US economy, but the world will have to pay the consequences, as is often said" when the United States is sick, the world she has to take the pill ”. The resulting severe inflation, economic recession and other problems have already appeared on a large scale in many countries. Thirty-six currencies around the world have lost at least one-tenth of their value this year, with the Sri Lankan rupee and Argentine peso falling by more than 20% since the dollar strengthened ”.

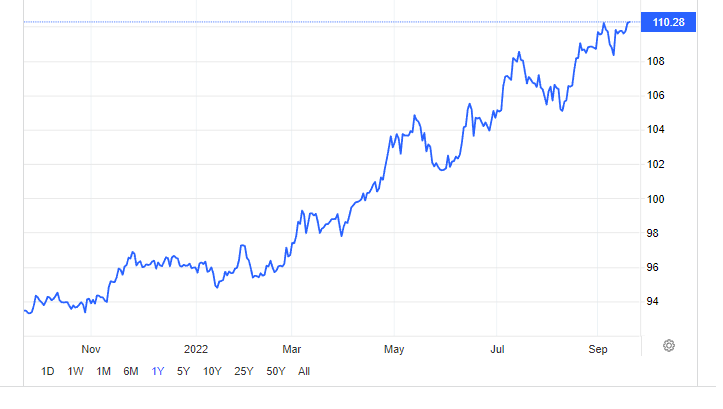

It would be useless to deny that the Dollar is now experiencing a moment of excessive comparative strength for the situation of the US economy as can be seen from the graph below:

The article highlights how in the past periods of strong dollar have always coincided with crises in developing countries, from the two lost decades in South America to the lost decade in Asian economies. Indeed, the strong dollar and the high interest rates to which they are linked have always been the cause of deep public and private debt crises in emerging countries that do not issue debt in their own currency, from Argentina, to China, to countries like Pakistan. and Sri Lanka.

Obviously what is the solution for China? The end of dollar supremacy. “ The best way to curb rampant hegemony is to practice true multilateralism. Whether it is the Asian financial crisis of 1997 or the global financial crisis of 2008, the world seems to have stumbled on the same stone more than once, but it is no longer so solid. The instability and fragility of the international financial markets are making themselves felt again. It is precisely in these moments that the international community should be most determined to cooperate and build a reliable, systemic and long-term multilateral international financial system. We cannot wait “.

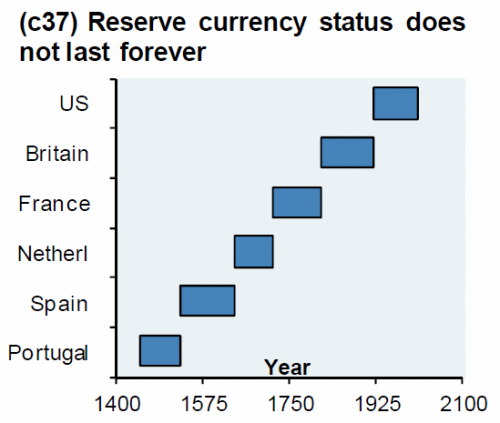

Obviously, the overcoming of the dollar as a world reference currency is only the prologue to the passage to a new era of financial dominance linked to the Yuan. The transition from one currency to another has occurred several times in the history of the world, usually preceded by the industrial or commercial overcoming of one nation over another.

The next dominant currency will be, rebus sic stantibus, the Yuan. We just have to see how this step will happen.

PS: in all this Europe, with the Commission reduced to a sort of colony of the Dem White House, is only a passive spectator.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The dollar is still the problem of the world. China attacks the US currency in its moment of major dominance comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-dollaro-e-ancora-il-problema-del-mondo-la-cina-attacca-la-valuta-usa-nel-suo-momento-di-dominanza-maggiore/ on Wed, 21 Sep 2022 08:00:41 +0000.