The FED: A Brief Guide to the Central Bank of the United States

The United States When was the Federal Reserve System created? First of all, the US has had as many as three central banks, or attempts at a central institution, during its lifetime. The first "First Bank of United States" was created in 1791, but its shares were sold in 1795 to raise cash. Then came the Second Bank of the United States, which was to regulate private credit, from 1816 to 1836, when it too was privatized. The fact is that the US has always had a conflicting relationship with the idea of a centralized institution that would control the banks, and the consequences are still visible today.

The Federal Reserve System was created in 1913 to regulate the flow of money and credit into the American economy. Its main task is to conduct monetary policy, that is, to establish the level of interest rates and the amount of money in circulation. In this way, the Federal Reserve seeks to foster economic growth, full employment, price stability, and the general welfare of the population.

The Federal Reserve is not just about monetary policy. It also has four other important functions :

– Promotes the stability of the financial system and seeks to prevent and contain systemic risks, actively monitoring and intervening in the American and international financial markets.

– Promotes the safety and soundness of individual financial institutions and monitors their impact on the financial system as a whole.

– Helps secure and efficient payment and settlement systems by providing services to the banking industry and the US government that facilitate dollar transactions and payments.

– Promote consumer protection and community development, through consumer-oriented supervision and scrutiny, research and analysis of emerging consumer issues and trends, community economic development activities, and community administration consumer protection laws and regulations.

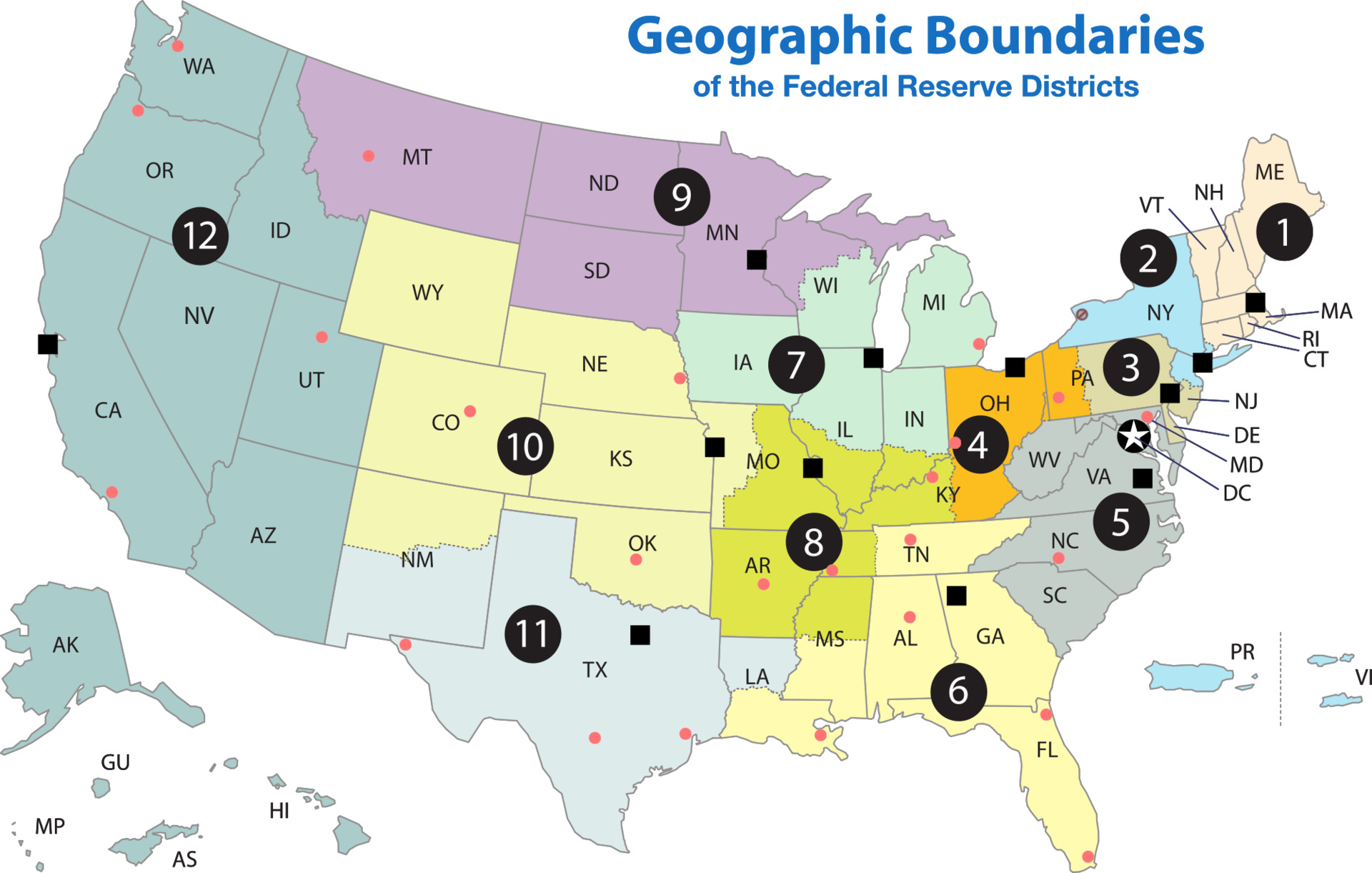

The FED is made up of three main entities: the Board of Governors, the 12 regional Federal Reserve Banks, and the Federal Open Market Committee (FOMC).

The Board of Governors, Council of governors

The Federal Reserve System Board of Governors, commonly known as the Federal Reserve Board, is the principal governing body of the Federal Reserve System . It is tasked with overseeing the Federal Reserve Banks and helping implement US monetary policy. Governors are appointed by the President of the United States and confirmed by the Senate for staggered 14-year terms. It is headquartered in the Eccles Building on Constitution Avenue, NW in Washington, DC

By law, appointments must produce a "fair representation of the financial, agricultural, industrial and commercial interests and geographical divisions of the country." As stipulated in the Banking Act of 1935, the chairman and vice chairman of the board are two of the seven board members of governors appointed by the president from among the incumbent governors of the Federal Reserve Banks.

The terms of office of the seven council members span multiple presidential and congressional terms. Once a member of the board of governors is appointed by the president, the members function mostly independently. This independence is unanimously supported by leading economists.

The Council is required to present an annual management report to the President of the Chamber. It also oversees and regulates the operations of the Federal Reserve Banks and the US banking system in general. The Board obtains its funding from charges it assesses on the Federal Reserve Banks, not from the federal budget; however, as the net earnings of the Federal Reserve Banks are eventually remitted to the US Treasury,[5] and Federal Reserve System spending reduces the size of these remittances, the effects of this funding source distinction are largely optical part.

The governors of the headquarters of the Federal Reserve

The regional governors are

- Federal Reserve Bank of Boston

- Federal Reserve Bank of New York

- Federal Reserve Bank of Philadelphia

- Federal Reserve Bank of Cleveland

- Federal Reserve Bank of Richmond

- Federal Reserve Bank of Atlanta

- Federal Reserve Bank of Chicago

- Federal Reserve Bank of St. Louis

- Federal Reserve Bank of Minneapolis

- Federal Reserve Bank of Kansas City

- Federal Reserve Bank of Dallas

- Federal Reserve Bank of San Francisco

The Federal Reserve Open Market Committee

The FOMC is the body responsible for defining monetary policy, i.e. the actions taken by the FED to influence the availability and cost of money and credit, in order to favor national economic objectives. The FOMC consists of 12 members: the 7 members of the Board of Governors, the chairman of the Federal Reserve Bank of New York, and 4 of the remaining 11 regional Reserve Bank chairmen, who serve on a one-year rotation.

The FOMC meets eight times a year on a regular basis and other times as needed. At these meetings, the Committee reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-term objectives of price stability and sustainable economic growth.

The main tool used by the FOMC to conduct monetary policy is the federal funds rate, i.e. the interest rate at which custodian institutions lend each other balances at the Federal Reserve Banks overnight. The FOMC sets a target for the federal funds rate and communicates it to the public through a press release at the end of each meeting.

To achieve the federal funds rate target, the FOMC uses open market operations, i.e. the purchase and sale of federal government securities on the secondary market. These operations affect the supply and demand of bank reserves, i.e. the balances that depository institutions hold at the Federal Reserve Banks.

When the FOMC wants to reduce the federal funds rate, it buys securities from the market, injecting reserves into the banking system and increasing liquidity. This decreases the cost of money and stimulates spending and investment. Conversely, when the FOMC wants to increase the federal funds rate, it sells securities to the market, withdrawing reserves from the banking system and reducing liquidity. This drives up the cost of money and slows down spending and investment.

Changes in the federal funds rate trigger a series of events that affect other short-term interest rates, foreign exchange rates, long-term interest rates, the amount of money and credit, and ultimately a number of economic variables , including employment, output, and the prices of goods and services.

The FOMC also publishes a detailed account of its deliberations and decisions in the form of minutes, which are released three weeks after the date of the monetary policy decision. In addition, four times a year, the FOMC releases economic projections that reflect members' expectations on key macroeconomic variables. Finally, the president of the FOMC holds a press conference after each meeting in which he presents economic projections, to explain the reasons for the decisions taken and answer questions from journalists.

In conclusion, the FOMC performs a fundamental function in the FED and in the US economy, as it determines the level of interest rates

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article The FED: a short guide to the Central Bank of the United States comes from Scenari Economics .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-fed-breve-guida-sulla-banca-centrale-degli-stati-uniti/ on Sat, 05 Aug 2023 13:08:38 +0000.