Are we heading towards a new stock market crisis like in 1987?

While many hedge fund managers believe the Fed / US government duopoly will step in to put interest under controls and that foreign demand will still stop the growth of BofA's fixed income research group disagrees and claims that US Treasury yields will continue to rise with real yields breaking out on good economic news, COVID.

The reason for Tepper's sudden bullish trend is simple and we've discussed it numerous times recently: demand for US Treasuries as yields offer asset allocators more options (and trigger CTA reversals).

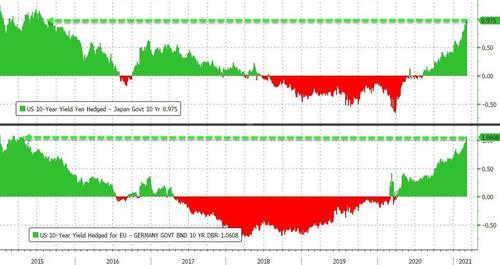

Tepper's positive view is based on support for bonds from overseas buyers, who, as we noted earlier, now benefit from over 100 basis points of recovery by buying currency-hedged Treasuries on their local bonds…

Hedge Funds rely on capital flows from abroad, especially from Germany and Japan, where Kuroda keeps rates low, generating cash flows towards US securities:

But, countering this, BofA warns that the Fed currently has little reason to intervene and investors on their own for now …

The Fed currently has little reason to respond to the market volatility created by the rate shock: monetary and fiscal policy is exceptionally accommodative; financial conditions remain very loose; credit spreads are close to post-crisis lows; good economic news is exactly what the Fed is trying to achieve.

In addition, BofA offers this "Reminder":

The Fed's focus is on the economy (jobs, inflation), not the markets, so until a significant rise in interest rates leads to a drop in credit supply, who made the wrong bet will be left alone.

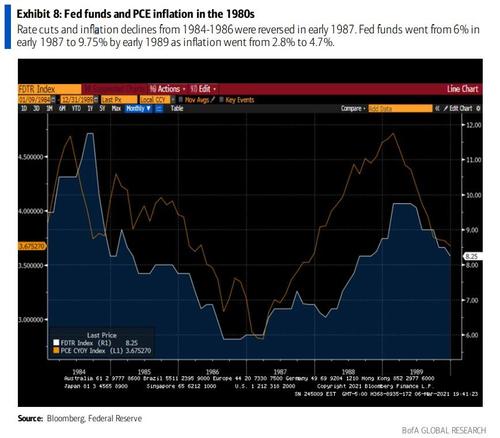

Finally, and this is the greatest threat, BofA warns that a 1987 bond sell-off (culminating in the October 1987 crash) is in progress.In 1987 this began in April and culminated in the October stock market crash. Comparing everything to the current situation:

1) after two years of easy monetary policy, inflation returned to the upside, with increases linked to the improvement in the employment situation, according to a Phillips curve that was not yet dead

Then…

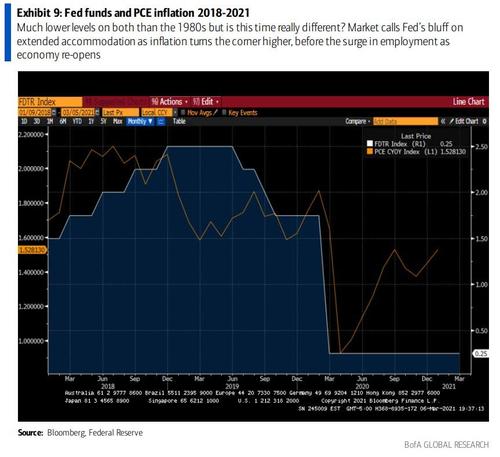

Now we are at this point …

Another factor that could lead to the sale of the securities is that the supply of the same this year will be huge, 2500 billion dollars against just over 900 billion the previous year. So are there the conditions for a new 1987-like stock crash in the fall? Much depends on what happens to inflation, which may stop growing: the Phillips curve is no longer that of the 1980s, but is now much flatter. The inflationary flare could be much less, therefore with not so strong effects on the stock market.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Are we heading towards a new stock market crisis like in 1987? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/stiamo-andando-verso-una-nuova-crisi-di-borsa-come-il-1987/ on Wed, 10 Mar 2021 08:00:36 +0000.