Biden’s Investment Plan? Doing so will cause GDP to drop. Wharton analysis

As Biden paints his investment plan (American Job Plan, AJP, an analysis conducted by the Penn Wharton Budget Model found that proposed corporate tax provisions – which continue beyond the budget window – will decrease GDP by 0.8%. in 2050, compared to current legislation. The Wharton is one of the most prestigious US business schools. Here's why:

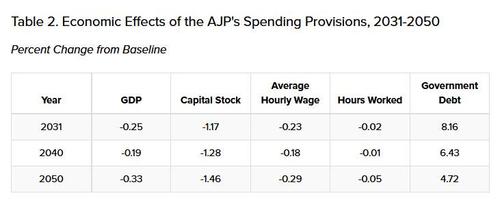

- AJP spending provisions, in the absence of tax increases, would increase public debt by 4.72% and reduce GDP by 0.33% in 2050, as the exclusion of investment due to higher government deficits would outweigh the increases productivity of new public investments.

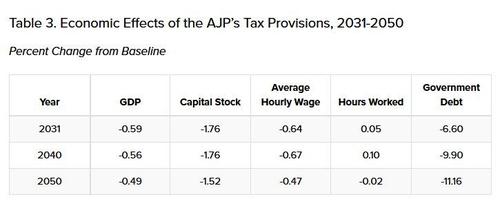

- the tax provisions proposed in the AJP, in the absence of new spending, would decrease public debt by 11.16% in 2050. Despite the reduction in public debt, the tax provisions of the AJP discourage business investment and therefore reduce GDP 0.49% in 2050.

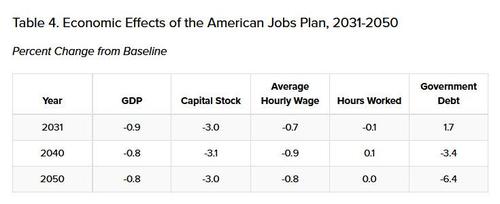

Taken together, the model finds that AJP's fiscal and spending provisions would increase government debt by 1.7% by 2031 but reduce government debt by 6.4% by 2050. More importantly, the Biden plan it ends up decreasing GDP by 0.8% in 2050. In other words, not only is there no benefit from the BIden plan, but it will actually reduce growth over the next four decades.

Why this phenomenon? Does Keynesian theory no longer work? It is actually a design problem of the Biden plan.

On the expense side we would have the following effects;

- large contributions to families would reduce the supply of labor;

- spending in Medicare mainly benefits seniors with limited additional spending;

- in the US environment, announced public investments would displace private ones.

The effects are as follows:

From the point of view of revenues, on the other hand, the question becomes more frequent, also because the programs related to taxes, with the increase in taxes for companies and the cuts in subsidies to fossil fuels, become a potentially permanent program, which will to drain resources to the economy between now and 2050.

While investment and aid programs are planned in the medium term, tax increases are permanent, or at least designed to be. So between now and 2050 the effects will even be a reduction of the debt of 6.4% and therefore the overall effects will be restrictive:

There is even a reduction in hourly wages. In short, it is not certain that, if not compensated by future programs, the AJP is socially and economically favorable for the US economy:

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Biden's Investment Plan? Doing so will cause GDP to drop. Analysis of the Wharton comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-piano-di-investimenti-di-biden-fatto-cosi-fara-calare-il-pil-analisi-della-wharton/ on Thu, 08 Apr 2021 08:00:31 +0000.