Bitcoin legitimately enters the banking system. Word of BIS ..

The Basel Committee on Banking Supervision (BCBS), a global committee of banking supervisors and central banks, has proposed new requirements for banks wishing to hold cryptocurrencies such as Bitcoin (BTC).

In a consultation paper released Thursday, the committee provided preliminary proposals for the prudential treatment of banks' exposure to cryptocurrencies.

The document was based on the contents of the 2019 committee discussion paper and the responses received from various stakeholders and international figures in the sector.

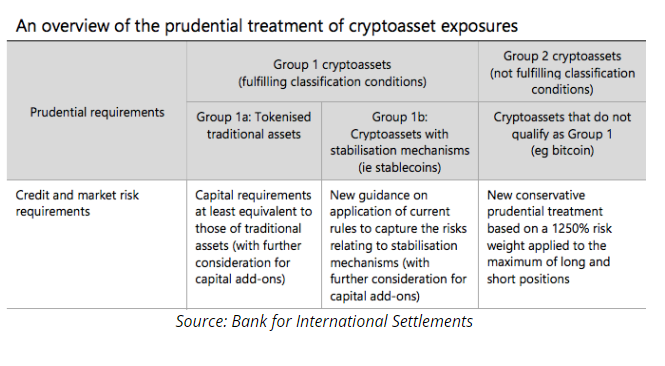

Crypto's perceived volatility and potential for misuse led the BCBS to recommend a 1,250% risk weight for Bitcoin. This essentially means that banks must hold a dollar of capital for every dollar of Bitcoin exposure. At the same time, however, much lower values were left for both Crypto assets, i.e. tokens representing securities or bonds, and for stable coins.

According to the document, this would ensure that there is sufficient capital to absorb a complete cancellation of cryptocurrency exposures "without exposing depositors and other senior creditors of banks to losses." therefore riskier assets would see full hedging with reserves.

The BCBS proposed dividing cryptographic assets into two broad categories: those eligible for processing under the Basel Framework with some changes; and assets such as Bitcoin (BTC), which are subject to the new conservative prudential treatment.

The first category would include traditional tokenized assets and "crypto assets with effective stabilization mechanisms", or stablecoins, although it will be rather complex to evaluate stabilization mechanisms when they do not correspond to a 1 to 1 ratio in ordinary currency.

The second group includes Bitcoin and other assets that "do not meet any of the classification conditions" such as the application of a stabilization mechanism. So practically all cryptocurrencies, excluding stabel coins

The BCBS noted that a high risk weight of 1,250% will lead to a “conservative outcome” for direct cryptocurrency exposures. Regarding crypto derivatives, however, "care must be taken in defining what the 'value' is in the formula to ensure the outcome is equally conservative," the committee noted.

Despite the extremely prudential attitude, the doors are opened to Virtual Currencies in banks' balance sheets, given the need for such a strong hedge they will be introduced only in those cases where the yield is very high, speculative. Otherwise the cost of the Risk Weighted Asset (RWA) Hedge will not make it possible or cost effective to operate in this asset class.

However this is great news for virtual currencies, in conjunction with its legal tender acceptance in El Salvador.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The Bitcoin article legitimately enters the banking system. Word of BIS .. comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/bitcoin-entra-legittimamente-nel-sistema-bancario-parola-di-bis/ on Thu, 10 Jun 2021 16:59:52 +0000.