Credit Suisse loses billions in assets under management. Will he be able to survive?

FILE PHOTO: The logo of Swiss bank Credit Suisse is seen at its headquarters in Zurich, Switzerland March 24, 2021. REUTERS/Arnd Wiegmann//File Photo/File Photo

Readers will recall that we reported in mid-October that the Fed was quietly sending increasing amounts of dollars to the Swiss National Bank – eventually peaking at around $11 billion a week – which in turn used these swap lines. in dollars to fill the dollar funding gaps of one or more Swiss commercial banks.

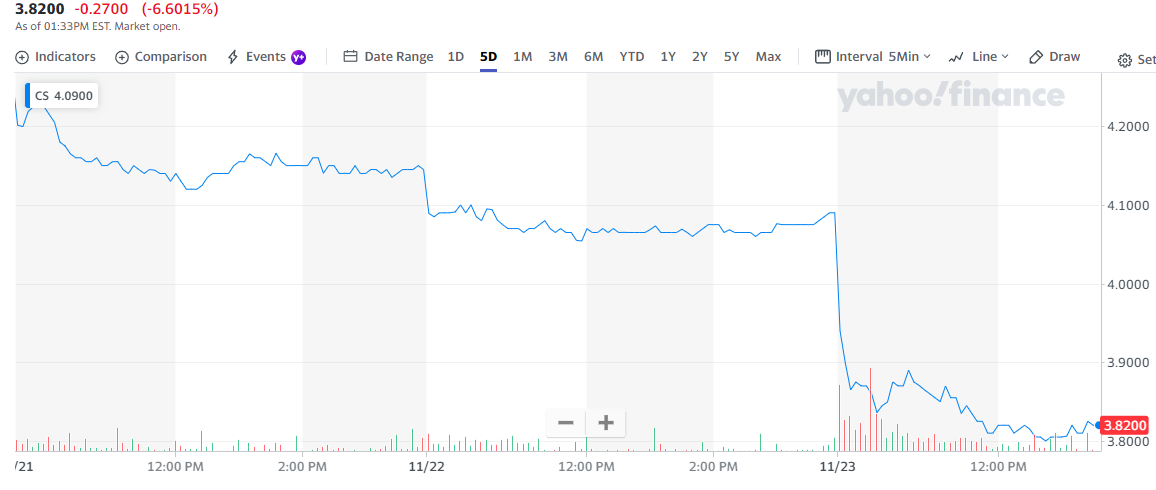

You didn't have to be a rocket surgeon to figure out that the bank in question was Credit Suisse, which had seen its stock plummet amid a relentless barrage of scandals, corporate blunders and the occasional fraud (of which we know), and which according to us was probably undergoing a painful bank run behind the scenes.

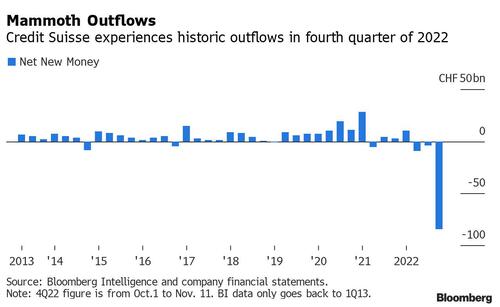

A month later, this morning Switzerland's second-largest bank confirmed our worst-case scenario, admitting that it had just experienced an impressive bank run in which customers withdrew 84 billion Swiss francs, or $88.3 billion, from the bank. , during the first few weeks of the quarter, underlining current concerns about the bank's restructuring efforts after years of scandal.

Today the quotation of the Swiss bank, already not particularly brilliant, has suffered a real collapse:

It could not have been otherwise given the news of this enormous flight of capital which hit what was once the flagship of the company: asset management. The massive net outflows in Wealth Management, CS' core business, are worrying for the fall in confidence they signify.

JPMorgan Chase & Co. and Jefferies analysts said outflows from wealth management were far more severe than expected and warned the bank is not out of the woods. The Ethos Foundation, a proxy advisor, said more steps may be needed to restore investor confidence than the bank has so far outlined.

How can trust be rebuilt in an institution that recently missed a move and suffered, as Bloomberg pointed out, very heavy losses in mark-to-market values in July. The challenge that the institute will have to face is impressive and it is not said that it will be able to overcome it.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

Article Credit Suisse loses billions in assets under management. Will he be able to survive? comes from Economic Scenarios .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/credit-suisse-perde-miliardi-in-patrimonio-gestito-riuscira-a-sopravvivere/ on Wed, 23 Nov 2022 20:33:48 +0000.