Debt ceiling: the announcement of the agreement is expected today

The US debt ceiling compromise will most likely be announced between House Speaker McCarthy and the White House today. It could not have gone otherwise because June would see a fall in the funds available to the US Treasury. The worst-case scenarios relating to the cash funds available to the federal government saw their exhaustion as early as around June 6th

What would an agreement between the two sides look like?

While not many details are available on the potential compromise, Goldman Sachs has made some predictions about this deal which should contain at least 4-5 key elements:

- A debt limit suspension based on a calendar date (rather than a dollar amount) that places the next debt limit increase in mid-2025.

- Limits on discretionary spending

- Employment requirements for benefit programs (primarily Temporary Assistance for Needy Families, formerly known as "social benefits", and possibly the Supplemental Nutrition Assistance Program, formerly known as "food stamps")

- Cancellation of unused Covid funds

- Reform of energy permits

Of these, the suspension of the debt limit and the spending caps will form the core of the agreement, even if the caps on spending have never been effective because they can be circumvented. The cancellation of unused Covid funds also appears very likely, as do the new requirements of work to obtain public contributions.

Cutting discretionary funds is essential and should bring them back to a physiological level after the Covid-19 boom

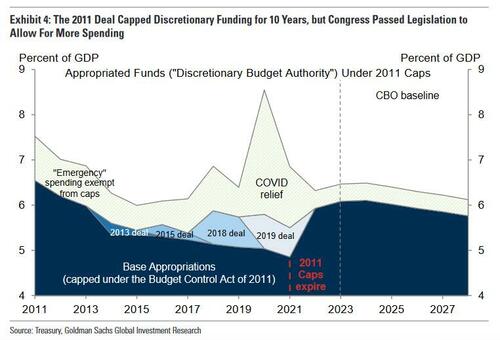

Similar to the 2011 debt cap episode, spending caps — which Goldman has been saying for months will be an integral part of the deal — appear to be at the heart of the debt cap deal. Ironically, while the 2011 agreement capped discretionary funding for 10 years, Congress didn't wait long before raising the caps. About every two years after the deal went into effect, Congress passed legislation to allow for increased spending, rendering the deal unnecessary.

That said, negotiators have yet to reach agreement on several spending points. In the current debt limit negotiations, at least four important parameters need to be decided:

- Fiscal Year 2024 Spending Level: White House reportedly proposed to freeze spending at 2023 level. House-approved Republican bill would reduce spending to fiscal year 2022 level, a nominal 9 percent reduction . The middle ground could be to fix 2024 spending at the 2022 inflation-adjusted level. This would allow both sides to claim a victory (spending would decrease slightly in nominal terms, but be no less in real terms than President Biden and Democrats in Congress agreed to in late 2021). Just another little theater.

- Duration of the caps: The White House would have agreed to limit spending for at least two years. The House Republican bill would have included a 10-year spending cap, but the position has reportedly been reduced to a 6-year cap. The middle ground is clear, although the final decision will depend on other aspects of the deal, especially the growth rate of the caps.

- Spending growth under caps: The Republican House bill proposed cap growth of 1% (nominal) per year. The White House reportedly agreed to a 1% cap growth rate, even though this would only apply for a year. A growth rate of 1% could be difficult for the White House to accept if the ceilings lasted 4 or 6 years. That said, it is likely to fall short of the CBO's baseline forecast, which assumes growth in discretionary funds of around 2.5%.

- Breakdown between defense and other chapters: Democrats are likely to insist on separate caps for defense and other chapters, given that most Democrats support robust non-defense spending, while there is greater overall support ( between both parties) for defense spending. A plausible scenario is that defense may increase slightly for fiscal 2024, while nondefense decreases in fiscal 2024, but that the caps for both grow at the same rate thereafter.

The agreements on these four missing points should be concluded today, making the agreement definitive. This will reduce not so much the interest on government bonds, influenced above all by the interest levels applied by the Fed, but above all the cost of the CDS linked to the probability of default of the US debt.

Thanks to our Telegram channel you can stay updated on the publication of new articles from Economic Scenarios.

The article Debt ceiling: the announcement of the agreement expected for today comes from Scenari Economici .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/tetto-del-debito-atteso-per-oggi-lannuncio-dellaccordo/ on Fri, 26 May 2023 08:00:38 +0000.