“Doctor Doom”: “Goldilocks” is dying, a stagflation winter will come

Nouriel Roubini , the economist known as "Doctor Doom" for his propensity to predict disasters, some that have come true, others less, from Project Syndacate highlights what, according to him, is the end of the financial dream of "Riccioli d'0ro" and fears of a stagflationary push that will bring debt-ridden economies to their knees.

According to the author, today's high debt ratios, supply-side risks and extremely accommodative monetary and fiscal policies create a rosy scenario that will disappear in the face of new supply-side crises that will lead to repeated stagflationary shocks.

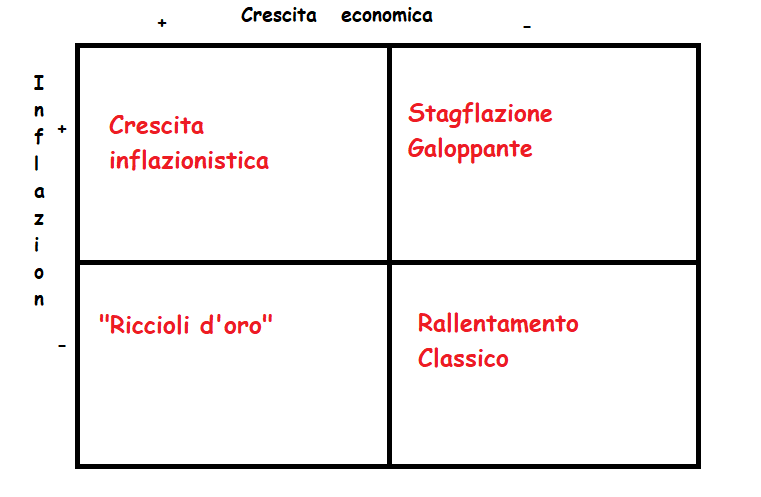

He sees four possible scenarios after this year's price hike that led to supply-side problems and thus inflation above 2%, as well as a decline in bond yields. The different scenarios depend on the speed of growth and the future trend of inflation.

- Wall Street and most policymakers are expecting a "Goldilocks" scenario of stronger growth coupled with moderating inflation in line with central banks' 2% target. According to this view, the recent stagflation is largely driven by the impact of the Delta variant. Once that's gone, supply-side restrictions will too, as long as no new virulent variants emerge. Then growth would accelerate while inflation would fall. In this rosy scenario, inflation would fall, keeping its own at around 2%, bond yields would gradually increase with real interest rates, and central banks would be able to reduce quantitative easing without shaking equity markets. or bonds. In equities, there would be a rotation from US to overseas markets (Europe, Japan and emerging markets) and from growth, tech and defensive stocks to cyclical and value stocks. An ideal scenario, but the ideal is very rare.

- The second scenario involves the "overheating" of the economy. Here, growth would accelerate as supply bottlenecks are eliminated, but inflation would remain stubbornly higher, because its causes would be not temporary, but tied to traditional labor cost dynamics in the event of rapid growth. With unspent savings and already high pent-up demand, the continuation of ultra-loose monetary and fiscal policies would further stimulate aggregate demand. The resulting growth would be associated with persistent above target inflation, disproving central banks' belief that price increases are only temporary. The market response to inflation would therefore depend on how central banks react. If politicians stay behind the curve, equity markets may continue to rise for a while as real bond yields remain low. But the resulting increase in inflation expectations would ultimately push nominal and even real bond yields up, forcing a correction in stock prices. Alternatively, if central banks became aggressive and started fighting inflation, real rates would rise, driving bond yields up and, once again, forcing a major correction in equities. Whatever happens, in this scenario, the stock exchanges would fall.

- A third scenario is ongoing stagflation, with high inflation and much slower growth over the medium term. In this case, inflation would continue to be fueled by expansive monetary, credit and fiscal policies. Central banks, trapped in a debt trap due to high public-to-private debt ratios, would struggle to normalize rates without triggering a financial market crash. Furthermore, a series of persistent medium-term negative supply shocks could reduce growth over time and increase production costs, increasing inflationary pressure. As I noted earlier, such shocks could stem from deglobalization and increasing protectionism, balkanization of global supply chains, demographic aging in developing and emerging economies, migration restrictions, Sino-American "decoupling", from the effects of climate change commodity prices, pandemics, cyber warfare and the backlash against income and wealth inequality. In this scenario, nominal bond yields would rise faster than inflation rates by breaking free. And real yields would also be higher (even if central banks stayed behind the curve), because rapid and volatile price growth would increase risk premiums on longer-term bonds. Under these conditions, equity markets would be poised for a sharp correction, potentially in bear market territory, with a sharp decline in values of around 20%.

- The latter scenario would be characterized by a slowdown in growth. Weakening aggregate demand would prove not just a transitory scare, but a harbinger of the new normal, particularly if monetary and fiscal stimulus is withdrawn too soon. In this case, lower aggregate demand and slower growth would still lead to coexistence with contained and external inflation. Equities would fall to reflect weaker growth prospects and bond yields would fall further (because real yields and inflation expectations would be lower).

Which of these four scenarios is most likely for Roubini?

In the short term, the "Goldilocks" best-case scenario may appear more realistic, driven by fiscal and monetary adjustment policies and good news on the delta variant.

But in the medium term, as a series of persistent negative supply shocks hit the global economy, we could end up with far worse stagflation or overheating – full stagflation with much lower growth and higher inflation. . The temptation to reduce the real value of large fixed-rate nominal debt ratios would lead central banks to adjust to inflation rather than fight it and risk an economic and market crash.

But today's debt ratios (both private and public) are substantially higher than they were in the stagflationary shocks of the 1970s. So when inflation hit nominal and / or real rates, we would have the risk of a series of bankruptcies in the private sector, but also in public debt, primarily in states that do not have the ability to manipulate monetary leverage, both because they do not issue money, both because they are indebted in foreign currency. A Greek crisis, but on steroids.

A nightmare that no one now seems to take seriously.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article "Doctor Doom": "Goldilocks" is dying, a seasonal winter will arrive comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/doctor-doom-riccioli-doro-sta-morendo-arrivero-un-inverno-stagflattivo/ on Wed, 22 Sep 2021 06:00:08 +0000.