Energy, war, peace and finance

by Davide Gionco

29.03.2022

Energy as an instrument of war and peace

TV and newspapers do not cease to hammer us with the news on the war in Ukraine, while families and businesses find themselves dealing with increasingly unsustainable energy costs.

Something similar had already happened in the 1970s. At that time the Yom Kippur War had pushed the Arab oil producing countries, in solidarity with Syria and Egypt in the war against Israel, to unilaterally raise the selling price of oil, which at the time was the main source of energy in Europe and especially in Italy, as a source of retaliation towards Western countries that supported Israel. The result was the severe energy crisis of 1973-1974, which led the Italian government to take measures aimed at saving energy and diversifying energy sources. It was then that Italy decided to focus on methane gas as a primary source of energy to replace oil, which became a reality about ten years later (do you remember the advertisement "methane gives you a hand"?).

After a few years, starting in 1979, there was a second energy crisis, caused first by the Iranian revolution and then by the ensuing American-backed Iraq-Iran war. The decision to reduce Italy's dependence on oil was confirmed by these facts.

History teaches us that the export of energy is often either the cause of wars or an instrument of economic pressure following wars. But also that stable energy supply agreements are an instrument of peace, through trade and economic development agreements between nations, with mutual convenience.

We recall by way of example how the occupation of the Ruhr basin (in Germany) by France and Belgium in the years 1923-1925 was a way to wage an economic war against the Germans, who took revenge on this during the Second World War. . A lot of coal was produced in the Ruhr, which at the time was the main source of energy for Germany, but also for neighboring countries. With the end of the Second World War, the construction of peace in Europe started with the constitution of the ECSC (European Coal and Steel Community), through which coal was made available to all member countries, as did steel. produced thanks to the use of coal together with iron ores.

For better or for worse, energy is always a determining factor in relations of peace or war between nations.

Italy's energy strategy to reduce dependence on oil

The decision to diversify Italy's energy supplies was aimed at avoiding suffering excessively the continuous variations in the price of oil.

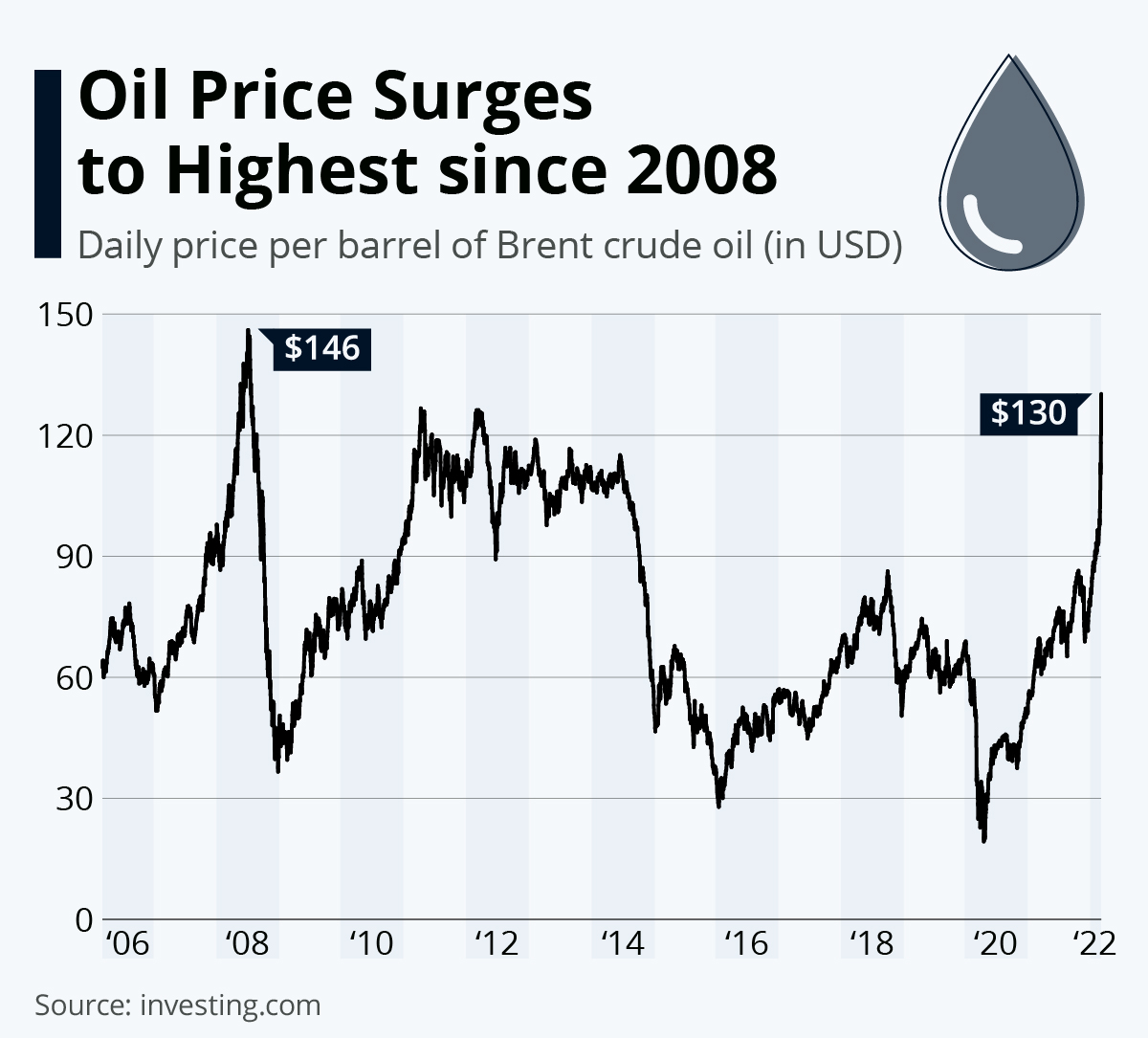

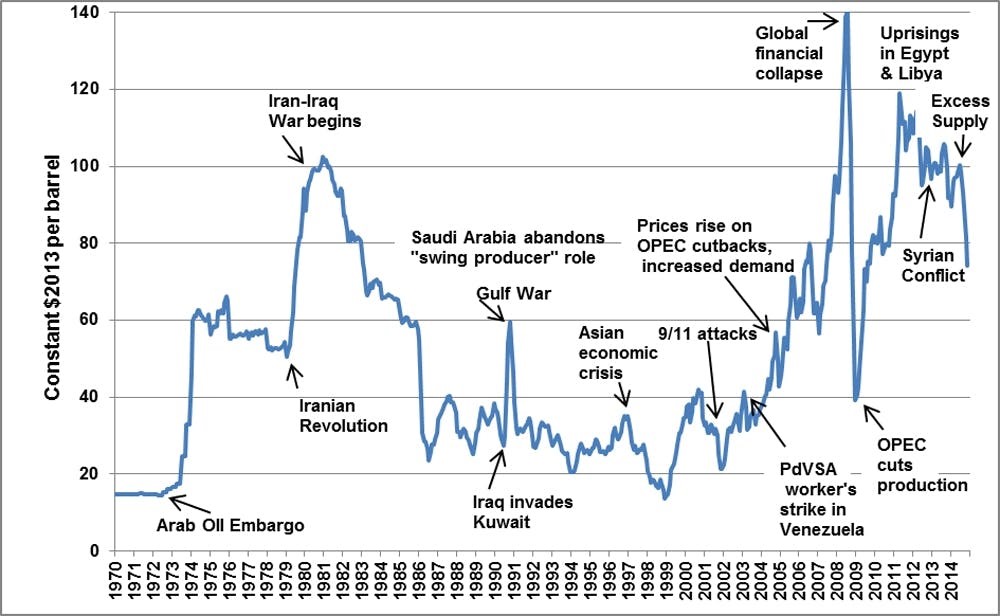

Graph 1

Source: https://theconversation.com/

It can be noted how much the international price of oil varies in function of geopolitical events, but also of financial events.

This type of trend is confirmed by the evolution of the oil price in recent years. Finance always finds reasons to speculate on oil price changes.

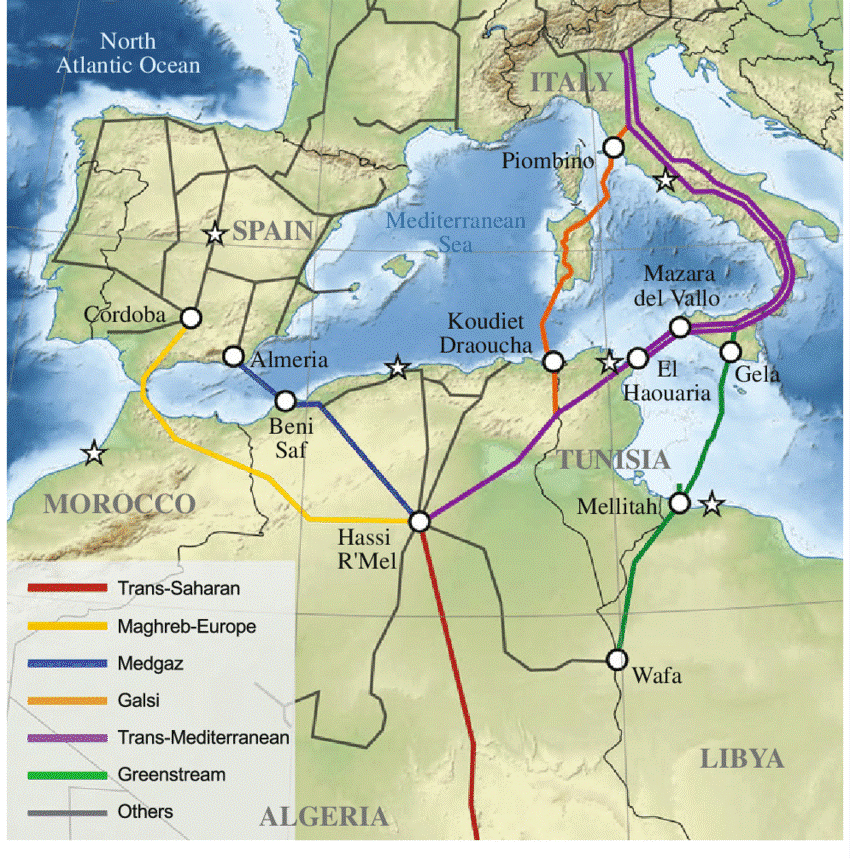

Italy's political line to reduce its dependence on oil was, on the one hand, to invest in energy savings and, on the other, to use a slightly more expensive source of energy, but with a much more stable price: natural gas. For this purpose, contracts were stipulated for supplies of large quantities and for a long duration with the governments of nations of North Africa, such as Libya, Algeria-

Graph 3

Source: https://www.researchgate.net/

But above all with the Russian government, even if it is "Soviet".

Graph 4

Source: https://en.wikipedia.org/

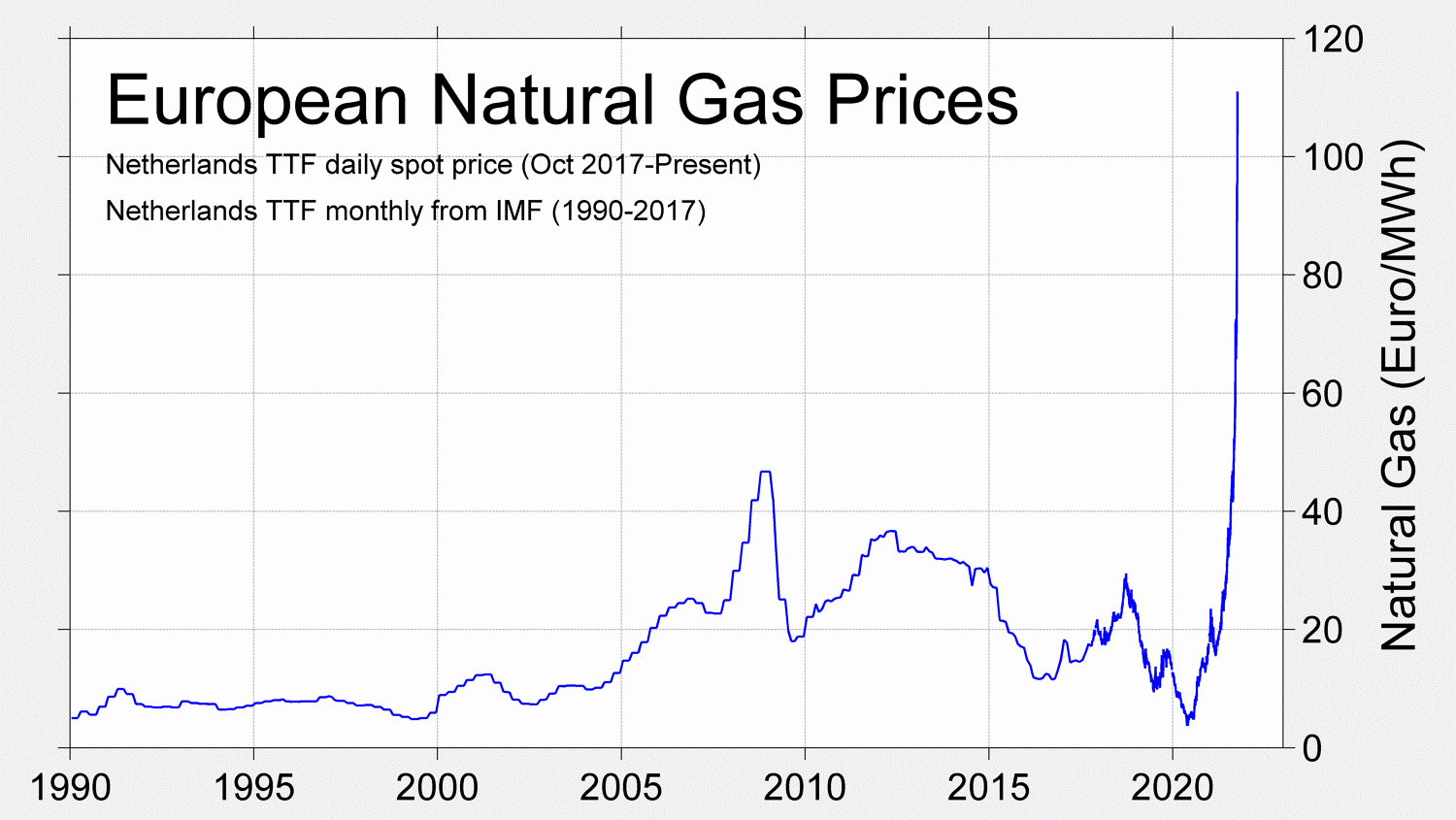

Italy's decision was certainly prudent, as the price of gas over the years turned out to be much more stable than that of oil at least until 2020, after which in 2021 something new happened that also caused the price of gas to rise. gas. We will return to that later.

Graph 5

Source: https://tradingeconomics.com

In recent years, diversification has increased, adding a fairly significant share of energy from renewable sources.

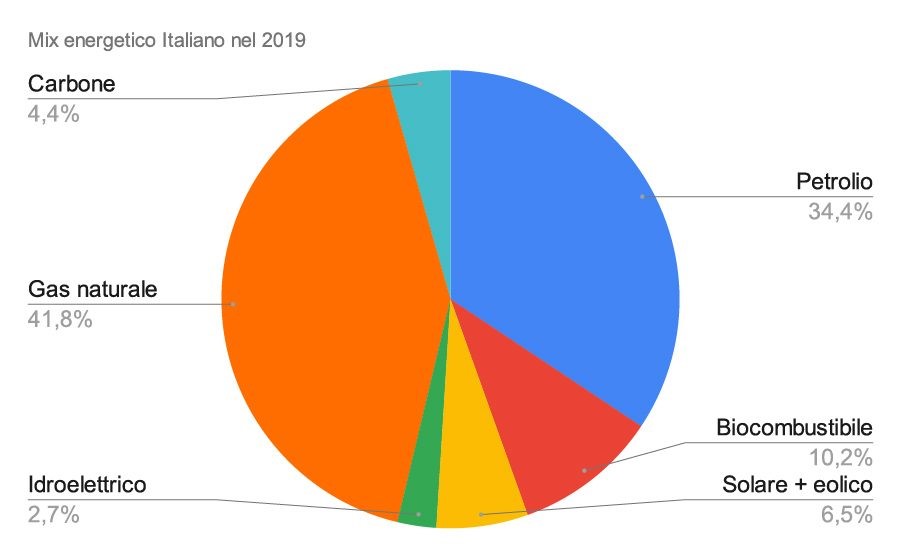

Graph 6

Source: Data: IEA 2019

The war in Ukraine and the release from Russian gas supplies

With the unfortunate war in Ukraine and the increase in tensions between NATO and Russia, the political power is proposing nothing less than to give up all of a sudden the gas supplies from Russia, as an economic sanction against Putin guilty of invading Ukraine. But is this a viable proposal? At what price?

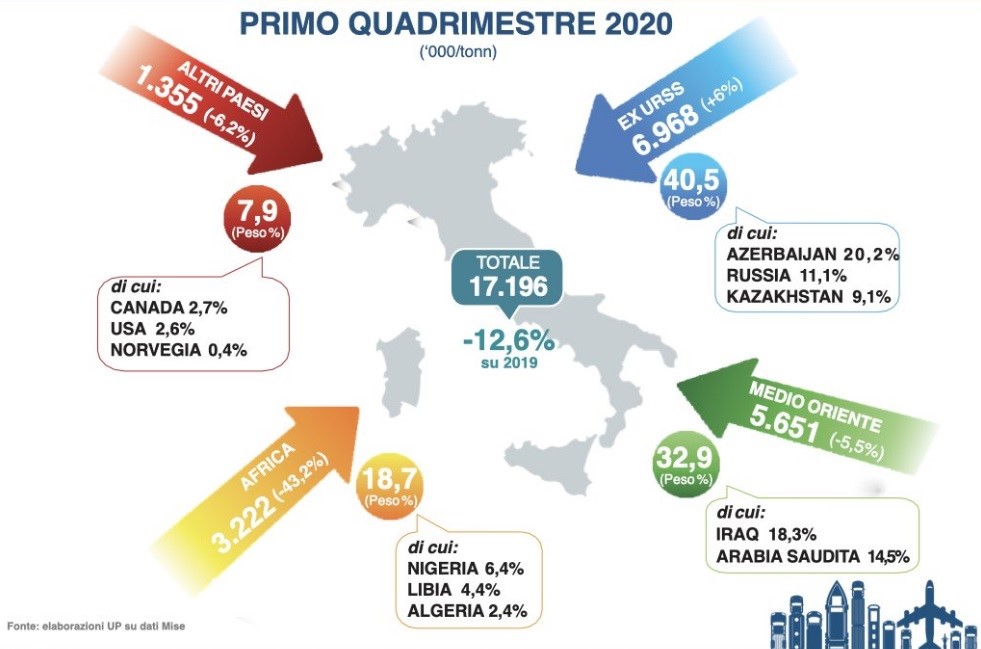

How much does Italy depend on Russian energy?

Source: https://oilgasnews.it/

Oil imports from Russia make up about 11% of the total. If we were to do without Russian oil, it shouldn't be very difficult to replace it with purchases from other producers. Importing oil is simple: you order the goods, load them on an oil tanker and they are delivered to one of our ports, after which we can refine and use them.

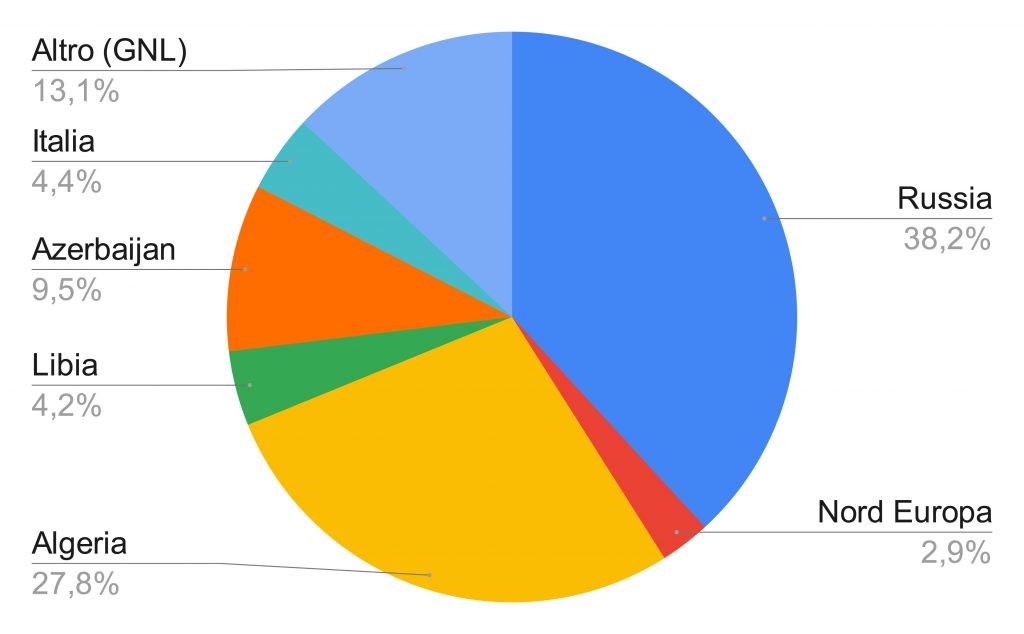

The supply of natural gas, on the other hand, is very different, 38% of which Italy depends on Russian imports.

Source: MISE 2021 data

To deliver the gas, it is necessary to build gas pipelines from the sources to the country of delivery. From the Jamal wells in northern Siberia to Italy there are 4,500 km of gas pipelines, which took many years to build, with substantial investments. For this reason, those who built them have an interest in signing long-term contracts, which Italy has been doing for decades with Russia, to the benefit of the production system and Italian families. If the supply from Russia were to cease, the other gas producers with which Italy is connected would not be able to replace it, both for lack of the same production capacity and for the limited transport capacity of the existing gas pipelines.

Someone proposes to use the natural gas present in Italy. But, apart from the fact that it takes several years to build the plants alone, Italy's natural gas reserves, if we only used those, would run out in 10-12 months. We therefore have a largely insufficient quantity for our needs.

The alternative proposed by the "American friends" is to purchase Liquefied Natural Gas (LNG) from large international producers such as the USA, Qatar, Saudi Arabia, Kuwait. But this would mean going from the current 13.3% to (13.3 + 38.2 in Russia) to 51.5% of the total supply, almost quadrupling the current availability of regasifiers (plants where liquefied gas is re-evaporated to put it in the network), of LNG carriers. But it would also mean structurally accepting to buy more expensive gas, as the costs of cooling down to -160 ° C would be added to the basic extraction costs, the costs of transport with LNG carriers (ships with huge refrigeration systems to maintain the liquefied gas) and the regasification costs in Italy.

And we must not overlook the fact that we would go from a dependence on Russia to the dependence of the energy multinationals that control the LNG market, companies listed on the stock exchange and much more linked to international financial speculation. It is not so obvious that the choice is convenient.

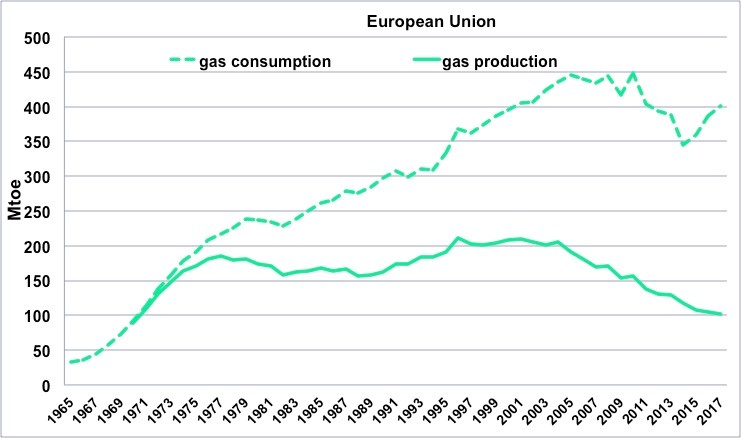

The issue becomes even more complicated if we look at the numbers at the European level. The gas needs of the European Union depend very heavily on imports.

Graph 9

Source: https://jancovici.com/ data processing from BP Statistical Review

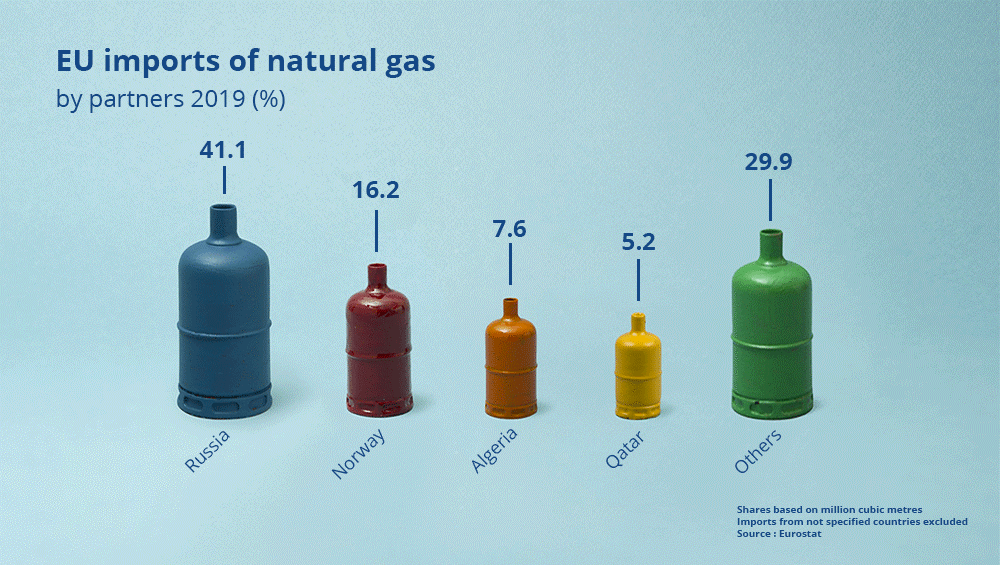

Over 40% of which imports come from Russia.

Graph 10

Source: https://ilbolive.unipd.it/

So it would be a question not only of finding an alternative gas supplier for Italy, but for all of Europe, which is currently supplied by Russia for over 40% of its needs.

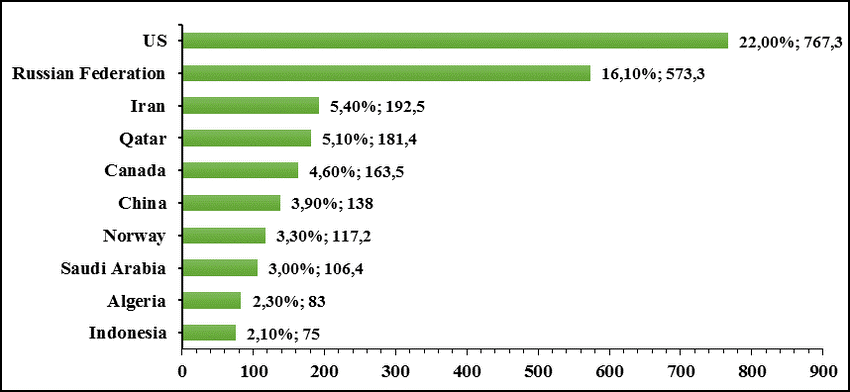

Observing the gas tanker production capacity at world level, we can see that only the USA would, in theory, have a production capacity adequate to European needs, in the event of a stop of imports from Russia.

Chart 11

Leading producers of natural gas in the world, in billions of cubic meters per year

Source https://www.researchgate.net/

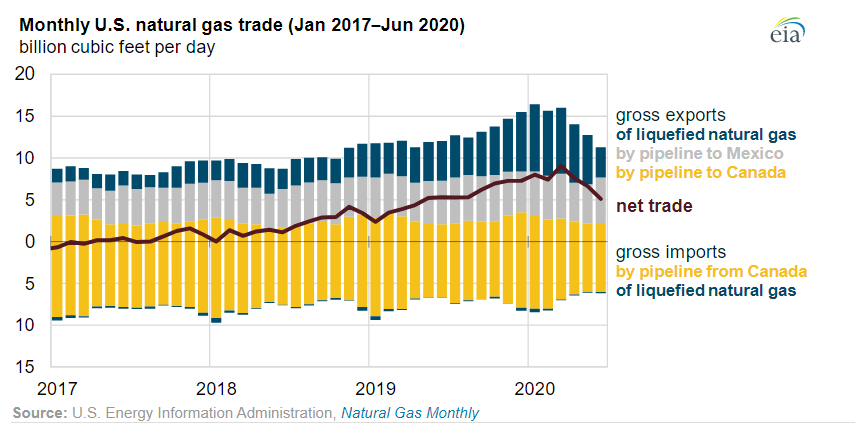

But we must also note that currently only a small part (the one highlighted in dark blue in the graph below) of US production is destined for export.

Graph 12

Source: https://www.eia.gov/

This means that the US, despite the great proclamations, is absolutely unable to guarantee Europe the replacement of methane gas supplies. Note that US gas exports are of the order of 5 billion cubic meters per year, while Russian production is of the order of 500 billion cubic meters per year, 100 times higher.

If the US does not have the production capacity to replace Russian gas in Europe, it means that no other producer in the world can have this possibility. This certainly in the short and medium term, waiting for new gas fields to be discovered who knows where.

The conclusion is that Europe, and therefore even more so Italy, has no possibility of freeing itself from Russian gas supplies, unless we reduce our gas consumption within a few minutes, in order to reduce imports. of Russian gas.

How much?

From Graph 6 we deduce that gas represents 41.8% of the national energy needs. From Graph 8 we deduce that 38.2% of this gas comes from Russia. The quantity of gas that would be missing would therefore be of the order of 38.2% of 41.8%, which is 16.0%.

It may seem "little", but it means that, on average, industries should reduce their annual production by 16% or that businesses have to reduce their opening hours by 16% or that in our homes we have to cut the electricity for 4 hours a day. As if the closures imposed during the covid-19 pandemic weren't enough!

In a very simplified way we could expect a collapse of 16% of the national Gross Domestic Product,

The economic consequences would be catastrophic for the Italian economy. And something similar should be expected, some more, some less, for the rest of Europe.

And we have not taken into consideration the certain increases in food prices, caused by the blocking of imports of cereals from Russia and Ukraine.

We cannot exclude the possibility of finding, over time, alternative energy sources, but all this could not be done in a short time, so the economic shock is inevitable.

We will talk about "times" in the next paragraph.

So before launching proclamations about the interruption of Russian gas supplies, we should take note of the fact that the relationship of gas supply from Russia is a structural requirement for Italy and for the European Union. And, I would add, it is also a structural need for Russia, which has a backward production system and which badly needs the financial proceeds from energy exports to Europe, necessary to import quality goods and services from Europe itself.

To give an easy example to understand, it is as if Russia were the only water supplier and we were the only food producer: to survive we could not do without each other, structurally, without the possibility of alternatives, at least in the short and medium term.

This fundamental consideration should lead our political class to review their positions, which are very much based on ideology and not at all based on concrete data on energy relations with Russia. Even if Putin were "bad" or "killer", knowing that we have no alternatives to Russian gas, political choices should take this into account.

Why have energy prices gone up?

On television they tell us that the prices of petrol and gas have risen "because of the war".

We propose the graphs shown above:

In reality, it has always happened that the price of oil has varied strongly due to geopolitical changes or speculative actions of the financial markets.

But this had never happened for gas, the price of which was contractually linked to that of oil and only indirectly and to a limited extent.

If we look in detail at the trend in the price of natural gas in recent months in Europe

Chart 13

Source: https://tradingeconomics.com/

we note how the price increases started as early as August-September 2021, while the war in Ukraine started in February 2022. So the increases started before the conflict, certainly for other reasons.

We add the quite evident consideration that this winter none of us ran out of gas to keep warm, even if the wrath of God paid for it. The requested gas was delivered, there was no shortage of supplies that justified it. the increase in prices.

So what led to these increases? What has changed the dynamics of the gas price making them the same type as those of the oil price?

The answer lies in the gas purchase contracts , which have changed after decades of stability.

The international oil market was born, many decades ago, on the basis of short-term sales contracts. Oil producers were looking for customers around the world, selling it at the best possible price. And buyers were looking for the highest possible bidder. There was a certain freedom of choice.

The ability to deliver oil tankers relatively quickly to any customer in the world has created a world market, hence the birth of OPEC, hence the listing of oil on the stock exchange.

The stock market listing has led to the emergence of many intermediaries between sellers and buyers, who buy purchase options on oil, which they resell and buy back trying to maximize profit margins, like any other financial product. Obviously, there are often close links between the ruling class of the producing countries and these brokerage firms. And whoever doesn't play along (see Venezuela, see Iran, see Russia) is put under politico-military pressure from the United States.

The result is a continuous fluctuation in prices, which favors the realization of profits by financial investors, obviously at the expense of consumers and businesses.

The gas market, on the other hand, has always been a "local" market. The marketing of liquefied gas LNG has always remained a minority due to the high costs. For this reason, the delivery of gas orders has always been made almost exclusively through pipes, which to be built require large investments that need many years before being amortized.

For this reason supply contracts were stipulated not between producers and small intermediaries, but directly between states or by national energy companies.

The first European supply contract was signed in 1969 by Eugenio Cefis, president of ENI, and Russian president Leonid Breznev. The following year a similar contract was also signed by Germany.

These were contracts lasting 20-30 years, which assured the supplier the certainty of returning their investments and at the same time guaranteed the buyer the certain supply of energy at an agreed price for 20-30 years. It should be noted that this situation was also ideal for households and businesses, allowing them to avoid excessive fluctuations in the price of gas.

To better amortize the initial investments, the contracts also provided that the buyer had to store the gas in the gas meters during the summer (period of minimum demand), in order not to oblige the supplier to increase the gas flow in winter. In fact, higher flow rates mean larger pipes and higher investment costs, which can be avoided with summer storage.

This long-term contract system continued until 2021, when it happened that …

Do you remember that in recent years we have been bombarded with telephone calls and advertisements for the transition from the "protected market" of energy to the "free market"?

In recent years, the European Union has adopted a series of measures aimed at liberalizing the energy market, in particular with regard to electricity and gas.

The underlying ideology of the EU is always the same: we must liberalize the market, so as to achieve a decrease in prices. But the game rarely works.

The reality is always the same: more freedom for speculators and more costs for consumers. Especially if the liberalizations are applied to a sector which is monopolistic by nature (with very few producers) such as that of gas.

What happened, and certainly those who wanted this "reform" knew it, is that the new intermediaries entered the gas market, those who were already operating in the fluctuating oil market, who began to buy, sell, buy back and resell purchase options on gas, in order to create price fluctuations and profit from them.

In addition, other small parties have begun to enter into new purchase contracts with suppliers, but of the "spot type" or for gas supplies lasting a few months and for small quantities. To save money, these investors avoided summer storage costs, as has been the case for decades.

In this way, the supplier will be obliged to sell less gas in the summer, due to fewer orders due to the lack of storage, and less gas in the winter, since the pipelines are not sized to transport the peak demand of the colder periods of the year. For the moment, the suppliers have managed to guarantee supplies, as the pipes have been oversized to take into account the growth margins of orders, but the non-realization of summer storage will certainly limit future gas delivery capacities in the event of increases in demand, for example due to economic growth. This will lead to a further increase in costs if you do not revert to the previous type of contract.

We add the fact that the supplier, faced with short-term contracts, with no guarantees for the future, with expensive plants to amortize and in the absence of competitors, will have an interest in increasing sales prices, something that did not happen in the past.

These new dynamics were mainly triggered by the decisions of the European Union, of course – as always – without informing the citizens. We can suppose that these decisions are a consequence of the action of the usual lobbies operating in Brussels, both to the pressures of the USA aimed at damaging Russia economically, but also to encourage greater sales of American liquefied gas.

It was not the "bad" Putin who increased the gas to spite us, but it was the "good guys" of the European Commission and the US presidency who brought us into this situation.

Personally, I have the doubt that the escalation of the war in Ukraine (the increase in provocations that pushed Russia to military intervention) took place only after the implementation of these reforms of the European energy market precisely to maximize the returns of investors on the occasion of the disturbances caused by war.

The ecological transition

Certainly one of the ways to reduce our energy dependence on foreign suppliers is also to be able to produce more energy at home.

We propose the previous graph on the energy mix used in Italy to make an analysis.

The "Italian" renewable sources are hydroelectric, solar, wind and biofuel, which all together represent 19.4% of the total. In the years 2020 and 2021 the total share of production from renewable sources in Italy has further increased, not due to who knows what increase in investments, but above all due to the reduction in internal energy consumption caused by the production limitations of the anti-covid-19 measures. It is known that energy from renewable sources requires large initial investments, but then the energy is produced essentially "free", or at low cost. In the event of an overall reduction in energy requirements, consequently, it is natural that production from non-renewable sources is reduced, so that renewable sources cover a greater share of production. But once the situation is normalized, it will resume burning diesel and methane, as before.

For this reason, for our analysis we take into consideration the data of 2019, before the pandemic.

If Russian gas represents 16% of the annual national energy needs, to compensate for it we should bring the share from renewable sources from the current 19.4% to 35.4%.

The objective is absolutely desirable, because to the advantage of freeing ourselves from structural ties with Russia and, in general, from the conditioning deriving from foreign energy suppliers, we would also add the reduction of CO 2 emissions deriving from the lower combustion of natural gas.

Considering that the share of hydroelectricity has very few margins for further development, because we have already built the hydroelectric basins that we could build, we would have to substantially double the energy produced through biofuel, through solar plants and wind farms.

At this point there are two questions: with how many investments and in how much time?

Doubling the renewable energy production capacity means making huge investments and means waiting years for these new plants to be built and put into operation. It means that those who govern us should quantify these investments, find the money and finance quality projects, which guarantee effective results from an energy point of view.

Another valid possibility for Italy to reduce its energy dependence from abroad is to seriously invest in energy savings.

Indeed, we do not need energy as such, but we do need energy for heating in winter, for the production of goods and services and for transport.

By implementing appropriate energy saving and rationalization measures for air conditioning systems, production plants and transport, Italy could reduce its annual energy requirement, gradually reducing its foreign dependence and avoiding CO 2 emissions into the atmosphere. It is realistic to assume that the reduction potential compared to current needs is at least 30%.

Even in this case, however, substantial investments are required and it is necessary to wait several years before reaching the set objectives.

Politically speaking, it would be appropriate to invest both in the construction of plants for the production of green energy in Italy, and in energy saving. But it is a question of putting large capital into play and carrying out structural interventions, lasting at least 20-30, in order to develop solid skills in the sector and production chains. Today, unfortunately, our best engineers in the sector emigrate abroad, due to the lack of serious opportunities in Italy. We are a long way from following these goals.

There are those who speak of returning to nuclear power. The topic is complex and deserves at least one article to be explored. My personal opinion is that for nuclear power the costs of construction are too often underestimated, but even more the costs of disposal of waste, as well as the risks deriving from possible accidents, which can be of natural origin (earthquakes, tsunamis, floods ), but also of human origin (a war, an attack). These real risks make nuclear power much less safe than people think.

The "time" variable

The “time” variable is fundamental when it comes to changing the structures of the energy sector.

It takes years to build the plants that allow us to procure gas from other suppliers, for example from the Middle East or from new fields located between Egypt and Cyprus.

It takes years to build the necessary tankers and regasification plants, wanting to buy GN from more distant countries.

It takes years to build sufficient plants for the production of energy from renewable sources and the necessary transport networks.

It takes years to build new nuclear power plants.

Years are needed for the many interventions needed to reduce consumption for winter heating of buildings by 40%.

It takes years to adequately upgrade public transport, in order to reduce the needs of private transport, which is more energy-intensive.

Even if funding is found for these interventions, it will be very difficult to find it until Italy regains its monetary sovereignty, it will still be necessary to have a large skilled workforce, which we do not currently have. It takes years to train good engineers and skilled workers.

In general, it takes many years to transform a political objective into works projects and then to carry out those works.

Unfortunately, we see that our politicians demonstrate once more that they live in the clouds, not even realizing the time factor.

It is not enough to decide today to stop gas purchases from Russia today in order to have another replacement supplier or equivalent national production from renewable sources tomorrow or to be able to reduce national energy needs by 16%. It is crazy to even talk about such hypotheses, as they are out of touch with reality. If you decide that this is the right way to go, then you had to think about it first, at least 15-20 years ago.

If we want a virtuous example for our politicians to follow, we can look to neighboring Switzerland, which demonstrates a rational approach to the issue.

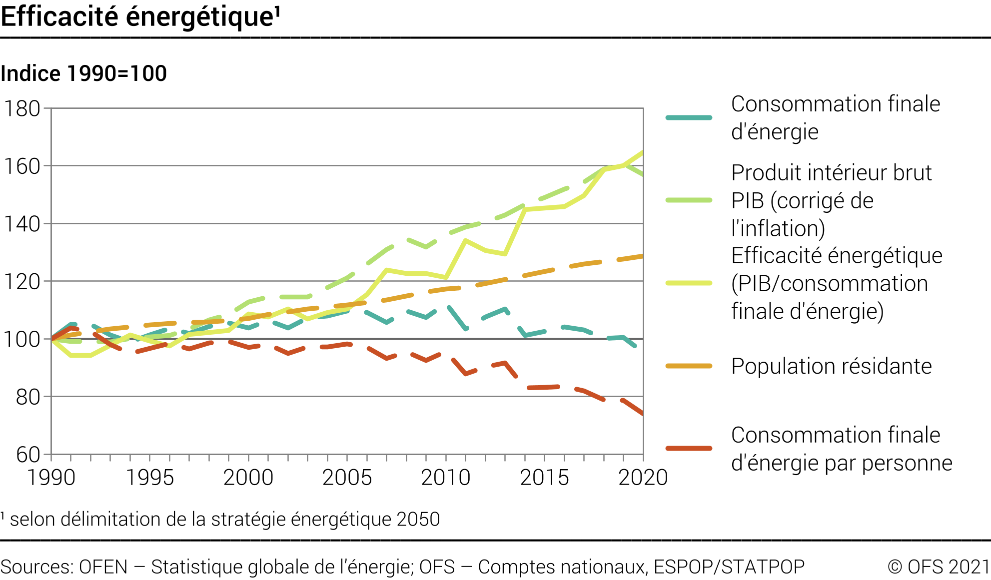

Below we have a graphic produced by the Swiss Federal Energy Office (OFEN)

Note how the overall energy requirement (dark green line) has been gradually decreasing over the last 10 years, despite the increase in the resident population (orange line) and despite the increase in gross domestic product (PIB, light green). Since every person consumes energy to live and since energy is consumed to produce, the growth of these factors would naturally lead to an increase in energy consumption.

But the index of energy consumption per person is constantly decreasing, while the index of gross domestic product in relation to the energy consumed is constantly growing, or more is produced by consuming less.

Switzerland achieves these objectives with structural policies of incentives for energy restructuring, incentives for the production sector to invest in rationalizing the use of energy, incentives for the construction of solar, wind and biomass plants and with a progressive increase in taxation of CO 2 emissions, in which they are announced years before, so that businesses and citizens can adequately target their investments.

In Italy, on the other hand, the political class irresponsibly launches itself into initiatives to break with our main energy suppliers to which we are structurally linked, such as Russia (already in 2011 we had supported, to our detriment, the war on Libya, our other supplier energy historian), without ever having seriously thought about a "Plan B" or structural interventions to reduce our energy dependence from abroad. Basically it is as if they decided to turn off the only tap that quenches our thirst, without having thought about alternative sources of water. The inevitable result can only be death from thirst.

Energy and peace

Returning to the structural ties of interdependence between Italy and Russia, which are also the ties between most European countries and Russia, let us ask ourselves what could be the "superior" interest that could justify breaking these relations.

The war in Ukraine risks enormously complicating the situation, leading to the breaking of equilibrium in international relations which had proved to work well, with advantages both for Europe and for Russia.

This is an extremely important issue that should be placed at the center of the peace negotiations between Russia, Ukraine, with Europe as a party.

The non-entry of Ukraine into NATO requested by Russia or the autonomy requested by the Donbass regions are well worth the price of restoring energy cooperation relations between Russia and the EU. They are worth it, because we have no alternatives at the moment and at least for the next 15-20 years.

The United States, on the other hand, pursues its own geopolitical objectives of far less significance, such as the isolation of Russia from Europe (which is a detriment to European countries) or the interests of some of their multinationals that intend to profit from the change of balances of the energy market.

Nothing that could be worth the price of the very serious consequences of the lack of energy in Europe, with an inevitable permanent increase in prices in the energy sector and with the need to structurally reduce the production of goods and services. Europe would fall into widespread poverty.

If those who govern us intend to do the good of the people, the choices to be made are quite obvious. If they make other choices, let us ask ourselves if they are incompetent or if they are acting in the interests of "others".

And Russia too has every interest in restoring peaceful collaborative relations with Europe in the field of energy.

Let everyone sit seriously around the table, discussing energy relations and peace in Ukraine. The solution that suits everyone, apart from the US, exists. You just need to have a far-sighted look and want it.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Energy, war, peace and finance comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/energia-guerra-pace-e-finanza/ on Tue, 29 Mar 2022 18:40:59 +0000.