How the financial wealth of households and businesses is changing. Bank of Italy report

The trend of financial wealth in 2022 of Italian households and businesses. Here's what emerges from the annual report of the Bank of Italy

(Excerpt from the 2022 annual report of the Bank of Italy)

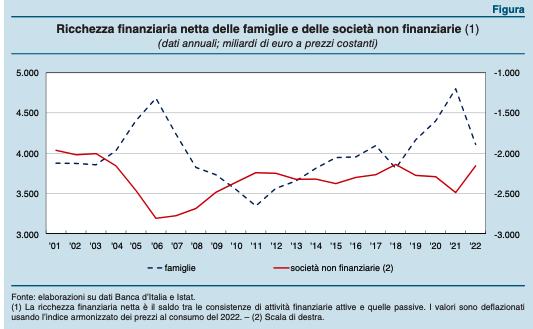

In 2022, high inflation significantly affected the real value of the financial assets and liabilities of households and businesses. The former, which have positive net wealth, have been penalised; the latter, for which debts typically exceed financial assets, instead benefited from a decrease in net liabilities in real terms.

The savings rate of Italian households fell further, to 10 per cent of gross disposable income, after the peak reached in 2020 (17.5 per cent) due to the exceptional compression of consumption during the most acute phase of the pandemic. Together with the huge capital transfers (4.2 per cent of disposable income), mainly attributable to building bonuses, savings allowed households to make investments in real assets equal to 10.5 per cent and in net financial assets equal to to 3.7 per cent of disposable income. However, the latter financial surplus did not offset the decline (equal to 7.2 per cent of disposable income) in the real value of those components of wealth (deposits, bonds, loans and trade credits) whose nominal value is more exposed to consumer price increase.

The growth of bank and postal deposits decreased significantly (0.6 per cent, from 5.3 on average in the period 2020-21), while purchases of private and public bonds regained strength (increased respectively by 9.2 and 44.7 percent). On the liability side, household debt continued to expand, with a slowdown in loans for house purchase. Overall, high inflation and the sharp decline in asset prices led to a reduction in households' net financial wealth, at constant prices, of 14.4 per cent (693 billion; figure). With reference to businesses, in 2022 the marked increase in gross fixed investments, more sustained than that in profits, decreased the financial surplus to 3.5 per cent of value added, in line with pre-pandemic levels and clearly below below those, particularly high, observed in the two-year period 2020-21.

Net purchases of bonds returned positive (11.3 billion, of which 42 per cent public securities) and investments in shares and equity investments issued by resident companies continued (41 billion). Deposits, on the other hand, decreased by 8 billion, due to the recovery in investments and the disappearance of the precautionary motive that had characterized the period of the pandemic. This affected overall debt, which slowed down compared to the previous two years, particularly in the bank loan component (adjusted for securitisations), also due to the increase in financing costs.

The sharp rise in consumer prices was reflected in a contraction in the real value of liabilities greater than that of financial assets most exposed to inflation, for an amount equal to 6.3 per cent of value added. This determined, together with the financial surplus, an increase in the net financial wealth of firms, at constant prices, of 13.3 per cent (332 billion).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-sta-cambiando-la-ricchezza-finanziaria-di-famiglie-e-imprese-report-bankitalia/ on Wed, 31 May 2023 09:22:26 +0000.