Inflation is burning savings, who will be saved?

After Powell's statements to the US Senate , it is now official, the increase in inflation that has been going on for a few months is not transitory.

Precisely. the exact opposite of what the head of the FED was preaching until a few days ago.

The newspapers have not made any fuss about it, even if this news deserves some that made at large cash.

On the contrary, the media will continue to tell us about the GDP boom tablet as if all is well.

In two of the most recent economics articles we talked about thephantom boom of GDP , Boom that was described to us as a prodigy due to the skills of Draghi & C., but also of inflation, more recognizable by the average Italian if called by his second name: price increase .

In these articles we have shown how the GDP, so much heralded on the national media, is inflated by the increase in prices and fixed costs saddled – thanks also to the excuse of the green transition – to the rump of citizens.

When the predictions turn out to be completely wrong

But how the media are particularly adept at catching crabs, that is, at drinking everything that the experts squawk, then ready to contradict themselves immediately afterwards we have been having proof for decades.

From the proclaimed success of the Euro; started with the slogan "we will work one day less earning as if we worked one more day" to the example of Greece, and then moved on to the catastrophic predictions of Brezìxit, which later proved to be a success, up to the jugglers, sorry, the jesters of covid, the list is long.

To prove it, I invite you to download the free ECONOMI / GRAM e-book , which opens its archive full of these examples.

Is inflation good or bad?

Inflation is good if the economy is good, that is, if the increase in prices is due to the economic well-being of the people who are therefore inclined to spend more.

It is bad if the economy is also bad, because it means that there are not enough goods to buy, the shelves are empty, and therefore the money, being in excess of the availability of goods, loses its value.

We explained the reason for the scarcity of goods and raw materials in this article a few weeks ago.

The current inflation finds one of its main causes in the bottlenecks that are found around the world. One, for example, is due to the Chinese monopoly that we talked about in this other article .

The goods do not arrive on the shelves and therefore the prices of those available are skyrocketing.

The same goes for raw materials and semi-finished products.

A striking example is the shortage of electronic chips which is slowing the automotive industry and has virtually paralyzed some sectors of consumer electronics.

So today's inflation is by no means a positive sign.

Non-stop inflation

That hyperinflation in America had already been heard of since the beginning of the year and that this would be contagious at least as much as the covid was in itself a foregone conclusion.

Now that Jerome Powell, the Chairman of the Federal Reserve , has denied himself and the entire world mainstream information, we have the confirmation.

What was supposed to be a transitory phenomenon proved to be what we feared. Partly out of modesty and partly out of fear of looking like birds of ill omen, we never talked about the impression the Fed chief's words made.

The increase in prices that has characterized the last few months of the market is not transitory.

In recent days it has reached 6% in Germany and is approaching 5% in Italy and is destined to rise further, as well as to remain a constant over time. God only knows how much. Indeed, perhaps the Gods of banking Olympus know this.

Inflation is transitory …

… Powell said it …

… And we also explain why …

… Oops!

ECONOMIES / GRAM

STOP TO TAKING AROUND OF THE MAS MEDIA

The most ridiculous excuse in the world

Who did you blame for the inflation, Powell? To the variant to covid-19 called Omicron; the so-called South African variant.

It doesn't matter if you don't have enough information about this yet; Powell is on the safe side. Among the faults of lasting inflation is the Omicron variant. A variant that according to current estimates would have claimed just 33 victims in 8 states.

But if we are given a misleading excuse, the question is: when the Fed chief reassured everyone, was he in good faith or was he lying to us knowing he was lying?

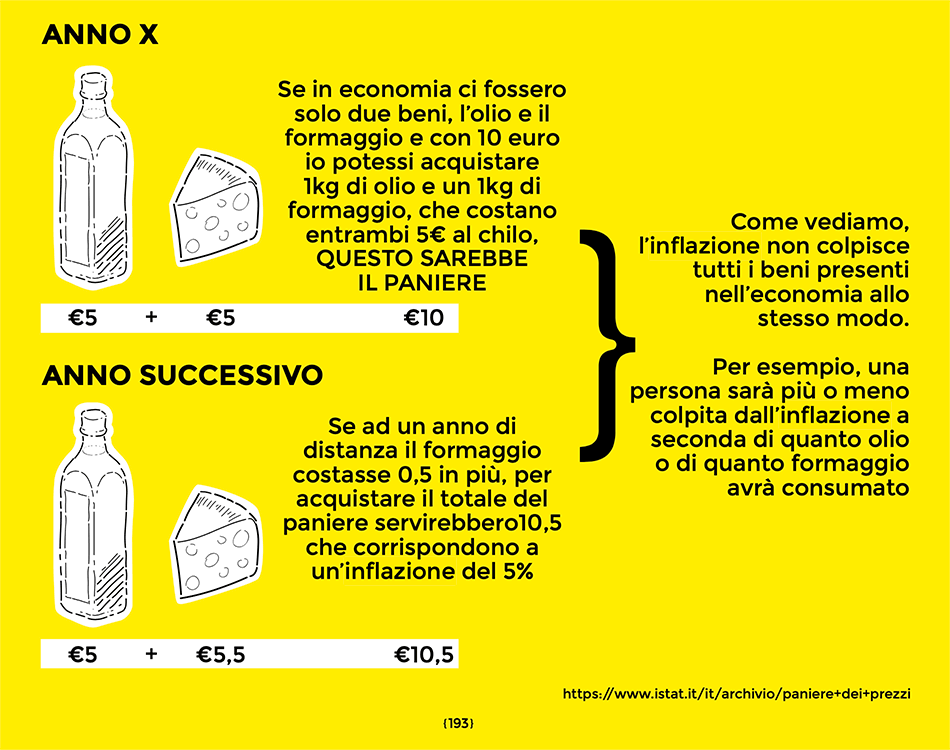

Who Hits Inflation?

Inflation is overwhelming everything because it starts with rising commodity prices.

So all the productions, from food, to chemistry, agriculture (which is mainly based on chemistry), electronics, etc. are affected by the increases.

Since it is a question of an increase in prices and therefore of the loss of value of money, this phenomenon affects everyone.

In particular, it will affect the savings held in current accounts that will devalue because, trivially, the money is devaluing.

It will also affect those on a fixed salary, because they cannot adjust their income as the situation changes; unlike a professional or companies that can adjust their price and tariff lists over time.

Those who have a mortgage to pay will have a hard time; not for the installment itself, because that depends on the rates on money and on the mortgage formula (variable or fixed?).

For them the problem is that if shopping at the supermarket, energy bills and fuel cost more, paying the installment becomes more difficult. Ditto for those with high condominium expenses.

Debts and debtors

As a rule, when there is high inflation it becomes easier to repay debts. This happens because since there is more money in circulation than it would take, in theory it should be easier to earn it (too bad you need a job to do it, not such a common factor today).

Inflation helps pay off debts even those with capital aside. Now it's better to use them instead of waiting for them to devalue. Indeed it would have been appropriate to think about it 4, 5 months ago.

But these are exceptions, because we are going through a period of economic crisis.

Hard life for workers and for those who have granted loans

Even those who have lent money will have a hard time, because when they did, money was worth more than it is today. So when the debtor repays him that money will be worth less.

Hence inflation damages: 1) those who have not invested their savings in securities and assets with a higher return than inflation; 2) consumers.

Financial markets are also affected, because inflation leads to a state of uncertainty. The uncertainty is determined by the fact that consumers, knowing that prices are rising, will tend to postpone their consumption.

The financial markets go accordingly, with the exception that on the financial markets, where someone loses, on the other side there is someone who gains.

Another category penalized are the rentiers, that is, those who live on a rent on deposited capital and which have not been invested.

In this sense, the non-stop inflation that has just been announced is like a kind of large balance sheet on the checking accounts of the rich.

In this historical juncture, who will be saved?

An example of those who have the opportunity to get by is those who have invested their savings in energy sectors (and in general raw materials on the production side), the waste treatment sector and in general all those actions related to the ecological and energy transition market .

In fact, in Europe it was decided to take this path at all costs. The public funding allocated to this sector is an additional push to make this segment of the market grow.

Those who buy government bonds (already at negative or close to zero rates) or have recently bought them lose out, because they are sure that today's inflation is higher than the guaranteed annuity at maturity.

Who will keep their savings from inflation?

The most effective way to preserve your savings when commodity inflation is rampant is to invest in those sectors that are not affected.

The two main assets preferred by savers and speculators are currently gold and bitcoin (which, however, is in the throes of a speculative bubble) and crypto currencies in general : for those who trust.

The states that are burdened with important public debts are smiling, because at this moment they are in the most advantageous position to repay them, because money costs less. After all, it is a question of the mirror position of those who have public securities in their pockets.

What does inflation mean for ordinary people?

According to some observers, the current inflation is a consequence of the enormous effort by central banks to inject liquidity into the economy.

All these barrels with Mario Draghi bazooka shots (which however remained almost entirely on the financial markets, inflating the stock market), the reduction in the cost of money that has encouraged individuals and companies to take out mortgages and loans, as well as having arrived only with the dropper (and with the guarantee of the state in the manner of the Conte government and its firepower ), now they must return in some way.

In short, the loans were there, but now we have to settle the accounts.

Those who benefited from the unlimited money printing were the financial markets. We have been repeating this for about ten years.

The reason lies in the mechanism with which central banks operate and which we find perfectly explained in the book of Easy Explained Economy and we will not be here to repeat.

In short, according to these observers, after sowing the time of harvest has arrived. And the most immediate way to reduce all the amount of money in the markets and the economy is simply to let inflation run in order to reduce its value in circulation , causing inflation to devour some of it. How much is not yet known.

HAVE YOU SEEN THAT UNDERSTANDING ECONOMICS IS CONVENIENT?

And what have we been dealing with while all these games unfolded over our heads?

Have we taken care of our savings?

Did you also take it out on the wrong fascists?

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Inflation is burning savings, who will be saved? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/linflazione-sta-bruciando-i-risparmi-i-tuoi-sono-al-sicuro/ on Mon, 06 Dec 2021 11:00:26 +0000.