Is Mario Draghi a traitor?

Mario Draghi the lamb werewolf

Mario Draghi at the same time is not a man of finance, but he is a man of banks.

From 1985 to 1990 he was executive director of the World Bank.

In 1991 he was appointed Director General of the Treasury.

In 1992 he is one of the Italians invited on board the Britannia where he sells off Italy and is well rewarded as from 2002 to 2005 he was appointed Vice President for Europe of Goldman Sachs, to be then at the end of 2005 appointed Governor of the Bank of ' Italy.

It was 2011 when, with his famous letter, co-signed with Trichet, he helped to bring down the Berlusconi government and was subsequently appointed president of the ECB.

Many have raised the flag when Draghi was placed at the top of the ECB, with inadequate patriotism, completely disconnected from reality.

Mario Draghi is a banker, he does not wear the blue jersey and he is not the captain of the national team. He is a technician who thinks, lives and breathes as such.

His task was not to save the Italian public accounts or to pay some debt to Italy as some pathetic big babies have hoped. Rather, his intent was to extend the stock with the purchases of government bonds, not in the national interest, but in the survival of the Euro.

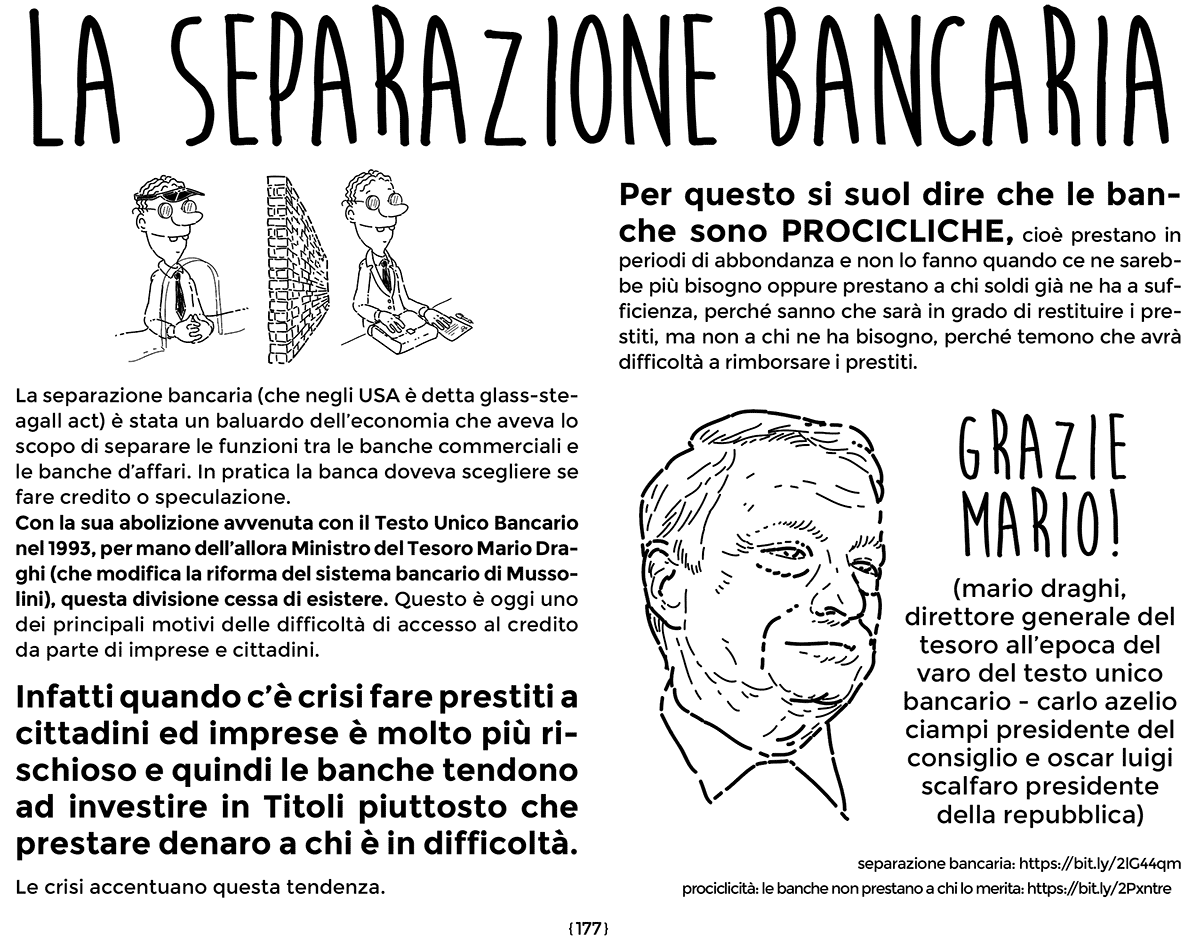

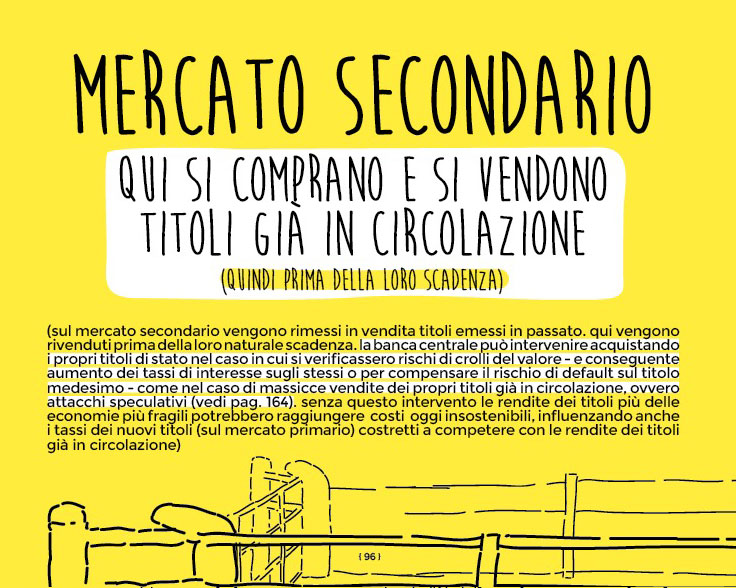

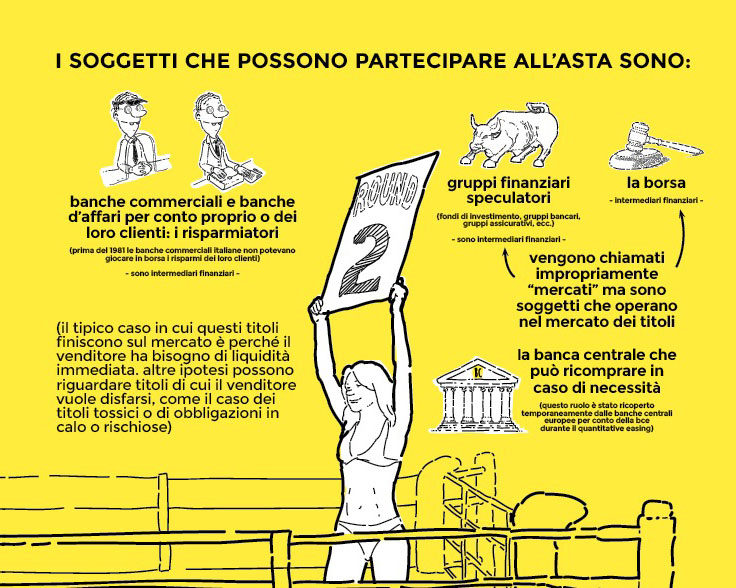

With the QE Draghi caused the European Central Bank (ECB) to buy public securities on the secondary market; a process explained in detail but simply in our easy explained economics book.

Below is a small taste of part of the explanation.

How the secondary securities market works

Effects of the ECB intervention

With the direct intervention of the ECB, a completely artificial demand for securities (including Italian ones) was created, which replaced the buyers who did not want to buy them.

In other words, thanks to Draghi's maneuver – absolutely notwithstanding the constraints of the ECB to which Germany and its peripheral countries were opposed – he was in fact able to make the ECB buy all those public bonds that no one wanted except at a high price from the public coffers. .

In this way, it affected the market for all public securities, not only the old ones (which circulate in the secondary market), but “by contagion” also the yields of future bonds.

What does all this talk mean in layman's terms? It means that the market for government bonds has been calmed or that the rates of those bonds have fallen and consequently also the annuities that the States will have to repay to the lenders, or to the market operators when these bonds will expire.

The role played by the ECB during QE is called the lender of last resort that we have described in this article and also in our book.

With the QE Draghi made sure that the public accounts of Southern Europe did not explode and thus averted the collapse of the eurozone and the return to national currencies.

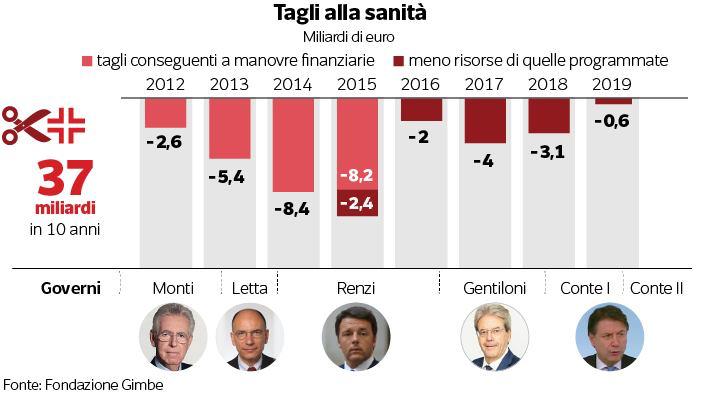

Mario Draghi and the cuts

So did Draghi serve Italy's interests? No, it served the interests of the creditors of the states which, if they defaulted, would have caused them huge losses and in fact the collapse of the markets themselves. That these interests coincided with the survival of public accounts is obvious, because large portions of the interests of the stock markets are based on these.

At this point I happened to be teased: Draghi is the savior of the country because by doing QE he avoided the (false) cuts linked to austerity.

Luca Menini does not know a significant enough fact.

Quantitative easing (QE) is monetary policy, not fiscal policy. It is the budgetary policies that lead to cuts and spending.

What determines how much and how to spend is determined by the state budget – that is, politics – and not the monetary issue by the Central Bank, whatever it may be.

“ Fiscal policy is not the responsibility of central banks and their governors. And in fact Draghi has never failed to urge the states with spending capacity to spend on investments, and not from today. "

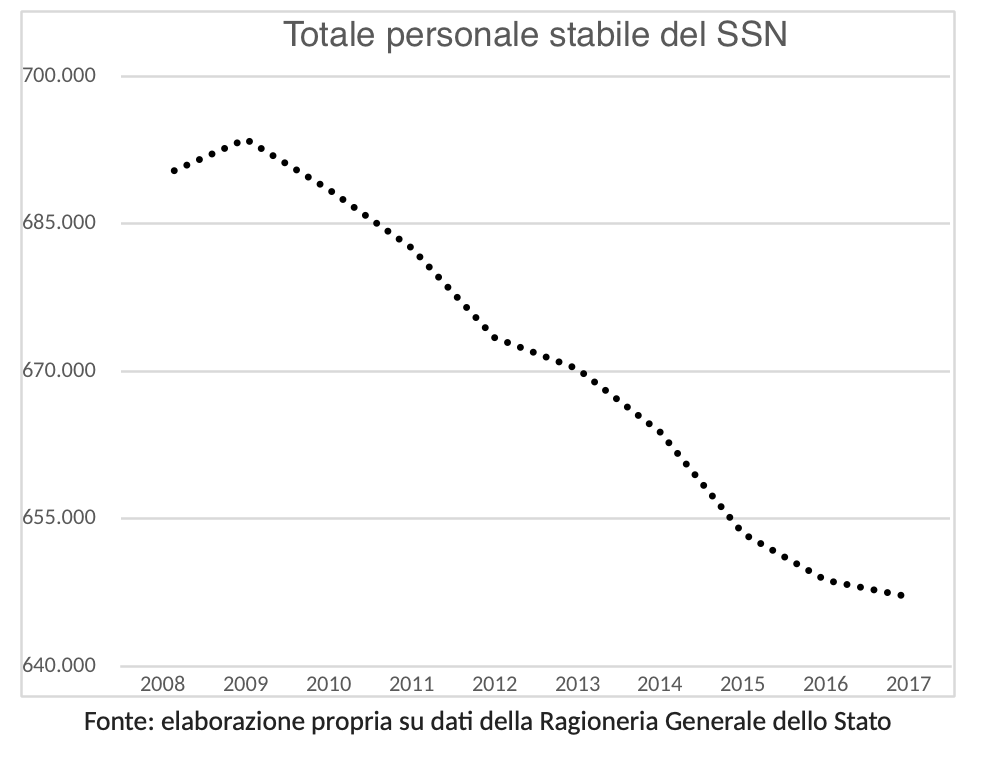

In fact, does anyone appear to have stopped cutting public spending?

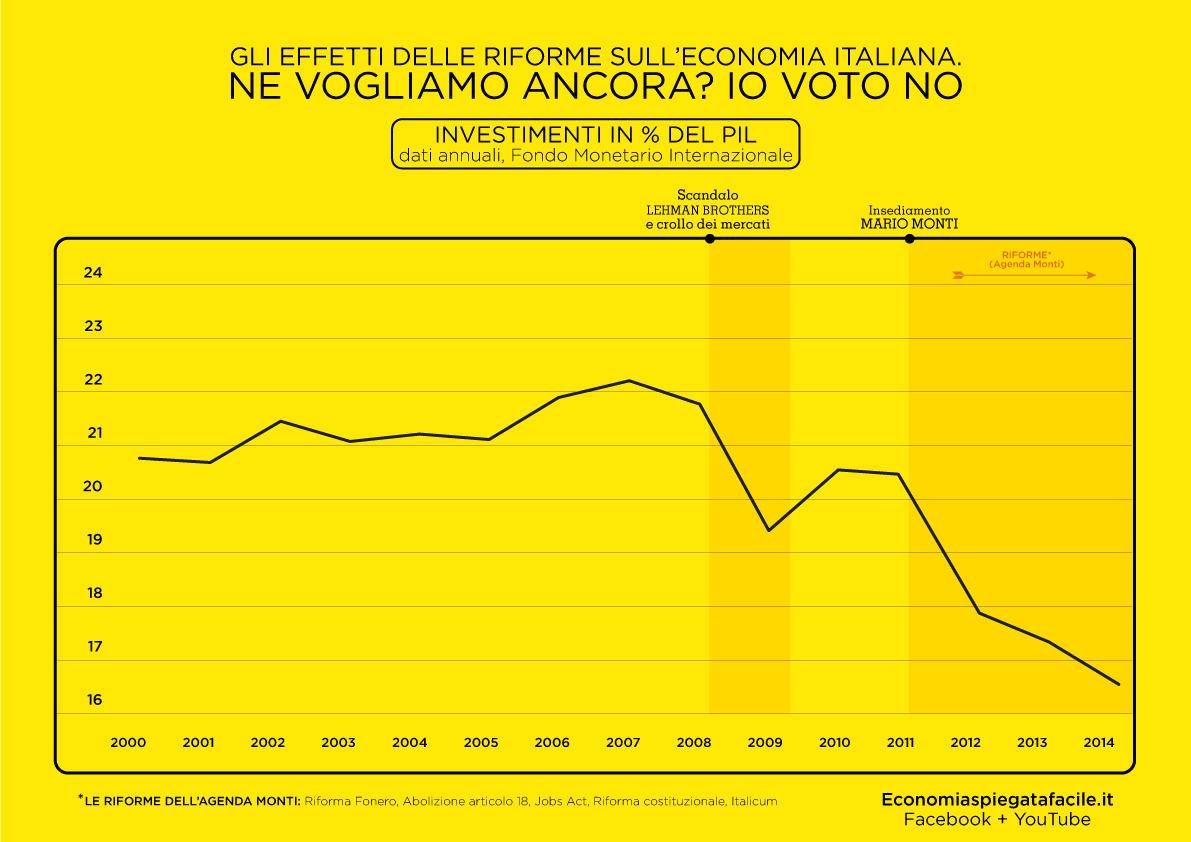

Investment chart 2000 – 2014

So how do Draghi's choices on monetary policies reconcile with the trend of these graphs?

Simple because the balance of public finances serves to guarantee creditors, not the well-being of citizens: while spending cuts are reduced, debt containment is guaranteed, which reassures the markets.

Result on the reduction of public debt? There he is:

Because, as the basic laws of the economy teach, if you cut public spending, you impoverish the country and a poorer country will have to contain expenses, consequently remaining behind the economies in which the most is invested. In the long run, the poor remain behind on all counts and will have to resort to new debt to try to keep up with the progress of competition.

In short, more austerity = more debt.

UNDERSTANDING THE ECONOMY IS FUNDAMENTAL

TODAY IT HAS ALSO BECOME EASY:

![]()

SECURE PAYMENTS

![]()

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

Is the article Mario Draghi a traitor? comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/mario-draghi-e-un-traditore/ on Mon, 24 Jan 2022 08:52:40 +0000.