Laundering and taking advantage of public debt traffic

a case study, by Marco Saba, November 16, 2020, 80 EA (eightieth of the Atomic Era).

To finance income earners, take away from the poor to give to the rich, the state uses the mechanism of public debt. By renouncing to legislate the direct issue of money [provided for in the Constitution in Art. 117, par. “E”: The State has exclusive legislation … money , savings protection and financial markets; competition protection; currency system ; state tax and accounting system ; harmonization of public budgets; equalization of financial resources; – The article is used in a negative way to prevent the regions to make direct] the state organizes monthly auctions where to sell, to an audience selected [ "Specialists in government": 16 banks among the largest and multi punished for criminal activity ], of government bonds, in practice of the "atypical bills-drafts" with which the state indebted the population, without its explicit approval.

F onte: MEF http://www.dt.

T he primary market

This procedure has no rational explanation because the state could directly provide for the creation of the necessary fiat money and account for it as a cash inflow – it is a sovereign power (in the past it did so by issuing state notes which it accounted, however, as a false floating liability , hiding so seigniorage to the same public finances …)

When the “ specialist” commercial bank wins the lot of securities at the auction, at the end of the auction, it creates a bank deposit out of thin air in the name of the Treasury for the discounted price at which it purchased them. (The precise balance is established ex post by taking as a reference the most disadvantageous discount price for the status reached in the auction.)

This creation of bank money, must purchase securities, is recorded as an outlay of cash to the bank, a financial outflow, ndo falsifies the balance sheet: the amount of securities purchased is "matched" by the deposit liabilities, final zero, without taking into account the creation from nothing of the monetary means used . In practice, a bank that bought all the public debt, 2,500 billion, would have a balanced budget: the 2,500 billion created from nothing does not appear . At this point the bank laundered the money creation out of thin air by buying the “public debt” asset. The bank is even, the state has a debt equivalent to the face value of the bank money "bought" at full price plus the interest payable on the debt.

Taking a profit: selling on the secondary market

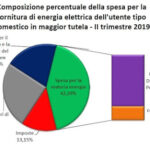

The bank at this point must "launder" the securities to obtain the corresponding and "cleaned up" money for free. Let's take an emblematic example: the purchase of government bonds by the company SOGIN ( https://www.sogin.it/it ) . SOGIN is financed by the electricity bill, of which 40% of the amount consists of the cost of energy and 60% by hires:

Source: https://www.qualenergia.it/articoli/199440dal-primo-aprile-la-bolletta-cala-ma-cosa-paghiamo/

“In Italy, for example, the external separate fund CCSE (Equalization Fund for the electricity sector) pays all the decommissioning costs of the public body Sogin responsible for decommissioning and waste management. But the funds were partly used for other public interest purposes other than decommissioning, as the state is free to use the money for any purpose. " – Source: World Nuclear Waste Report, 2019. Page 77 https://worldnuclearwastereport.org/wp-content/themes/wnwr_theme/content/World_Nuclear_Waste_Report_2019_Focus_Europe.pdf

The figure corresponding to ARIM , formerly A2 , included in the "Expenditure for system charges" , is taken to the electricity user "to dismantle nuclear power plants" by CCS E , which turns part of it to SOGIN and part of the state that he will do what he wants. Note that the user does not know exactly how much it is because it is not reported disaggregated in the bill.

Source: ARERA https://bolletta.arera.it/bolletta20/index.php/guida-voci-di-spesa/elettricita

SOGIN decides to invest 75% of the budget in government bonds (because in reality it does not know how to make radioactive waste safe, nobody in the world knows, but despite this, at least ten million tons are produced per year ). At this point, SOGIN, with your electricity bill money, buys government bonds from the bank that bought them at auction . The bank gets back the capital it had created out of nothing , but not accounted for, and, in accounting terms, it is always even: it no longer has the securities but it has the money. In fact the money that seem to have disappeared from the budget, they arrived in the centralized account of the bank and can be re lev ati with a judicial finding or a forensic accounting investigation of the account of cash flows (who regularly is never done). The most daring try to justify this phenomenon to the superfluous people by claiming that banks create and destroy money …

This simple example shows how the bank recycles the money created in black, by buying government bonds, and then get it cleaned up as stolen property, with a seemingly legitimate operation.

In fact, SOGIN was simply concerned with parking the money profitably. But, as you will have understood by now, the one who pays is always you, and the one who never pays is the system .

System dementia: caused by radiation?

For those wishing to investigate the origins of dementia of the actors in the system , or the fact that no one complains about it or takes radical measures in this regard, it might be useful to study this document:

A risk factor for radiation dementia [2018]

https://stop-u238.blogspot.com/2020/11/un-coefficiente-di-rischio-per-la.html

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Recycling and taking advantage of public debt traffic comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/riciclaggio-e-presa-di-beneficio-nel-traffico-del-debito-pubblico/ on Tue, 17 Nov 2020 21:24:17 +0000.