Meme Trading, or the surreal story of how a student came to own 6% of a listed share that took home $ 100 million in profit

In the crazy world of "meme trading", where PR and social engagement skills are important, while the real balance sheet data is zero, a 20-year-old boy can find himself owning 6% of a listed company, see it grow 300% and prepare it for a crack. Let's look at the case of Bed Bath and Beyond (BBBY) , a listed company that controls a chain of American home accessories stores that is rather decadent, but not enough to not make sparks on the stock market …

The absurd trading of this company features two protagonists: Ryan Cohen and Jake Freeman.

Cohen was already known for being one of the inspirers and early investors in the Gamestop bubble. He repeated the same operation with BBBY, becoming its second investor and taking the company to the stars in the stock market price with a + 300% in value.

Cohen led to an explosion of the stock through the careful use of OTM call options therefore at a higher price than the market price. Rapidly provoked growth, even with the usual PR activity, the good Ryan, who became the second holder of BBBY shares, as a shrewd speculator, presented a document in which he declared that he was completely selling his holdings, including options, through Morgan Stanley , taking home a nice profit, in the face of those who followed him and bought just after him.

But Ryan Cohen is not the strangest and most speculative trading on BBBY. In an article published in the FT we read the story of a 20-year-old college student, J ake Freeman, who studies applied mathematics and economics at the University of Southern California, and managed to accumulate 6.2% of the entire stake in Bed Bath & Beyond for less than $ 5.55 worth $ 27 million, as announced in a 13-G activist letter to BBBY management on July 21, 2022, and which less than a month later sold its entire stake. at maximum values not through a first choice broker, but through its TD Ameritrade and Interactive Brokers accounts, earning $ 110 million in the process!

This position of Freeman resulted when someone noticed that the fourth holder of BBBY shares was a mystery "Freeman capital", that no one knew who he was, until Freeman himself introduced himself to the board as an "Activist Investor"; then with economic / social reasons behind him, giving a lesson to the whole board on how to do their job and advising them to reduce the main debt by 600 million, transforming it into a less expensive debt (how?) and to raise a billion on the market , an easy operation only in words for a company with a very low operating income (EBIDTA) and which was quoting less than 10 dollars a share had a reason.

Meanwhile, in less than a month, Freeman took home a profit of 100-110 million dollars, selling his shares on the market, without intermediaries, for over 130 million and having invested about 26 million, collected between friends and family. Congratulations to him and to a market that allows this type of operation, for heaven's sake, completely legitimate. Obviously if you believe that family and friends gave 26 million to a 20-year-old.

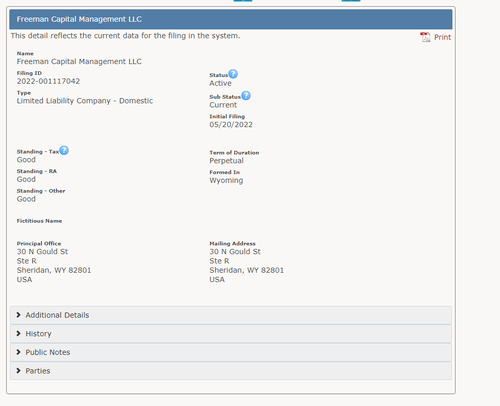

Because his company, Freeman capital, with which he invested, does NOT actually exist, except in the accounting records relating to its creation in May 2022, in Wyoming, with registered office at a "Factory of company £" which, between the other has sometimes hidden dark operations.

So it is possible that the good Freeman is nothing more than a trustee to hide someone who has operated very skillfully using his name.

Meanwhile BBBY a bin was and a bin remains,

However, in the meantime, it has generated many, but many, useful for a handful of speculators, who have chosen it precisely because it is semi-bankrupt and therefore with a “Beta”, that is, stellar volatility. Obviously if someone has gained, someone else has lost …

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Meme Trading, or the surreal story of how a student came to own 6% of a listed share that comes from ScenariEconomici.it and takes home $ 100 million in profit .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/meme-trading-ovvero-la-surreale-storia-di-come-uno-studente-e-arrivato-a-possedere-il-6-di-unazione-quotata-che-per-un-po-e-cresciuta-del-300/ on Thu, 18 Aug 2022 08:00:33 +0000.