Oil: what is the right price, at least according to Goldman Sachs

Oil was the victim of the announcement of the "Horrible" Omicron Variant. We recall the evolution of the price of WTI oil after the announcement

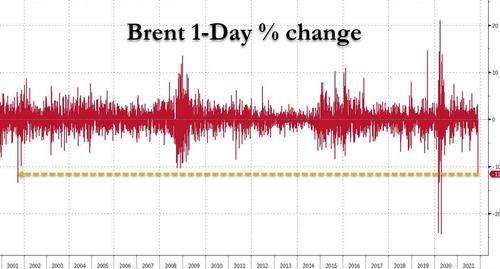

The change for a single day was of an entity that hadn't been seen for some time. This also applies to the European price of Brent oil, the basis for many contracts with Russia and the Middle East:

With the 2020 crisis removed, the downward variation was not seen in these dimensions since 2005.

But is the current price of Brent oil right, or is the market overpricing a temporary phenomenon? Let's see what Goldman Sachs thinks

The bank notes how the panic over the oil market has spread to every corner of the market, from European diesel trading and time spreads, from the relative value of today's oil versus forward futures, to the more expensive options markets. opaque. In short, the bearish push, also thanks to the use of automatic trading algorithms, has spread everywhere.

“ Factors such as the break in technical support levels and a lower liquidity environment after the Thanksgiving holiday intensified the drop in prices, ” said Giovanni Staunovo, UBS's commodities analyst.

Damien Courvalin, of GS, has in recent months, however, set the price of over 90 dollars as a target in the coming months, writes today that with a price of 74 $ / bbl for Brent, the market is evaluating a drop in demand of about 4 million barrels a day for the next three months, with no response from OPEC +. This is a very large figure, according to the analyst, excessive.

To give an idea of the proportions at stake, global oil demand dropped by "only" two million barrels a day from peak to low during last winter's Covid wave, which means the market has paid off today. a wave twice as severe as last winter! Will the Omicron variant, and the insanity of governments, be able to cause such a downfall?

These are huge numbers, according to GS the drop can be at most in the order of 1.5 million barrels per day, with a much lower effect on prices.

Furthermore, it must also be considered that OPEC + has already jeopardized the production increases already declared, in the face of this drop in prices, and in any case it could delay the increases in output. This being the case, the correction to the announcement of the Omicron variant should have been in the order of $ 2 a barrel or a little more. Instead, Brent fell to $ 12 below it, in excess of about $ 10.

Also combining the effects of bearish announcements linked to falling reserves, which could lead, at best, to a drop of 5 million barrels per day in demand. Also in this perspective, even if OPEC + did not change the course of production, the right price could be, for Goldman Sachs, equal to 80 dollars a barrel for Brent, so the current 73 would be a bargain.

If you trust Goldman Sachs …

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Oil: what is the right price, at least according to Goldman Sachs comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/petrolio-qual-e-il-prezzo-giusto-almeno-secondo-goldman-sachs/ on Sat, 27 Nov 2021 14:00:21 +0000.