Powell declares war on inflation for now

The Federal Reserve on Wednesday said it will likely raise interest rates in March and reaffirmed its intention to end its bond purchases that month in what US central bank chief Jerome Powell promised will be an ongoing battle to tame. inflation. An expected announcement given that many now expect more than a rate hike, given the level of inflation.

"The committee intends to raise the federal funds rate at the March meeting, assuming the conditions are appropriate to do so," Powell said at a news conference, staring at a policy statement from the central bank's Federal Open Market Committee that only said that rates would rise "soon".

Subsequent interest rate hikes and an eventual reduction in the Fed's holdings of assets would follow as needed, Powell said, as officials monitor how quickly inflation falls from the current multi-year highs to the 2% target of the Fed. central bank. However, we remind you that the goal is “Mobile”, a sota of media, rather than a precise threshold.

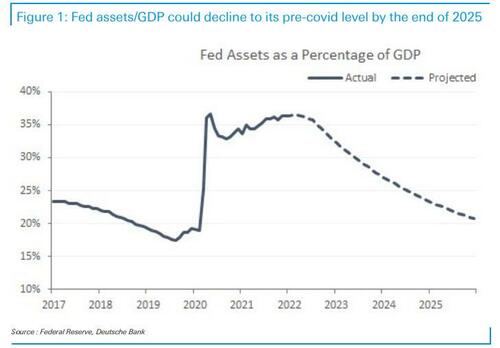

Much remains to be decided, he told reporters following the end of the Fed's last two-day policy meeting, including the pace of subsequent rate hikes or how quickly officials will let his massive balance sheet decline. Because the balance sheet of the US central bank remains very high. Deutsche Bank expects there to be 3 trillion worth of securities to be sold, a move that will drain a lot of liquidity from the market.

But Powell was outspoken on a key point: that with inflation high and seemingly worsening for now, the Fed plans to steadily contain credit this year and end the extraordinary support it provided to the U.S. economy during the pandemic. coronavirus.

Since the Fed's last policy meeting in December, Powell said, inflation “hasn't improved. It has probably worsened slightly… To the extent that the situation deteriorates further, our policy will have to reflect this ”.

"This will be a year in which we will steadily move away from the very accommodative monetary policy we have put in place to address the economic effects of the pandemic," he added.

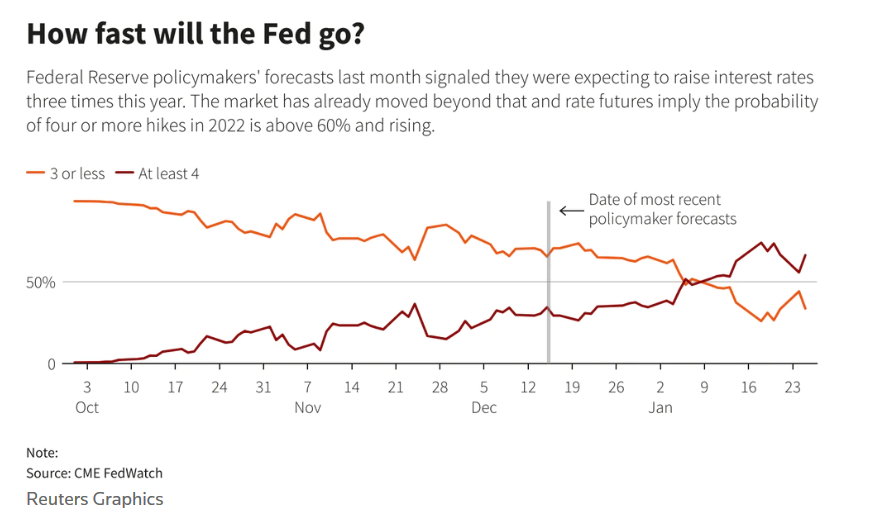

So more rate hikes are to be expected after March. Even the market would expect four.

US stocks, spurred on earlier this year by concerns about how quickly the Fed might move to contain inflation, slipped as Powell repeatedly stressed the underlying strength of the economy and persistence of inflation and refused. to rule out more aggressive tightening if necessary.

In reality, the number of rate changes will depend on the response of the economy and employment. If the stock market responds very badly to the first hike, and unemployment increases, Powell, despite everything, would be forced to review his positions and reduce the number of rate hikes, including for political reasons. However, we are in an election year.

The Fed's fiscal-sensitive longer-term Treasury yields rose as Powell signaled that a decision would soon be made on when to start reducing the central bank's $ 8 trillion portfolio of securities. US Government and Mortgage Backed Securities (MBS). The dollar jumped 0.5% to its highest level in a month against a basket of currencies from major trading partners.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article Powell declares war on inflation, for now it comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/powell-dichiara-guerra-allinflazione-per-ora/ on Thu, 27 Jan 2022 13:30:08 +0000.