“The Big Short 2.0.” $ 700 million starts to jump. The CMBS bomb

Over the past 6 months we have talked a few times on Economic Scenarios about the plight of commercial real estate which, unlike most other financial assets, did not benefit from a Fed bailout or backstop (but may soon change). In June, we hit a crisis high when the unprecedented surge in new CMBS (Commercial Mortgage Backed Securities) defaults heralded a commercial real estate disaster.

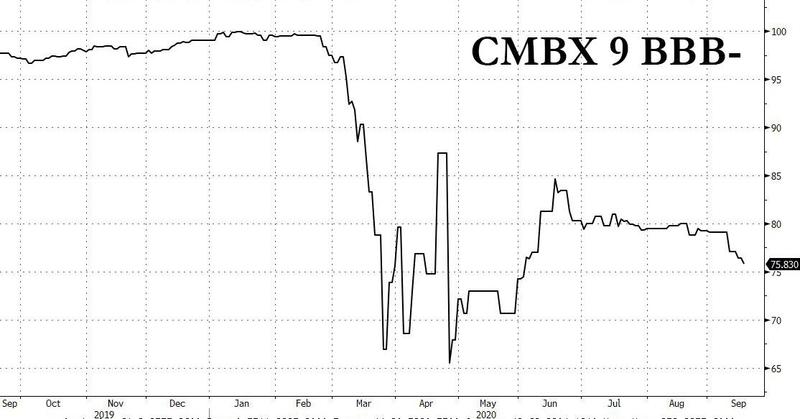

The ongoing crisis of structured debt secured by commercial real estate in general and hotels in particular prompted Wall Street to launch the “Big Short 2.0” trading: betting against hotel-backed loans, which had the largest representation in the CMBX 9 index whose BBB core series continued to slide even as the broader market recovered. So we went back to the “good times” of the “Syntetic CDO”, derivatives built to bet on the failure of other CDOs. Of course the names have changed, but the gambling nature of these financial products is the same.

The index representing the value of these CMBS is CMBS 9

The blow is likely to be strong because major failures in the CMBS universe have so far been very rare due to excessive collateralisation, that is, a guarantee provided to funds even in difficulty. However, the economic crisis has been dragging on for too long, the various measures of economic stimulus are expiring and as the owners fail to pay the rent, the various layers of liquidity incorporated for safety into the funds have quickly run out. As a result, we are approaching redde rationem, at the time when some funds will start popping like champagne bottle corks.

The first of these will almost certainly be the 2014-STAR Starwood Retail Property Trust, a portfolio backed by a loan in default of nearly $ 700 million secured by several malls , including The Mall at Wellington Green in Florida, owned by Barry. Sternlich's Starwood Capital, and whose investors are starting to suffer losses according to Bloomberg, after the Covid-19 pandemic closed stores, paralyzed rent payments and ran out of emergency liquidity to pay interest. the default remains.

Now 700 million seems a little, but remember what we wrote at the beginning: finance is starting to bet against this type of product. Now when there is a bet, usually in this case in the form of a CDS. maybe packaged in other products, if someone bets against, there is also someone who bets in favor, perhaps to earn warm and abundant commissions. I don't know, but I seem to have already seen this story in 2006-07 and ended in a massacre, with hundreds of billions of values burned and, unfortunately, the cutting off of very few heads and the failure of too few banks.

Just like in 2007, a large part of the credits contained in these CMBS was, until yesterday, rated "Triple A" by the rating agencies, which, as usual, have done their job in hiding the actual riskiness of a product, not evaluating any risk profiles that are not immediately evident. Yet retail, both hotel and commercial, was already under stress from the competition of alternative formulas born from IT. The black hole remains that whoever issues the security pays for its rating, eventually getting a little bit of what they want. after all, what can go wrong?

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article "The Big Short 2.0." $ 700 million starts to jump. The CMBS bomb comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/the-big-short-2-0-700-milioni-di-dollari-iniziano-a-saltare-la-bomba-cmbs/ on Sun, 20 Sep 2020 09:09:52 +0000.