The Commission confirms it: the revision of the land registry serves only to tax. Draghi tells us a lie

The European Commission has made known the Country Reports, the letters with which an institution that does not carry out the impact analysis of its work, as happened for the whole Green Deal, gives the recommendations, almost mandatory for the individual national states. Anyone who wants can read the whole document at this link .

What is new in this report and what recommendations does it come with? A very simple thing: that the Commission wants a strong increase in taxes starting from those of the house and with an extension also to VAT, and on bathing concessions and it does so so badly that in the report itself it highlights how, in reality, this move would lead to nothing but an enormous destruction of the wealth of families.

Let's start on how the revision of the land registry, despite the promises, and exactly as it happened in Greece, is destined to lead to a sharp increase in house taxes.

Let's take some significant extracts, translated into Italian, of this document:

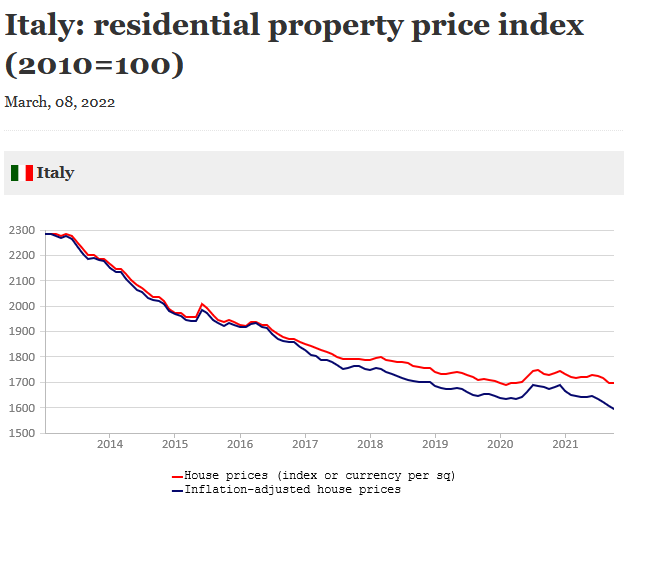

- page 15 Early homes are exempt from recurring property tax for nearly all real estate, due to a high home ownership rate, and the corresponding tax base is outdated. The relevant data on the properties have been collected in a single digital platform, but updates of the cadastral values have not yet been carried out . From this document it is clear that the revision of the land register has the sole purpose of increasing taxation. Furthermore, it is also evident that they want to punish 70% of Italian households owning homes by further taxing them. In the end it is the cure given to Greece and it didn't work. Among other things, the Commission itself notes that the value of real estate in Italy has not grown as in other European countries (page 59). In truth, the values have fallen sharply since 2012, when real estate tax revenues went from 9 to 25 billion,

a sign that taxation is far too high. Then on page 63 they say it clearly: The revenue from recurring property taxes as a percentage of GDP was higher than the EU aggregate, but the first residences are exempt for almost all properties and values of land and buildings used for taxation of properties are largely obsolete. How! We have a system that taxes properties much more than the EU average and we want to tax them further!

a sign that taxation is far too high. Then on page 63 they say it clearly: The revenue from recurring property taxes as a percentage of GDP was higher than the EU aggregate, but the first residences are exempt for almost all properties and values of land and buildings used for taxation of properties are largely obsolete. How! We have a system that taxes properties much more than the EU average and we want to tax them further! - VAT. The Commission complains that there are preferential rates for basic necessities. The revenue from value added taxes is relatively low, also due to the prolonged use of reduced rates. For the Commission, bread and a Ferrari are the same thing, to be taxed in the same way. This Commission is the reference of the Italian left.

- Concessions. The Commission commends the sale of hydroelectric concessions which ceded an essential asset of the community, and also commends the Government's willingness to enter the battle and surrender the bathing concessions (page 15): Furthermore, the use of public concessions for public goods , like the beaches, it turned out to be suboptimal. This implies a significant loss of revenue, as these concessions have been automatically renewed for long periods and at rates far below market value. In February 2022, the government introduced important changes to the draft law on annual competitions ( competition law), which provides for open tenders for bathing concessions starting from 2024. This explains the Draghi government's confidence in bathing concessions: it has promised them in Brussels. An issue that has little to do with money and very much to do with the will to expropriate Italians.

This "Country report" shows two things:

- the Commission acts out of preconceptions, contradicting itself on property taxation. In the same way it acts in an antisocial way on VAT and Concessions;

- Draghi knows very well that the revision of the Cadastre only serves to increase taxation. There is no other purpose, and for that alone it would not deserve trust.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The Commission confirms it: the revision of the land registry serves only to tax. Draghi tells us a lie comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-commissione-lo-conferma-la-revisione-del-catasto-serve-solo-a-tassare-draghi-ci-dice-una-bugia/ on Wed, 25 May 2022 07:00:45 +0000.