THE MANAGEMENT OF LAGARDE? A FAILURE. WORD OF DRAGONS

A Working Paper by Mario Draghi for the “Group of 30” highlights many contradictions in the current monetary policy of the ECB. We know that Mrs. Lagarde is a pure politician with minimal knowledge of economics, as underlined by her enormous communication gaffes, first of all "The ECB does not aim to limit spreads" of last March. However, it is obvious that the central bank's intervention on corporate debt and the European economic system is only a pale reflection of what the Fed has achieved in the US.

Let's start with Draghi: in his working paper it is emphasized how the ECB's intervention on company liquidity has led to the survival not only of "Zombie" companies, that is, which normally could not pay interest on their debt (negative EBIT), m also of the “Vampire” companies, that is, which have a negative operating profitability (negative EBITDA) and which therefore survive even in their typical business only by destroying resources. They are companies that, in a normal market situation, would fail to leave room for more efficient initiatives. After all, what is the market for, if not to select the most efficient companies? A normal situation, attention, is also one in which workers are protected by the welfare state in the transition and the structures are incorporated by other realities, not one in which an industrial desert remains …

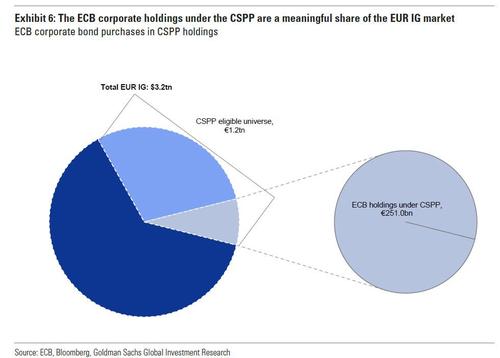

LA Lagarde has invested heavily in corporate debt. approximately 272 billion euros, from 185 already unsettled at the beginning of the year. To make a comparison, the Fed with the CCF has invested in corporate debt, of large companies, only 14 billion dollars.

Virtually 8.5% of all debt of large European companies is in the hands of the ECB. It's not good, it's absolutely not good, especially because it creates a dangerous drug: if many of these companies have EBIT, if not negative EBIDTA, what will happen the day the ECB no longer buys their debt, perhaps at negative rates almost? We have practically reduced the European corporate sector to a sort of money-aid addict by socializing it. We are marching towards real socialism, but in the hands of hyper-capitalism.

therefore the European economy at the level of large companies is on the way to being a sort of soviet, without even the ideological cover of Marx, indeed in the name of the most unbridled capitalism. Because these inefficient companies will then prevent the growth of the small mediums that should replace them.

What does Draghi recommend to solve this situation?

- Strengthening the financial system;

- a targeting of aid at the sectoral level, not to rain on all, with the identification of strategic sectors to be saved and others not;

- therefore a more productive use of resources by relying on private expertise to increase the efficiency of companies and focus on green efficiency.

The first two points are interesting, but not conclusive: a robust financial and credit system is always preferable to a shaky one, and a definition of the strategic sectors to be helped and on which to concentrate investments is necessary. The third point sincerely appears a bit contradictory: first of all it would not be better, at this point, to rely on a management mechanism of the guided corporate restructuring (see IRI of the origins). In addition, the "Green" investments; a Must in Brussels, they are by their nature not very economically rewarding, especially with oil at $ 50 a barrel and can only be sustained with public contributions and adequate shearing of citizens' pockets. However, there is no doubt: Lagarde was a big step behind Draghi at the ECB.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article THE MANAGEMENT OF LAGARDE? A FAILURE. PAROLA DI DRAGHI comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-gestione-della-lagarde-un-fallimento-parola-di-draghi/ on Wed, 23 Dec 2020 10:28:29 +0000.