THE RECOVERY FUND? A FAILURE. Word of the Ministry of Economy and Finance

The Ministry of Finance has made assessments on the impact of the Recovery Fund, or rather the "Resiliance and reconstruction fund" as they like to call it in Brussels. The government officially hopes to be able to bring Italian economic growth to 1.5% -1.8% in 2021 and thereafter, little compared to the decline to the double-digit limit of 2020, but more than what has been achieved in the last few quarters. before the Covid-19 crisis, with growth that was now below 0.5% and the latest in Europe.

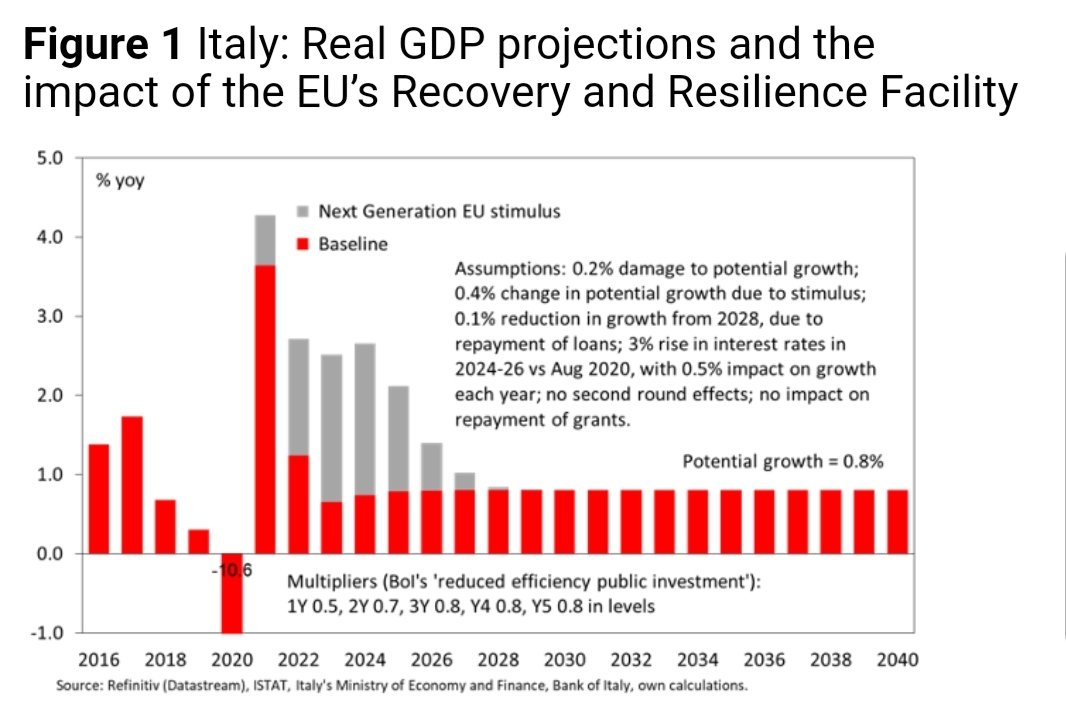

Then the MEF decides to provide us with its prediction and, frankly, we are quite amazed at its realism:

What is analyzed in this graph. the effects of the RRF (Resiliance and recovery fund) on the economy, based on a series of assumptions, some of which are frankly unrealistic, but we will talk about this at the end.

The effect of the RRF in the end is:

a) temporary;

b) not very significant on long-term growth

c) poorly productive

As regards the first point, it is clear from the graph that the effect is of a short, indeed very short, period and in the end it only meant starting from 2022. In 2021 the recovery will essentially be the "Dead cat bounce" after the fall of this year..

Regarding the second point, in the end the net long-term adjustment will be only 0.2%. The potential long-term growth is only touched upon by the recovery plan.

At the third point we can see how even the MEF believes that the Recovery Fund will be poorly productive. in a world where mainstream economists praise productivity, these investments seem, from this point of view, a real ciofeca: in fact the MEF uses the lower side of the productivity of public investments, with a multiplicative effect equal to only 0, 5% the first year, 0.7% the second year, and 0.8% for the following 3. The pivotal value of 1 is not exceeded. In the end, the lower value of the multiplier for the defined public expenditure is chosen the Bank of Italy shows that even the MEF, that is the Government, no one really believes in the effectiveness of the RRF.

We can see that then there is a hypothesis at least risky and one instead wrong. For the risky hypothesis, we see that this forecast is based on the assumption that interest rates from 2024 will be equal to 3%, which, frankly, seems unrealistic at this time, because both world growth and demographic trends make tensions unlikely. inflationary future. The wrong hypothesis is that the reimbursement of the RRF is only starting from 2028: in reality the part in contributions will be repaid immediately, through the "own means", that is the European taxes, which will begin to come into force on January 1, 2021 with the plastic tax. The repayment of the loans will start from 2028, but that is another story. So the actual multiplier of the RRF will be even lower because a substantial part will begin to be repaid immediately, cutting the effect.

This confirms that anyone expecting a raise from this fund is, frankly, deluded, and is also deceiving the Italian population.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article THE RECOVERY FUND? A FAILURE. Word of the Ministry of Economy and Finance comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/il-recovery-fund-un-fallimento-parola-di-ministero-delle-finanze/ on Sun, 20 Sep 2020 12:25:57 +0000.