USA: the illusion of falling inflation for an economy on a razor’s edge

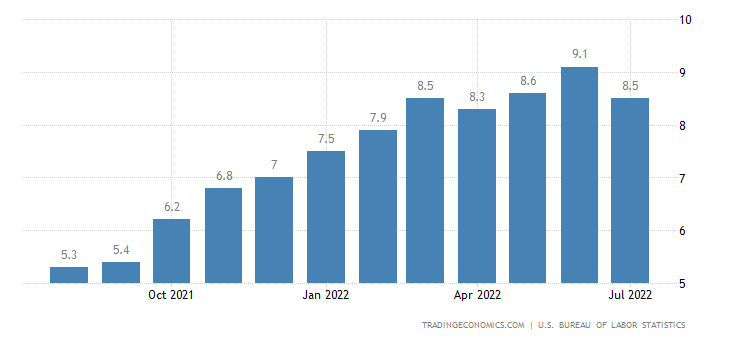

Yesterday Biden celebrated the first drop in the inflation rate before going on vacation. Indeed, at least apparently, the annual inflation rate in the United States slowed more than expected, falling to 8.5% in July 2022 from its over 40-year high of 9.1% in June, and below market forecasts by 8.7%. Energy CPI rose 32.9%, after hitting a 42-year high of 41.6% in June, mainly due to a sharp slowdown in gasoline costs (44% versus 59.9%) , fuel oil (75.6% versus 98.5%) and natural gas (30.5% versus 38.4%) , while electricity prices accelerated (15.2%, the maximum since February 2006). Costs also slowed for new vehicles (10.4% vs 11.4%) and for air fares (27.7% vs 34.1%). On the other hand, inflation continued to rise for foodstuffs (10.9%, the largest increase since May 1979, compared to 10.4%), for housing (5.7% against 5, 6%) and used cars and commercial vehicles (6.6% against 1.7%). Compared to the previous month, CPI remained unchanged after hitting a 17-year high of 1.3% and below the forecast of 0.2%. Core inflation remained stable at 5.9%, beating expectations of 6.1% and offering support that inflation has finally stabilized.

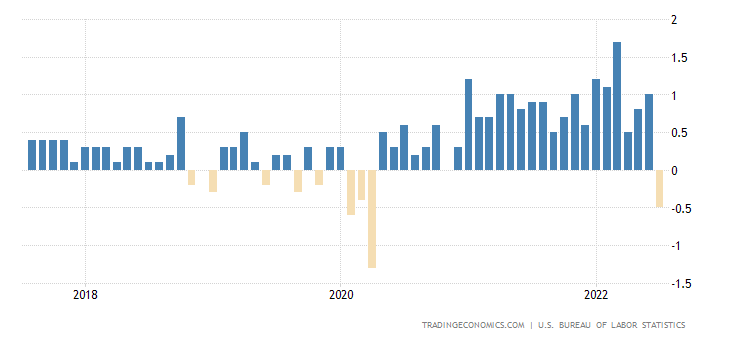

There has even been a drop in producer prices, also linked to the drop in energy prices, especially oil prices. In this case it has been a while since there has been a reduction in producer prices, as you can see from the graph below.

Biden will be able to say, for a month or so, that inflation has dropped thanks to him, that his measures are working and that he therefore deserves confidence in the mid-term elections in November. I strongly doubt it: the current decline is linked to a reduction in the price of oil and gasoline on the US market. On Scenarios you read how the sharp drop in black gold prices that took place last week originated from at least dubious demand data , and in any case the effect of reducing the price of oil is wearing out. There has been a sharp rise in price this week. From a level below 90 dollars a barrel we have already returned to 93, and the very limited increase in quotas decided by OPEC + suggests that the price will take off soon. If we go back to around $ 100, much of the decline in inflation we have witnessed will vanish, while inflation in the food and services sectors must be fully discharged, which will be felt later.

So the relief from the decline in inflation is only temporary, but it has a positive side: it could push the Fed to reduce the heat in its monetary tightening, especially if the employment data were not positive.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The US article: the illusion of falling inflation for an economy on a razor's edge comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/usa-lillusione-del-calo-dellinflazione-per-uneconomia-sul-filo-del-rasoio/ on Fri, 12 Aug 2022 07:47:16 +0000.