The tax table

(… I facilitate a contribution from the director:

and I am going to give you some technical ideas on one of the themes of the day, the famous "tax table", on which the media are scratching with their usual grace, like wild boars in a rose garden, saying more or less well-founded things. Here we will start with the data, as we have always done, since you apparently like it, or you are kind enough to pretend you like it … )

I am a lucky man. The curse of the VAT number did not hit me, I was always an employee, until I became your representative (which does not mean your employee, as some fatuous anti-parliamentary rhetoric would suggest). The fact is that the "taxes" (which would be taxes, but I will spare you this detail: who does not know the difference can ask for it) I have practically never paid them simply because I have always been paid the net income. This is not exactly the case because very often I have had, in addition to the income from employment, income from self-employment deriving from a reduced consultancy activity (always authorized by the department, etc. etc.); moreover, like all Italians, I have a real estate property (a third of a house co-owned with my brothers: I suggest to grillini and other voyeurs to consult here the forms that other colleagues have filled in a little too distractedly); the fact is that even with such a simple life, and with a state that lovingly took care of me, and avoided tempting me by paying me the net income, in any case a couple of F24 a year I always had to make them and the relative declaration I've always had an expert do it, because here, even the declaration of a (fiscally) simple person is complicated.

Then, of course, since karma exists, after having avoided dealing with my taxes for 56 years, I ended up in the Finance Commission dealing with those of everyone else, including you, and if I hadn't had solid colleagues like Bitonci, Garavaglia, Gusmeroli, Siri, etc., I would certainly have done damage. Conversely, with them we did the scrapping ter , the balance and excerpt, the "mini flat tax" (I apologize for the journalistic language). Not everyone, of course, agrees on the success and appropriateness of these measures. Some may find them harmful. I can only say that as an employee I have never considered the self-employed a class enemy, for the simple reason that ( as this blog demonstrates ) I have never been satisfied with the well-known simplistic narrative of the country's problems, the talk show narrative ( remember Idraulik ?).

In any case, my friend Karma took me last Friday and will take me back at least a couple of times to the MEF table, in the anteroom of Minister Franco, to talk about tax issues. I would therefore like to quickly provide you with some technical elements to frame the ongoing debate.

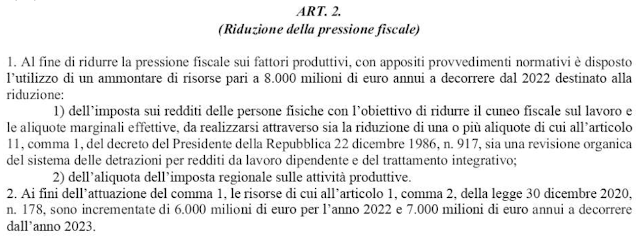

Meanwhile, the "tax table" was born because art. 2 of the budget law 2022 ( AS 2448 ) establishes that:

The Government has allocated an 8 billion dollar fund in the budget law to reduce the tax burden, with the aim of "reducing the tax burden on production factors" (a phrase inherited, as you know, from the rhetoric with which Brussels wants to convince us to accept a tightening of the tax burden on "things": consumer goods – VAT – and housing – IMU). Letters 1 and 2 of paragraph 1 indicate the taxes on which to intervene: IRPEF and IRAP. The margins of the intervention to be done are further limited. For IRPEF, the specific objective is to reduce the tax wedge on labor and the effective marginal rates, and there are three possible tools: the reduction of one or more rates, the revision of the deduction system, the revision of the supplementary treatment .

For IRAP it is simpler: we are simply talking about reducing the rate.

However, the Government did not have time to define the interventions in the budget law, establishing with this article 2 a kind of delegation criterion to itself, and the parties are called to find a shared solution to achieve this delegation (spending these eight billion to reduce the tax burden).

I would start from IRAP, the simplest thing, because, as we will see, this is already quite complicated.

To make you appreciate the nuances, I remind you in the meantime that in the sessions of 30 June 2021 the two Finance Committees of the Chamber and Senate voted separately on a jointly drafted document, the Concluding Document approved by the Commission on the fact-finding investigation on the reform of the income tax of individuals and other aspects of the tax system (Doc. XVII, 3) . The text of the document, together with the explanations of vote, can be found here . This is the document that, in the intentions of some parliamentarians, would outline the reform of the Italian tax system. Using the conditional because despite the good will with which the parliamentarians met to discuss the development of common positions (eventually just Leu abstained), the fact remains that this document is not an act of address, and then the government is not in any way bound to take them into account. The so-called "tax reform voted in Parliament" must therefore be assessed in the light of this mere fact.

However, adhering to the communis opinio according to which the document would have drawn lines which the delegating law and other acts enacted by the government (including the budget law) should have followed, we immediately encounter a couple of difficulties.

The first is that art. 2, paragraph 1, number 2 of the budget law speaks of the IRAP rate, but IRAP does not have a single rate: as you know (if you do not know, it is explained well here ) it has at least five according to the taxable persons (i.e. of those who pay: ordinary businesses, concessionaires, banks, insurance companies, public administrations …), but in reality many more, considering that the rates can be modulated by region (as explained here ). Therefore, it would be necessary to understand on which rate it would eventually be necessary to intervene.

The second difficulty is that the Commission document does not mention reducing the IRAP rates charged to general taxation. In the document "the Commission recommends a reabsorption of the IRAP revenue into the currently existing taxes, preserving the maneuverability of the local authorities and the level of financing of the national health service, without burdening the income from employees and similar with additional burdens." The idea is essentially that expressed in a hearing by the National Council of Chartered Accountants and Accounting Experts several times (once I was there too, it was 13 September 2018 ), or to reabsorb the IRAP revenue in additional IRES (the IRES is this thing here : a flat – i.e. proportional – tax at 24% on corporate income). A problematic aspect (known to all) of this approach is that not all IRAP taxable persons are also IRES taxable persons: some pay IRPEF. In particular, the IRAP subjects who are natural persons pay it (it is not a surprise). For clarity (I hope) I report the art. 3 of the "IRAP decree", the legislative decree of 15 December 1997, n. 446 :

Art. 3.

Taxable persons

1. Taxable persons those who carry out one or more of the activities referred to in article 2. Therefore they are subject to the tax are:

a) the companies and entities referred to in article 87, paragraph 1, letters a) and b), of the consolidated income tax law, approved by decree of the President of the Republic 22 December 1986, n. 917;

b) general partnerships and limited partnerships and those equivalent to them pursuant to article 5, paragraph 3, of the aforementioned consolidated act, as well as natural persons carrying out commercial activities referred to in article 51 of the same text unique;

c) natural persons, simple companies and those equivalent to them pursuant to article 5, paragraph 3, of the aforementioned consolidated act exercising arts and professions referred to in article 49, paragraph 1, of the same consolidated text;

d) ((LETTER REPEALED BY L. 28 DECEMBER 2015, N. 208)); ((52))

e) the private entities referred to in article 87, paragraph 1, letter c), of the aforementioned consolidated act no. 917 of 1986, as well as the companies and entities referred to in letter d) of the same paragraph;

e-bis) the public administrations referred to in article 1, paragraph 2, of legislative decree no. 29, as well as the administrations of the Chamber of Deputies, the Senate, the Constitutional Court, the Presidency of the Republic and the legislative bodies of the regions with special status;

To understand what intervention it would be possible to do, you need to enter a moment as IRAP returns to the Treasury, also to dismantle certain kind interlocutors from talk shows that "costs 25 billion, there are no resources !! 1!". The revenue figures are found here and clarify that:

1) the taxpayers of individuals and partnerships in 2018 were 1,639,354 and 719,457 respectively:

2) the total revenue attributable to these two categories of taxpayers was around 2.6 billion euros (pre-crisis data).

In the current estimates of the Finance Department, abolishing IRAP for these categories of taxpayers would cost less than two billion (also considering that the crisis has struck over 350,000 self-employed workers). The bulk of the IRAP is in any case paid by joint-stock companies and the public administration (these two categories both contribute about 10 billion each, poorly counted), and for these one could think in one case of re-absorption in IRES and in the 'other to eliminate the game of tour with which the public administrations pay a tax to themselves.

Our proposal is therefore to eliminate letters (b) and (c) from article 3, paragraph 1 of the IRAP decree, as a first step towards the definitive dismantling of IRAP in the ways mentioned above, to reduce not only and not so much the tax burden, as well as the bureaucratic burden on professionals and self-employed persons.

And up to here it was the simple piece of the speech, simple also because IRAP, despite having different rates, is one of the many proportional taxes, that is flat , that make up our tax system (which is why we really do not understand the scandal of facing the flat tax proposal made by the Lega: if every single company were to be progressive, VAT, IRES, IRAP, etc. would be unconstitutional) …

It is much more complex to understand what could be done on IRPEF with 8 billion (or with the 6 that remain after having made a simple but decisive intervention on IRAP).

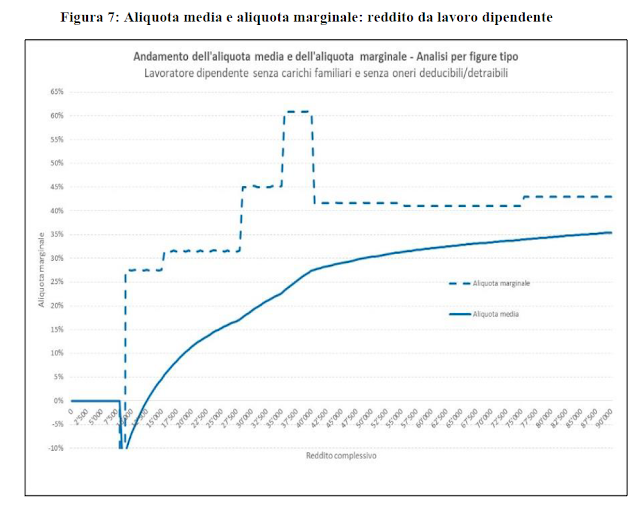

The Government's position on IRPEF is that expressed at the hearing by the Department of Finance, in the document you find here . Figure 7 on p. 24 of the memorandum filed in joint commissions, which I report here for convenience:

it is often at the center of the specialized debate (and never at the center of the television one). It represents the average effective rate (the ratio between tax paid and total income) and the effective marginal rate (ratio between tax increase and income increase) for various income classes, from 0 to 90,000 euros.

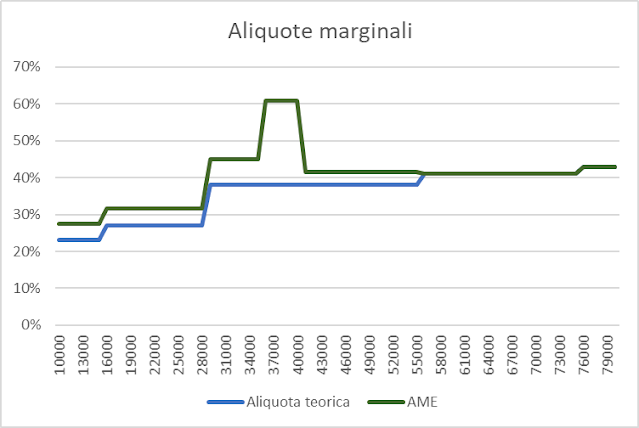

The problem, highlighted by the micro-simulations of the TAXBEN-DF model of the Department of Finance (but as you will see, a simple Excel sheet is enough) is that some taxpayers, not the richest, find themselves in the unfortunate situation of having to pay the tax authorities 60 euros every 100 euro of additional income. It happens in correspondence with the "hump" of the effective marginal rate, indicatively for the income classes between 35,000 and 40,000 euros.

Now: since, how could you know (and if you don't know, you can find it written here ) the maximum personal income tax rate is 43%, how can it happen that someone gets 60% removed if they dare to earn more? This is exactly one of the things that cannot be explained in the television studios, populated by kind interlocutors who are ready to be moved by the fate of the less well-off (which, as you know, is also important to us), but less willing to enter into a reasoning. .

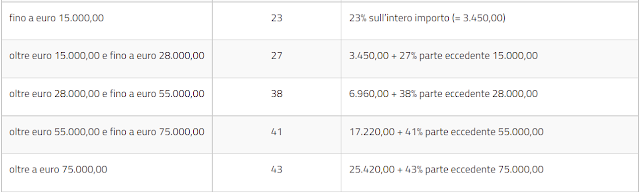

In the meantime, it should always be remembered that the IRPEF owes its progressivity not so much to the tax rate system, but to that of deductions (and this is the reason why certain tatters of clothes when appointing the flat tax are completely out of place if not is reflected in the deductions provided), and that the tax works in brackets, which, in essence, means that the rates for "low" incomes are also applied (pro-rata) to those with a "high" income.

Just to understand, with two examples: a taxpayer who earns 8,000 euros a year does not pay 23% of 8,000 euros (or 1,840 euros), but essentially zero (for a reason that I will explain immediately), while a taxpayer who earns 20,000 euro does not pay 27% of 20,000 euros (or 5,400 euros), but it should pay 4,800 for a reason that I will explain later and which is clarified by this table, and comes to pay 2,261 for another reason.

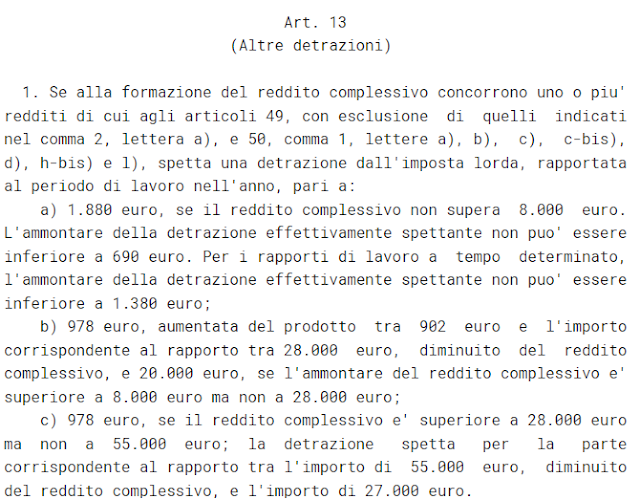

Meanwhile, let me explain why an employee up to 8,000 euros does not pay personal income tax: because art. 13 of the TUIR says that:

or that whoever receives income from employment has the right to a deduction from the tax that "fades" progressively, to cancel itself out at 55,000 euros. For incomes up to 8,000 euros this deduction can reach 1,880 euros and therefore exceeds the tax that should theoretically be paid (I remind you that the deductions are sums that are deducted from the tax, the deductions are sums that are deducted from the taxable amount on which the tax is calculated). I say "it can come" because the amount of the deduction must be commensurate with the days worked, so it could be less than 1,880, but not below the minimum indicated in art. 13 paragraph 1 letter (a) of the Decree of the President of the Republic 22 December 1986, n. 917 (for friends, TUIR: Consolidated Income Tax).

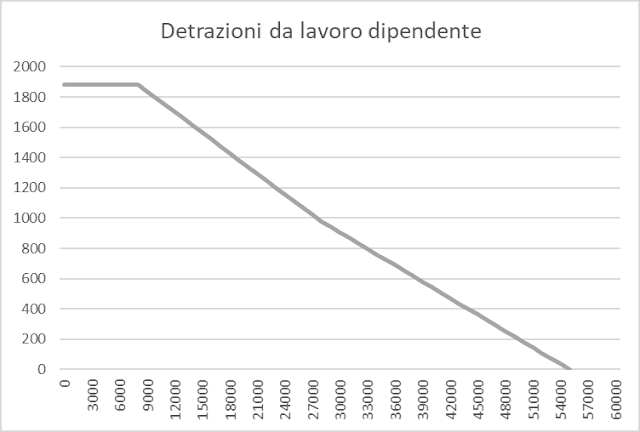

And so you have also seen a piece of the "system of employee deductions" mentioned in art. 2 paragraph 1 number 1 of the budget law currently under discussion. By applying the formulas described in article 13, for the deductions we obtain this curve:

which begins to drop almost straight after the 8,000 euros of income and resets to 55,000 (there is an angular point at 28,000, where the calculation criterion changes, but it is barely perceptible).

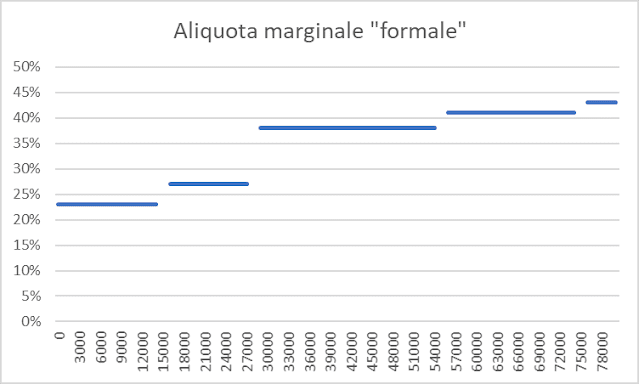

Then there is the other aspect, that of staggered operation. It means that the tax rate system:

it is applied (as the table above clarifies) by multiplying each rate by the income received in the corresponding bracket. So, for example, if your income is 20,000 your tax is not:

It follows that there are no "poor" rates. Simply, if in this example the lowest rate were lowered by three points, bringing it from 23% to 20%, obviously those who, like our friend in the previous example, were subjected to the theoretical marginal rate of 27% would also benefit. , which would pay:

15,000 x 0.20 + 5,000 x 0.27 = 4,350 <4,800

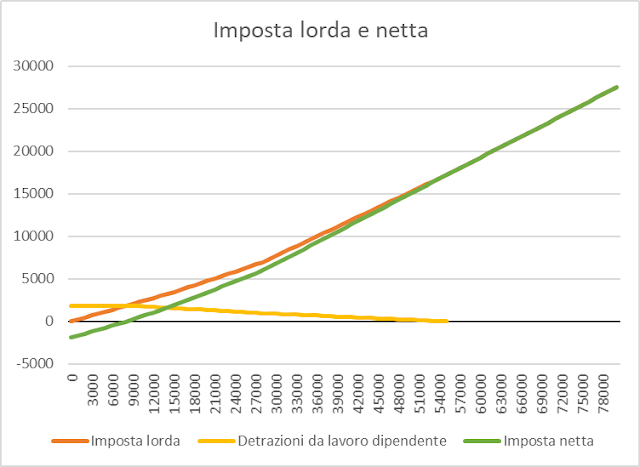

However, with the staggered system, the tax before the deduction for employee income works as follows:

By subtracting the deductions from this tax, you get the net tax:

That is: subtracting the yellow from the orange you get the green, the net tax, which is more progressive (it grows more rapidly) due to the progressive décalage of the deductions (the yellow line).

Now, normally when you are subject to a tax rate (say, 23%), this means that the extra 100 euros earned 23 go to the state. The deduction system adds a complication, because in a certain income range as the income of the income increases, the deductions decrease. It follows that in calculating how much goes to the state when you earn more you have to consider not only the higher tax, but also the lower deduction. The effective marginal rates, those that take this aspect into account, therefore look like this:

and are obviously higher than the theoretical ones starting from where the décalage of deductions begins (i.e. over 8,000 euros), and then rejoin the theoretical ones where the deductions are zeroed (over 55,000 euros, where the rate at 41 %).

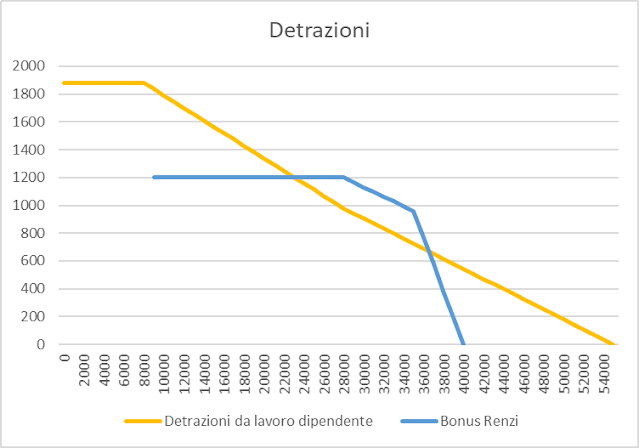

Since it was not complicated enough like this, the Renzi bonus and subsequent modifications are added to the deductions from employee work, explained by this circular from the Agenzia dell'Entrate (for those who love details), or in this informative article from which we draw this useful table :

Then another one is added to the "standard" deductions from employment:

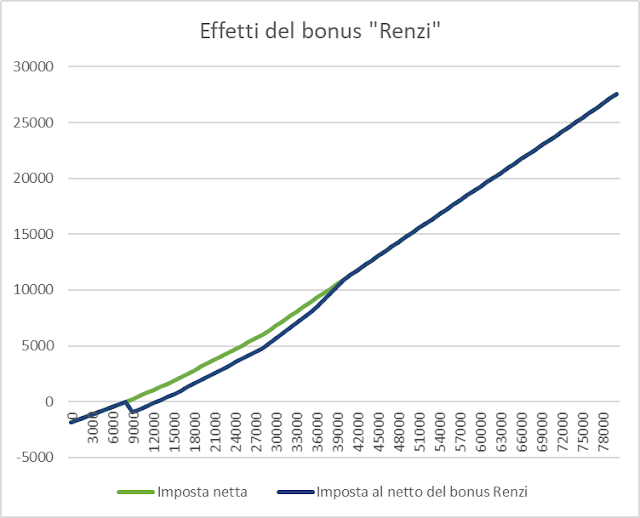

which, since it starts after and ends earlier, a little before the middle of the 28,001-55,000 bracket, complicates the profile of the net tax, which becomes:

From here it is not clear that much, but since the décalage of the "Renzi" bonus is particularly rapid, there will naturally be a range of income in which the effective rates (which consider not only the higher tax but also the lower deductions) will be particularly high. You can see it here:

that is, in the "homemade" version of the graph I showed you above. The range in which every 100 euro more earned by the taxpayer loses 60 (between higher taxes and lower deductions) is obviously the one in which the Renzi bonus goes down, i.e. that between 35,001 and 40,000 euro of income (it can be seen from table and figure above).

Good.

Here I stop, because it's after midnight and I don't want to dream of this stuff. I think that those who did not know have understood a few things: for example, that the progressivity of the tax does not depend only on the increase in tax rates but also on the decrease in deductions, and that some operations carried out in the recent past are the cause of a series of obvious distortions. There are many theories on how to remove them. In practice, I think it is difficult to do this with an amendment to a budget maneuver that unfortunately arrived a month late. I therefore think that we will have to set ourselves less ambitious but more visible objectives.

I would have an idea, but I promised that I would not tell anyone, and therefore … I leave you in doubt!

This is a machine translation of a post (in Italian) written by Alberto Bagnai and published on Goofynomics at the URL https://goofynomics.blogspot.com/2021/11/il-tavolo-delle-tasse.html on Sun, 21 Nov 2021 23:29:00 +0000. Some rights reserved under CC BY-NC-ND 3.0 license.