All anti-US chemistry in the Sinochem-ChemChina merger

China has approved the merger between the country's two main chemical groups, Sinochem and ChemChina. Facts, numbers and comments

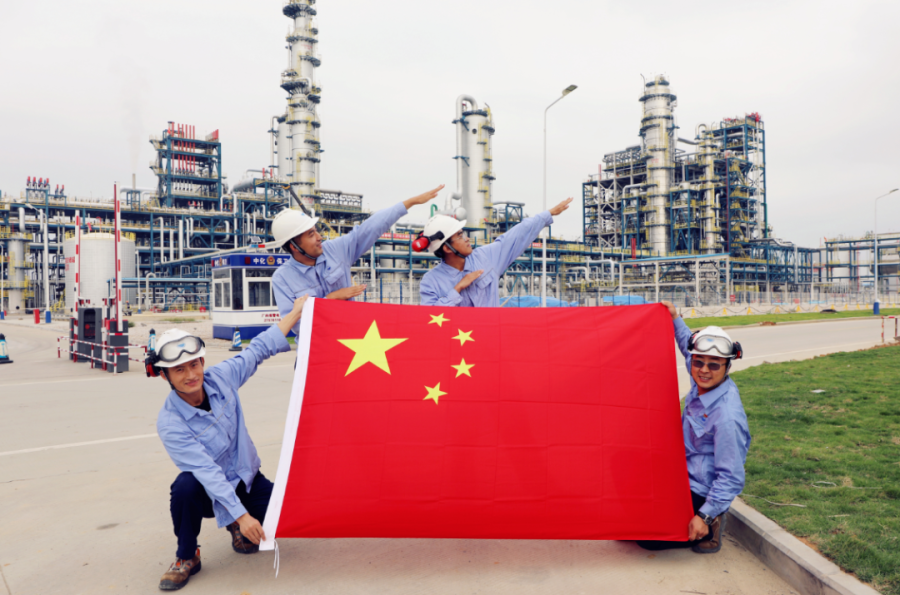

In the end they did it: the creation of a Chinese giant of energy and chemicals is underway.

China has approved the merger between the country's two main chemical groups, Sinochem and ChemChina.

There has been talk of a merger between the companies since 2016, following the acquisition of the Swiss agrochemical company Syngenta by ChemChina, China's largest foreign acquisition.

The two groups will be placed under a holding company financed and supervised by a government agency, the Commission for the Supervision and Administration of State-owned Assets.

This was announced by Sasac, the Chinese government body that monitors state assets in a note released yesterday evening.

It would be the largest chemical conglomerate in the world with about 1 trillion yuan in annual revenue, equal to about 153 billion dollars.

Putting the businesses of ChemChina and Sinochem under a single holding is a move to avoid triggering control by the US government. The US could in fact raise revisions on Chinese ownership in the Swiss agricultural giant Syngenta.

In early 2020, both ChemChina and Sinochem were added to a Pentagon blacklist of companies that would have ties to the Chinese military. This gives the White House broad powers to impose crippling sanctions on any company that does business with them.

All the details.

THE MERGER BETWEEN SINOCHEM AND CHEMCHINA IS STARTED

"After reporting to the State Council", the Chinese government, "for approval, Sinochem Corporation and China National Chemical Corporation (ChemChina) have implemented a joint reorganization".

DETAILS OF THE OPERATION

The two Chinese chemical giants, according to Sinochem separately in a note, will become subsidiaries of a new holding operated by Sasac.

For Sinochem, the merger with ChemChina would create economies of scale, optimize resource allocation and “help forge a complete and industry-leading chemical group”.

Since 2018, the two companies have both been chaired by Ning Gaoning, a move to signal that the merger was proceeding as planned.

THE VALUE OF THE NEW POLO OF CHEMISTRY

With the green light for the restructuring plan of the two groups, writes the Bloomberg agency, China paves the way for the creation of a chemical pole with over 100 billion dollars in assets.

If it were to go public someday, this could result in a market capitalization of 777 billion yuan on the multiple of 0.75 times the typical selling price of large chemical companies, roughly the size of BASF SE, Dow Inc. and Nutrien Ltd. put together, Bloomberg always pointed out last year.

THE STRATEGY FOR OVERCOMING US RESTRICTIONS

The new holding was designed to avoid US squeeze, for national security reasons, on the Syngenta property, acquired by Sinochem in 2017 for $ 43 billion, which has received authorization from over 20 jurisdictions. Any change in Syngenta ownership would trigger a review.

NO IMPACT FOR PIRELLI (CHEMCHINA REMAINS LEADING SHAREHOLDER)

Finally, Pirelli also received a communication from ChemChina with which it was informed of the establishment of the new holding.

“There is absolutely no repercussion on us,” commented Pirelli's CEO, Marco Tronchetti Provera. “We are not directly involved: we have a separate management both by statute and by agreements. If our shareholders manage to carry out an operation they have worked for for years, we are only happy ”.

Upon completion of the joint restructuring, ChemChina will remain Pirelli's largest shareholder.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tutta-la-chimica-anti-usa-nella-fusione-sinochem-chemchina/ on Thu, 01 Apr 2021 13:18:33 +0000.