All branches of banks in Italy. Fabi report

What emerges from the report of the Fabi – the banking federation led by the secretary general Lando Maria Sileoni – on the national banking rate

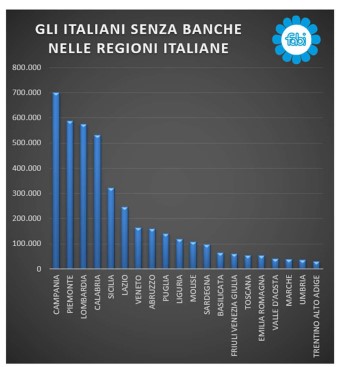

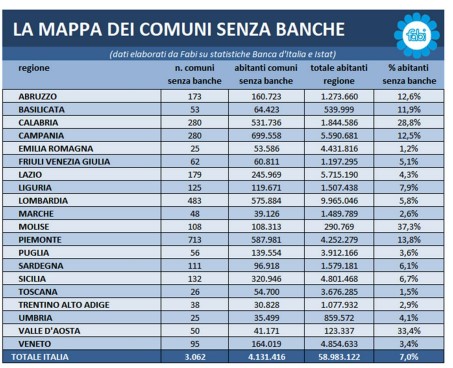

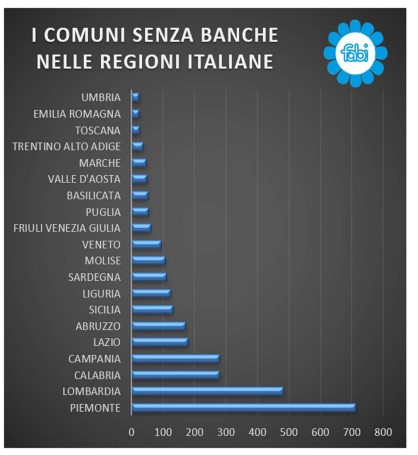

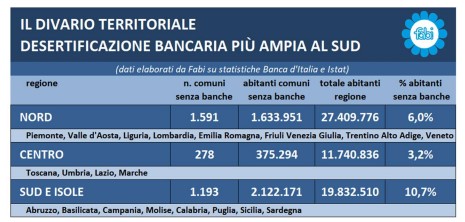

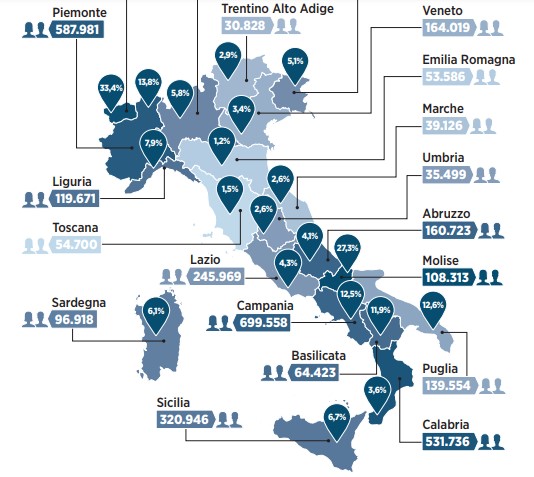

There are more than 4 million Italians "without a bank", ie the inhabitants of the 3,062 municipalities in which there are no longer any bank branches. Out of a total of 58.9 million citizens, 4,131,416 live in areas where banks are absent, equal to 7% of the total population.  A percentage that, however, shows conspicuous differences on a geographical basis: if in the North the banking "desertification" affects 6% of the population, in the Center the phenomenon is more limited (3.2%), while in the South and in the islands, where the the issue is decidedly more marked, citizens who no longer have a banking agency “near their home” or at a limited distance represent 10.7% of residents. Campania is the first region in terms of number of inhabitants without a bank: there are almost 700 thousand. All this is the result of the progressive closure of the agencies by the banks: the branches, 32,881 in 2012, at the end of 2021 were 21,650, down by 11,231 (-34%). Among the largest regions, the one with the lowest presence of banks, in percentage terms, is Calabria with 28.8% of citizens residing in territories not covered by banking agencies. Then, to follow: Piedmont (13.8%), Abruzzo (12.6%), Campania (12.5%). Among the smaller regions, the record is Molise (37.3%) followed by Valle D'Aosta (33.4%). In the islands, bank desertification affects 6.7% of the population in Sicily and 6.1% in Sardinia.

A percentage that, however, shows conspicuous differences on a geographical basis: if in the North the banking "desertification" affects 6% of the population, in the Center the phenomenon is more limited (3.2%), while in the South and in the islands, where the the issue is decidedly more marked, citizens who no longer have a banking agency “near their home” or at a limited distance represent 10.7% of residents. Campania is the first region in terms of number of inhabitants without a bank: there are almost 700 thousand. All this is the result of the progressive closure of the agencies by the banks: the branches, 32,881 in 2012, at the end of 2021 were 21,650, down by 11,231 (-34%). Among the largest regions, the one with the lowest presence of banks, in percentage terms, is Calabria with 28.8% of citizens residing in territories not covered by banking agencies. Then, to follow: Piedmont (13.8%), Abruzzo (12.6%), Campania (12.5%). Among the smaller regions, the record is Molise (37.3%) followed by Valle D'Aosta (33.4%). In the islands, bank desertification affects 6.7% of the population in Sicily and 6.1% in Sardinia.

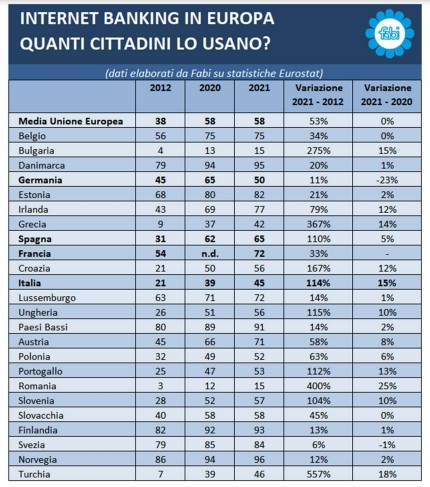

Emilia Romagna and Tuscany, on the other hand, are the regions with the highest bank rate in the national territory: the population residing in municipalities without banks, in fact, corresponds, respectively, to only 1.2% and 1.5% of the total. In absolute terms, the region with the largest number of municipalities without banks is Piedmont (713 local authorities, 587,000 inhabitants), followed by Lombardy (483 local authorities, 575,000 inhabitants) and, more distantly, Calabria (280 local authorities, 531,000 inhabitants). ), Campania (280 local authorities, 699 thousand inhabitants), Lazio (179 local authorities, 245 thousand inhabitants), Abruzzo (173 local authorities, 160 thousand inhabitants). In Sicily and Sardinia, the municipalities without inhabitants are 132 (320 thousand inhabitants) and 111 (96 thousand inhabitants) respectively. As for the demographic dimension, it ranges from insignificant realities, with a few dozen inhabitants, to local authorities with over 10,000 residents (13 overall, 10 of which in Campania): in the list of 3,062 municipalities without banks, the smallest are both in Lombardy, Pedesina (Sondrio) and Morterone (Lecco), and have respectively 30 and 34 inhabitants; while the first in the ranking is Pollena Trocchia (Naples, Campania) with 13,514 citizens who can no longer count on even an agency or a bank at hand. This represents a very significant problem if we consider that in Italy the development of e-banking is still scarce compared to the European average: less than half of banking customers (45%) use digital channels to access banking services, compared to an average 58% and compared to major economic powers, such as Spain and France, which have customer rates accustomed to digital banking equal to 65% and 72%; our country is aligned with realities such as Greece (42%) and Turkey (46%).

From the research, carried out by crossing the statistical data of the Bank of Italy and Istat updated at the end of 2021, it emerges, therefore,  the conspicuous removal of banks from the territories, hand in hand with the advent of new technologies, which push to promote digital channels, and the common attention, by the top management of the banking sector, to reducing costs. Thus, while almost all banks are in a hurry to close their agencies – basing this strategy on the increase in customers who prefer to access banking services with digital channels – there is a significant slice of the Italian population that is in fact forgotten: a situation that it will inevitably create enormous inconveniences, even of a practical nature, for both families and businesses, especially smaller ones.

the conspicuous removal of banks from the territories, hand in hand with the advent of new technologies, which push to promote digital channels, and the common attention, by the top management of the banking sector, to reducing costs. Thus, while almost all banks are in a hurry to close their agencies – basing this strategy on the increase in customers who prefer to access banking services with digital channels – there is a significant slice of the Italian population that is in fact forgotten: a situation that it will inevitably create enormous inconveniences, even of a practical nature, for both families and businesses, especially smaller ones.

In fact, digital tools are not yet so accessible and widespread, both for personal reasons and for poor coverage of the internet in the national territory, which should be implemented according to the objectives of the National Recovery and Resilience Plan (Pnrr); it follows that bank desertification can cause on the one hand a severe limitation in access to banking services (from the request for financing to investment advice), on the other it can push customers out of the legal financial circuit and, therefore, of economy, to the benefit of criminal organizations, with consequent damage to the growth of the country and also to public finances in terms of lower revenues in the state coffers.

THE COMMENT OF SILEONI

«The social role that banks are gradually losing, also through a progressive disengagement on the territories, with indiscriminate and unacceptable closures of banking agencies, is a topic that cannot be underestimated by political parties. It is serious that few within the political class are interested in this problem: they do not care enough with the justification that, being the banks private companies, they are somehow legitimized to do what they want. This simplistic thesis cannot be passed precisely because banks have always taken care of the savings of Italians and should absolutely not transform themselves into simple financial shops, thus drastically reducing consultancy to businesses and families, without anyone intervening. The reduction of branches is creating and will cause considerable damage to the country and to customers.  I am referring, in particular, to the elderly, who have little familiarity with digital tools, and to those who live in the South, where not only the phenomenon of the closure of banking agencies is more marked and worrying also due to an obvious problem of access to the internet. The inevitable consequences therefore also bring out an economic issue with a sudden change in the business model, all centered on the sale of financial and insurance products and little or nothing, on the granting of loans, mortgages and credits in general. In short, we are witnessing a radical change without any financial and political regulator intervening to protect customers and bank employees. The absence of bank branches in the small and medium-sized centers of the country also runs the concrete risk of removing both businesses and families from the legal circuit of finance and credit, with the consequential danger of expelling millions of individuals from the regular economy: it follows that space is left for criminal organizations, usury and all those illegal financial activities that always manage to take advantage of situations of hardship and economic difficulty. Ours therefore represents an evident cry of alarm, supported not only by the numbers, but also by the testimonies of an entire category of banking workers, their daily experiences and the fact that we represent an "essential public service" which is also decisive for making it work the economy of the country in the heavy periods of the pandemic, when, unfortunately, many bank employees lost their lives in the daily exercise of their fundamental activity »comments the secretary general of Fabi, Lando Maria Sileoni.

I am referring, in particular, to the elderly, who have little familiarity with digital tools, and to those who live in the South, where not only the phenomenon of the closure of banking agencies is more marked and worrying also due to an obvious problem of access to the internet. The inevitable consequences therefore also bring out an economic issue with a sudden change in the business model, all centered on the sale of financial and insurance products and little or nothing, on the granting of loans, mortgages and credits in general. In short, we are witnessing a radical change without any financial and political regulator intervening to protect customers and bank employees. The absence of bank branches in the small and medium-sized centers of the country also runs the concrete risk of removing both businesses and families from the legal circuit of finance and credit, with the consequential danger of expelling millions of individuals from the regular economy: it follows that space is left for criminal organizations, usury and all those illegal financial activities that always manage to take advantage of situations of hardship and economic difficulty. Ours therefore represents an evident cry of alarm, supported not only by the numbers, but also by the testimonies of an entire category of banking workers, their daily experiences and the fact that we represent an "essential public service" which is also decisive for making it work the economy of the country in the heavy periods of the pandemic, when, unfortunately, many bank employees lost their lives in the daily exercise of their fundamental activity »comments the secretary general of Fabi, Lando Maria Sileoni.

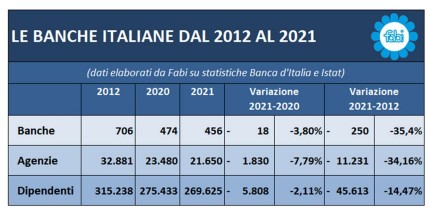

11,231 COUNTERS CLOSED IN LESS THAN 10 YEARS

In less than 10 years, Italian banks closed 11,231 branches: there were 32,881 branches at the end of 2012, before falling to 23,480 in 2020 and again to 21,650 at the end of 2021. Since 2012, the reduction has been equal to 34.16%, while between 2020 and 2021 the contraction was 7.79%: in just one year there were 1,830 closures. Banks are also far fewer: from 706 credit institutions in 2012, they went to 474 in 2020 and 456 in 2021. That means 250 fewer banks (-35.4%) from 2012 to 2021 and 18 fewer, in one year (-3.80%), from 2020 to 2021: the decrease is the result of the progressive aggregation between large groups and smaller banks, driven by the indications of the Italian and European regulator and supervisory bodies.  The contraction also affected staff: female workers and bank workers were 315,238 at the end of 2012, 275,433 at the end of 2020 and 269,625 at the end of 2021. The net reduction was 45,613 units (-14.47%) between 2012 and 2021 and of 5,808 units (-2.11%) between 2020 and 2021. All the departures of bank employees, however, were managed with voluntary retirement and early retirement, without layoffs and therefore without any social tension, thanks to the solidarity, an instrument, an important trade union achievement in 2000, which weighs nothing, in financial terms, on the state budget. At the same time, thanks to another instrument, the Employment Fund, about 38,000 young people under 35 were hired and an important generational turnover was thus guaranteed in the banking sector.

The contraction also affected staff: female workers and bank workers were 315,238 at the end of 2012, 275,433 at the end of 2020 and 269,625 at the end of 2021. The net reduction was 45,613 units (-14.47%) between 2012 and 2021 and of 5,808 units (-2.11%) between 2020 and 2021. All the departures of bank employees, however, were managed with voluntary retirement and early retirement, without layoffs and therefore without any social tension, thanks to the solidarity, an instrument, an important trade union achievement in 2000, which weighs nothing, in financial terms, on the state budget. At the same time, thanks to another instrument, the Employment Fund, about 38,000 young people under 35 were hired and an important generational turnover was thus guaranteed in the banking sector.

ITALY AT THREE SPEED: IN THE SOUTH 2 MILLION ITALIANS LIVE IN MUNICIPALITIES WITHOUT BANK COUNTERS

The map of the Italian network of bank branches gives a photograph of a three-speed Italy. Bank desertification is very accentuated in the South and in the Islands, with 10.7% of the population living in 1,193 municipalities where there are no bank branches:  in all, there are 2.1 million subjects residing in Abruzzo, Basilicata, Campania, Molise, Calabria, Puglia, then in the islands of Sicily and Sardinia. More contained, the phenomenon in the North (Piedmont, Valle d'Aosta, Liguria, Lombardy, Emilia Romagna, Friuli Venezia Giulia, Trentino Alto Adige, Veneto) where Italians without banks are 1.6 million, equal to 6% of the total. The question of looking at the Center is much less worrying: in Tuscany, Umbria, Lazio and Marche, in fact, only 375,294 people, equal to 3.2% of the total, live in territories that do not have bank branches.

in all, there are 2.1 million subjects residing in Abruzzo, Basilicata, Campania, Molise, Calabria, Puglia, then in the islands of Sicily and Sardinia. More contained, the phenomenon in the North (Piedmont, Valle d'Aosta, Liguria, Lombardy, Emilia Romagna, Friuli Venezia Giulia, Trentino Alto Adige, Veneto) where Italians without banks are 1.6 million, equal to 6% of the total. The question of looking at the Center is much less worrying: in Tuscany, Umbria, Lazio and Marche, in fact, only 375,294 people, equal to 3.2% of the total, live in territories that do not have bank branches.

Among the largest regions, the one with the lowest presence of banks is Calabria with 28.8% of citizens (531 thousand subjects) residing in territories not covered by banking agencies. Then, to follow: Piedmont (13.8%, 587 thousand subjects), Abruzzo (12.6%, 160 thousand subjects), Campania (12.5%, 699 thousand subjects). Among the smaller regions, the record is Molise (37.3%) followed by Valle D'Aosta (33.4%, 41 thousand subjects). In the islands, bank desertification affects 6.7% of the population in Sicily (320 thousand subjects) and 6.1% in Sardinia (96 thousand subjects). Emilia Romagna and Tuscany, on the other hand, are the regions that have the highest rate of banking on the national territory: the population residing in municipalities without banks, in fact, corresponds, respectively, to only 1.2% (53 thousand subjects) and to 1.5% (54 thousand subjects) of the total.

CUSTOMERS STILL LITTLE ATTRACTED BY E-BANKING, ITALY LIKE GREECE AND TURKEY

On accessing the bank via digital channels, Italy has made progress, doubling the percentage of the population that uses e-banking, but it still remains at the levels of countries such as Greece and Turkey. Despite the recent acceleration of the digital evolution of the Italian banking system, the analysis of the e-banking rate of the European population shows different preferences between countries and a degree of “digital maturity” at different speeds.  In 2012, in Italy, only 21% of the population used e-banking services, a figure below half the European average, equal to 38%, and far removed from the banking digitization rate of citizens of the major countries. In less than 10 years in Italy, the propensity to use digital channels, although doubled, does not show that it is still in step with Europe because the multichannel relationship continues to leave room for direct relationships with customers.

In 2012, in Italy, only 21% of the population used e-banking services, a figure below half the European average, equal to 38%, and far removed from the banking digitization rate of citizens of the major countries. In less than 10 years in Italy, the propensity to use digital channels, although doubled, does not show that it is still in step with Europe because the multichannel relationship continues to leave room for direct relationships with customers.

According to Eurostat data, over the last decade the use of online banking services by the Italian population has been very limited and the experience of social distancing in the most recent post-Covid years has been of no use. In fact, Italy is still the laggard among Western countries throughout the euro area, with just 45% of the total population preferring e-banking to branch banking in 2021. Compared to an overall average of 58%, in the European comparison our country precedes only Greece (42%), Turkey (46%), Bulgaria (15%) and Romania (15%) while other important countries like France do much better than us ( 72%), Spain (65%) and Germany (50%).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tutte-le-sportellate-delle-banche-in-italia-report-fabi/ on Fri, 12 Aug 2022 05:52:13 +0000.