All the mistakes of those who invoke the Mes (while Gualtieri has a full cash register and the ECB buys)

Giuseppe Liturri's analysis

The legend according to which the difficulties in facing a new, hopefully presumed, health emergency from Covid, are attributable to the lack of financial resources and, in particular, to not having (yet?) Requested the loan from the Mes, continues to circulate with insistence . And with the same insistence we must reiterate that this is a false and misleading statement at the root.

And we will demonstrate this with the data, both on the expenditure front and on the financial availability front.

Let's start with the shopping. The update note to the economics and finance document (Nadef) and the Budget Planning Document (Dpb) tell us two very clear things:

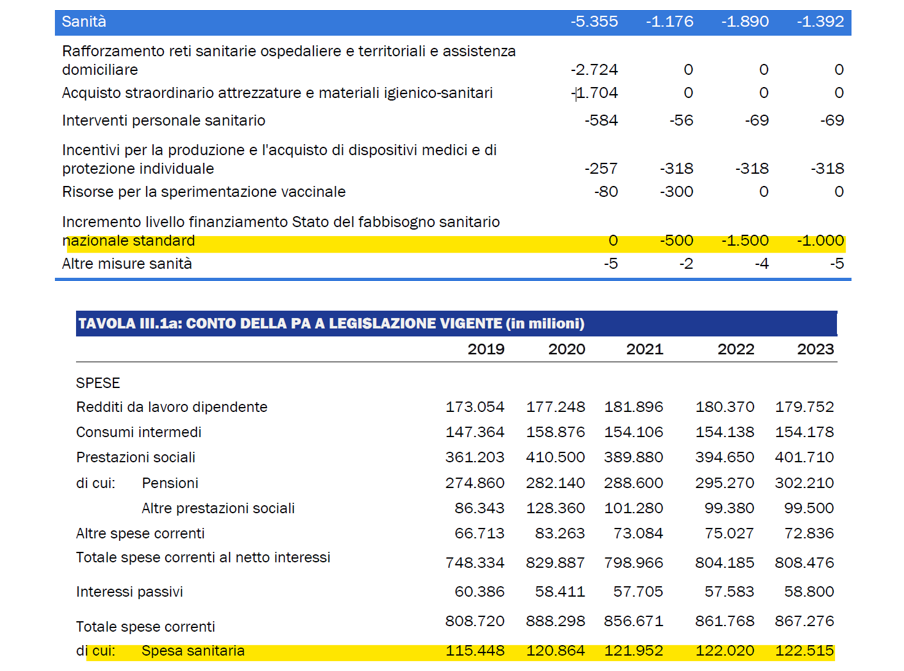

- After years of asphyxiated growth, just equal to the inflation rate and the GDP growth rate, 2020 will finally see health expenditure increase by about 5.4 billion, due to the provisions contained in the three legislative decrees issued so far by the Government (Cura Italy, Relaunch and August) which, overall, allowed an extra deficit of 100 billion.

2. The DPB (essentially the framework of the 2021 budget law sent to the EU Commission), contains interventions in health under various headings:

-

- There are about 5 billion allocated to interventions by various ministries including "allowances for health personnel"

- There are 1.4 billion for the financing of the National Health Fund; in particular for the establishment of a fund for the purchase of vaccines and for other needs related to the Covid emergency.

- There is another 1.6 billion for investment support, including healthcare construction.

Are these sums insufficient? Could more have been done? There is no reason to believe that if more had been needed, the government would have done it. We do not dare to believe that, between Palazzo Chigi and via XX Settembre, there was an attack of masochism. It is reasonable to assume that, out of a national health fund of about 120 billion that grew by just one or two billion a year, a growth of no less than 10 billion in three years is proportionate to the weight of a disease which, unfortunately, does not it is the only one that affects the human being.

Rather, it should be emphasized that we have come from over 10 years of containment of healthcare costs, which has brought the number of beds per 1000 inhabitants down from 7.2 in 1990 to 3.2 in 2018. This downward trend is also recognizable in France and Germany, but not of the same size. It's even worse for ICU places. Therefore, those who today complain of the insufficiency of hospital structures should look back over the years and check who has cut and defined health care spending, often with linear cuts. Since a hospital cannot be built in a few months, it is those who have made those choices, from the Monti government onwards, that we must ask for an account of the current problems.

The answer given by President Giuseppe Conte in last Sunday's press conference should be framed in this sense. Since the expenses already in the budget connected to Covid and therefore financed by the ESM are rather modest and certainly do not amount to 36 billion (it would be a stratospheric 29% of the internal FSN), the use of the ESM entails the preventive use of NEW spending measures and therefore with a greater deficit or, with the same deficit, at the cut of other expenses or higher taxes. He said it very badly, not making anyone understand anything, but that is what he meant, as Gualtieri later specified better on another occasion. Alternatively, the Mes can finance expenses already foreseen under current legislation, that is the few billions mentioned above.

But let's get to the second point. Granted and not granted that the necessary and sufficient expenses to face the health emergency are those already in the budget, does the state currently have problems in finding those sums on the financial markets? Or, even if the needs were higher, would there be problems?

The answer is no. Dry. Indeed, we have arrived at the paradox that Minister Gualtieri, as there are no significant cash drawings, has also slowed down the pace of emissions.

The picture that emerges from the figures is impressive: from March to September the Italian Treasury issued 364 billion bonds, which net of repayments, is 134 billion net available to finance expenses. In the same period, the liquidity account at the Bank of Italy rose from 73 billion to 84 billion. A figure never so high in the past. With 134 billion, Italy is clearly behind France and Germany with, respectively, 247 and 231 billion, and surpasses only Spain, which issued 103 billion, which however has a public debt and a much lower GDP than ours.

In September, Italian net issues were the paltry figure of 6.5 billion, much lower than the other countries mentioned, which fluctuated between 11 and 22 billion. The pace has not changed in October so far. On the other hand, there was no reason to accelerate if the spending laws do not give rise to payments.

But this is not the most sensational aspect. In fact, in the same period from March to September, the ECB carried out net purchases of Italian bonds for a good 136 billion, thus higher than the 134 of net issues.

It therefore happened that the ECB caused a, albeit modest, decrease in the net stocks of securities of other holders (families, financial institutions and foreign investors), absorbing little more than anything when offered by the Treasury on the market.

Who, in this situation, deems it appropriate to resort to the loan of an institution specifically designed to be a lender for countries in difficulty that have lost access to the market, and therefore equipped with a regulatory apparatus to keep the debtor under strict control (with enhanced surveillance and post program still in force), is simply irresponsible or ignorant or, hypothesis with non-zero probability, is the author of the cuts of the past and has a guilty conscience.

And the little credible valuations of convenience, according to which the rate of the Mes would be cheaper than that of a 10-year BTP, are worthless. We have repeated to the point of boredom that such a comparison would lead to failure in a finance exam, since apples are compared with pears. The correct comparison would be that between the ESM rate (which is not exactly known and variable over time) and the rate of a loan issued by Italy on international markets, guaranteeing investors the status of privileged creditor. Since the markets price this guarantee, the rate would certainly be much lower than that of the BTP and very similar to that of the MES or the French ten-year bond. So negative or around zero. Gualtieri try to issue a security with these characteristics and then we'll talk about it.

Those who, at this moment, invoke the ESM are probably doing so to shift the focus of the discussion from the scandalous inability to spend already deliberate sums and from the equally scandalous policy of cuts that has led us in the current state of structural deficiency, to the choice of the instrument of loan to be activated to pay for that expense.

The money is there, the ECB buys everything (at least until the end of 2021, and then it will renew the securities expiring for a long time), but it is the organizational spending capacity that is missing and the recourse to the Mes, as a country would do on brink of bankruptcy, he will certainly not be able to create it out of thin air.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/primo-piano/tutti-gli-errori-di-chi-invoca-il-mes-mentre-gualtieri-ha-la-cassa-piena-e-la-bce-compra/ on Sun, 25 Oct 2020 07:14:55 +0000.