All the next moves of central banks

Central banks under an "adaptive cruise control" regime, up to the first meetings of 2023. The analysis by Antonio Cesarano, chief global strategist, Intermonte

The end of the year is approaching and in the meantime we can begin to take stock of the interaction markets/central banks with the related impacts on the market.

High inflation has forced central banks to accelerate with restrictive measures, starting with the Fed, which added quantitative tightening to rate hikes, which also accelerated in September, together with the pace of rate hikes, which rose from 50 to 75bp.

A generic 60% bond /40% equity year-to-date global portfolio peaked at around -22% in October, posting similar performances to the MSCI WORLD index

In summary:

the typical negative bond/equity correlation this year did not bring the benefits of past years, in a context of rapid regime change on rates induced by the hyperinflationary phase in progress

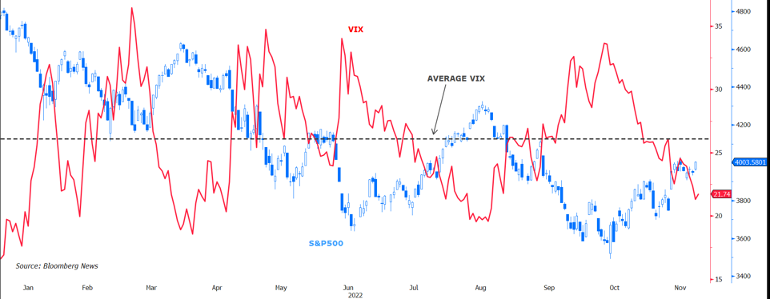

If we look more directly at the US stock market, we can see how the S&P500 index reached its lowest point in the middle of the year, marginally updating it in October, but actually marking a double low with the June levels.

The variable that remained relatively constant was the volatility range, with the VIX index included in the 20/35 range

Ex post this range was made possible mainly by the alternating hard/soft tone of the Fed:

in the middle of the year he hinted at the hypothesis of a slowdown in the pace of increases (which the market mistook for an imminent pivot)

at the end of August reference to "we will carry on even with the recession"

in October the major reminder of the risks of financial stability, also in the light of the UK pension fund case in September

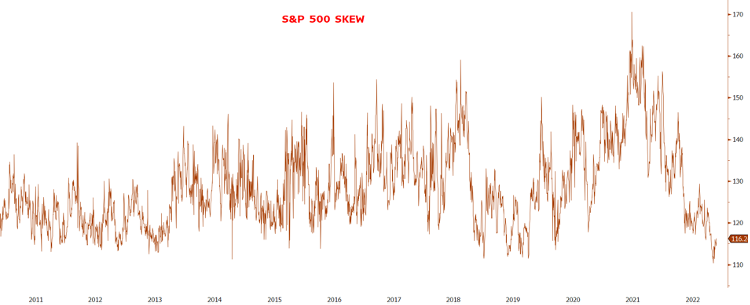

In hindsight, this attitude of the Fed was accepted by operators who gradually began to hedge less and less against extreme risks, for example of a continuous downward spiral of the markets

Evidence of this is the fact that the cost (i.e. the volatility) of extreme risk insurance has fallen, as evidenced by the so-called SKEW near historic lows

In other words, operators have perceived the need to cover themselves from downpours (i.e. limited and controlled drops in equity) but not hurricanes (aka continuous and uncontrolled drops)

Let's add another ingredient: the acceleration of the pace of rate hikes in the second half of the year progressively increasingly affected the short-term part of the curve, while the long-term part followed an independent path until it embarked on a dichotomous path (interest rates short-term rates up and long-term rates down)

In other words, the interest rate curves have increasingly inverted, especially in the US

All these factors can be the first ingredients that can be used to try to trace the market scenario up to the first months of 2023, i.e. up to the first FED/ECB meetings next year, respectively 1 and 2 February

Central banks, led by the Fed, could continue to try to control market volatility, in an attempt to avoid both excessive downward spirals and also excesses of euphoria: in the first case, the risk would be that of triggering one of the many financial stability risks , in the second case (euphoria) that of frustrating part of the restrictive intentions, forcing the same central banks to have to chase the markets by further raising rates and/or accentuating the QT, which in turn would increase the risks of financial stability (difficulty part of some categories of operators, lack of collateral, growing illiquidity of the bond markets, etc.)

In fact, a regime that we could metaphorically define as "adaptive cruise control" where central banks adapt their tones/maneuvers not only to macro data, but increasingly to the behavior of the markets, with the compass in hand represented by the volatility that could continue to fluctuate in the 20/35 range seen throughout 2022

All this at least until the first months of 2023, waiting to verify the trend in inflation and the impact of the restrictive measures implemented so far.

Therefore, within the first two February FED/ECB meetings:

Controlled trend (by central banks) of equity taking into account

the 20/35 range of the VIX which could correspond to a 3600/4200 range for the S&P500 index

On the interest rate front, the levels reached so far open up opportunities for the gradual and progressive introduction, above all of govies and corporate bonds in the portfolio, in view of an initial landing on rates in February in the 5% Fed area and 2.75/3% ECB , which the market has effectively incorporated into expectations

In this case, the compass for operators and central banks could be the monitoring of real rates which are starting to give signals that the top has been reached. The US 10y real rate (in blue in the graph) in fact stopped at the highest since 2010 in the 1.70% area, while the 10y nominal rate (in white in the graph) went as far as reaching the top since 2008 in area 4 ,35%

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tutte-le-prossime-mosse-delle-banche-centrali/ on Sun, 27 Nov 2022 06:51:19 +0000.