Because Autogrill does not feast on the stock market with the capital increase

Autogrill's board of directors proposes a capital increase to shareholders, but the stock collapses on the stock market. Numbers, details and comments

After the slimming treatment that led to the sale of the Spanish business , Autogrill is preparing a capital increase, up to 600 million, to support future investments and take advantage of any acquisition opportunities.

The plans, however, cause the stock to waver. All the details.

THE CAPITAL INCREASE

Let's start with the facts. Autogrill's board of directors proposes to shareholders a capital increase, to be carried out in one or more tranches, up to € 600 million, including any share premium. The idea will be submitted for the approval of the extraordinary assembly, which will be held on 25 February.

THE SHAREHOLDERS

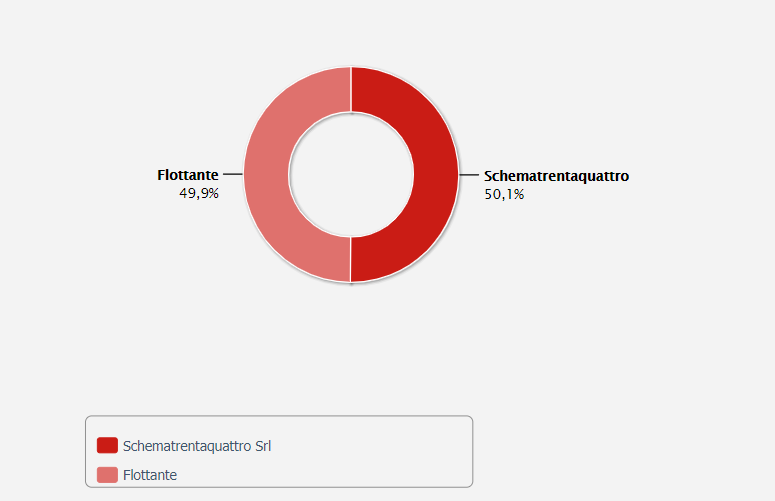

Autogrill, chaired by Paolo Zannoni and led by the group ceo Gianmario Tondato Da Ruos is an Italian multinational active in the sector of catering services for travelers, controlled by Schematrentaquattro, 100% owned by Edizione, financial holding of the Benetton family, with 50 , 1% of the share capital. 49.9% is free-floating, held by institutional investors and individual shareholders.

THE AUTOGRILL TITLE CRASHES ON THE STOCK EXCHANGE

The news of a capital increase causes the stock to collapse, which at 15.25 marks a collapse of 13.44%, to 4.35 euros.

THE OBJECTIVE OF THE CAPITAL INCREASE FOR AUTOGRILL

The capital increase should contribute to the achievement of the strategic objectives of the Autogrill group, which intends to consolidate and strengthen its international leadership position.

"It is essential to strengthen the Group's financial structure, with the consequent availability of additional resources to finance future investments, to continue the Group's path of innovation and growth and to be ready to seize potential market opportunities", reads a note of society.

THE PRE-SUBSCRIPTION AGREEMENTS

Even before the approval of the extraordinary shareholders' meeting, the directors of Autogrill started the procedures to stipulate a pre-subscription contract with a consortium of leading international banks.

EDITION APPRECIATES INCREASE OF AUTOGRILL

Edizione Srl has already expressed a positive opinion on a possible capital increase. The strategic reasons, reads a note, "appear to be fully shared and, consequently, it intends to provide its subsidiary Schematrentaquattro spa with the necessary financial resources".

GIANMARIO TONDATO DA RUOS: WE WANT TO STRENGTHEN EQUITY STRUCTURE

"After a strong focus on minimizing the impact of the pandemic in 2020, today, having better visibility in a still highly uncertain context, we are embarking on a journey aimed at strengthening our capital structure, being financially ready and flexible to exploit any potential opportunity. future ”, commented Gianmario Tondato Da Ruos, Group CEO.

EQUITA SIM FORECASTS

And just a capital increase had been put into account by Equita Sim, according to what MF-Milano Finanza reports. "If on the one hand we believe that Autogrill has no liquidity problems, on the other hand the gross debt is very high: over 1.5 billion euros and the EBITDA probably still low in 2021. For these reasons and based on our projections , not too dissimilar to those of the consensus, we believe that a capital strengthening has a probability of over 50% ”, argued the analysts.

Equita, for 2021, has foreseen, for Autogrill, an ebitda ex IFRS 16 to 110 million from the 290 million previously expected, lowering the target price on the company from 5.4 to 5.3 (rating hold confirmed).

THE FUNDING OF SACE

In November 2020, the company signed a medium / long-term loan agreement for 300 million euros and a five-year duration with UniCredit, Intesa Sanpaolo, Banco Bpm, Banca Nazionale del Lavoro, Crédit Agricole Corporate and Investment Bank, Milan Branch, Mediobanca and Union of Italian Banks. The loan is backed by a guarantee from Sace.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-autogrill-non-banchetta-in-borsa-con-laumento-di-capitale/ on Thu, 21 Jan 2021 15:06:12 +0000.