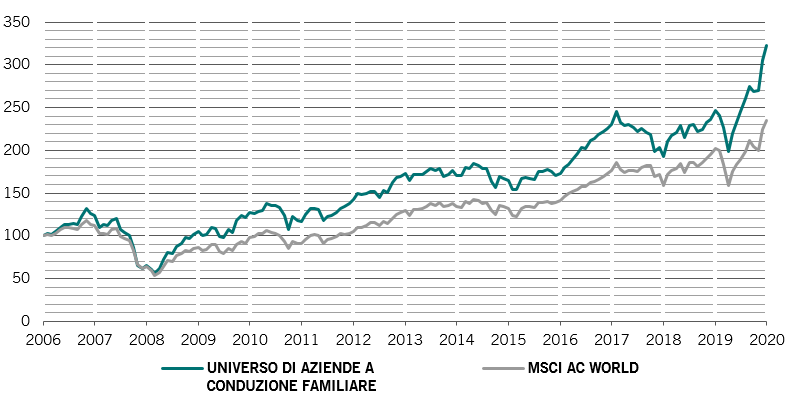

Because family businesses have a competitive advantage

“Brands and families, a winning combination”. The analysis by Alain Caffort, Pictet Asset Management's senior investment manager

I n Pictet Asset Management we classify listed companies in which a person or family holds at least 30% of the voting rights as family businesses.

The success factors of family businesses

So why do family-owned businesses outperform?

We believe there are three basic reasons. First of all, since families usually invest a large part of their wealth and reputation in companies, the interests are strongly aligned. This, in turn, leads to the second reason: compared to their counterparts, family-owned businesses often reinvest a larger share of their profits back into the business. Finally, the stability of ownership allows management to take a long-term perspective instead of obsessively focusing on next quarter profits.

This leads overall to active and engaged properties, which often combine a strong financial commitment with socially profitable investments.

A competitive advantage

In building and growing a brand, family ownership can also be an advantage in terms of competitiveness.

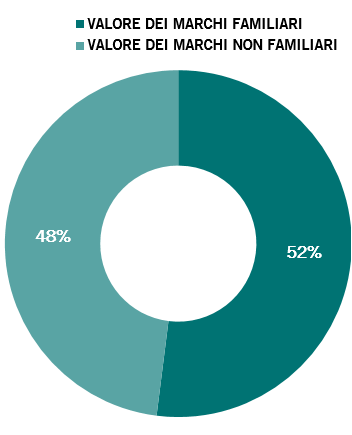

The brand value, estimated by Interbrand, demonstrates the centrality of brands for family businesses. Family-owned businesses account for 52% of those in the top 100 by brand value globally, with brands such as Amazon, Louis Vuitton, Toyota, BMW, Samsung and Chanel positioned at the top of the overall rankings.

The identity of the family members is intertwined with the brand and, consequently, the protection of the brand is a fundamental aspect for these companies.

Furthermore, the values we associate with family businesses (tradition, stability, long-term relationships with stakeholders) can be used and promoted by the companies themselves in their branding activity. The long-standing values and tradition are, by their very nature, the most significant and difficult to imitate and therefore offer an established family business an advantage in building and promoting brands with real authenticity. Hermès, owned by the same family for six generations, provides a clear example of quality and tradition woven into the fabric of the brand itself.

Compared to other types of companies, family-run companies have a longer-term planning. This allows them to build longer lasting relationships with all stakeholders and to develop relationships based on trust and partnership. The greater stability of the top management of family-owned companies, compared to the average of publicly-traded companies, also provides greater consistency in the management of the brand and in the corporate message.

One person behind the brand

Trust in an organization increases if behind a company you see a human being, a face or if there is a family that takes responsibility for what happens within the company. The fact that the reputation of the family is inextricably intertwined with that of the company can also foster the desire to provide excellent customer service.

Employees also tend to be treated like family. CGI, the Canadian IT services giant, is about members, not employees. The company supports its stakeholders both in good times and in difficult times, as evidenced by the contributions to communities and to society as a whole. This can also have a positive effect on employee motivation and public support for the company.

During the COVID-19 pandemic, family businesses set out to support their communities. Between March and June 2020 alone, PWC identified 209 billionaires who have cumulatively committed $ 7.2 billion in public pledges to pandemic-related causes.

Long-term philanthropy is also part of this same matrix. The rise of foundations launched by business owners (such as those of Square, Hermes or Meituan) certainly has positive effects on the associated brand.

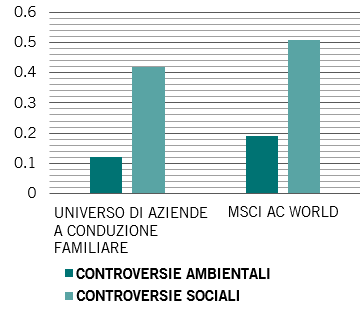

The increase in ESG investments has further increased attention on this aspect. Sustainalytics Dispute Tracking shows that family businesses take environmental and social issues seriously.

The virtuous cycle whereby having a positive impact on society leads to receiving a positive reputation for one's brand, does not only apply to family-run businesses; however, these often have a longer history, they can create a tradition and imprint the family name on it in a way that other companies cannot.

If you understand the relationship between family businesses and brands, it is not surprising that they have risen to the top in sectors where their core values are highly valued: trust, authenticity, tradition and stability.

Owning families understand better than anyone the importance of the brand, as they are directly affected by the resonance of their brand in society. This leads to a competitive advantage, a driver of the outperformance of family businesses.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/aziende-conduzione-familiare/ on Sun, 26 Dec 2021 07:02:16 +0000.