Because the accounts of the European dreamers are busted

What the numbers on the “Sure” fund really say. Giuseppe Liturri's analysis

In the days when it is discovered that the King is naked – that is, that the only quick and therefore effective response to mitigate the exceptional increase in energy costs is that coming from the budgets of each Member State, with Germany leading the way alone – we note that there are still some "Japanese" who continue to believe in the role of the European budget.

At first, the Draghi government hesitated for months in making “real” resources (not rounds of accounting entries) available to businesses and families, in the not hidden hope that this budgetary discipline would quickly find replenishment in initiatives at the European level. On 4 October it was the turn of the EU Commissioners Paolo Gentiloni and Thierry Breton who, with a speech published in the major European newspapers, reaffirmed the need for “ mutualized instruments at European level ”. A European budget response to prevent the different margins for maneuver of national budgets from creating irreparable gaps in the functioning of the internal market, causing fragmentation and irreparable distortions of competition in the internal market.

According to them, it is necessary to be inspired by the “ Sure ” mechanism, a fund proposed and managed by the Commission which provided 93 billion (of which 27.4 to Italy) to the Member States between the end of 2020 and the whole of 2021.

That fund was intended to cover the higher expenses incurred by each state to mitigate the impact of the production stop caused by the pandemic lockdown. Basically, for Italy they covered the expenses for the 4.3 billion hours of layoffs authorized in 2020. 16 times those authorized in 2019.

According to the Commissioners, " Europe has already shown that it can react strongly by overcoming divisions and pooling its budgetary power at European level, in order to demonstrate solidarity and justice".

Well, this is only true in the dream world of European dreamers. Then there are the facts and numbers that tell us this:

- The “Sure” fund managed to disburse 92 billion in favor of 19 Member States (Italy and Spain add up to 48 billion) under the sole and decisive condition of the provision of a pro-quota guarantee by each State. Otherwise, the Commission would not have been able to issue triple A rated securities at a rate lower than that of BTPs. Other than "solidarity", everyone has guaranteed for himself. To say, as it did to the Commission, that this resulted in a saving of 3.7 billion in interest for Italy over an average duration of about 15 years of those loans, is simply false because it neglects the cost of the guarantee provided by the Italian Republic. which, like all guarantees, has a cost, which however you forget to take into account. Otherwise why does a mortgage loan generally have a lower rate than an unsecured one?

- In 2020 and 2021, the state borrowing requirement was respectively 159 and 109 billion. The beauty of 268 billion which coincides almost perfectly with the approximately 290 billion Italian government bonds that the ECB has put in its portfolio from March 2020 and March 2022 with the Pepp program. Given the order of magnitude of these figures, can anyone still reasonably argue that the “true” European solidarity came from the Commission, or instead from the ECB? Which, by increasing purchases by 10%, would also have made the Sure loans useless.

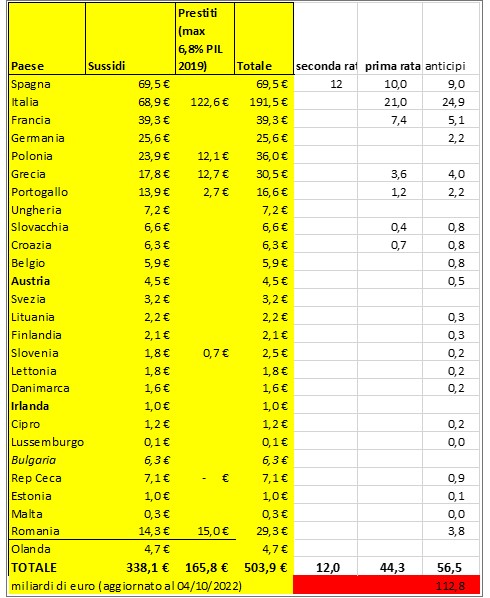

- It is no coincidence that Gentiloni and Breton took the example of the Sure and omitted that of the EU Next Generation. Because the latter is only the merciless photograph of how slow and inefficient the EU is when it has to move with its own funds. It is the numbers that prove it. Do you remember the famous rain of billions, laboriously negotiated by Giuseppe Conte in an interminable European Council in July 2020? Since then, it took February 2021 for the EU Regulation of the RRF (the heart of NextGenEu) to see the light. Then another two months to submit the PNRR. Then another two months to get it approved. Finally, in August, we collected the pre-financing of 13%, and then in April 2022 the first installment and, perhaps, by November, also the second. At the European level, the picture is bleak. Of the 724 billion (at current prices) of the RRF, only 504 have been committed (338 grants and 166 loans) and around 200 billion of loans are still unsolicited. But what matters and generates growth are the payments, not the spending commitments. And on this front it stops at 113 billion. Yes, you read that correctly. Two and a half years after the pandemic lockdown, only a fraction of 113 out of 724 billion made it into the coffers of the member states. 0.8% of EU GDP.

If this is the "budget power" of which Gentiloni and Breton speak, it is good that the next Italian government knows that the European dream has biblical times and is not convenient. The risk, in this case, is to wake up with chilblains and empty pockets.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/numeri-fondo-sure/ on Thu, 06 Oct 2022 05:17:09 +0000.