Because WhatsApp makes Citigroup, Goldman Sachs, Ubs and more cry

Sixteen banks – including Barclays, Citigroup, Goldman Sachs and UBS – have been fined 1.8 billion by US authorities for sending business communications via WhatsApp and the like, without archiving them. All the details

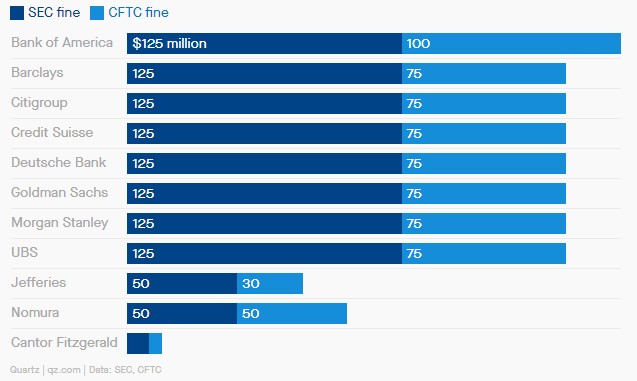

Sixteen US and European financial services firms – including Barclays, Citigroup, Goldman Sachs and UBS – have been fined a total of $ 1.8 billion by the SEC and the CFTC. (the government agency that regulates derivatives markets) for illegitimate use of WhatsApp and other similar messaging services.

WHAT HAPPENED

The two commissions found that, from January 2018 to September 2021, employees of fined banks regularly sent work-related messages via WhatsApp on the personal devices of colleagues and customers, without properly recording the chats. The practice – illegal – reached peaks during the most critical periods of the coronavirus pandemic, due to the spread of work from home .

WHAT THE AMERICAN LAW SAYS

In fact, US federal law obliges banks to keep a register of communications between brokers and customers. Private exchanges that do not fall within the official channels are more difficult for the authorities to monitor.

Furthermore, the use of personal devices – generally less secure than corporate devices – increases the risk of theft of confidential information by cybercriminals.

THE (HARD) WORDS OF THE CFTC

CFTC Commissioner Christy Goldsmith Romero said “it's time for Wall Street to stop waiting for coercive action before changing its practices. The tone at the top must change on Wall Street. Change can only happen if the top management of the banks establish a culture of compliance rather than evasion ”.

THE BAD PRACTICES OF MANAGERS

As reconstructed by Quartz , many bank employees found guilty of exchanging thousands of messages via WhatsApp with colleagues and customers were not low-level employees: on the contrary, the investigation involved several CEOs and heads of trading desks.

For example, an executive at a Bank of America trading desk – the institution that paid the most fines – not only asked its junior employees to delete messages sent with messaging applications, but even urged them to switch to Signal (a more advanced encryption app) while the CFTC investigation was underway.

FINES

THE JPMORGAN AGREEMENT

JPMorgan was the first financial company to settle with the US authorities, agreeing to pay a $ 125 million fine last December for illegal sending of text messages and e-mails between employees.

At the beginning of 2020 the bank first suspended and then fired Edward Koo, a trader with twenty years of experience, for having created a WhatsApp group in which to chat about work-related issues. A dozen brokers at JPMorgan also had their bonuses reduced for not sending communications through formal channels.

A NEW ROLE: THE "WHATSAPP POLICEMAN"

Several banks – such as Bank of America, Goldman Sachs and Morgan Stanley – have made a commitment to hire a "WhatsApp cop". That is, a consultant specialized in examining the ways in which these companies monitor and archive work-related communications, even those present on employees' personal devices.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/multe-banche-wall-street-whatsapp/ on Thu, 29 Sep 2022 08:08:46 +0000.