Chip, SoftBank aims for an alliance between Arm and Samsung

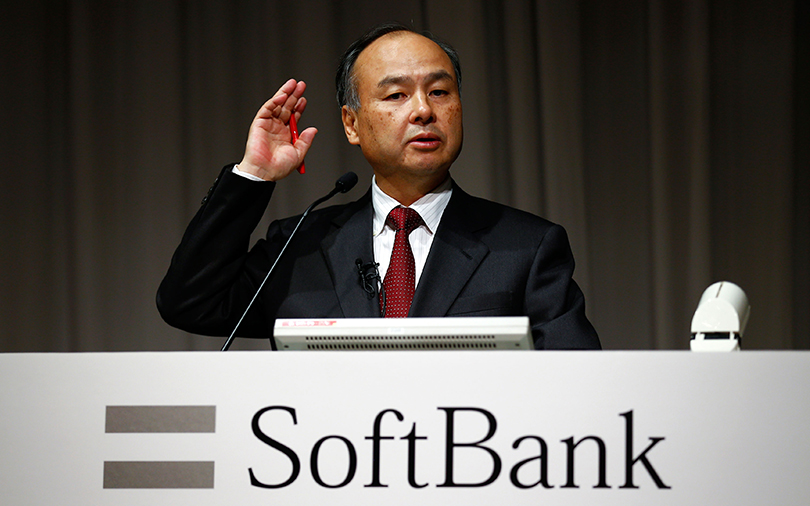

After the shipwrecked sale to Nvidia, Softbank returns to the attack for Arm. Masayoshi Son will visit Seoul in October to explore the link between Samsung and the British chip designer

In semiconductor risk, Softbank, the Japanese technology group, is ready to make a new move for its British subsidiary Arm, which specializes in microchips.

SoftBank founder and CEO Masayoshi Son said today he plans to meet Samsung Electronics to discuss a potential "strategic alliance" between the South Korean tech giant and chip designer Arm. The billionaire will make his first visit to Seoul in three years, Reuters points out.

In 2016, SoftBank acquired Arm, the technology of which powers Apple's iPhone and nearly every other smartphone, for $ 32 billion. In autumn 2020 Softbank announced its intention to sell Arm, the global microprocessor giant, to American graphics card champion Nvidia for $ 40 billion. But opposition from numerous regulators around the world scuppered the project.

“Following that setback, Son shifted his focus to an initial public offering for Arm in the US, a move that triggered intense lobbying by the UK government to ensure that a part of the listing took place in London ” reports the Financial Times .

Son's visit to South Korea comes amid speculation about the potential formation of an industrial consortium to invest in Arm and ensure its neutrality.

All the details.

THE ALLIANCE BETWEEN ARM AND SAMSUNG

In a statement Thursday, Son said: “I intend to visit Korea. I am looking forward to visiting Korea for the first time in three years. I would like to talk to Samsung about a strategic alliance with Arm ”.

An alliance with Arm could be a strategic choice for Samsung as the market leader in memory chips invests heavily in trying to catch Taiwan Semiconductor Manufacturing Co in logic chips, Reuters comments. The South Korean conglomerate is still seen as hampered by technical limitations in the original technology for non-memory chips such as application processor architecture, which Arm specializes in.

THE SOFTBANK STRATEGY

SoftBank's move comes at a time of difficulty for the group and its technology investment vehicle Vision Fund, both of which are under enormous pressure due to the collapse of equity markets and the collapse of technology valuations.

So much so that this summer Softbank sold a third of its stake in Alibaba to raise cash. After that Son tried to open a quote for the British chipmaker, but the volatility of the markets removed this prospect as well. The deteriorating situation in the US stock market was not conducive to Arm's IPO, analysts reprized from the FT said.

THE COMMENT OF THE ANALYSTS

According to analysts, Samsung would be interested in buying Arm due to its weakness in the non-memory chip business, but it would be difficult for the South Korean company to pursue the deal on its own, as it would face regulatory hurdles similar to Nvidia.

"Given Arm's unique position in the market, monopoly risks increase when it is taken over by a particular company," said James Lim, analyst at US hedge fund Dalton Investments, reprized by the London financial newspaper. “Samsung will likely face less regulatory opposition than Nvidia, but it would still be burdensome for the company to pursue the deal on its own, given its position in the semiconductor market. It could form a consortium with Intel and others to pursue the deal ”.

"There has to be someone in the middle that mediates to bring various companies into a consortium, and Son could try to play such a role," said Lee Min-hee, an analyst at BNK Investment & Securities, quoted by Reuters . "A potential proposition could be that companies interested in owning a portion of Arm could enter a pre-IPO placement at a lower price before an IPO next year," he added.

INTEL, QUALCOMM AND NOT ONLY IN THE RISIKO OF CHIPS

Finally, according to Reuters, other possible suitors of Arm include Intel Corp, whose CEO Pat Gelsinger in February expressed interest in joining a consortium to buy the chip designer. Rival Samsung SK Hynix has also expressed interest in Arm, according to Yonhap news agency.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/chip-softbank-punta-a-unalleanza-tra-arm-e-samsung/ on Thu, 22 Sep 2022 13:57:04 +0000.