Energy and support decree, here is a summary and full text

Energy dossier and more: all the details on the decree to support businesses and economic operators, work, health and local services, connected to the COVID-19 emergency, as well as to contain the effects of price increases in the sector electric

Below is the summary (by the Presidency of the Council) of the decree for the support of businesses and economic operators, of work, health and territorial services, connected to the emergency from COVID-19, as well as for the containment of the effects of increases in prices in the electricity sector and then the full text of the provision approved by the council of ministers on January 21, 2022 ( Start Magazine Editorial )

+++

COVID-19, SUPPORT OF ECONOMIC ACTIVITIES AND HEALTH AND TERRITORIAL SERVICES AND FIGHTING INCREASE IN THE ELECTRICITY SECTOR

Sectors in difficulty

The decree intervenes in support of sectors that have been closed as a result of the pandemic or have been severely damaged by it.

Among them the following sectors:

- theme parks, aquariums, geological parks and zoos.

- organization of parties and ceremonies, weddings, hotels, restaurants, catering, bar-cafes and swimming pool management

- trade of textile products, of the fashion, of the calzaturiero and of the pelletteria, articles of vestimenta, calzature and articles in skin.

- tourism, tourist accommodation, agencies and tour operators, amusement and theme parks, spas

- discos, game rooms and billiards, Bingo halls, museums and management of bus stations, funiculars and chairlifts

- entertainment, cinema and audiovisual

- sport

Interventions on electricity produced by renewable energy plants

5.5 billion against the high bills in the first quarter of 2022

The decree also intervenes to deal with the expensive bills. The executive had already intervened in the first quarter of 2022 by allocating 3.8 billion in order to mitigate the rise in the cost of energy, especially for families. With today's provision, the government intervenes again with a further 1.7 billion, a total of 5.5 billion in the period January / March 2022. This intervention today is more aimed at supporting the business world.

System charges zeroing

The provision provides that the Regulatory Authority for Energy, Networks and the Environment – ARERA, in order to further reduce the effects of price increases in the electricity sector, will cancel, for the first quarter of 2022, the rates relating to general system applied to users with available power equal to or greater than 16.5 Kw, also connected in medium and high / very high voltage or for public lighting or charging electric vehicles in places accessible to the public.

Tax contribution for energy eaters

The standard is aimed at guaranteeing energy-intensive companies a partial compensation of the extra costs due to the exceptional increase in energy costs.

Those that have undergone an increase in the cost per kWh of more than 30 percent in the same period of the year 2019, deriving from the particular contingency due to the increase in the costs of the energy in question, an extraordinary contribution is recognized, in the form of a credit. tax, in partial compensation of the higher costs incurred. The benefit is quantified at 20 per cent of the expenses incurred for the energy component purchased and actually used in the first quarter of 2022.

Renewable extra-profits

The law binds operators who are producing energy without bearing the effects of the exceptional increase in the price of energy to pay a difference calculated taking into account fair prices before the crisis.

Given the emergency logic to which it is inspired, the intervention has a limited duration. Starting from February 1, 2022 and until December 31, 2022, on the electricity produced by photovoltaic plants with a power exceeding 20 kW which benefit from fixed tariffs deriving from the Energy Account mechanism, not dependent on market prices, as well as on the electricity produced by plants powered by hydroelectric, geothermal and wind sources that do not access tariff incentives for difference, a two-way compensation mechanism is applied on the price of energy entrusted to GSE, the Energy Services Manager.

++++

Decree-law containing urgent measures in the field of support to businesses and economic operators, work, health and local services, connected to the emergency from COVID-19, as well as to contain the effects of price increases in the electricity sector

HAVING REGARD to articles 77 and 87 of the Constitution;

GIVEN the resolutions of the Council of Ministers of January 31, 2020, July 29, 2020, October 7, 2020, January 13, 2021 and April 21, 2021, as well as article 1, paragraph 1, of the decree-law of July 23, 2021, no. . 105, converted, with modifications, by the law 16 September 2021, n. 126 and article 1, paragraph 1, of the decree-law 24 December 2021, n. 221, with which the state of emergency was declared and subsequently extended on the national territory relating to the health risk associated with the onset of pathologies deriving from transmissible viral agents;

GIVEN the declaration of the World Health Organization of 11 March 2020 with which the COVID-19 epidemic was assessed as a "pandemic" in consideration of the levels of diffusivity and severity achieved globally;

GIVEN the decree-law 17 March 2020, n.18, converted, with modifications, by the law 24 April 2020, n. 27;

GIVEN the decree-law of 19 May 2020 n. 34, converted, with amendments, by law 17 July 2020, n. 77;

GIVEN the decree-law of 14 August 2020, n. 104, converted, with modifications, by the law 13 October 2020, n. 126;

GIVEN the decree-law of 22 March 2021, n. 41, converted, with modifications, by law 21 May 2021, n. 69;

GIVEN the decree-law of 25 May 2021, n.73, converted, with modifications, by the law of 23 July 2021, n. 106;

GIVEN the decree-law 24 December 2021, n. 221;

GIVEN the decree-law of 30 December 2021, n. 229;

GIVEN the decree-law of 7 January 2022, n. 1;

CONSIDERING the extraordinary need and urgency to introduce specific and more incisive measures to support the economic and working sectors most directly affected by the restrictive measures, adopted for the protection of health in connection with the persistence of the epidemiological emergency from Covid-19;

CONSIDERING the extraordinary need and urgency to introduce measures to support businesses and the economy, interventions to protect work and health, to guarantee the continuity of supply of services by local authorities and to restore the sectors most affected by the emergency epidemiological Covid-19;

GIVEN the resolution of the Council of Ministers, adopted at the meeting of… .;

On the proposal of the President of the Council of Ministers and the Minister of Economy and Finance, in agreement with the Minister of Economic Development, the Minister of Culture, the Minister of Tourism and the Minister of Ecological Transition

It emanates

the following decree-law:

Title I.

Support for businesses and the economy in relation to the Covid-19 emergency

ART. 1.

(Support measures for closed activities)

- The Fund for the support of closed economic activities referred to in article 2 of the decree-law of 25 May 2021, n. 73, converted, with modifications, by the law of 23 July 2021, n. 106, is refinanced in an amount equal to XX million euros for the year 2022 destined to the activities that at the date of entry into force of this decree are closed as a result of the preventive measures adopted pursuant to article 6, paragraph 2, of decree-law 24 December 2021 n. 221. For the implementation of this provision, the current implementation measures governed by article 2 of decree-law no. 73 of 2021, converted, with amendments, by law no. 106 of 2021.

- For persons carrying out business activities, art or profession, having their tax domicile, registered office or operational headquarters in the territory of the State, whose activities are prohibited or suspended until January 31, 2022 pursuant to article 6, paragraph 2, of the decree-law 24 December 2021 n. 221, are suspended:

- a) the terms relating to the payment of withholding taxes, referred to in articles 23 and 24 of the decree of the President of the Republic no. 600 and the deductions relating to the regional and municipal surcharge, which the aforementioned subjects operate as withholding agents, in January 2022;

- b) the terms of the payments relating to the value added tax due in January 2022.

- Payments suspended pursuant to paragraph 2 are made, without the application of penalties and interest, in a single solution by 16 September 2022. There is no reimbursement of the amount already paid.

- The charges deriving from paragraph 1 equal to 30 million euros for the year 2022 are provided pursuant to article …

ART. 2.

(Fund for the revitalization of retail trade economic activities)

- In order to contain the negative effects deriving from the prevention and containment measures adopted for the epidemiological emergency from COVID-19 and to provide specific support measures for the most affected subjects, a fund has been established in the forecast of the Ministry of Economic Development , called the "Fund for the relaunch of economic activities", with an endowment of XXX million euros for the year 2022, aimed at granting aid in the form of a non-repayable grant in favor of companies, in possession of the requisites referred to in paragraph 2, which mainly carry out retail trade activities identified by the following codes of the classification of economic activities ATECO 2007: 47.19, 47.30, 47.43, all the activities of groups 47.5 and 47.6, 47.71, 47.72, 47.75, 47.76, 47.77 , 47.78, 47.79, 47.82, 47.89 and 47.99.

- In order to benefit from the aid provided for in this article, the companies referred to in paragraph 1 must have an amount of revenues referring to 2019 not exceeding 2 million euros and have suffered a reduction in turnover in 2021 of not less than thirty percent compared to 2019. For the purposes of quantifying the reduction in turnover, the revenues referred to in article 85, paragraph 1, letters a) and b) , of the Consolidated Income Tax Act approved by decree of the President of the Republic 22 December 1986, n. 917 relating to the tax periods 2019 and 2021. At the date of submission of the application – the same companies must also be in possession of the following requirements:

- have their legal or operational headquarters in the territory of the State and be duly constituted, registered and "active" in the Business Register for one of the activities referred to in paragraph 1;

- not be in voluntary liquidation or subjected to bankruptcy proceedings for liquidation purposes;

- not already be in difficulty as of 31 December 2019, as per the definition established by article 2, point 18, of regulation (EU) no. 651/2014 of the Commission, of 17 June 2014 , without prejudice to the exceptions provided for by the European framework of reference on the subject of State aid referred to in paragraph 3;

- not to be the recipients of disqualification sanctions pursuant to article 9, paragraph 2, letter d) , of legislative decree no. 231.

- The contributions, quantified in the manner referred to in paragraph 5, are granted within the limits of the financial resources referred to in paragraph 1, pursuant to and in compliance with the limits and conditions set out in Section 3.1 of the "Temporary framework for aid measures State in support of the economy in the current emergency of COVID-19 ″ referred to in the communication of the European Commission 2020 / C 91 I / 01 and subsequent amendments, or, after the period of validity of the same, of, relating to the application of Articles 107 and 108 of the Treaty on the Functioning of the European Union . In the event of application of the aforementioned Temporary Framework, the granting of aid is subject, pursuant to Article 108 (3) of the Treaty on the Functioning of the European Union, to authorization by the European Commission. 1407/2013 of the Commission, of 18 December 2013. In the event of application of the aforementioned Temporary Framework, the granting of aid is subject, pursuant to Article 108, paragraph 3, of the Treaty on the Functioning of the European Union, to the authorization of European Commission.

- In order to obtain the grant, the companies concerned submit, exclusively electronically, an application to the Ministry of Economic Development, with the indication of the existence of the requirements defined by the previous paragraphs, proven through specific substitutive declarations made pursuant to the President's decree. of the Republic 28 December 2000, n. 445. The application must be presented within the terms and in the manner defined by the provision of the Ministry of Economic Development, which also provides the necessary operational indications on the methods of granting and disbursing aid and any other element necessary for the implementation of the measure provided for in this article. The same provision provides the necessary specifications in relation to the verifications and controls, also with automated methods, relating to the contents of the declarations made by the requesting companies as well as the recovery of contributions in the case of revocation, ordered pursuant to article 9 of the legislative decree 31 March 1998, n. 123 in the event of a detected absence of one or more requisites, or incomplete or irregular documentation, for facts attributable to the applicant and which cannot be remedied. In any case, the provisions of article 48- bis of the decree of the President of the Republic of 29 September 1973, n. 602 and the checks on the regularity of contributions of the beneficiary companies.

- After the closing of the final deadline for the transmission of the requests for access to the contribution, established with the provision referred to in paragraph 4, the financial resources of the fund provided for in paragraph 1 are divided among the companies entitled to it, recognizing each of the aforementioned companies a amount determined by applying a percentage equal to the difference between the average monthly amount of revenues relating to the 2021 tax period and the average monthly amount of the same revenues relating to the tax period, as follows: a) sixty percent, for subjects with revenues relating to the 2019 tax period not exceeding four hundred thousand euros; b) fifty percent, for subjects with revenues relating to the 2019 tax period exceeding four hundred thousand euros and up to one million euros; c) forty percent, for subjects with revenues relating to the 2019 tax period exceeding one million euros and up to two million euros.

- For the purposes of quantifying the contribution pursuant to paragraph 5 – the revenues referred to in article 85, paragraph 1, letters a) and b) of the Consolidated Income Tax Act approved by decree of the President of the Republic 22 December 1986, no. . 917. It is understood that, with reference to each applicant company, the amount of the contribution determined pursuant to paragraph 5 is reduced if necessary in order to ensure compliance with the applicable state aid legislation pursuant to paragraph 3. the aforementioned purposes, the provision envisaged by paragraph 4 also identifies, among other things, the methods for ensuring compliance with the conditions and limits provided for by the applicable state aid regulations.

- If the financial endowment referred to in paragraph 1 is not sufficient to satisfy the request for relief referring to all eligible applications, after the deadline for submitting the same, the Ministry of Economic Development will proportionally reduce the contribution based on the financial resources available and the number of admissible applications received, taking into account the different income brackets provided for in paragraph 5.

- To carry out the activities provided for in this article, the Ministry of Economic Development may make use of in-house companies through the stipulation of a specific agreement. The charges deriving from the aforementioned agreement are charged to the resources assigned to the fund referred to in this article, up to a maximum limit of 1.5 per cent of the resources themselves.

- 9. The charges referred to in this article, equal to 200 million euros for the year 2022, are provided pursuant to article __ (financial coverage article)

ART. 3.

(Additional support measures for economic activities particularly affected by the epidemiological emergency)

- The Fund referred to in article 26 of the decree-law of 22 March 2021, n. 41, converted, with modifications, by law 21 May 2021, n. 69 is extended to the year 2022 with an allocation of 20 million euros, for the year 2022, to be allocated to interventions in favor of theme parks, aquariums, geological parks and zoological gardens. The allocation of resources is carried out according to the procedures set out in the aforementioned article 26 of decree-law no. 41 of 2021 and the deadline for the adoption of the allotment decree starts from the entry into force of the conversion law of this decree.

- In article 1-ter of the decree-law of 25 May 2021, n. 73, converted, with modifications, by the law of 23 July 2021, n. 106, the following amendments are made: a) after paragraph 2 the following is added: “2-bis. For the purposes referred to in paragraph 1, in consideration of the effects of the epidemiological emergency, 40 million euros have been allocated for the year 2022 to be allocated to interventions for companies carrying out activities identified by the following ATECO economic activity classification codes: 96.09.05, 56.10, 56.21, 56.30, 93.11.2, which cumulatively meet the following requirements: a) in the year 2021, they suffered a reduction in turnover of no less than 40 (forty) percent compared to the turnover of 2019. for the purpose of quantifying the turnover, the revenues referred to in Article 85, paragraph 1, letters a) and b), of the TUIR, relating to the tax periods 2021 and 2019, are recognized. reduction in turnover, to the same extent, is related to the activity period of 2020 starting from the date of incorporation and registration in the register of companies, taking into consideration the turnover recorded in the aforementioned period and the urate recorded in the corresponding period of 2021; b) have registered, in the tax period 2021, a worsening of the economic result for the year to an extent equal to or greater than the percentage defined by the decree of the Minister of Economy and Finance adopted pursuant to article 1, paragraph 19, of the decree-law of 25 May 2021, n. 73. For the implementation of this paragraph, the provisions of the decree referred to in paragraph 2 apply, insofar as they are compatible "; b) in paragraph 3, the words: "To the charges deriving from this article" are replaced by the following: "To the charges deriving from paragraph 1".

- The tax credit referred to in article 48-bis of the decree-law of 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, is recognized, for the year in progress as at 31 December 2021, also to companies operating in the textile, fashion, footwear and leather goods trading sector that carry out activities identified by the following codes of the classification of economic activities ATECO 2007 : 47.51, 47.71, 47.72. Consequently, in article 48-bis, paragraph 1, last sentence, of the decree-law of 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, the words "150 million euros for the year 2022" are replaced by the following "250 million euros for the year 2022".

- The charges deriving from this article, amounting to € 160 million for the year 2022, are provided in accordance with article…. (financial coverage article).

ART. 4.

(Single National Tourism Fund)

- The fund referred to in article 1, paragraph 366, of law no. 234, increased by 100 million euros for the year 2022.

- From 1 January 2022 to 31 March 2022, the exemption referred to in article 7 of the decree-law of 14 August 2020, n. 104, converted, with modifications, by the law 13 October 2020, n. 126, is recognized, with the same modalities, limited to the period of the contracts stipulated and in any case up to a maximum of three months, for fixed-term hiring or with seasonal employment contract in the tourism and spa establishments sectors. In the event of conversion of these contracts into a permanent employment relationship, article 6, paragraph 3, of the decree-law of 14 August 2020, no. 104, converted, with modifications, by the law 13 October 2020, n. 126. The contributory benefit referred to in paragraph 1 is recognized within the limit of 40 million euros for the year 2022 from the resources referred to in paragraph 1.

3 The charges deriving from paragraph 1 equal to 100 million euros for the year 2022 are provided in accordance with article … (coverage article).

ART. 5.

(Tax credit in favor of tourism companies for real estate rents)

- The tax credit referred to in article 28 of the decree-law of 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, is up to the companies in the tourism sector, with the methods and conditions indicated therein as compatible, in relation to the fees paid with reference to each of the months from January 2022 to March 2022.

- The tax credit referred to in paragraph 1 is due provided that the subjects indicated therein have suffered a decrease in turnover or fees in the reference month of the year 2022 of at least 50 percent compared to the same month of the year 2019.

- The provisions of this article apply in compliance with the limits and conditions set out in the Communication of the European Commission of 19 March 2020 C (2020) 1863 final "Temporary framework for state aid measures to support the economy in the current emergency of the COVID-19 ", and subsequent amendments. Economic operators submit a specific self-declaration to the Revenue Agency certifying that they meet the requirements and compliance with the conditions and limits set out in Sections 3.1 "Aid of limited amount" and 3.12 "Aid in the form of support at fixed costs not covered" of the aforementioned Communication. The methods, terms of presentation and the content of the self-declarations are established by provision of the director of the Agency itself, to be issued within… days from the date of publication of the present… in the Official Journal.

- The effectiveness of this measure is subject, pursuant to Article 108 (3) of the Treaty on the Functioning of the European Union, to authorization by the European Commission.

- The charges deriving from this article, valued at 128.1 million euros for the year 2022, are provided pursuant to article… (coverage article).

ART. 6.

(Vouchers for spa services)

- In consideration of the permanent epidemiological emergency situation, the vouchers for the purchase of spa services referred to in article 29-bis of the decree-law of 14 August 2020, n. 104, converted, with modifications, by the law 13 October 2020, n. 126, not used as of January 8, 2021, can be used by March 31, 2022.

ART. 7.

(Provisions on wage integration treatments)

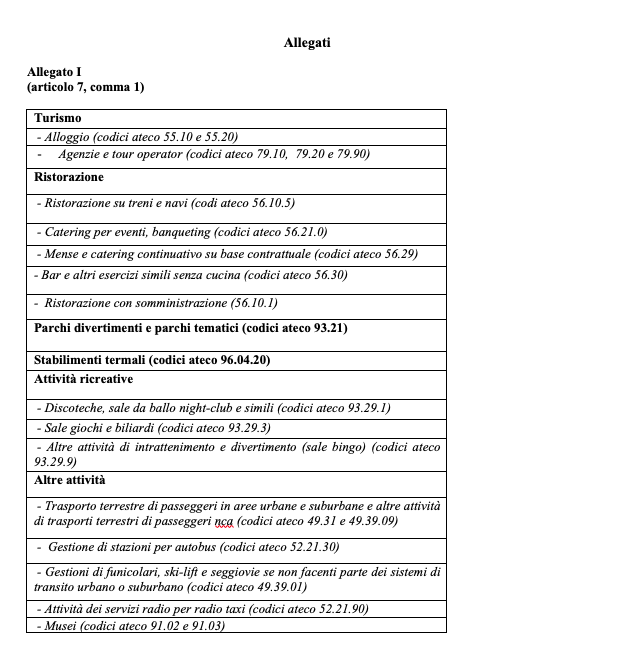

- Employers in the sectors referred to in the Ateco codes in Annex I to this decree who, starting from the date of January 1, 2022 until March 31, 2022, suspend or reduce their working activity pursuant to the legislative decree of September 14, 2015 , no. 148, are exempt from paying the additional contribution referred to in articles 5 and 29, paragraph 8, of legislative decree no. 148.

- The charges deriving from this article, equal to 80.2 million euros for the year 2022, are drawn from the fund referred to in article 1, paragraph 120, of law no. 234.

ART. 8.

(Urgent support measures for the culture sector)

- The funds referred to in article 89, paragraph 1, of the decree-law of 17 March 2020, n. 18, converted, with amendments, by law 24 April 2020, n. 27, established in the forecast of the Ministry of Culture, increased for the year 2022 by 50 million euros for the current part and by 25 million euros for capital account interventions.

- The fund referred to in article 183, paragraph 2, of the decree-law of 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, established in the forecast of the Ministry of Culture, increased by 30 million euros for the year 2022.

- In article 65, paragraph 6, of the decree-law of 25 May 2021, n. 73, converted, with modifications, by the law of 23 July 2021, n. 106, the words " 31 December 2021 ", are replaced by the following: " 30 June 2022 ".

- For the purposes referred to in paragraph 3, the fund established by article 65, paragraph 7, of the decree-law of 25 May 2021, n. 73, converted, with modifications, by the law of 23 July 2021, n. 106, increased by 6.5 million euros for the year 2022. The allocation of the fund among the interested entities is carried out with one or more decrees of the Minister of the Interior, in agreement with the Minister of Economy and Finance, subject to agreement in the State-City Conference and local autonomies, to be adopted by the 20th…. 2022. In the event that the condition envisaged by article 3, paragraph 3, of legislative decree no. 281, the decree is in any case adopted.

- The charges deriving from this article, equal to 111.5 million euros for the year 2022, are provided through …

ART. 9.

(Urgent provisions on sport)

- In order to support the operators of the sports sector affected by the restrictive measures introduced with the decree law of 30 December 2021, n. 229, containing "Urgent measures to contain the spread of the COVID-19 epidemic and provisions on health surveillance", the provisions referred to in article 81 of the decree-law of 14 August 2020, no. 104, converted, with amendments, by law 126 of 13 October 2020, already extended by article 10, paragraph 1, of law decree no. 73, converted with modifications, by law 23 July 2021, n. 106, also apply to advertising investments made from 1 January 2022 to 31 March 2022. For this purpose, spending is authorized, for a total amount of 20 million euros for the first quarter of 2022, which constitutes an expense ceiling.

- In order to support the operators of the sports sector affected by the restrictive measures introduced with the decree law of 30 December 2021, n. 229, containing "Urgent measures to contain the spread of the COVID-19 epidemic and provisions on health surveillance" to contain the spread of the COVID-19 epidemic, the endowment of the fund referred to in Article 10, paragraph 3, of the decree law 25 May 2021, n. 73, converted with modifications, by law 23 July 2021, n. 106, increased by € 20 million for the year 2022. This amount constitutes an expense limit and is intended for the disbursement of a non-repayable grant to reimburse health care and prevention costs and for carrying out diagnostic tests. of the COVID-19 infection, in favor of professional sports clubs and amateur sports clubs and associations registered in the national register of amateur associations and clubs.

- To cope with the economic crisis caused by the containment and management measures of the epidemiological emergency from COVID-19 introduced with the decree law 30 December 2021, n. 229, containing "Urgent measures to contain the spread of the COVID-19 epidemic and provisions on health surveillance", the resources referred to in the "Single Fund to support the strengthening of the Italian sports movement" referred to in article 1 , paragraph 369, of the law of 27 December 2017, n. 205 , may be partially intended for the disbursement of grants for amateur sports associations and clubs most affected by the restrictions, with specific reference to amateur sports associations and clubs that manage sports facilities. A portion of the resources referred to in the first period, up to 30 million euros, is intended for amateur companies and associations that manage swimming facilities. By decree of the delegated political authority in the field of sport, to be adopted within thirty days from the date of entry into force of this decree, the methods and terms for submitting requests for disbursement of contributions, the admission criteria, the methods of disbursement, as well as the control procedures, to be carried out also on a sample basis.

- The "Single Fund to support the strengthening of the Italian sports movement" referred to in Article 1, paragraph 369, of Law no. 205 increased by XX million euros for the year 2022.

- The charges deriving from the provisions referred to in paragraphs 1 and 2, equal to € 40 million for the year 2022, are provided with resources worth …

ART. 9- bis

(Transition plan 4.0)

- In article 1, paragraph 44, letter b), of law no. 234, the following sentence is added at the end: "For the portion exceeding 10 million euros of investments included in the PNRR, aimed at achieving ecological transition objectives identified by decree of the Minister of Economic Development, in agreement with the Minister of ecological transition and with the Minister of Economy and Finance, the tax credit is recognized to the extent of 5 per cent of the cost up to the maximum limit of total eligible costs equal to 50 million euros. For the purposes referred to in this paragraph, the expenditure of € 30 million per year is authorized. ".

Title II

Regions and territorial bodies

ART. 10.

(State contribution to health costs related to the Covid-19 emergency incurred by the regions and autonomous provinces)

- The endowment of the Fund referred to in article 16, paragraph 8-septies, of the decree-law 21 October 2021, n. 146, converted, with modifications, by the law of 17 December 2021, n. 215, increased by 400 million euros for the year 2022.

ART. 11.

(Increase in contribution for non-collection of tourist tax)

- The fund referred to in article 25, paragraph 1, of the decree-law of 22 March 2021, n. 41, converted, with modifications, by law 21 May 2021, n. 69, established in the estimate of the Ministry of the Interior, for the non-collections relating to the first quarter of 2022, increased by XX million euros for the year 2022.

- The division of the Fund among the interested entities is carried out with one or more decrees of the Minister of the Interior in agreement with the Minister of Economy and Finance, subject to agreement in the State-City Conference and local autonomies, to be adopted by 30 April 2022.

- The charge referred to in paragraph 1, equal to XX million euros for the year 2022, is provided pursuant to article …

ART. 12.

(Use in the year 2022 of the resources assigned to local authorities in the years 2020 and 2021)

- The resources of the fund referred to in article 1, paragraph 822, of law no. 178, are bound to the purpose of restoring any loss of revenue and higher expenses, net of lower expenses, connected to the epidemiological emergency from COVID-19 also in the year 2022 and the resources assigned for the aforementioned emergency by way of specific expense reimbursements that fall within the certifications referred to in article 1, paragraph 827, of the law of 30 December 2020, n. 178, and in article 39, paragraph 2, of the decree-law of 14 August 2020, n. 104, converted, with modifications, by the law 13 October 2020, n. 126, can also be used in the year 2022 for the purposes to which they have been assigned. The resources referred to in the previous period not used at the end of the 2022 financial year, converge in the restricted portion of the administration result and cannot be released pursuant to article 109, paragraph 1-ter, of the decree-law of 17 March 2020, no. . 18, converted, with amendments, by law 24 April 2020, n. 27, and are not subject to the limits set out in article 1, paragraphs 897 and 898, of law no. 145. Any resources received in excess are paid into the state budget.

- In article 1, paragraph 823, of law no. 178, the last sentence is replaced by the following “Any excess resources received by the regions and autonomous provinces of Trento and Bolzano are paid into the state budget.

- Local authorities that use the resources referred to in paragraph 1 in the year 2022 are required to send, using the web application http://pareggiobilancio.mef.gov.it, within the peremptory deadline of May 31, 2023, to the Ministry of economy and finance – Department of State General Accounting, a certification of the loss of revenue related to the epidemiological emergency from COVID-19, net of lower expenses and resources assigned in various capacities by the State to restore lower income and higher expenses related to the aforementioned emergency, digitally signed, pursuant to article 24 of the digital administration code, as per legislative decree n. 82, by the legal representative, by the head of the financial service and by the economic-financial auditing body, through a model and with the procedures defined by decree of the Ministry of Economy and Finance, in agreement with the Ministry of the Interior, after hearing the State-City and Local Autonomy Conference, to be adopted by 30 October 2022. The certification referred to in the previous period does not include the reductions in revenue deriving from interventions independently undertaken by the region or autonomous province for the local authorities of its territory, with the exception interventions to adapt to national legislation. The electronic transmission of the certification has legal value pursuant to article 45, paragraph 1, of the code referred to in the aforementioned legislative decree no. 82 of 2005. The certification obligations referred to in this paragraph, for the local authorities of the Friuli Venezia Giulia and Valle d'Aosta regions and of the autonomous provinces of Trento and Bolzano that exercise functions in the area of local finance exclusively, are acquitted through the same regions and autonomous provinces.

- Local authorities that transmit the certification referred to in paragraph 3 after the peremptory deadline of May 31, 2023, but by June 30, 2023, are subject to a reduction in the experimental rebalancing fund, compensatory transfers or the municipal solidarity fund to an extent equal to 80 percent of the amount of resources allocated, pursuant to the first sentence of paragraph 822 of article 1 of law no. 178, to be applied in three years starting from the year 2024. In the event that the certification referred to in paragraph 3 is transmitted in the period from 1 July 2023 to 31 July 2023, the reduction of the experimental rebalancing fund, of compensatory transfers o the municipal solidarity fund referred to in the first period is imposed in an amount equal to 90 percent of the amount of the allocated resources, to be applied in three annuities starting from the year 2024. The reduction of the experimental rebalancing fund, of compensatory transfers o the municipal solidarity fund referred to in the first period is applied in an amount equal to 100 percent of the amount of the allocated resources, to be applied in three annuities starting from the year 2024, if the local authorities do not transmit the certification referred to in paragraph 3 by 31 July 2023. Following the late sending of the certification, the reductions in resources are not subject to restitution. In the event of insufficient resources, the procedures referred to in Article 1, paragraphs 128 and 129, of Law no. 228.

- In paragraph 1 of article 106 of the decree-law of 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, the words: "31 October 2022" are replaced by the following: "31 October 2023".

- In article 109, paragraph 2, of the decree-law of 17 March 2020, n. 18, converted, with amendments, by law 24 April 2020, n. 27, the words: "limited to the financial years 2020 and 2021", wherever they occur, are replaced by the following: "limited to the financial years 2020, 2021 and 2022".

Title III

Urgent measures to contain electricity costs

ART. 13.

(Reduction of system charges for the first quarter of 2022 for users with available power equal to or greater than 16.5 kW)

- To reduce the effects of price increases in the electricity sector, in addition to the provisions of article 1, paragraph 504, of law no. 234, the Regulatory Authority for Energy, Networks and the Environment (ARERA) will cancel, for the first quarter of 2022, with effect from 1 January 2022, the rates relating to general system charges applied to users with available power equal to or higher than 16.5 kW, also connected in medium and high / very high voltage or for use in public lighting or for charging electric vehicles in places accessible to the public.

- The charges deriving from paragraph 1, equal to 1,200 million euros for the year 2022, are provided by means of a corresponding use of part of the proceeds from the auctions of CO2 emissions quotas referred to in article 23 of the legislative decree of 9 June 2020, n. 47 , relating to the year 2022, which are paid monthly by the Energy Services Operator (GSE) to the specific account opened at the State Treasury to be re-charged to the Energy and Environmental Services Fund (CSEA). If the monthly payments are lower than the cash needs of the CSEA, as determined pursuant to paragraph 1, the Ministry of Economy and Finance may authorize, at the request of the CSEA, the use of advances from the state treasury to be paid by 31 December 2022.

- If the payments referred to in paragraph 2, made by the GSE in favor of CSEA, are lower than the amount of 1,200 million euros, the difference will be made, within the year 2022, by paying the same amount to the CSEA of the share of the proceeds from the auctions of CO2 emissions quotas referred to in 2020, relating to the year 2021, destined for the Ministry of Ecological Transition and the Ministry of Economic Development, held in the specific account opened with the State treasury. To this end, there is no reallocation in the balance sheet of the amounts held in the State Treasury until the achievement by CSEA of the amount due pursuant to paragraph 2.

ART. 14.

(Reduction of bills for energy eaters)

- To companies with a high consumption of electricity referred to in the decree of the Minister of Economic Development of 21 December 2017 whose costs per kWh of the electricity component, calculated on the basis of the average of the last quarter of 2021 and net of taxes and any subsidies, have undergone an increase in the cost per KWh of more than 30 percent relating to the same period of 2019, assessed also taking into account any duration supply contracts stipulated by the company, an extraordinary contribution is recognized in partial compensation of the higher costs incurred , in the form of a tax credit, equal to 20 per cent of the expenses incurred for the energy component purchased and actually used in the first quarter of 2022.

- The tax credit referred to in paragraph 1 can only be used in compensation pursuant to Article 17 of Legislative Decree 9 July 1997, n. 241. The limits referred to in article 1, paragraph 53, of law no. 244, and referred to in article 34 of the law of 23 December 2000, n. 388. The tax credit does not contribute to the formation of business income or the taxable base of the regional tax on productive activities and is not relevant for the purposes of the relationship referred to in articles 61 and 109, paragraph 5, of the consolidated act referred to to the decree of the President of the Republic 22 December 1986, n. 917. The tax credit can be combined with other concessions that have the same costs as their object, provided that such accumulation, also taking into account the non-competition in the formation of income and the taxable base of the regional tax on productive activities, does not lead to upon exceeding the cost incurred.

- The tax credit referred to in paragraph 1 can be transferred, even partially, with the exclusion of the right of subsequent transfer by the transferee to other subjects, including banks and other financial intermediaries.

- The Revenue Agency checks the due and correct use of the tax credit, in accordance with the provisions in force.

- The charges deriving from paragraph 1, equal to 540 million euros for the year 2022, are provided by means of the corresponding use, of part of the proceeds from the auctions of CO2 emissions quotas referred to in Article 23 of Legislative Decree 9 June 2020 , no. 47 relating to the year 2022, intended for the Ministry of Ecological Transition and the Ministry of Economic Development, paid by the Energy Services Manager (GSE) to the specific account opened at the State Treasury to be re-charged to the Energy and Environmental Services Fund. If the payments are lower than the cash needs of the CSEA, as determined pursuant to paragraph 1, the Ministry of Economy and Finance may authorize, at the request of the CSEA, the use of advances from the state treasury to be paid by 31 December 2022.

ART. 15.

(Interventions on electricity produced by renewable energy plants)

- Starting from the date of February 1, 2022 and until December 31, 2022, on the electricity produced by photovoltaic plants with a power exceeding 20 kW which benefit from fixed tariffs deriving from the Energy Account mechanism, not dependent on market prices , as well as on the electricity produced by plants powered by hydroelectric, geothermal and wind sources that do not access tariff incentives for differences, a two-way compensation mechanism is applied to the price of energy.

- For the purposes referred to in paragraph 1, the Energy Services Manager – GSE SpA (hereinafter: GSE) calculates the difference between the values referred to in the following letters a) and b):

- a) an average reference price set equal to the average of the hourly zonal prices recorded from the date of entry into operation of the plant until 31 December 2020, revalued on the basis of the annual rate of change in the consumer prices of the households of blue-collar and white-collar workers recorded by Istat, or, if the plant entered into operation prior to 1 January 2010, at the average of the hourly zone prices recorded from 1 January 2010 to 31 December 2020 revalued according to the same method;

- b) the hourly market zonal price of electricity, or, for supply contracts stipulated before the date of entry into force of this provision that do not comply with the conditions referred to in paragraph 5, the average price indicated in the contracts themselves.

- If the difference referred to in paragraph 2 is positive, the GSE pays the relative amount to the producer. In the event that the aforementioned difference is negative, the GSE balances or requests the corresponding amounts from the producer.

- Within thirty days from the date of entry into force of this decree, the Regulatory Authority for Energy, Networks and the Environment (ARERA) regulates the methods by which the provisions referred to in paragraphs 1, 2 and 3 are implemented, as well as the methods with which the relative proceeds are paid into a special fund set up at the Fund for energy and environmental services and brought to reduce the requirement to cover the general charges relating to the electricity system referred to in Article 3, paragraph 11, of the legislative decree 16 March 1999, n. 79.

- The provisions referred to in paragraphs 1, 2, 3 and 4 do not apply to energy subject to supply contracts concluded before the date of entry into force of this decree, provided that they are not linked to the trend in spot market prices. of energy and which, in any case, are not stipulated at an average price 10 percent higher than the value referred to in paragraph 2, letter a), limited to the duration of the aforementioned contracts.

ART. 16.

(Amendments to the rules of the Technical Commission PNRR-PNIEC)

- In order to further accelerate the authorization processes for energy production plants from renewable sources and increase the country's level of energy self-sufficiency, pursuant to article 8 of legislative decree no. 152, the following changes are made:

- a) in paragraph 2- bis :

1) the fourth sentence is replaced by the following: “The members appointed in the PNRR-PNIEC Technical Commission carry out this activity full time. By decree of the Minister of Ecological Transition, on the proposal of the President, the members of the Commission referred to in paragraph 1, up to a maximum of six, may also be appointed as members of the Commission referred to in this paragraph. ";

2) the following sentence is added at the end: "The provisions of article 73, paragraph 2, of the decree-law of 17 March 2020, n. 18, converted, with amendments, by law 24 April 2020, n. 27, also applies to the investigative work carried out by the Commissioners in the context of the Subcommittees and the Investigating Groups. ";

- b) after paragraph 2- septies , the following is inserted: “2- octies . At the Commissions referred to in paragraphs 1 and 2- bis , in order to allow for an increase in operations, a contingent of four units of the forestry, environmental and agri-food units of the Carabinieri has been set up, which the same Command provides for identify and detach within ten days of the request from the Ministry of Ecological Transition. ".

ART. 17.

(Reduction of environmentally harmful subsidies)

Title IV

Other urgent measures

ART. 18.

(Urgent measures for school, university and family)

- In order to ensure the supply of FFP2 type masks in favor of pupils and school staff under the self-monitoring regime referred to in article 4 of the decree-law of 7 January 2022, n. 1, on the basis of a certificate from the educational institution concerned that proves the actual need, the pharmacies and other authorized retailers who have adhered to the memorandum of understanding stipulated pursuant to art. 3 of the decree-law of 30 December 2021, n. 229, promptly provide the aforementioned masks to the same educational institutions, accruing the right to the benefit referred to in paragraph 2. For the implementation of the previous period, the fund for the epidemiological emergency from COVID-19 for the school year 2021/2022 referred to in art. 58, paragraph 4, of the decree-law of 25 May 2021, n. 73, converted, with modifications, by the law of 23 July 2021, n. 106, is an increase in the spending limit of 45.22 million euros in 2022.

- In order to pay the amount due for the supply referred to in paragraph 1, the Ministry of Education promptly allocates the fund for the epidemiological emergency from COVID-19 for the subsequent transfer, in a single solution, of the sums necessary to the educational institutions. . The implementation procedures are defined by decree of the Ministry of Education.

- The charges referred to in paragraph 1 are provided by means of a corresponding reduction …

- In consideration of the prolongation of the epidemiological emergency from Covid-19, the doctoral students who benefited from the extension pursuant to article 33, paragraphs 2- bis and 2- ter , of the decree-law of 22 March 2021, n. 41, converted with amendments by law 21 May 2021, n. 69 and who finish the PhD program in the academic year 2020/2021 may submit a further request for an extension, not exceeding three months, of the final term of the course, without charges to be borne by public finance. The possibility remains for universities to finance the scholarships corresponding to the extension period with their own resources, or from the resources deriving from agreements with other subjects, public or private.

- The extension referred to in paragraph 4 can also be used by doctoral students who are not recipients of a scholarship, as well as public employees on leave for the frequency of a research doctorate, for which the public administration to which they belong can extend the leave for an equal period. to that of the extension of the PhD program.

- In article 12 of the consolidated income tax law, referred to in the decree of the President of the Republic of 22 December 1986, no. 917, the following changes are made:

- a) in paragraph 1, letter d), first sentence, the following are added after the words "provisions of the judicial authority": ", children are excluded in any case, even if they do not qualify for the deduction pursuant to letter c ) ";

- b) the following is added after paragraph 4-bis: «4-ter. For the purposes of the tax provisions that refer to the persons indicated in this article, also referring to the conditions set out therein, the children for whom the deduction is not due pursuant to letter c) of paragraph 1 are considered on a par with the children for whom it is this deduction. ".

ART. 19.

(Provisions on anti Sars-CoV2 vaccines and measures to ensure the continuity of services connected to molecular diagnostics)

- In article 1 of law no. 210, after paragraph 1, the following is added: “1-bis. The compensation referred to in paragraph 1 is also due, under the conditions and in the manner established by this law, to those who have suffered injuries or infirmities, from which a permanent impairment of psycho-physical integrity has resulted, due to the anti-SARS vaccination. CoV2 recommended by the Italian health authority. " The charge, valued at 50 million euros for the year 2022 and 100 million euros starting from the year 2023, is provided for XXX . By decree of the Minister of Health, in agreement with the Minister of Economy and Finance, the procedures for annual monitoring of requests for access to compensation and the relative results are established.

- In order to face the epidemiological emergency underway by SARS-CoV-2, and to ensure operational continuity of the medical and scientific units responsible for providing services related to molecular diagnostics to combat the spread of COVID-19, the Ministry of Defense , within the framework of the recruitment faculties available under current legislation and in accordance with the Plan referred to in article 6 of the decree law 9 June 2021, n. 80, converted, with modifications, by the law 6 August 2021, n. 113, is authorized to hire with a permanent employment contract up to a maximum of fifteen units of non-executive level personnel of Area III, economic position F1, professional profile of technical officer for biology, chemistry and physics, personnel who have passed the simplified bankruptcy procedures referred to in article 8, paragraph 2, of the decree-law of 17 March 2020, n. 18, converted, with amendments, by law 24 April 2020, n. 27.

- The charges deriving from the implementation of paragraph 2, within the spending limit of € 611,361 starting from the year 2023, will be applied to the recruitment faculties of the Ministry of Defense already accrued and available under current legislation.

- For the strengthening of the military health services and of the Celio scientific department necessary to face the exceptional needs connected to the trend of the COVID-19 epidemic in synergy with the national health service by increasing the current prevention, diagnostic and diagnostic capabilities molecular, sequencing, prophylaxis and treatment, the total expenditure of 8,000,000 euros for the year 2022 is authorized for the infrastructural and bioinformatic adaptation of the structures as well as for the procurement of medical devices, machinery and sanitation .

- The charges deriving from paragraph 4, equal to Euro 8,000,000 for the year 2022, are provided through xxxxx.

ART. 20.

(Measures on electronic health records and digital health governance)

ART. 21.

(Extension of the wage integration treatment in favor of companies of significant national strategic interest and the suspension of mortgages in the municipalities of the Central Italy crater)

- Exceptionally, companies with no less than a thousand employees who manage at least one industrial plant of national strategic interest pursuant to article 1 of decree-law no. 207, converted, with modifications, by the law 24 December 2012, n. 231, may submit an application for an extension of the wage supplement treatment referred to in article 3 of the decree-law of 20 July 2021, n. 103, converted with amendments by law 16 September 2021, n. 125, for a maximum duration of a further twenty-six weeks usable until March 31, 2022.

- The treatments referred to in paragraph 1 are granted within the maximum spending limit of 42.7 million euros for the year 2022. INPS monitors the spending limit referred to in this paragraph. If from the aforementioned monitoring it emerges that the spending limit has also been reached prospectively, the INPS does not consider further questions. The related charges are taken into account … ..

- In article 14, paragraph 6, of the decree-law of 30 December 2016, n. 244, converted, with amendments, by law no. 19, the following amendments are made: the words "31 December 2021", recurring everywhere, are replaced by the following: "31 December 2022".

- In article 2-bis, paragraph 22, third sentence, of the decree-law of 16 October 2017, n. 148, converted, with amendments, by law 4 December 2017, n. 172, the following amendments are made: the words: “31 December 2021” are replaced by the following: “31 December 2022”.

- The State contributes, in whole or in part, to the charges deriving from paragraphs 3 and 4, within the overall spending limit of 1,500,000 euros for the year 2022.

ART. 22.

(Urgent provisions on local public transport and medium and long distance transport)

- In consideration of the persistence of the epidemiological emergency from COVID-19, the endowment of the fund referred to in article 1, paragraph 816, of law no. 178, increased by a further 80 million euros for the year 2022. These resources, until 31 March 2022, the end of the same state of emergency, are intended to finance the additional services planned in order to cope with the effects deriving from the limitations placed at the filling coefficient of the vehicles, also in line with the results of the prefectoral tables referred to in the decree of the President of the Council of Ministers adopted pursuant to article 2 of the decree-law of 25 March 2020, n. 19, converted, with amendments, by law 22 May 2020, n. 35, and according to methods that allow the detection of actual use.

- The resources referred to in paragraph 1 are assigned to the regions, to the autonomous provinces of Trento and Bolzano as well as to companies operating regional public transport services that remain under the jurisdiction of the state and are distributed with the same percentages established for the assignment of resources allocated for the same purpose by article 51, of the decree law 25 May 2021, n. 73, converted, with modifications, by the law of 23 July 2021, n. 106.

- The entities referred to in paragraph 2 shall report to the Ministry of Sustainable Infrastructure and Mobility and to the Ministry of Economy and Finance, by 15 May 2022, the use of the assigned resources, certifying that the additional services have been exercised to an extent that higher than the requirement deriving from the limitations placed on the filling coefficient of the vehicles referred to in paragraph 1.

- Any residual resources of the overall allocation referred to in paragraph 1, as resulting from the reporting referred to in paragraph 3, can be used, in the year 2022, for the strengthening of control activities aimed at ensuring that the use of means of transport local public takes place in compliance with the measures to contain and combat health risks deriving from the spread of COVID-19, as well as for the purposes set out in article 200, paragraph 1, of the decree-law of 19 May 2020, n. 34 , converted, with amendments, by law 17 July 2020, n. 77 . With the same procedures as referred to in paragraph 3, the entities referred to in paragraph 2 shall report the use of the resources referred to in this paragraph by 31 January 2023.

- The charges deriving from paragraphs 1, 2, 3 and 4 equal to 80 million euros are provided …

- In consideration of the persistence of the emergency situation connected to COVID-19 and in order to mitigate the negative effects produced on the sector of scheduled road transport services by bus and not subject to public service obligations, it is established at the Ministry of Infrastructure and sustainable mobility, a fund, with an endowment of 15 million euros for the year 2022, intended to compensate, within the limit of available resources and for a maximum amount not exceeding 11 per cent of the revenues recorded in the period between January 1, 2022 and March 31, 2022, the damages suffered as a result of the containment and contrasting measures to the emergency from COVID-19 by the companies operating the services referred to in this paragraph pursuant to and for the purposes of the legislative decree 21 November 2005, n. 285 , or on the basis of authorizations issued by the Ministry of Sustainable Infrastructure and Mobility pursuant to Regulation (EC) no. 1073/2009 of the European Parliament and of the Council, of 21 October 2009 , or on the basis of authorizations issued by the regions and local authorities pursuant to the regional regulations implementing the legislative decree 19 November 1997, n. 422 , as well as by companies operating bus rental services with driver pursuant to law no. 218.

- For the same purposes of paragraph 6, the fund referred to in article 85, paragraph 1, of the decree-law of 14 August 2020, n. 104, converted, with modifications, by the law 13 October 2020, n. 126, increased by 5 million euros for the year 2022 for the reimbursement of loan installments or leasing installments, with maturity included, also due to the extension between 1 January 2021 and 31 March 2022 and concerning purchases made, starting from 1 January 2018, also through financial leasing contracts, of new factory vehicles of category M2 and M3, by companies operating the services referred to in paragraph 6 pursuant to and for the purposes of the legislative decree 21 November 2005, n. 285, or on the basis of authorizations issued by the Ministry of Sustainable Infrastructure and Mobility pursuant to Regulation (EC) no. 1073/2009 of the European Parliament and of the Council, of 21 October 2009, or on the basis of authorizations issued by the regions and local authorities pursuant to the regional regulations implementing legislative decree no. 422 of 1997.

- The criteria and procedures for the disbursement of the resources referred to in paragraphs 6 and 7. 9. The effectiveness of the decrees referred to in paragraph 8 is subject to the authorization of the European Commission pursuant to Article 108, paragraph 3, of the Treaty on the Functioning of the European Union .

- The charges deriving from paragraphs 6 and 7, equal to 20 million euros for the year 2022, are provided _________________.

ART. 23.

(Urgent measures for the railway sector)

- In order to support the railway sector and in consideration of the persistence of the epidemiological emergency from COVID-19, the expenditure of 10 million euros for each of the years from 2022 to 2034 is authorized in favor of the Italian Railway Network Spa. first period is deducted by the Italian Railway Network Spa from the total net costs relating to the services of the minimum access package in order to have, from 1 January 2022 to 31 March 2022, within the maximum limit of the allocation referred to in the same first period, a reduction of the fee for the use of the railway infrastructure up to 100 percent of the amount exceeding the coverage of the cost directly linked to the provision of the railway service referred to in Article 17, paragraph 4, of Legislative Decree no. 112, for passenger rail services not subject to public service obligation and for freight rail services. Il canone per l'utilizzo dell'infrastruttura su cui applicare la riduzione di cui al secondo periodo è determinato sulla base delle vigenti misure di regolazione definite dall'Autorità di regolazione dei trasporti (ART) di cui all'articolo 37 del decreto-legge 6 dicembre 2011, n. 201, convertito, con modificazioni, dalla legge 22 dicembre 2011, n. 214.

- Eventuali risorse residue, nell'ambito di quelle di cui al comma 1, sono destinate a compensare il gestore dell'infrastruttura ferroviaria nazionale delle minori entrate derivanti dal gettito del canone per l'utilizzo dell'infrastruttura ferroviaria nel medesimo periodo. Entro il 31 maggio 2022, Rete ferroviaria italiana Spa trasmette al Ministero delle infrastrutture e della mobilità sostenibili e all'Autorità di regolazione dei trasporti una rendicontazione sull'attuazione del presente articolo.

- Agli oneri di cui al comma 1 si provvede mediante corrispondente riduzione dell'autorizzazione di spesa di cui all'articolo 214, comma 3, del decreto-legge 19 maggio 2020, n. 34 convertito, con modificazioni, dalla legge 17 luglio 2020, n. 77.

ART. 24.

(Misure urgenti a sostegno del settore suinicolo)

- Al fine di tutelare gli allevamenti suinicoli dal rischio di contaminazione dal virus responsabile della peste suina africana e risarcire gli operatori della filiera suinicola danneggiati dal blocco alla movimentazione degli animali e delle esportazioni di prodotti trasformati, nello stato di previsione del Ministero delle politiche agricole alimentari e forestali sono istituiti due fondi denominati, rispettivamente, “Fondo di parte capitale per gli interventi strutturali e funzionali in materia di biosicurezza” (di seguito, “Fondo di parte capitale”), con una dotazione di 15 milioni di euro per l'anno 2022 e “Fondo di parte corrente per il sostegno della filiera suinicola” (di seguito, “Fondo di parte corrente”), con una dotazione di 35 milioni di euro per l'anno 2022.

- Il Fondo di parte capitale è destinato al rafforzamento degli interventi strutturali e funzionali in materia di biosicurezza, in conformità alle pertinenti norme nazionali e dell'Unione europea, ed è ripartito tra le regioni e le province autonome di Trento e Bolzano con decreto del Ministro delle politiche agricole alimentari e forestali, d'intesa con la Conferenza permanente per i rapporti tra lo Stato, le Regioni e le Province autonome di Trento e di Bolzano, sulla base di criteri che tengano conto della consistenza suinicola e del numero delle strutture produttive a maggiore rischio, comprese quelle ad uso familiare e che praticano l'allevamento semibrado, attribuendo priorità alle aree delimitate ai sensi dell'articolo 63, paragrafo 1 del regolamento (UE) 2020/687 e alle Province confinanti con quelle in cui sono situati i Comuni interessati dai provvedimenti di blocco alla movimentazione degli animali.

- Il Fondo di parte corrente è destinato ad indennizzare gli operatori della filiera colpiti dalle restrizioni sulla movimentazione degli animali e sulla commercializzazione dei prodotti derivati. Con decreto del Ministro delle politiche agricole alimentari e forestali, d'intesa con la Conferenza permanente per i rapporti tra lo Stato, le Regioni e le Province autonome di Trento e di Bolzano, sono stabilite le modalità di quantificazione dei contributi erogabili ai produttori della filiera suinicola a titolo di sostegno per i danni subiti, sulla base dell'entità del reale danno economico patito.

- La concessione dei contributi economici di cui al presente articolo è subordinata alla preventiva verifica della compatibilità dei medesimi con le pertinenti norme dell'Unione europea in materia di aiuti di Stato nel settore agricolo e agroalimentare.

- Agli oneri di cui al presente articolo, pari ad euro 50 milioni per l'anno 2022, si provvede mediante …

ART. 25.

(Disposizioni urgenti di adeguamento alla normativa europea)

- Al decreto-legge 19 maggio 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, sono apportate le seguenti modificazioni:

- a) all'articolo 54:

– al comma 1 le parole: “fino a un importo di 1,8 milioni di euro per impresa”, sono sostituite dalle parole “fino a un importo complessivo che in qualsiasi momento non supera i 2,3 milioni di euro per impresa”;

– al comma 2 parole “al di sotto del massimale di 1,8 milioni di euro per impresa” sono sostituite dalle parole “al di sotto del massimale di 2,3 milioni di euro per impresa”;

– il comma 3 è sostituito dal seguente: “Gli aiuti non possono superare in qualsiasi momento l'importo di 345.000 euro per ciascuna impresa operante nel settore della pesca e dell'acquacoltura o di 290.000 euro per impresa operante nel settore della produzione primaria di prodotti agricoli; l'aiuto può essere concesso sotto forma di sovvenzioni dirette, agevolazioni fiscali e di pagamento o in altre forme come anticipi rimborsabili, garanzie, prestiti e partecipazioni, a condizione che il valore nominale totale di tali misure non superi il massimale di 345.000 euro o 290.000 euro per impresa; tutti i valori utilizzati devono essere al lordo di qualsiasi imposta o altro onere. ”;

– Il comma 7 bis è sostituito dal seguente: “Gli aiuti concessi in base a regimi approvati ai sensi del presente articolo e rimborsati prima della concessione di nuovi aiuti non sono presi in considerazione quando si verifica che il massimale applicabile non è stato superato.”.

- b) all'art. 60 bis:

– al comma 5 le parole “10 milioni di euro” sono sostituite da “12 milioni di euro”;

– dopo il comma 5 è aggiunto il seguente comma 5 bis: “Gli aiuti concessi in base a regimi approvati ai sensi del presente articolo e rimborsati prima della concessione di nuovi aiuti non sono presi in considerazione quando si verifica che il massimale applicabile non è superato”.

- L'articolo 21 della legge 23 dicembre 2021, n. 238, è abrogato.

ART. 26.

(Misure di contrasto alle frodi nel settore delle agevolazioni fiscali ed economiche)

- Al decreto-legge 19 maggio 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, sono apportate le seguenti modificazioni:

- a) all'articolo 121, comma 1:

1) alla lettera a), le parole «con facoltà di successiva cessione del credito» sono sostituite dalle seguenti: «cedibile dai medesimi» e -dopo le parole «gli altri intermediari finanziari» sono inserite le seguenti: «, senza facoltà di successiva cessione»;

2) alla lettera b) le parole «, con facoltà di successiva cessione» sono soppresse e dopo le parole «gli altri intermediari finanziari» sono inserite le seguenti: «, senza facoltà di successiva cessione»;

- b) all'articolo 122, comma 1, dopo le parole «altri intermediari finanziari» sono inserite le seguenti: «, senza facoltà di successiva cessione».

- I crediti che alla data del 7 febbraio 2022 sono stati precedentemente oggetto di una delle opzioni di cui al comma 1 dell'articolo 121 del decreto-legge n. 34 del 2020, ovvero dell'opzione di cui al comma 1 dell'articolo 122 del medesimo decreto-legge n. 34 del 2020, possono costituire oggetto esclusivamente di una ulteriore cessione ad altri soggetti, compresi gli istituti di credito e gli altri intermediari finanziari, nei termini ivi previsti.

- Sono nulli:

- a) i contratti di cessione conclusi in violazione delle disposizioni di cui all'articolo 121, comma 1, del decreto-legge n. 34 del 2020, come modificato dal comma 1, lettera a), del presente articolo;

- b) i contratti di cessione conclusi in violazione delle disposizioni di cui all'articolo 122, comma 1, del decreto-legge n. 34 del 2020, come modificato dal comma 1, lettera b), del presente articolo;

- c) i contratti di cessione conclusi in violazione delle disposizioni di cui al comma 2.

ART. 27.

(Revisione dei prezzi degli appalti)

Titolo V

Disposizioni finali e finanziarie

ART. 28.

(Disposizioni finanziarie)

ART. 29.

(Entrata in vigore)

- Il presente decreto entra in vigore il giorno successivo a quello della sua pubblicazione nella Gazzetta Ufficiale della Repubblica italiana e sarà presentato alle Camere per la conversione in legge.

Il presente decreto, munito del sigillo dello Stato, sarà inserito nella Raccolta ufficiale degli atti normativi della Repubblica italiana. È fatto obbligo a chiunque spetti di osservarlo e di farlo osservare.

Dato a

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/decreto-energia-e-sostegni-ecco-sintesi-e-testo-integrale/ on Fri, 21 Jan 2022 18:52:19 +0000.