Gigafactory, like Italy and Europe trot with batteries

Two in Italy, 70 throughout Europe: here are the gigafactories that will emerge in a few years

In Italy, two gigafactories are envisaged for electric batteries, one in the former Olivetti site in Ivrea and the other in the former Indesit headquarters in Teverola, near Caserta. In Europe by the end of the decade there should be about seventy, according to European Commissioner Maroš Šefčovič.

The Ivrea plant was announced on 18 February, then presented on 4 March in Ivrea, at Confindustria Canavese, and in Châtillon, in Valle d'Aosta, on 9 April. It provides for an annual production capacity of batteries of 45 GWh, with the possibility of increasing to 70 GWh, an investment of 4 billion and 4 thousand jobs. The upcoming completion of the business plan was confirmed in Châtillon, the transfer of the company's registered office, currently in Milan, to Piedmont, the start of the permit applications and the design, with works that should begin in 2022, with production capacity since 2024. The local press and La Stampa of Turin keep the initiative under surveillance for fear that it will have little solidity: in the meantime, discussions have been started with Comau for the plants, with Pininfarina Architettura for the structure of the plant and with the ownership of the land that hosted Olivetti, now managed by Prelios, formerly Pirelli Real Estate.

The Teverola (Caserta) project is more advanced. It relies on a company already operating in the battery sector, FAAM, acquired by Seri Industrial in 2013, which in 2017 bought the former Indesit site (closed in 2017), between Naples and Caserta, from Whirpool. From an investment of 60 million, it is producing customized lithium batteries for 300MWh / year, in lithium-iron-phosphate (LifePo4), relying on Lithops in Orbassano (Turin), acquired in 2015, for research and innovation. 2021 is the transition to the gigafactory, with an initial capacity of 7-8 GWh / year expected to be fully operational in 2023-2024. It has a loan of 505 million euros that comes from the 2.9 billion of the European Commission allocated for the battery sector with the second “ Important Project of Common European Interest ” (IPCEI), one of the operations on the so-called “strategic autonomy”. Compared to Italvolt – which seems to be rather on paper – FAAM is operational and already embedded in the European system of the European Battery Alliance, the corresponding supply chains and automotive companies.

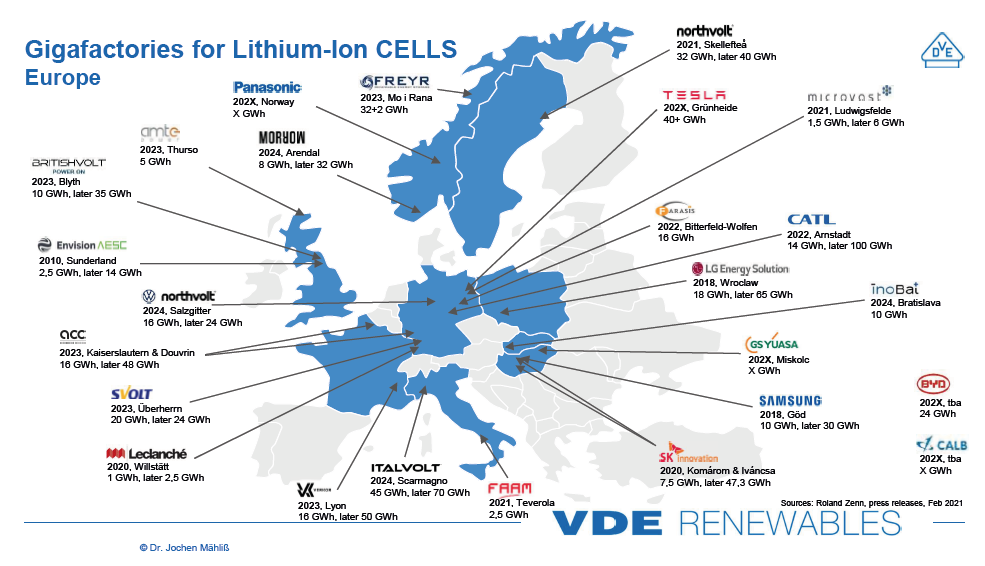

On the other hand, on March 15, Herbert Diess, CEO of Volkwagen, planned 6 gigafactories for a total of 240 GWh / year of batteries to support the electrification of the group's cars, for a mix of sales of zero-emission cars. 70% by 2030 (and not 35% as we said). For Volkswagen and BMW, in addition to the Swedish plant in Skellefteå, of 40 GWh / year mentioned by StartMag and financed by the EIB for 350 million euros, Northvolt is planning a second gigafactory, also of 40 GWh / year, in Salzgitter, around 70 km southeast of Hannover.

On the sidelines of the ministerial meeting of the EU Alliance for batteries, on 11 March, the European Commissioner Maroš Šefčovič had mentioned in all the 27 member countries as many as 70 projects similar to that of Ivrea, Teverola, Skellefteå, Berlin (with Tesla) and Salzgitter.The European strategy dates back to 2019 , a proposal for a regulation was adopted on 10 December and is currently in consultation. The demand for batteries is expected to be high in the European Union, up to 565 GWh by 2030, on the 3600 GWh global.

If you look at the European map released by Jochen Mähliß ( here the link ), of the Bavarian VDE Renewables, the idea of this multitude of gigafactories becomes clearer. There are projects still in the phase of simple conception, such as ItalVolt in Ivrea or Verkor in Grenoble, or well supported, such as ACC (Automotive Cell Company) in Douvrin and Billy-Berclau in the parts of Calais, in northern France, and in Kaiserlautern, in Germany.

ACC is designing a production of up to 48 Gwh / year from 2023 for 5 billion investments, owned by Saft (batteries, bought by Total in 2016 for 1 billion euros) and Stellantis, which therefore involves PSA / Opel (which explains the Kaiserslautern settlement) and FCA from afar.

The ministers of economic development Giancarlo Giorgetti and Bruno Le Maire mentioned gigafactory during the Italian-French meeting on March 19 last . However, the two countries are still a good step behind German activism, France perhaps attentive or distracted by the hydrogen supply chain, Italy perhaps intent on positioning itself, given the apparent weakness of the Scarmagno project.

Eight factories are planned in Germany and another four will be in Slovakia, including InoBat in Bratislava. In the Battery and Systems segment, just 5 Italian partners are part of the European Battery Alliance: Comau, Faam, Green Energy Storage, the Italian Institute of Technology in Genoa (IIT) and the Politecnico di Milano.

In the same segment, there are 13 subjects for France, 34 for Germany.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/smartcity/gigafactory-come-litalia-e-leuropa-trottano-con-le-batterie/ on Sat, 17 Apr 2021 06:45:51 +0000.