Here are the new markets stimulated by the pandemic

What are the frontier markets after the pandemic. The analysis by Holger Siebrecht, Fixed Income Investment Analyst of Capital Group

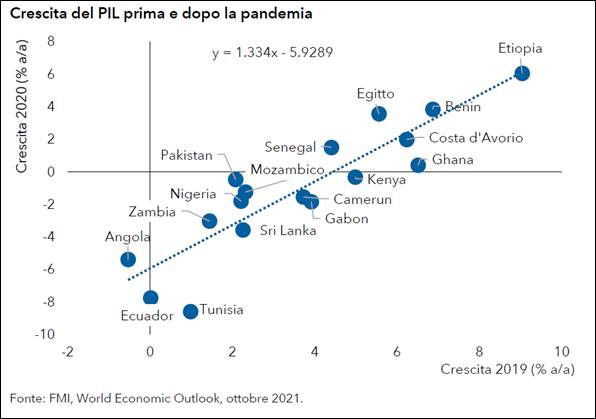

The pandemic has severely disrupted the growth path of many economies, including those of frontier markets, but the countries with the highest growth have suffered less. The following graph shows that in 2020 the slowdown in growth in frontier markets was linearly dependent on the growth rate recorded in these countries in 2019. The slope (1.25) of the linear regression line indicates that for each additional percentage point of growth that a country experienced in 2019, the subsequent recession in 2020 was 1.25 percentage points shallower.

Various frontier markets show high rates of structural growth, so much so that they can become emerging markets (EM) over time. Many have not experienced a recession in 2020 and may experience continued growth in growth. These include more traditional frontier economies, such as Benin and Ethiopia, which often have low per capita GDP and other human development measures, are highly dependent on agriculture, have underdeveloped financial markets and low debt levels. . At the other end are countries such as Ecuador and Tunisia, where the recession took on staggering proportions in 2020. Both countries did not experience high growth before the pandemic; therefore, in 2020 they showed huge drops in GDP.

Among the countries of the "EM Club" are the most advanced, diversified and rich economies with a milder growth path, such as Nigeria, Cameroon, Gabon, Angola and Sri Lanka. For years Nigeria has implemented policies that have hindered growth and the country is still suffering from the consequences of the collapse in oil prices, like other nations that depend on this raw material. Sri Lanka also has a mix of heterodox policies and is highly dependent on tourism, a sector that in 2020 was heavily affected by lockdowns and travel restrictions. EM Club countries are expected to grow faster thanks to economic and travel recovery, but are unlikely to return to pre-pandemic GDP levels before 2022 or 2023.

Finally, there are the “countries that drive growth”, that is, broadly speaking, the African countries as we imagined them ten years ago. Their high structural growth rates imply a strong rebound; in fact, many have not experienced a recession. The group includes frontier economies such as Benin and Ethiopia, but also more diverse and wealthy countries such as Senegal, Ivory Coast, Kenya and Ghana.

Another factor with which to evaluate the impact of the pandemic is represented by the fiscal reaction. Generally, richer and more developed countries have implemented tighter lockdowns and earmarked more money for support measures than poorer countries, resulting in less revenues and increased spending, resulting in higher fiscal deficits.

While this is the norm, there are some interesting exceptions. Mozambique, Zambia and Ghana have implemented extraordinarily high countercyclical policies, while Angola and Gabon have kept their deficits in check more rigorously than might be expected from countries with their income levels in a time of crisis. Another factor that can help understand the dynamics of debt is the analysis of the interest / income ratio, especially in light of the recent low GDP data on frontier markets, as countries improve their statistics and capture parts of the economy that are not visible. previously. In theory, GDP is the basis of all economic activity that can be converted into tax revenues, so some countries with low debt but high interest costs, such as Nigeria, show high potential, while for others it is not. more possible to increase revenues to lower the interest / income ratio, like Tunisia. In the latter this ratio is extremely high, but the cause is to be found in the concessionary nature of a large part of the debt, moreover the country has already largely exploited the mobilization of revenues.

While debt-to-GDP ratios and indebtedness are relevant factors, fundamentals are no different, so we favor countries with higher debt-to-GDP ratios and even higher interest costs but with solid fundamentals (such as Angola ) compared to countries with a lower debt / GDP ratio but with an interest / income ratio and above all with non-positive fundamentals (such as Nigeria).

The high prices of raw materials have improved the trading conditions of many frontier exporting markets. After the initial shock, the recovery in commodity prices has in fact supported the external balances of many frontier economies. Ghana, for example, had a firmer balance in 2020 than fundamentally justified thanks to gold exports as well as remittances and reduced imports.

In addition to high commodity prices, these markets benefit from solid support from institutions. Foreign balances were also affected by the pandemic due to restrictions on mobility. Many frontier markets are indeed popular tourist destinations. While 2021 promises to be better than 2020 for the tourism sector, the pandemic has continued to have a major impact on it. The OECD estimates that international tourism has declined by about 80% in 2020. In many frontier markets, tourism is an economic driver, but the following graph highlights a wide divergence between countries that rely heavily about it and those who are less addicted to it. Some countries depend on tourism for both GDP growth and balance of payments (such as Morocco), while others depend only on tourism (such as Ethiopia).

The pandemic has amplified the need to take environmental, social and governance (ESG) factors into account in investment decisions. In particular, social and governance factors were taken into consideration when assessing health and safety or job protection and crisis management by governments. However, for frontier markets, compared to more developed EM countries or developed markets, a research-based approach is even more important since traditional ESG indicators can be retrospective and often penalize less developed countries.

In some countries, for example in Rwanda, ESG factors can vary significantly even within the same country, which confirms the need for a research-based approach. The institutional framework in Rwanda is in many ways comparable (and even better) to that of South Africa, the business environment is among the best on the continent and the country has one of the highest numbers of women in parliament. At the same time, however, the regime is repressive, as illustrated by the low score obtained in the item “Freedom of expression and responsibility” of the World Bank's global governance indicators, on a par with, for example, Ethiopia and Cameroon.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/nuovi-mercati-pandemia/ on Sat, 01 Jan 2022 07:22:17 +0000.