The EU: Italy no more expenses and low productivity. When the Commission writes to prejudice

Karten / Yanko Tsvetskov

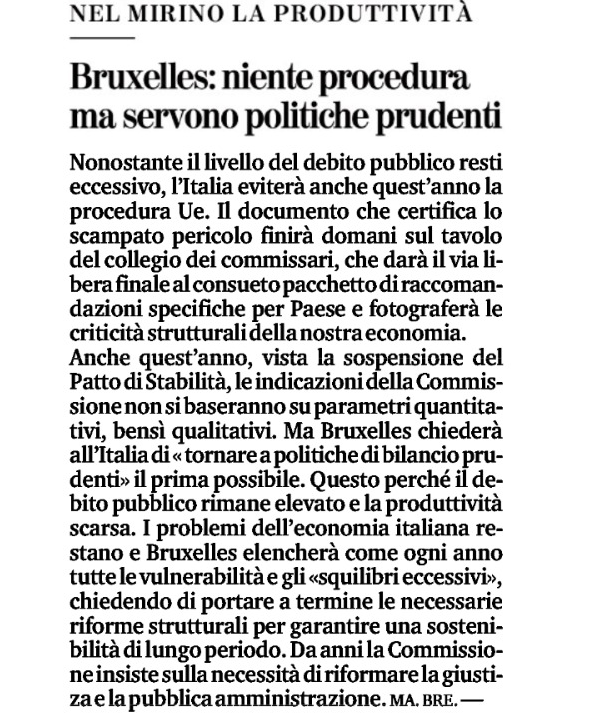

Tomorrow the commissioners will draw up their own country recommendations homework and, from what has been published by the mainstream media, such as "La Stampa" on p. 8 of today's edition, they will recommend that we return as soon as possible to “prudent policies”, that is to austerity, and therefore complains about “low productivity” and “high debt”, which can create dangerous imbalances. For the more curious, here is the text:

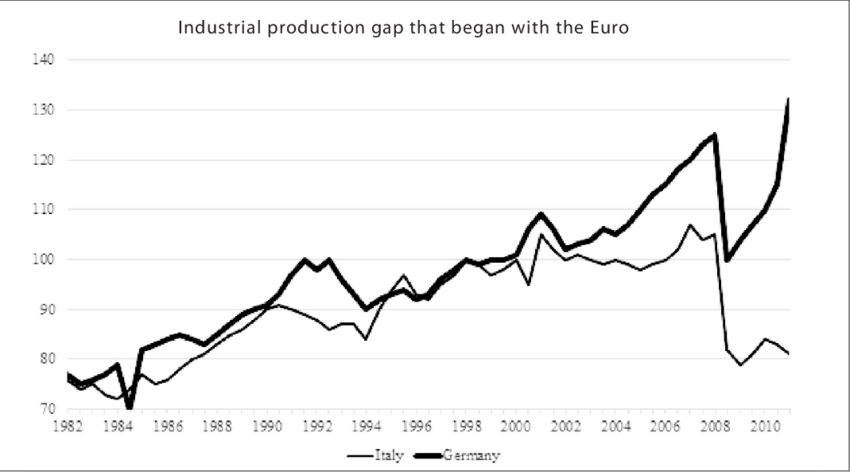

It is clear that in the foolish Nordic ethics Southern Europe is guilty because it is productive, practically a slacker. Naturally, however, ignoring the existence of Kaldor's second law on economic growth is a sign of high productivity, so high that one has not had time to open an economics book. Kaldor's second law, empirically proven, states that productivity increases as production increases. The more production volume is reached, the higher the productivity of the system will be, linked to factors such as economy of scale, creation of production districts, refinement of supply relationships, stabilization of production practices. It is enough to look at the industrial output between Italy and Germany to understand why productivity moves differently in the two countries.

Instead, the request for “Prudence”, therefore for “Austerity”, goes in the opposite direction, that of the return of a restrictive policy, which further punishes production and internal demand, therefore manufacturing production. Among other things, we always talk about imbalances within the Italian economy without considering that the Union is the main cause of these imbalances, and this for two obvious facts:

- first of all the euro, which has canceled the main instrument of rebalancing in the comparative competitiveness of a system, that is, the rebalancing of exchange rates;

- therefore the seven-year plans of the Commission, based on objectives that abstract from the individual states and which, conceived with a rigidity similar to the Soviet five-year plans, exacerbate, not dissolve, the economic inconsistencies in the states and between the individual states.

The Commission periodically does its bad job by sending recommendations to this or that country based not on a thorough knowledge of the facts, but on ethical, racial prejudices or in any case on a profound ignorance of the basis of the economy. The beauty is that he does so without even asking himself for a second any doubts about what he is saying and why he is doing it, making it more and more evident how intellectually crude those who produce certain documents are. But what are we to say, nothing will change anyway, up to the objective threat of a "Brexit style" exit.

Thanks to our Telegram channel you can stay updated on the publication of new articles of Economic Scenarios.

The article The EU: Italy no more expenses and low productivity. When the Commission writes to prejudice it comes from ScenariEconomici.it .

This is a machine translation of a post published on Scenari Economici at the URL https://scenarieconomici.it/la-ue-italia-basta-spese-e-bassa-produttivita-quando-la-commissione-scrive-a-pregiudizio/ on Tue, 01 Jun 2021 10:00:45 +0000.