Here is the Ristori decree with the Ateco restored codes. The full text

The full text of the Ristori decree: the provision allocates about 1 billion for non-repayable contributions to the new Ateco codes added to the list of Ristori 1 the new categories involved in the anti-Covid squeeze.

All the details on the Refreshments decree with Ateco codes .

The Ristori bis decree was stamped by the State General Accounting Office: the text rises to 33 articles and also includes some measures for the precarious of sport.

In particular, it is possible to use the savings in the disbursement of the previous allowances for sports workers to finance the new 800 euro bonus also for expired and not renewed contracts until October 30th.

A fund of 340 million in 2020 and 70 million in 2021 to help further activities if there are new orange or red areas. This is provided for by the refreshment decree bis, stamped and awaiting publication in the Official Gazette.

The provision allocates about 1 billion for non-repayable contributions to the new Ateco codes added to the list of Ristori 1 the new categories involved in the anti- Covid squeeze . Another 280 million are allocated in 2021 for the refreshments of activities in shopping centers and for the food supply chain.

Also allocated 234 million in 2020 (and 78 in 2021) for the tax credit on rents, 38 million for the refreshment to municipalities for the extension of the cancellation of the Imu, and 35.8 million for the suspension of taxes for Isa and about half a billion for the stop to payments in November.

"Continue to guarantee an adequate network of social and economic protection to workers, businesses and families, who live and operate in the areas of the country subject to greater restrictions to contain the spread of Covid-19 infections. This is the objective of the Ristori bis decree, which allocates an additional 2.5 billion euros to finance aid and support measures for the most affected categories and which is added to the 5.4 billion already allocated in the first Ristori decree and already paid directly in the current accounts of the beneficiaries ". This was stated in a note by the senators of the 5 Star Movement of the work commission of Palazzo Madama. "With the new provision – they continue – we suspend the November contribution payments for companies in the 'red' and 'orange' areas, in which, to stop the increase in infections, greater limitations are envisaged, we extend the contribution exemption for companies in the agricultural supply chain throughout the country, we extend the Covid-19 layoffs to workers hired after July 12; we guarantee full financial coverage of the social safety nets for the artisans enrolled in the sector solidarity fund ". "The new rules then introduce – they underline – a further package of interventions to protect families and employees who reside in the 'red zones' and have children enrolled in lower secondary schools, who may request extraordinary Covid parental leave and , in the case of the self-employed, see the baby-sitting bonus renewed ". “Finally – they add-, we set up an extraordinary fund dedicated to third sector entities and we refinance the tax assistance centers and, with regard to Inail, we extend the deadline for the hiring of doctors and nurses by the Institute”. "These are necessary measures to contain the contagion curve and indispensable to safeguard the social and economic stability of the country, in this complex and very delicate phase", conclude the senators of the 5 Star Movement.

++++

HERE IS THE FULL TEXT

THE PRESIDENT OF THE REPUBLIC

HAVING REGARD to articles 77 and 87 of the Constitution;

HAVING REGARD to the resolutions of the Council of Ministers of January 31, 2020, July 29, 2020 and October 7, 2020 with which the state of emergency on the national territory was declared and extended relating to the health risk associated with the onset of pathologies deriving from viral agents transmissible

GIVEN the declaration of the World Health Organization of 11 March 2020 with which the COVID-19 epidemic was assessed as a "pandemic" in consideration of the levels of diffusivity and severity achieved globally:

GIVEN the decree-law 17 March 2020, n.18, converted, with modifications, by the law 24 April 2020, n. 27;

GIVEN the decree-law of 8 April 2020, n.23, converted, with amendments, by the law of 5 June 2020, n. 40;

GIVEN the decree-law 19 May 2020 n. 34, converted, with amendments, by law 17 July 2020, n. 77;

GIVEN the decree-law of 14 August 2020, n. 104 converted, with amendments, by law 13 October 2020, n. 126;

GIVEN the decree-law 28 October 2020, n. 137;

GIVEN the Decree of the President of the Council of Ministers of 24 October 2020 containing further implementing provisions of the decree-law of 25 March 2020, n. 19, converted, with modifications, by the law 25 May 2020, n. 35, containing "Urgent measures to deal with the epidemiological emergency from COVID-19", and the decree-law of 16 May 2020, n. 33, converted, with amendments, by law 14 July 2020, n. 74, containing «Further urgent measures to deal with the epidemiological emergency from COVID-19» with which restrictions were placed on the exercise of certain economic activities in order to contain the spread of the COVID-19 virus, published in the Official Gazette no. 265 of 25 October 2020;

GIVEN the Decree of the President of the Council of Ministers of 3 November 2020 containing “Further implementing provisions of the decree-law of 25 March 2020, n. 19, converted, with modifications, by the law 25 May 2020, n. 35, containing "Urgent measures to deal with the epidemiological emergency from COVID-19", and the decree-law of 16 May 2020, n. 33, converted, with amendments, by law 14 July 2020, n. 74, containing «Further urgent measures to deal with the epidemiological emergency from COVID-19», published in the Official Gazette no. 275 of 4 November 2020;

CONSIDERING the extraordinary need and urgency to introduce further measures to support the sectors most directly affected by the restrictive measures, adopted with the aforementioned Decrees of the President of the Council of Ministers of 24 October 2020 and 3 November 2020, for the protection of health in connection with epidemiological emergency from Covid-19;

GIVEN the resolution of the Council of Ministers, adopted at the meeting of 6 November 2020; On the proposal of the President of the Council of Ministers and the Minister of Economy and Finance; It emanates

the following decree-law:

Title I – Support for businesses and the economy

Art. 1

(Redetermination of the non-repayable contribution referred to in article 1 of the decree-law 28 October 2020, n.137 and new contribution in favor of the operators of shopping centers).

- Annex 1 to the decree-law 28 October 2020, n. 137 is replaced by Annex 1 to this decree. In article 9, paragraph 3, of the decree-law of 28 October 2020, n. 137, the words "increased by 101.6 million euros for the year 2020" are replaced by the following: "increased by 112.7 million euros for the year 2020".

- For operators in the economic sectors identified by the ATECO codes 561030-ice cream and pastry shops, 561041-mobile ice cream and pastry shops, 563000-bars and other similar establishments without kitchen and 551000- Hotels with tax domicile or operational headquarters in areas of the national territory, characterized by a scenario of high or maximum seriousness and a high risk level, identified with the orders of the Minister of Health adopted pursuant to articles 2 and 3 of the decree of the President of the Council of Ministers of 3 November 2020, the non-repayable contribution of referred to in article 1 of the decree law 28 October 2020, n. 137 increased by a further 50 percent with respect to the share indicated in Annex 1 to the aforementioned decree.

- Paragraph 2 of article 1 of the decree-law of 28 October 2020, n. 137.

- The non-repayable grant referred to in this article is recognized in the year 2021 to operators with operational headquarters in shopping centers and to operators of industrial production in the food and beverage sector, affected by the new restrictive measures of the decree of the President of the Council of Ministers of 3 November 2020, within the spending limit of 280 million euros. The contribution is paid by the Revenue Agency upon presentation of an application in accordance with the procedures governed by the provision of the Director of the Revenue Agency referred to in paragraph 11 of article 1 of the aforementioned decree-law no. 137 of 2020.

- Without prejudice to the spending limit referred to in paragraph 4, for the subjects referred to in the aforementioned paragraph 4 who carry out as their main activity one of those referred to the ATECO codes that fall within Annex 1 to this decree, the contribution referred to in paragraph 4 it is determined within 30 per cent of the non-repayable contribution referred to in article 1 of decree no. 137 of 2020. For the subjects referred to in paragraph 4 who carry out as their main activity one of those referred to the ATECO codes that are not included in Annex 1 to this law decree, the contribution referred to in paragraph 4 is due under the conditions established in paragraphs 3 and 4 of article 1 of law decree n. 137 of 2020 and is determined within 30 per cent of the value calculated on the basis of the data present in the submitted application and the criteria established by paragraphs 4, 5 and 6 of article 25 of decree-law no. 34 of 2020.

- The charges deriving from this article, valued at 508 million euros for the year 2020 and equal to 280 million euros for the year 2021, consequent to the ordinance of the Minister of Health of 4 November 2020, published in the Official Gazette, Series General, no. 276 of 05 November 2020, for 458 million euros for the year 2020 and 280 million euros for the year 2021, pursuant to article 32 and for 50 million euros for the year 2020, by using of the resources deriving from the repeal of the provision referred to in paragraph 3.

Art. 2

(Non-repayable contribution to be allocated to VAT operators in the economic sectors affected by the new restrictive measures of the decree of the President of the Council of Ministers of 3 November 2020)

- In order to support the operators of the economic sectors affected by the restrictive measures introduced with the decree of the President of the Council of Ministers of November 3, 2020 to contain the spread of the "Covid-19" epidemic, a non-repayable grant is recognized in favor of subjects who, as of 25 October 2020, have an active VAT number, declare, pursuant to article 35 of the Presidential Decree of 26 October 1972 no. 633, to carry out as their main activity one of those referred to the ATECO codes listed in Annex 2 to this decree and have their tax domicile or operational headquarters in areas of the national territory, characterized by a scenario of maximum severity and a level of risk high, identified by ordinances of the Minister of Health adopted pursuant to article 3 of the decree of the President of the Council of Ministers of 3 November 2020. The contribution is not due to subjects who have activated their VAT number starting from 25 October 2020.

- With reference to the non-repayable grant referred to in paragraph 1, the provisions referred to in paragraphs 3 to 11 of article 1 of the decree-law of 28 October 2020, n. 137. The value of the grant is calculated in relation to the percentages indicated in Annex 2 to this decree.

- The charges deriving from this article, valued at € 563 million for the year 2020, resulting from the order of the Minister of Health of 4 November 2020, published in the Official Gazette, General Series, no. 276 of 5 November 2020, it is provided pursuant to article 32.

Art. 3

(Anti-mafia controls)

- The provisions of the memorandum of understanding referred to in paragraph 9 of article 25 of the decree-law of 19 May 2020, n. 34, signed between the Ministry of the Interior, the Ministry of Economy and Finance and the Revenue Agency, also apply in relation to the non-repayable contributions governed by this decree and by the decree-law of 28 October 2020, n. 137.

Art. 4

(Tax credit for rents for non-residential properties and business leases for companies affected by the new restrictive measures of the decree of the President of the Council of Ministers of 3 November 2020)

- To companies operating in the sectors listed in Annex 2 to this decree, as well as to companies that carry out the activities referred to in ATECO codes 79.1, 79.11 and 79.12 which have their operational headquarters in areas of the national territory, characterized by a scenario of maximum gravity and from a high risk level, identified with the ordinances of the Minister of Health adopted pursuant to article 3 of the decree of the President of the Council of Ministers of 3 November 2020, the tax credit for the rents of the properties for use non-residential and business lease referred to in article 8 of the decree

law 28 October 2020, n. 137, with reference to each of the months of October, November and December 2020.

- The charges deriving from this article, valued at € 234.3 million for the year 2020 and € 78.1 million for the year 2021 in terms of net debt and requirements, consequent to the ordinance of the Minister of Health of the 4th November 2020, published in the Official Gazette, General Series, n. 276 of 5 November 2020, it is provided pursuant to article 32.

Art. 5

(Cancellation of the second IMU installment)

- Without prejudice to the provisions of article 78 of the decree-law of 14 August 2020, n. 104, converted, with amendments, by law 13 October 2020, n. 126 and article 9 of the decree-law 28 October 2020, n. 137, in consideration of the effects related to the epidemiological emergency from COVID-19, for the year 2020, the second installment of the municipal tax (IMU) referred to in Article 1, paragraphs 738 to 783, of the law 27 December 2019, n. 160, which must be paid by December 16, 2020, concerning the properties and related appurtenances in which the activities referred to the ATECO codes listed in Annex 2 to this decree are carried out, provided that the relative owners are also managers of the activities therein. exercised, located in the municipalities of the areas of the national territory, characterized by a scenario of maximum gravity and a high level of risk, identified by ordinances of the Minister of Health adopted pursuant to article 3 of the decree of the President of the Council of Ministers of 3 November 2020.

- For the reimbursement to the municipalities of the lower income deriving from paragraph 1, the Fund referred to in article 177, paragraph 2, of the decree-law 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, increased by 31.4 million euros for the year 2020. The decrees referred to in paragraph 5 of article 78 of decree-law no. 104 of 2020 and paragraph 3 of article 9 of decree-law no. 137 of 2020 are adopted within sixty days from the date of entry into force of this decree.

- The charges deriving from this article, equal to 38.7 million euros for the year 2020, consequent to the ordinance of the Minister of Health of 4 November 2020, published in the Official Gazette, General Series, no. 276 of 5 November 2020, it is provided pursuant to article 32.

Art. 6

(Extension of the deadline for the payment of the second advance for subjects who apply the synthetic indexes of tax reliability)

- With regard to subjects that carry out economic activities for which the synthetic indices of fiscal reliability have been approved, identified by article 98, paragraph 1, of the decree-law of 14 August 2020, n. 104, converted, with amendments, by law 13 October 2020, n. 126, operating in the economic sectors identified in Annex 1 to the decree-law of 28 October 2020, n. 137, as replaced by article 1, paragraph 1, of this decree and in Annex 2 to this decree, having tax domicile or operational headquarters in areas of the national territory characterized by a scenario of maximum gravity and a high level of risk, identified with the ordinances of the Minister of Health adopted pursuant to article 3 of the decree of the President of the Council of Ministers of 3 November 2020, or carrying out the activity of managing restaurants in areas of the national territory characterized by a highly serious scenario and from a high risk level identified with the orders of the Minister of Health adopted pursuant to article 2 of the decree of the President of the Council of Ministers of 3 November 2020, the extension to 30 April 2021 of the deadline for the payment of the second or single installment of the advance on income taxes and IRAP, due for the tax period following the one in progress at 31 December 2019, provided a by article 98, paragraph 1, of law decree n. 104 of 2020, applies regardless of the decrease in turnover or fees indicated in paragraph 2 of the same article 98. There is no refund of the amount already paid.

- The charges deriving from this article, valued at € 35.8 million for the year 2020, resulting from the ordinance of the Minister of Health of 4 November 2020, published in the Official Gazette, General Series, no. 276 of 5 November 2020, it is provided pursuant to article 32.

Art. 7

(Suspension of tax payments)

- For subjects who carry out suspended economic activities pursuant to article 1 of the decree of the President of the Council of Ministers of 3 November 2020, with tax domicile, registered office or operational headquarters in any area of the national territory, for those who exercise the activities catering services that have their fiscal domicile, registered office or operational headquarters in areas of the national territory characterized by a scenario of high or maximum seriousness and a high level of risk identified with the orders of the Minister of Health adopted pursuant to articles 2 and 3 of the decree of the President of the Council of Ministers of 3 November 2020, as well as for subjects operating in the economic sectors identified in Annex 2 to this decree-law, or who carry out the hotel business, travel agency business or of tour operators, and who have tax domicile, registered office or operational headquarters in the areas of the national territory owing to a scenario of maximum gravity and a high level of risk identified with the orders of the Minister of Health adopted pursuant to article 3 of the decree of the President of the Council of Ministers of 3 November 2020, the terms expiring in the month are suspended November 2020 related to:

- a) to payments relating to withholding taxes, pursuant to articles 23 and 24 of the decree of the President of the Republic no. 600, and to the deductions relating to the regional and municipal surcharge, which the aforementioned subjects operate as withholding agents. Consequently, financial relations are regulated to ensure financial neutrality for the State, the regions and the municipalities;

- b) payments relating to value added tax.

- There is no reimbursement of the amount already paid.

- Payments suspended pursuant to paragraph 1 are made, without the application of penalties and interest, in a single solution by March 16, 2021 or by installments up to a maximum of four monthly installments of the same amount, with the payment of the first installment by on March 16, 2021.

- The charges deriving from this article, valued at 549 million euros for the year 2020, consequent to the ordinance of the Minister of Health of 4 November 2020, published in the Official Gazette, General Series, no. 276 of 5 November 2020, it is provided pursuant to article 32.

Art. 8

(Provisions for adaptation and compatibility of aid with European provisions)

- For the classification and updating of the areas of the national territory, characterized by a scenario of high or maximum severity and a high risk level, please refer to the ordinances of the Minister of Health adopted pursuant to articles 2 and 3 of the President's decree of the Council of Ministers of 3 November 2020.

- To the charges deriving from the extension of the measures referred to in articles 1, 2, 4, 5, 6, 7, 11, 13, 14 as a consequence of any subsequent ordinances of the Ministry of Health, adopted pursuant to articles 2 and 3 of the decree of the President of the Council of Ministers of November 3, 2020, it is provided within the limits of the fund for this purpose established in the estimate of the Ministry of Economy and Finance, with an endowment of 340 million euros for the year 2020 and 70 million euro for the year 2021.

- The resources of the fund are also used for any accounting adjustments by paying into special accounting no. 1778, headed: "Revenue Agency – Budget Funds". In relation to the greater needs deriving from the implementation of articles 5, 11, 13 and 14, the Minister of Economy and Finance is authorized to make the necessary budget changes within the limits of the available resources of the fund referred to in paragraph 1. residual account.

- The fund resources not used at the end of the financial year 2020 are kept in the residual account to be used for the same purposes set out in paragraph 1 also in subsequent years.

- For the purposes of articles 1 and 2, within the spending limit of 50 million euros for the year 2020, with one or more decrees of the Minister of Economic Development, in agreement with the Minister of Economy and Finance, further ATECO codes, with respect to those reported in Annexes 1 and 2 to this decree, referring to economic sectors entitled to the contribution referred to in Article 1, paragraph 1, of the decree-law of 28 October 2020, n. 137 and Article 2, paragraph 1, of this decree, provided that these sectors have been seriously affected by the restrictive measures introduced by the decrees of the President of the Council of Ministers of 24 October 2020 and 3 November 2020.

- The provisions referred to in Articles 1, 2, 4 and 5 apply in compliance with the limits and conditions set out in the Communication of the European Commission of 19 March 2020 C (2020) 1863 final "Temporary framework for State aid measures to support of the economy in the current emergency of COVID-19 ", and subsequent amendments.

- The charges deriving from this article are provided pursuant to article 32.

Title II – Provisions on health, work and family

Art. 9

(Services purchased by the SSN by accredited individuals)

- In article 4 of the decree-law of 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, the following changes are made:

- a) in paragraph 5, the words: "Pending the adoption of the decree referred to in paragraph 2, the" are replaced by the following: "The";

- b) after paragraph 5, the following paragraphs are added: “5-bis. The regions and the autonomous provinces of Trento and Bolzano which, depending on the trend of the Covid emergency, have suspended ordinary activities, also through their own bodies, may recognize accredited private structures receiving a special budget for the year 2020, up to a maximum of 90 percent of the budget assigned under the agreements and contracts referred to in article 8-quinquies of the legislative decree 30 December 1992, n. 502 stipulated for the year 2020, without prejudice to the guarantee of the economic balance of the Regional Health Service. The aforementioned recognition therefore takes into account both the activities ordinarily provided during the year 2020 whose actual production must be reported, and, up to the aforementioned maximum limit of 90 percent of the budget, a one-off contribution. linked to the emergency in progress and provided by the regions and autonomous provinces on which the budget recipient structure insists, to cover only the fixed costs incurred by the accredited private structure and reported by the same structure which, on the basis of a specific regional provision, has the activities envisaged by the related agreements and contracts stipulated for the year 2020 are suspended. The recognition, within the budget assigned for the year 2020, remains valid in the event of production of the volume of activity exceeding 90 percent and up to the of the budget foreseen in the agreements and contracts stipulated for the year 2020, as reported by the same structure concerned.

5-ter. The provision envisaged in paragraph 5-bis also applies to purchases of social and health services for the only part of health relevance with reference to accredited private structures receiving a 2020 budget as reported in the relative agreements and contracts signed for the year 2020. " .

Art. 10

(Fixed-term recruitment of military doctors and nurses)

- For the purposes referred to in article 7 of the decree-law of 17 March 2020, n. 18, converted, with amendments, by law 24 April 2020, n. 27, and in compliance with the provisions therein regarding the modalities, requirements, procedures and legal and economic treatment, for the year 2021 the recruitment, on request, of personnel of the Italian Army, of the Navy is authorized , of the Air Force in fixed-term service, with a one-year detention, which cannot be extended, and placed under the functional dependence of the General Inspectorate of Military Health, in the measures established below for each category and Armed Force:

- a) 30 medical officers with the rank of lieutenant or corresponding rank, of which 14 from the Italian Army, 8 from the Navy and 8 from the Air Force;

- b) 70 NCOs with the rank of marshal, of which 30 from the Italian Army, 20 from the Navy and 20 from the Air Force.

- Applications for enlistment can be submitted within ten days from the date of publication of the relative procedure by the Directorate General for Military Personnel on the online portal of the Ministry of Defense website www.difesa.it and are defined within next 20 days.

- The periods of service provided pursuant to this article constitute a title of merit to be assessed in the competition procedures for the recruitment of military personnel in permanent service belonging to the same roles as the Armed Forces.

- The medical officers recruited pursuant to this article are subject to article 19, paragraph 3-bis, of the decree-law of 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77.

- In article 2197-ter.1, paragraph 2, letter a), of Legislative Decree no. 66, the words "the nursing health profession" are replaced by the following: "the health professions referred to in article 212, paragraph 1,".

- The charges deriving from this article, equal to € 4.89 million for the year 2021, are provided in accordance with article 32.

Art. 11

(Suspension of payments of social security contributions for private employers with operational headquarters in the territories affected by the new restrictive measures)

- The suspension of contribution payments due in November 2020 referred to in article 13, of the decree-law of 28 October 2020, n. 137, also applies in favor of private employers belonging to the sectors identified in Annex 1 to this decree. The aforementioned suspension does not operate in relation to the premiums for compulsory INAIL insurance.

- The payment of social security and welfare contributions due in November 2020, in favor of private employers who have production or operational units in areas of the national territory, characterized by a scenario of maximum gravity and a high level of risk, is also suspended. , identified with the ordinances of the Minister of Health adopted pursuant to article 3 of the decree of the President of the Council of Ministers of 3 November 2020, belonging to the sectors identified in Annex 2 of this decree.

- The identification data relating to the aforementioned employers will be communicated by the Revenue Agency to INPS, in order to allow the beneficiaries to recognize the measures concerning the suspension.

- The payments of social security and welfare contributions, suspended pursuant to this article, are made, without the application of penalties and interest, in a single solution by March 16, 2021 or by installments up to a maximum of four monthly installments of the same amount, with the payment of the first installment by March 16, 2021. Failure to pay two installments, even if not consecutive, will result in the forfeiture of the benefit of the installment.

- The benefits of this article are attributed in accordance with current European Union legislation on state aid.

- The charges deriving from this article, valued at 206 million euros for the year 2020, are provided in accordance with article 32.

Art. 12

(Amendments to article 12 of decree-law n.137, of 2020)

- In article 12, of the decree-law of 28 October 2020, n. 137, the following changes are made:

- a) paragraph 7 is replaced with the following: “7. The deadline for sending applications for access to treatments related to the Covid emergency 19 referred to in articles 19 to 22-quinquies of the decree-law of 17 March 2020, n. 18, converted with amendments, by law 24 April 2020, n. 27, and subsequent amendments and additions, and the transmission of the data necessary for the payment or for the balance thereof which, in application of the ordinary regulations, are between 1st and 30th September 2020. ";

- b) after paragraph 8, the following is inserted: “8-bis. The wage integration treatments referred to in this article are also recognized in favor of workers under the date of entry into force of this decree-law. ";

- c) in paragraph 12, first sentence, the words "equal to 1,634.6 million euros, divided into 1,161.3 million euros for ordinary layoffs and ordinary check and 473.3 million euros for of Wage Supplement in derogation "are replaced by the following:" equal to 1,692.4 million euros, divided into 1,202.4 million euros for the ordinary layoffs and ordinary check and in 490 million euros for the integration in derogation ":

- d) in paragraph 17 the words: "3 million" are replaced by the following: "4 million".

- The greater charge deriving from paragraph 1, letter c), equal to 57.8 million euros for the year 2021, is provided, as for 2.5 million euros, through the higher revenues deriving from the same paragraph 1, letters a) and b) and for 55.3 million euros pursuant to article 32.

Art. 13

(Extraordinary leave for parents in case of closure of lower secondary schools)

- Limited to the areas of the national territory, characterized by a scenario of maximum gravity and a high risk level, identified by ordinances of the Minister of Health, adopted pursuant to article 3 of the decree of the President of the Council of Ministers of 3 November 2020, in which the closure of lower secondary schools has been ordered, and only in the cases in which the work performance cannot be carried out in an agile way, is recognized alternatively to both parents of pupils of the aforementioned schools, employees, the right to abstain from work for the entire duration of the suspension of the didactic activity in the presence foreseen by the aforementioned Decree of the President of the Council of Ministers.

- For the periods of leave taken pursuant to paragraph 1, an indemnity equal to 50 per cent of the salary itself, calculated in accordance with the provisions of Article 23 of the Consolidated Law of the legislative provisions on the protection and support of maternity and paternity, as per legislative decree 26 March 2001, n. 151, with the exception of paragraph 2 of the same article 23. The aforementioned periods are covered by a notional contribution.

- The benefit referred to in this article is also granted to parents of children with disabilities in a situation of ascertained seriousness pursuant to article 4, paragraph 1, of law no. 104, enrolled in schools of all types and levels or hosted in day care centers, for which closure has been ordered pursuant to the decrees of the President of the Council of Ministers of 24 October 2020 and 3 November 2020.

- The benefits referred to in paragraphs 1 to 3 are recognized within the overall limit of 52.1 million euros for the year 2020. On the basis of the applications received, INPS monitors, communicating the results to the Ministry of Labor and Policies and the Ministry of Economy and Finance. If the monitoring reveals that the spending limit referred to in the first sentence of this paragraph is exceeded, INPS proceeds to reject the applications presented.

- In order to guarantee the replacement of the teaching, educational, administrative, technical and auxiliary staff of the educational institutions who benefit from the benefits referred to in paragraphs 1 to 3, the expenditure of 2.4 million euros for the year 2020 is authorized.

- To the charge deriving from paragraphs 4, first period, and 5, equal to 54.5 million euros for the year 2020 and 31.4 million euros for the year 2021 in terms of net debt and requirements, consequent to the ordinance of the Minister of Health of 4 November 2020, published in the Official Gazette, General Series, no. 276 of 05 November 2020, it is provided in accordance with article 32.

Art. 14

(Baby-sitting bonus in red areas)

- Starting from the entry into force of this provision, limited to areas of the national territory, characterized by a scenario of maximum gravity and a high level of risk, identified by ordinances of the Minister of Health, adopted pursuant to article 3 of the decree of President of the Council of Ministers 3 November 2020 in which the closure of lower secondary schools has been ordered, the working parents of pupils of the aforementioned schools enrolled in the separate management referred to in Article 2, paragraph 26, of the law of 8 August 1995, n. 335, or enrolled in the special management of the Ago, and not enrolled in other compulsory social security forms, have the right to benefit from one or more bonuses for the purchase of baby-sitting services up to a maximum total limit of 1000 euros, to be used for services performed during the period of suspension of teaching activities in the presence provided for by the aforementioned decree of the President of the Council of Ministers. The use of the bonus referred to in this article is recognized alternatively to both parents, only in the case in which the work performance cannot be carried out in an agile mode, and is subject to the condition that in the family unit there is no other parent beneficiary of tools income support in the event of suspension or cessation of work or another unemployed or non-working parent.

- The benefit referred to in this article applies, with reference to children with disabilities in a situation of ascertained seriousness pursuant to article 4, paragraph 1, of law no. 104, enrolled in schools of all types and levels or hosted in day care centers, for which closure has been ordered pursuant to the decrees of the President of the Council of Ministers of 24 October 2020 and 3 November 2020.

- The provisions of this article also apply to foster parents.

- The bonus is not recognized for benefits rendered by family members.

- The bonus is paid through the family booklet referred to in article 54-bis of the decree-law 24 April 2017, n. 50, converted, with amendments, by law 21 June 2017, n. 96. The use of the bonus for supplementary services for children referred to in the previous period is incompatible with the use of the nursery bonus referred to in article 1, paragraph 355, law 11 December 2016, n. 232, as amended by article 1, paragraph 343, of law no. 160.

- The benefits referred to in paragraphs 1 to 5 are recognized within the overall limit of 7.5 million euros for the year 2020. On the basis of the applications received, INPS monitors, communicating the results to the Ministry of Labor and Policies and the Ministry of Economy and Finance. If the monitoring reveals that the spending limit referred to in the first sentence of this paragraph is exceeded, INPS proceeds to reject the applications presented.

- To the charge deriving from paragraph 6, first period, equal to 7.5 million euros for the year 2020 in terms of net balance to be financed and 7.5 million euros for the year 2021 in terms of net debt and borrowing requirement , consequent to the ordinance of the Minister of Health of 4 November 2020, published in the Official Gazette, General Series, n. 276 of 5 November 2020, it is provided pursuant to article 32.

Art. 15

(Extraordinary fund for the support of third sector entities)

- In order to cope with the economic crisis of the Third Sector entities, determined by the measures relating to the containment and management of the epidemiological emergency from COVID-19, it is established, in the forecast of the Ministry of Labor and Social Policies, the "Extraordinary Fund for the Support of Third Sector Entities", with an endowment of 70 million euros for the year 2021, for interventions in favor of voluntary organizations registered in the regional registers and of the autonomous provinces referred to in the law of 11 August 1991, n. 266, of the social promotion associations registered in the national, regional and autonomous provinces of Trento and Bolzano registers referred to in article 7 of the law of 7 December 2000, n. 383, as well as non-profit organizations of social utility referred to in Article 10 of Legislative Decree 4 December 1997, n. 460, registered in the relative registry.

- By decree of the Minister of Labor and Social Policies, in agreement with the Minister of Economy and Finance, to be adopted after agreement in the State – Regions Conference, the criteria for the allocation of the fund's resources between the Regions and Autonomous provinces, also in order to ensure the homogeneous application of the measure throughout the national territory.

- The contribution paid through the fund referred to in this article cannot be combined with the measures provided for in articles 1 and 3 of the decree-law of 28 October 2020, n.137.

- The charges deriving from this article are provided pursuant to article 32.

Art. 16

(Caf refinancing)

- In order to allow the beneficiaries of subsidized social benefits to receive assistance in submitting single self-tax returns for ISEE purposes, entrusted to the tax assistance centers – CAF, the expenditure of 5 million euros is authorized for the year 2020, by transfer to the National Institute of Social Security. The charges deriving from this paragraph, equal to 5 million euros for the year 2020 in terms of the net balance to be financed and 5 million euros for the year 2021 in terms of net debt and requirements, are provided pursuant to article 32.

- For the same purposes referred to in paragraph 1, the residual resources referred to in paragraph 10, of article 82 of the decree-law of 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, within the limits of the allocation provided therein, for the part not already used for the purposes of the emergency income.

Art. 17

(Amendment of Legislative Decree no.81 of 9 April 2008)

- Annexes XLVII and XLVIII referred to in Legislative Decree 9 April 2008, n. 81, are replaced by the following:

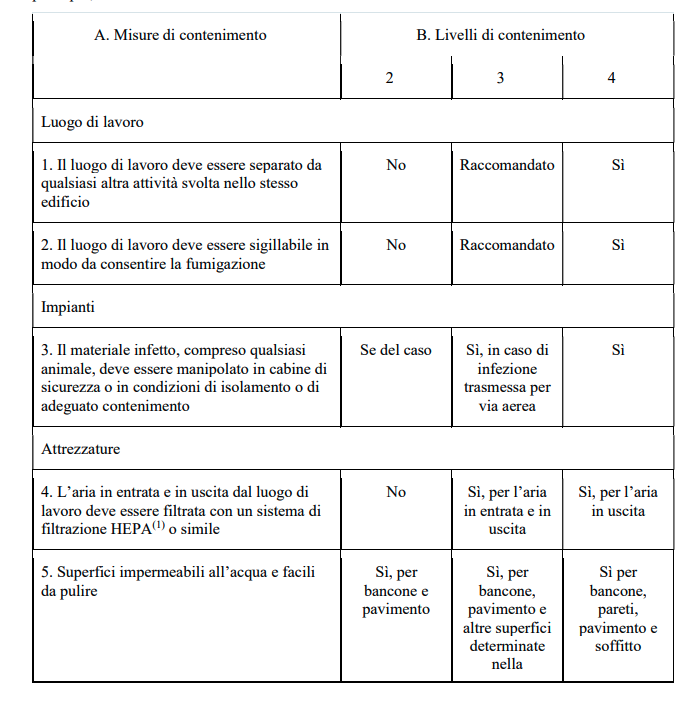

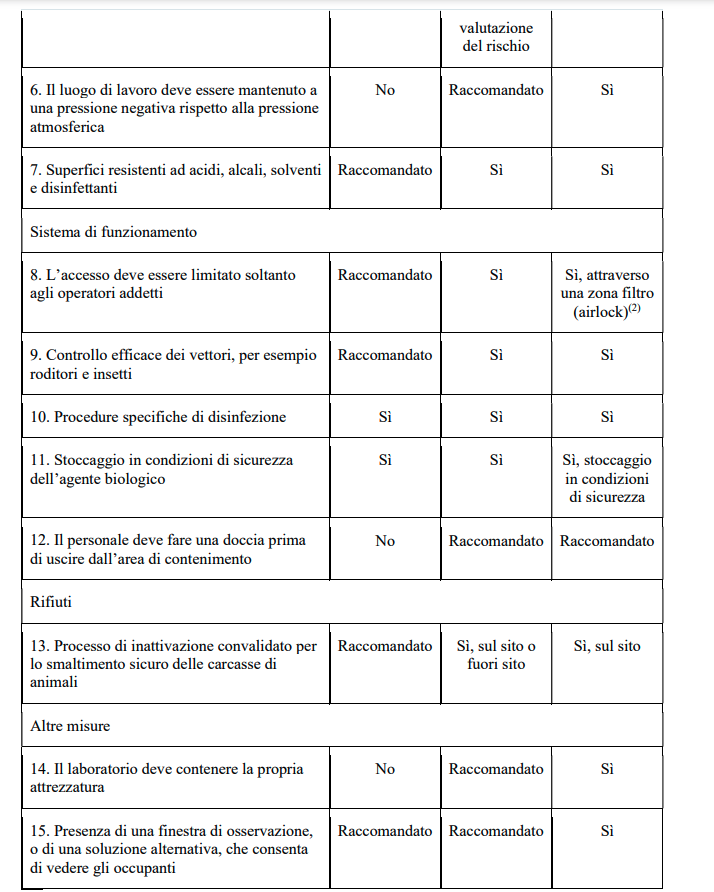

ANNEX XLVII

INDICATIONS ON MEASURES AND CONTAINMENT LEVELS

The measures provided for in this Annex must be applied according to the nature of the activities, the risk assessment for workers and the nature of the biological agent in question.

In the table, 'recommended' means that the measures should be applied in principle, unless the results of the risk assessment indicate otherwise.

(1) HEPA: high efficiency particulate filter

(2) Airlock / filter area: access must be through a filter area which is a room isolated from the laboratory. The contamination-free part of the filter zone must be separated from the

part with limited access via a changing room or showers and preferably by doors interlocking ";

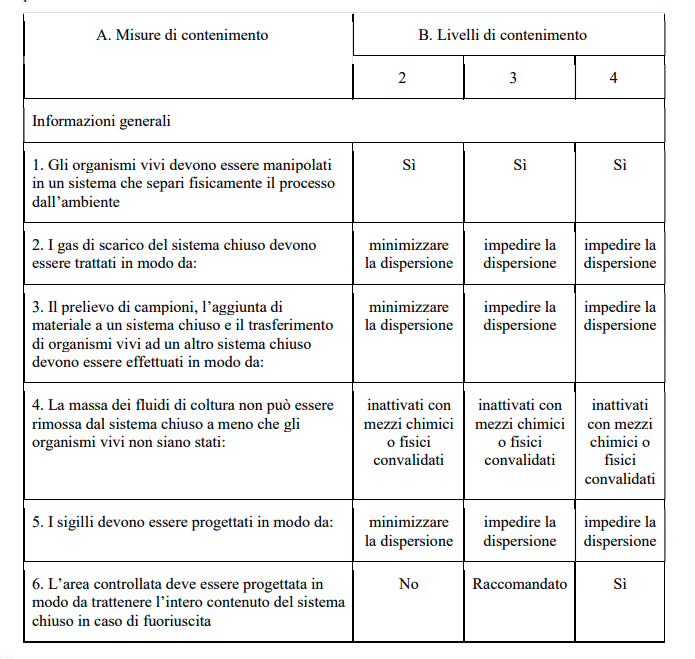

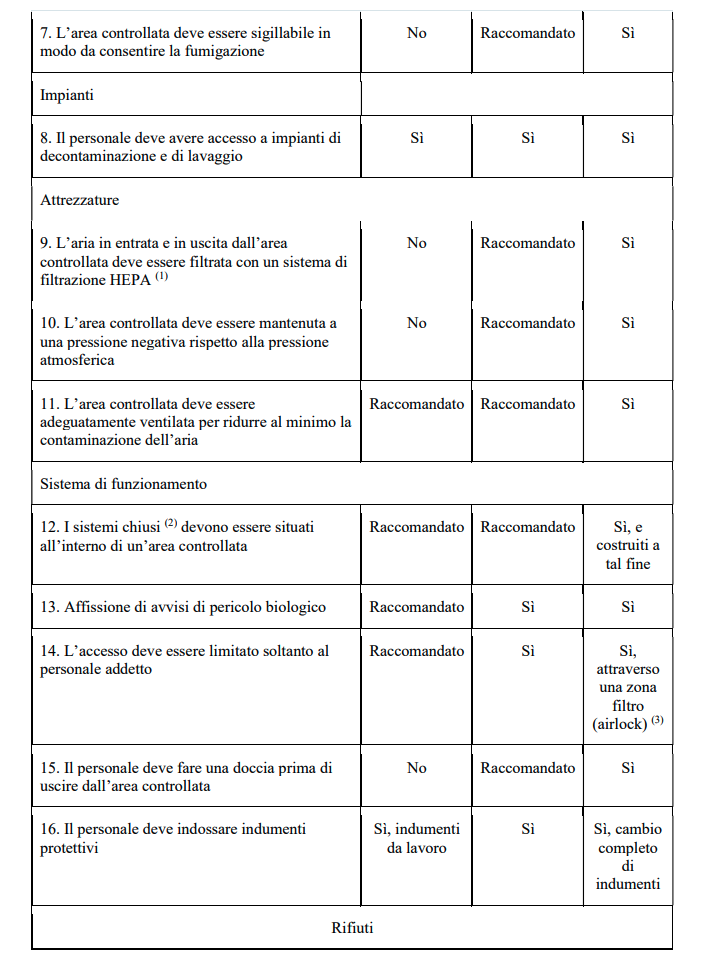

ANNEX XLVIII

CONTAINMENT FOR INDUSTRIAL PROCESSES

In the table, 'recommended' means that the measures should be applied in line with principle, unless the results of the risk assessment indicate otherwise.

Biological agents of group 1

For activities with group 1 biological agents, including live attenuated vaccines, the principles of occupational safety and hygiene must be respected.

Biological agents of groups 2, 3 and 4

It may be appropriate to select and combine the containment requirements of the different categories indicated below on the basis of an assessment of the risk associated with a particular process or one of its part.

(1) HEPA: High Efficiency Particulate Air filter (2) Closed system: a system that physically separates the process from the environment (for example incubation tanks, tanks, etc.).

(3) Airlock / filter zone: access must be through a filter zone which is a room isolated from the laboratory. The contamination-free part of the filter zone must be separated from the ad part limited access via a changing room or showers and, preferably, by interlocking doors. ".

Art. 18

(Amendments to article 42-bis, of the decree-law 14 August 2020, n.104, converted, with amendments, by law 13 October 2020, n.126)

- In article 42-bis, of the decree-law of 14 August 2020, n. 104, converted, with amendments, by law 13 October 2020, n. 126, the following changes are made:

- a) in paragraph 1, after the words "21 December 2020", the following are inserted: "or expired in the years 2018 and 2019," and after the words "are completed" the following are inserted: ", within the limit of 40% of 'amount due, with the exception of value added tax (VAT), ”;

- b) after paragraph 1, the following is inserted: “1-bis. For subjects carrying out economic activities, the 40 percent reduction referred to in paragraph 1 is applied in compliance with the conditions and limits of Regulation (EU) no. 1407/2013 of the Commission, of 18 December 2013, relating to the application of articles 107 and 108 of the Treaty on the Functioning of the European Union to de minimis aid, of Regulation (EU) no. 1408/2013 of the Commission, of 18 December 2013, on the application of articles 107 and 108 of the Treaty on the Functioning of the European Union to de minimis aid in the agricultural sector, and of Regulation (EU) no. 717/2014 of the Commission, of 27 June 2014, relating to the application of articles 107 and 108 of the Treaty on the Functioning of the European Union to de minimis aid in the fisheries and aquaculture sector. Persons wishing to make use of the facility must submit a specific communication to the Revenue Agency. The methods, terms of presentation and the content of the communication are established by provision of the director of the Agency itself, to be issued within twenty days from the date of publication in the Official Gazette of this decree. ".

- The charges deriving from the provisions referred to in paragraph 1, valued at € 14.8 million for the year 2020, are provided pursuant to article 32.

Art. 19

(Extension of article 10 of the decree-law March 17, 2020, n.18, converted with amendments by the law April 24, 2020, n.27 concerning the strengthening of human resources of INAIL)

- The provision referred to in article 10 of the decree-law of 17 March 2020, n. 18, converted, with amendments, by law 24 April 2020, n. 27, is extended until 31 December 2021. 2. The related charge, equal to € 20,000,000, is applied to the budget of the National Institute for Insurance against Accidents at Work, on the resources for covering relationships in agreement with outpatient medical specialists. The offsetting of the financial effects in terms of borrowing requirement and net debt, equal to € 10,300,000 for the year 2021, is provided for in accordance with Article 32.

Art. 20

(Bilateral Funds financing pursuant to art.27 of the legislative decree of 14 September 2015, n.148 for disbursement of ordinary Covid-19 allowance)

- The bilateral funds referred to in article 27 of legislative decree no. 148, are authorized to use the sums allocated by article 1, paragraph 7, of the decree-law of 14 August 2020, n. 104, converted, with amendments, by law 13 October 2020, n. 126, also for the disbursements of the ordinary COVID-19 check up to July 12, 2020.

Title III – Other urgent provisions

Art. 21

(Contribution exemption in favor of agricultural, fishing and aquaculture sectors)

- To the same subjects concerned by the exemption from the payment of social security and welfare contributions referred to in article 16 of the decree-law October 28, 2020, n. 137, who carry out the activities identified by the ATECO codes referred to in Annex 3 of this decree, the same benefit is also recognized for the remuneration period of December 2020.

- The exemption is recognized in compliance with the European Union rules on state aid.

- Article 7 of the decree-law 28 October 2020, n. 137.

- The charges deriving from this article, valued at 112.2 million euros for the year 2020 and 226.8 million euros for the year 2021, are provided for, for 12.2 million euros for the year 2020 and 226 , 8 million euros for the year 2021, pursuant to article 32 and for 100 million euros for the year 2020, through the use of the resources deriving from the repeal of the provision referred to in paragraph 3.

Art. 22

(Fourth range)

- Article 58-bis of the decree-law of 14 August 2020, n. 104, converted, with amendments, by law 13 October 2020, n. 126, is replaced by the following:

"Article 58-bis

(Interventions for the management of the market crisis of fourth range and first range evolved fruit and vegetables)

- In order to cope with the market crisis of fourth range fruit and vegetable products pursuant to law no. 77, and those of the so-called first evolved range, i.e. fresh, packaged, unwashed and ready for consumption, following the spread of the COVID-19 virus, recognized fruit and vegetable producers' organizations and their associations are granted a contribution to cope the reduction in the value of marketed production which occurred during the period of the state of emergency compared to the same period of the previous year.

- The contribution is granted, within the overall expenditure limit of 20 million euros for the year 2020, for the harvest before ripening or non-harvesting of fruit and vegetables destined for the fourth and first evolved ranges, based on the information available in the company file and in the treatment register referred to in Legislative Decree 14 August 2012, n. 150. The contribution is equal to the difference between the amount of turnover for the period from March to July 2019 and the amount of turnover for the same period of the year 2020. The contribution is divided by the beneficiary organizations and associations among the producer members in proportion the reduction of the product delivered. If the overall spending limit referred to in the first period is exceeded, the amount of the contribution is reduced proportionally among the beneficiaries.

- With the decree of the Minister of Agricultural, Food and Forestry Policies to be issued, after consulting the Regions and the Autonomous Provinces of Trento and Bolzano, the criteria and methods of implementation and the implementation of this decree-law are defined within thirty days from the date of entry into force of this decree-law. procedure for revocation of the contribution if the condition referred to in paragraph 2 above is not respected in relation to the distribution of the contribution among the producer members.

- The grant is granted in compliance with the European Union rules on state aid.

- The charges deriving from this article, defined in the overall limit of 20 million euros for the year 2020, are provided by means of a corresponding reduction in the Fund referred to in Article 1, paragraph 200, of Law no. 190, as refinanced by article 114, paragraph 4, of this decree. ".

Art. 23

(Provisions for the decision of criminal judgments of appeal in the period of epidemiological emergency from COVID-19)

- From the date of entry into force of this decree and until the expiry of the term referred to in article 1 of the decree-law of 25 March 2020, n. 19, converted, with amendments, by law 22 May 2020, n. 35, outside the cases of renewal of the hearing instruction, for the decision on the appeals against the sentences of first instance, the appeal court proceeds in the council chamber without the intervention of the public prosecutor and the defenders, unless one of the private parties o the public prosecutor makes a request for oral discussion or that the accused express his will to appear.

- By the tenth day prior to the hearing, the public prosecutor formulates its conclusions by means of a document transmitted to the registry of the court of appeal electronically pursuant to article 16, paragraph 4, of the decree-law of 8 October 2012, n. 179, converted, with amendments, by law 17 December 2012, n. 221, or by means of the systems that will be made available and identified with a provision by the general manager of information and automated systems. The registry sends the document immediately, electronically, pursuant to article 16, paragraph 4, of the decree-law of 8 October 2012, n. 179, converted. with amendments, by law 17 December 2012, n. 221, to the defendants of the other parties who, within the fifth day prior to the hearing, can present the conclusions by written document, sent electronically to the clerk of the court of appeal, pursuant to article 24 of the decree

law 28 October 2020, n. 137.

- The appeal court proceeds with the resolution in accordance with the procedures set out in article 23, paragraph 9, of the decree-law of 28 October 2020, n. 137. The operative part of the decision is communicated to the parties.

- The request for oral discussion is formulated in writing by the public prosecutor or by the defender within the peremptory term of fifteen free days before the hearing and is sent to the registry of the court of appeal through the channels of communication, notification and deposit respectively provided for in paragraph 2 Within the same peremptory term and with the same procedures the accused formulates, through the defender, the request to participate in the hearing.

- The provisions of this article do not apply in proceedings in which the hearing for the appeal judgment is set within fifteen days from the entry into force of this decree.

- Notwithstanding the provision referred to in paragraph 4, in proceedings in which the hearing is scheduled between the sixteenth and thirtieth day from the entry into force of this decree, the request for oral discussion or participation of the accused in the hearing is formulated within the peremptory term of five days from the entry into force of this decree.

Art. 24

(Provisions on suspension of the statute of limitations and terms of pre-trial detention in criminal proceedings in the period of epidemiological emergency from COVID-19)

- From the date of entry into force of this decree and until the expiry of the term referred to in article 1 of the decree-law of 25 March 2020, n. 19, converted, with amendments, by law 22 May 2020, n. 35, criminal judgments are suspended during the time in which the hearing is postponed due to the absence of the witness, the technical consultant, the expert or the accused in related proceedings who have been summoned to appear for the needs of obtaining evidence , when the absence is justified by the restrictions on movements imposed by the quarantine obligation or by the subjecting to fiduciary isolation as a result of the urgent measures regarding the containment and management of the epidemiological emergency from COVID-19 on the national territory provided for by the law or provisions implementation dictated by decrees of the President of the Council of Ministers or the Minister of Health. For the same period of time, the course of the limitation period and the terms provided for by Article 303 of the Code of Criminal Procedure are suspended.

- In the cases referred to in paragraph 1, the hearing may not be postponed beyond the sixtieth day following the foreseeable cessation of the restrictions on movements, otherwise, having regard to the effects of the duration of the suspension of the course of the prescription and the terms provided for by the 'Article 303 of the Code of Criminal Procedure, at the time of the restriction increased by sixty days.

- In calculating the terms referred to in Article 304, paragraph 6, of the Code of Criminal Procedure, except for the limit relating to the overall duration of pre-trial detention, the suspension periods referred to in paragraph 1 are not taken into account.

Art. 25

(Urgent measures regarding the oral tests of the notarial competition and the qualifying examination to practice the legal profession)

- In article 254, paragraph 3, of the decree-law of 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, the words: “scheduled until 30 September 2020” are deleted.

Art. 26

(Class-action entry into force deferral)

- In article 7, paragraph 1, of the law of 12 April 2019, n. 31, the words "nineteen months" are replaced by the following: "twenty-five months".

Art. 27

(Provisions on local public transport)

- In article 200, paragraph 1, of the decree-law of 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, the words "in the period from 23 February 2020 to 31 December 2020" are replaced by the following: "in the period from 23 February 2020 to 31 January 2021".

- For the purposes referred to in paragraph 1, the endowment of the fund provided for by article 200, paragraph 1, of the decree-law of 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, is increased by 300 million euros for the year 2021. These resources can be used, as well as for the same purposes referred to in the aforementioned article 200, also for the financing, within the limit of 100 million euros, of additional services of local and regional public transport, also intended for students, needed in the year 2021 to meet the transport needs resulting from the implementation of containment measures where the aforementioned services in the period prior to the spread of COVID

19 had a filling of more than 50 percent of the capacity.

- By decree of the Minister of Infrastructure and Transport, in agreement with the Minister of Economy and Finance, to be adopted within thirty days from the date of entry into force of this decree, subject to agreement in the Unified Conference referred to in Article 8 of the legislative decree of 28 August 1997, n. 281, the quotas are defined to be assigned to each region and autonomous province for the financing of the additional local and regional public transport services provided for in paragraph 2 as well as for the residual resources taking into account the methods and criteria set out in the decree of the Minister of transport infrastructures, in agreement with the Minister of Economy and Finance, 11 August 2020, n. 340.

- The charges deriving from paragraph 2 are provided in accordance with article 32.

Art. 28

(Provisions regarding the elections of the territorial and national bodies of the professional orders in the emergency period)

- The renewal of the collegial bodies of the professional, national and territorial Orders and Colleges can take place, in whole or in part, using telematic methods, in compliance with the principles of secrecy and freedom in participating in the vote.

- The National Council of the Order or of the College establishes, with its own regulation to be adopted, according to the rules provided for by the respective regulations, within 60 days from the date of entry into force of this decree, the methods for expressing remote voting and the procedures for organ settlement.

- In the case referred to in paragraph 1 and for the same purpose, the National Council of the Order or of the College arranges with its own provision the deferral of the date of the elections of the territorial and national bodies that take place in assembly form, if in progress at date of entry into force of this decree, for a period not exceeding 90 days from the same date.

- Up to the date of installation of the new bodies elected pursuant to this article and notwithstanding the terms referred to in article 3 of law no. 444, the acts issued by the territorial and national Orders and Colleges that have expired are reserved.

Art. 29

(Provisions in favor of sports workers)

- For the purposes of the payment of the indemnity referred to in article 17 of the decree-law of 28 October 2020, n. 137, all collaboration relationships expired on 31 October 2020 and not renewed are considered terminated due to the epidemiological emergency.

- In article 17 of the decree-law of 28 October 2020, n. 137, the following is added after paragraph 2: “2-bis. The spending limit referred to in paragraph 1 is increased by any expense surpluses available in the financial statements of Sport e Salute SpA which occurred with reference to the disbursement of the allowance referred to in article 96 of the decree-law of 17 March 2020, n. 18, converted, with amendments, by law 24 April 2020, n. 27, or referred to in article 98 of the decree-law 9 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, or referred to in article 12 of the decree-law 14 August 2020, n. 104, converted, with amendments, by law 13 October 2020, n. 126. ".

Art. 30

(Single Fund for the support of amateur sports associations and clubs)

- The resources referred to in article 218-bis of the decree-law of 19 May 2020, n. 34, converted, with amendments, by law 17 July 2020, n. 77, already in the availability of the autonomous budget of the Presidency of the Council of Ministers, are brought to increase, within the aforementioned budget, the resources coming from the Fund referred to in article 3 of the decree-law 28 October 2020, n. 137, which takes the name of "Single Fund for the support of amateur sports associations and clubs".

Art. 31

(Publication of the results of the monitoring of data concerning the epidemiological emergency from COVID-19)

- In article 1 of the decree-law of 16 May 2020, n. 33, converted, with amendments, by law 14 July 2020, n. 74, after paragraph 16 the following is inserted:

"16-bis. The Ministry of Health, on a weekly basis, publishes on its institutional website and communicates to the Presidents of the Chamber and Senate, the results of the monitoring of the epidemiological data referred to in the decree of the Minister of Health of 30 April 2020 published in the Official Gazette no. 112 of 2 May 2020. The Minister of Health with its own ordinance, having consulted the Presidents of the Regions concerned, can identify, on the basis of the data held and processed by the control room referred to in the decree of the Minister of Health of 30 April 2020 in accordance with the document of “Prevention and response to COVID-19; evolution of strategy and planning in the transition phase for the autumn-winter period ", as per attachment 25 to the decree of the President of the Council of Ministers of 3 November 2020, published in the Official Journal no. 275 of 4 November 2020, having also heard the technical-scientific committee referred to in the order of the Head of the Civil Protection Department of 3 February 2020 on the monitored data, one or more regions in whose territories there is a higher epidemiological risk and in which, consequently , the specific measures identified by the decree of the President of the Council of Ministers among those referred to in Article 1, paragraph 2, of the decree-law of 25 March 2020, n. 19, converted, with amendments, by law 22 May 2020, n. 35, additional to those applicable throughout the national territory. The ordinances referred to in the preceding paragraphs are effective for a minimum period of 15 days and in any case lapse upon expiry of the term of effectiveness of the decrees of the President of the Council of Ministers on the basis of which they are adopted, without prejudice to the possibility of reiteration. The assessment of the stay for 14 days in a level of risk or scenario lower than that which determined the restrictive measures entails in any case the new classification. By order of the Minister of Health, adopted in agreement with the Presidents of the regions concerned, based on the trend of the epidemiological risk certified by the control room referred to in the decree of the Minister of Health of 30 April 2020, it can be foreseen at any time, in relation to specific parts of the regional territory, the exemption from the application of the measures referred to in the previous period. The minutes of the Technical-Scientific Committee and of the Control Room referred to in this article are published in excerpt in relation to the monitoring of data on the institutional website of the Ministry of Health. Without prejudice to the ordinance of the Minister of Health of 4 November 2020, published in the Official Gazette, General Series, no. 276 of 5 November 2020, the data on the basis of which it was adopted are published within 3 days from the entry into force of this paragraph. ".

Title IV – Final provisions

Art. 32

(Financial provisions)

- To the charges deriving from articles 1, 2, 4, 5, 6, 7, 8, 10, 11, 12, 13, 14, 15, 16, 18, 19, 21 and 27, determined as a total of 2,568.8 million euros for the year 2020 and € 1,006.99 million for the year 2021, which increase, for the purposes of offsetting the effects in terms of net debt and requirements, to € 1,021.79 million for the year 2021, :

- a) as regards 160 million euros for the year 2020, through a corresponding reduction in the expenditure authorization referred to in article 9, paragraph 9, of the decree-law no. 104, converted with amendments by law 13 October 2020, n. 126;

- b) as to 1,200 million euros for the year 2020, by means of a corresponding reduction in the provision referred to in article 115, paragraph 1, of the decree-law of 19 May 2020, no. 34, converted, with amendments, by the law of 17 July 2020, n.77;

- c) as to 200 million euros for the year 2020, by means of a corresponding reduction in the provision referred to in article 3, paragraph 3, of the decree-law no. 3, converted, with amendments, by law 2 April 2020, n. 21;

- d) as for 830 million euros for the year 2020, by means of a corresponding reduction in the spending authorizations referred to in article 19, paragraph 9, of the decree-law no. 18, converted with amendments by law 24 April 2020, n. 27 and referred to in article 1, paragraph 11, of the decree-law 14 August 2020, n.104, converted, with amendments, by the law 13 October 2020, n. 126;

- e) as to 50 million euros for the year 2020, through the corresponding use of the sums paid at the entry of the State budget pursuant to article 148, paragraph 1, of law no. 388, which, at the date of entry into force of this decree, have not been reallocated to the relevant programs and which are definitively acquired by the Treasury for this amount;

- f) as for 100 million euros for the year 2020, through the corresponding use of the resources registered, for the same year, in the estimate of the Ministry of the Interior, relating to the activation, leasing and management of the detention centers and reception for irregular foreigners; g) as to 30 million euros for the year 2020, through the use of the amounts referred to in article 7, paragraph 1, of legislative decree no. 67;

- h) as to 230 million euros for the year 2021, through a corresponding reduction in the Fund for structural economic policy interventions referred to in article 10, paragraph 5, of the converted decree-law 29 November 2004, n.282, with amendments , by law no.307 of 27 December 2004, as refinanced by article 34, paragraph 1, decree-law no. 137 of 28 October 2020;

- i) as for 790.8 million euros, in terms of net balance to be financed, and 793.17 million euros, in terms of net debt and borrowing requirement, for the year 2021, through the use of a portion of the higher revenues and the lower expenses deriving from articles 6, 7, 10 and 11.

- In order to ensure compliance with the overall maximum limit of the authorizations for recourse to debt for the year 2020 approved by the Chamber of Deputies and the Senate of the Republic with the related Resolutions and, where necessary, the possible adoption of the envisaged initiatives

from article, 17, paragraph 13 of law no. 196 of 31 December 2009, the Ministry of Economy and Finance monitors the resources referred to in article 34, paragraph 4, of decree-law of 28 October 2020, no. 137 and of this decree.

- The resources intended for the implementation by INPS of the measures referred to in this decree are promptly transferred from the State budget to the Institute itself.

- For the purposes of the immediate implementation of the provisions contained in this decree, the Minister of the Economy and Finance is authorized to make the necessary budget changes, also in the residual account, by means of its own decrees. The Ministry of Economy and Finance, where necessary, may order the use of cash advances, the regularization of which is carried out by issuing payment orders on the relevant expense items.

Art. 33

(Entry into force)

- This decree enters into force on the day of its publication in the Official Gazette of the Italian Republic, at the same time as such publication, and will be presented to the Chambers for conversion into law.

This decree, bearing the seal of the State, will be included in the Official Collection of regulatory acts of the Italian Republic. Anyone responsible is obliged to observe it and have it observed.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-il-decreto-ristori-con-i-codici-ateco-il-testo-integrale/ on Mon, 09 Nov 2020 15:31:33 +0000.