How is the economy in Italy, Europe, the US and emerging economies. Report

Eurozone recovering between lights and shadows, still uncertainty about Brexit, USA still weak but emerging on the rise. The economic report of the Confindustria study center

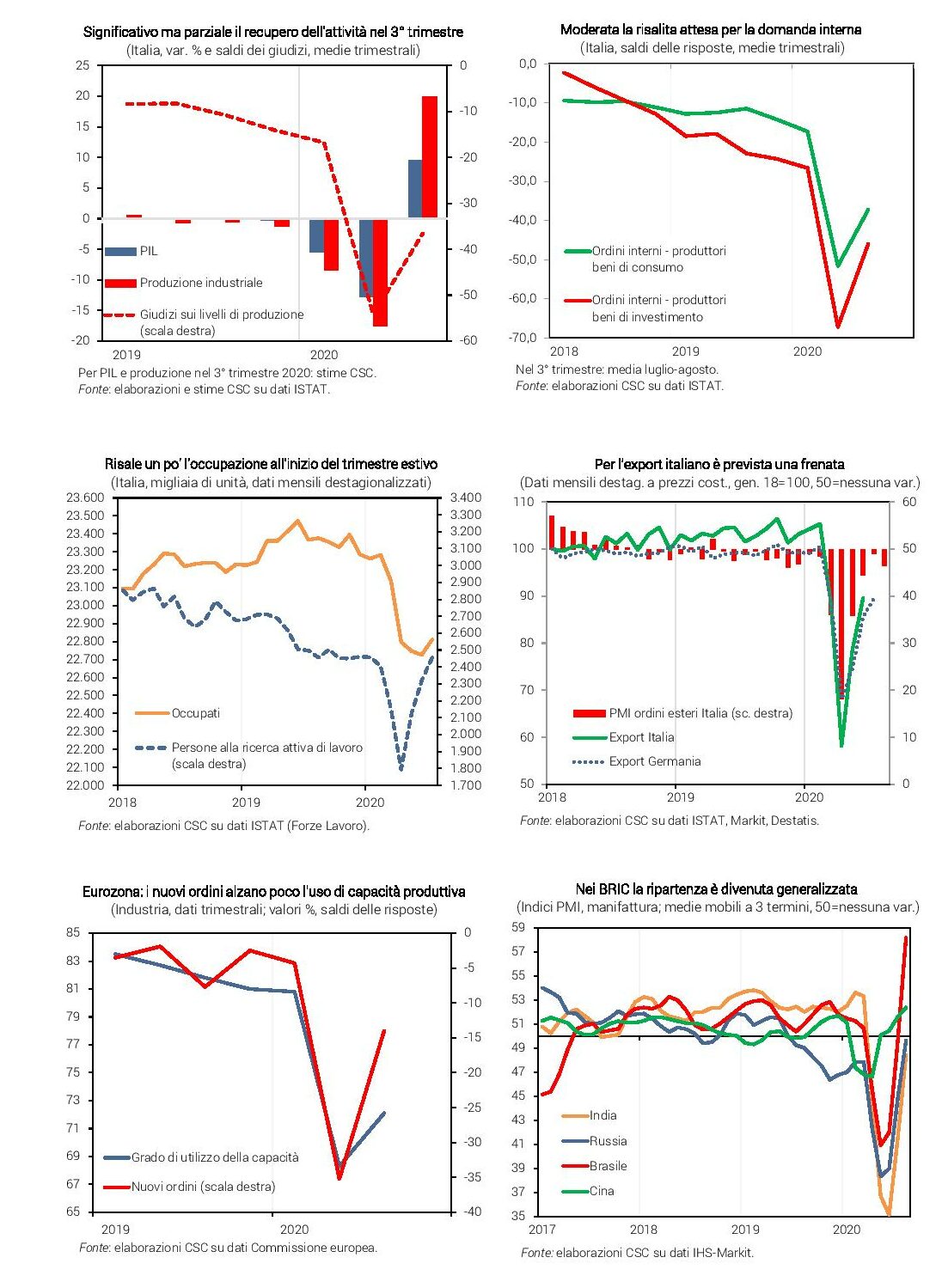

Partial rebound. The latest data on the Italian economy lead us to confirm that in the 3rd quarter there will be a rise in GDP of about + 9.0%, contained compared to the collapse in the 1st and 2nd (-17.6%). The activity therefore remains compressed far below pre-Covid levels. In 2020, GDP will be between -10 and -11%.

Services in difficulty. The PMI in services (Purchasing Managers' Index) signaled a new decline in activity in August (47.1), confirming the risks of a slow recovery. The tourism sector suffered a sharp decline in the summer months (-50% of admissions, -70% for art cities; Federalberghi estimates).

Industry still under pace. Production in July recovered as expected (+ 7.4%), but an average stabilization is expected in August-September (CSC estimates): this leads to just over + 20% in the 3rd quarter, but to -10% from pre-Covid levels. The PMI in August (53.1) provides positive signals on demand.

Internal demand: slow recovery. Consumer confidence barely recovered in August and remains low. Private consumption (-11.3% in Q2) will be held back by uncertainty and loss of income. The recovery in business confidence up to August was appreciable but partial. Domestic orders from producers of consumer and investment goods confirm a moderate recovery in the third quarter.

Export expected under braking. Goods exports recovered in June (+ 14.2%), albeit well below pre-Covid levels (-15.0%). A heterogeneous rise between sectors and markets: positive dynamics for food, sharp drop in means of transport; sales in Germany, China and Japan improved, while the contraction in the USA widened. Uncertain prospects: foreign orders from the manufacturing PMI weakened in August.

Holds the occupation. In July, the number of people employed increased (+85 thousand), but have remained in decline since February (-471 thousand). The number of active job seekers continues to rise, which fell during the lockdown. Employment will continue to hold until the end of the year, safeguarded by extensive use of the IGC.

Loans for growing liquidity. In July, there was a sharp increase in credit to businesses (+ 4.4% per annum), driven by public guarantees in response to the need for liquidity. Emergency loans then reached 90 billion as of 9 September (Task Force data). This helps in the short term, but weighs on bank debt: from 16.5% to 18.4% of liabilities (CSC estimates), canceling part of the decline in the last decade.

Rates at pre-Covid levels. The sovereign rate in Italy stabilized in September (0.99% ten-year BTP), on the low values of February. Same trend for the spread from the other Eurozone countries: that from Germany is still at + 1.46%. This favors public finances, but also highlights that markets continue to perceive Italy as more risky than the other economies in the area.

Eurozone: recovery, but uncertain. After the deep recession (-11.8% in the 2nd quarter), widespread in all countries, the data for the 3rd quarter show signs of a recovery in activity, timid and fluctuating. The rebound of the PMI in July was followed by a weakening in August (51.9). Confidence is on the rise, but slow, in all sectors. In industry, production capacity remains under-utilized, despite the flow of new orders.

Uncertainty about Brexit. The lights on the negotiations for treaties on economic relations with the EU will be rekindled since December 31, the end of the transitional period, after the January Brexit. There are no further extensions on the table: the UK would like an agreement by 15 October; the risk of no deal persists.

Oil down again. The Brent price declined in September (from $ 45 to $ 40 per barrel), after almost flattening out in July-August. This appears to reflect the large stocks of crude oil and new concerns about the recovery in global demand given the continuing pandemic in several countries.

Trade: mixed signals. Trade in Europe is improving, with some restart of continental value chains. Conversely, there are signs of weakness in Asia. Overall, the global PMI foreign orders climbed back just below the threshold indicating stability (49.9 in August).

Use still weak. After the worst postwar drop in GDP in the second quarter, the latest data indicate recovery (manufacturing PMI expanding for the third month), but activity is far from pre-Covid levels. Unemployment drops in August (8.4%), but the number of people laid off from a permanent job is growing (3 million in a month). This caused household confidence to drop and weighs on consumption in the third quarter.

Emerging in ascent. The manufactures of the main emerging companies are back in expansion. Chinese industry, in August, grew for the fourth month, also driven by exports (+ 9.5% annually); this stabilizes employment in the sector. Brazilian manufacturing, supported by the marked growth in orders, recorded a jump in the PMI (64.7). Russia and India are also expanding for the first month.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-va-leconomia-in-italia-europa-usa-ed-emergenti-report/ on Fri, 11 Sep 2020 13:50:11 +0000.