How the increase in costs will affect the quarterly

The analysis by Peter Garnry, Head of Equity Strategy for BG SAXO

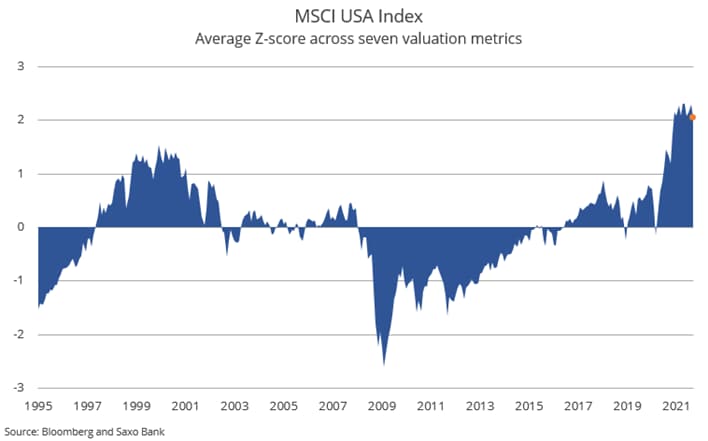

We are entering the quarterly season with high equity valuations and profit margins at all-time highs. There is a growing series of stress tests for companies starting with wage pressures, supply constraints pushing prices up and now, lately, even higher and higher energy costs.

Companies like FedEx, Nike and Bed Bath & Beyond have already sounded the alarm about rising production costs and pressure on margins. It was thought that these issues would be central starting next January but, in reality, many investors may be surprised at how they will impact on these quarterly too.

The increase in production costs will once again put pressure on companies in the industrial sectors, basic necessities and goods related to personal well-being.

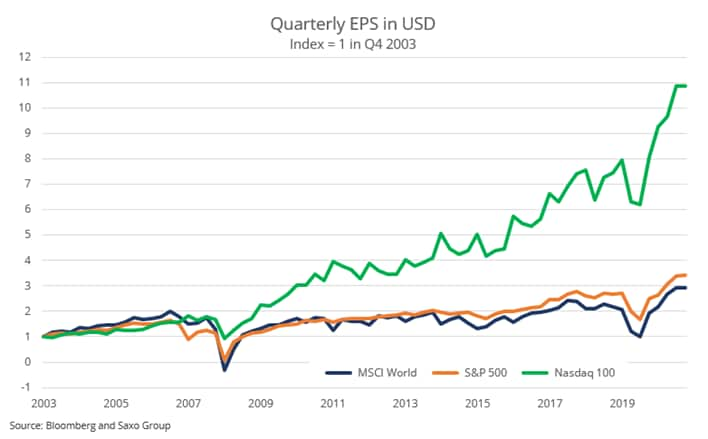

Instead, we expect digital businesses to deliver good results, as they generate a greater amount of revenue and profits from energy consumption used and often deliver their services over the Internet, making them more immune to global supply disruptions.

In short, we are facing another quarter that proves once more to investors that betting on digital companies is good for returns. The corollary will be increased pressure to try to tax digital companies.

The list below shows the most important quarterly to keep an eye on these days:

Wednesday: Delta Air Lines, JPMorgan Chase, BlackRock, First Republic Bank

Thursday: Fast Retailing, Bank of America, Wells Fargo, Walgreens Boots Alliance, Morgan Stanley, Citigroup, UnitedHealth, US Bancorp, Progressive, Domino's Pizza

Friday: Zijin Mining, BOC Hong Kong, PNC Financial Services, Goldman Sachs, Charles Schwab, Truist Financial

Delta Air Lines is expected to archive Q3 revenue of $ 8.4 billion, up 175% y / y and its profitable first quarter since the start of the pandemic, with EPS expected at $ 0.18 and EBITDA of $ 945 million rising. translates into a healthy operating margin of 11.2%. The focus is of course the increase in fuel costs associated with the ongoing global energy crisis, but also the difficult handling of passengers in the post-pandemic world.

Between banks and investment banks we focus on JPMorgan Chase for the full picture, and Bank of America for understanding underlying credit dynamics and loan demand situation in the US, while Citigroup is attractive for its penchant for emerging markets. Morgan Stanley and Goldman Sachs are often uninteresting as JPMorgan Chase is most of the time a good indicator on investment banking for the quarter.

Analysts expect a tough quarter for US banks q / q as activity normalizes in consumer and commercial banking. The key focus for banks is on their perspective on interest rates and any data on inflation and how it affects customers.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/come-laumento-dei-costi-influenzera-le-trimestrali/ on Sun, 17 Oct 2021 05:13:43 +0000.