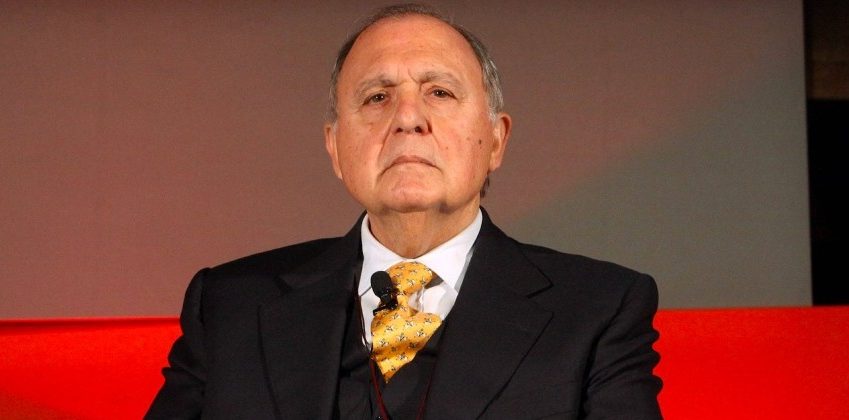

I reveal a couple of lies about the public debt. Signed: Savona

The problem of the public debt is therefore not that of repayment, but the costs necessary to renew it and the possible consequences, which depend on the state of trust. The speech by Paolo Savona, economist, president of Consob

Most Italian economists, after having supported the growth of Italian public debt starting with the oil crisis of the early 1970s, now agree that increasing debt in a situation like the one we live in is dangerous, but also necessary to avoid the worst. and not just for debt already outstanding. What is not convincing about this late conversion is the motivation: in fact, they say that the debt must be repaid.

Economic history teaches us that this concern has no foundation because, as illustrious masters have taught us, public debts are never repaid, but renewed by bearing the relative costs. If they were considered excessive, you would have to declare default, i.e. not wanting to repay it. Two other ways to lighten the debt burden is to depreciate it with inflation or to renegotiate it with creditors to agree on a lower amount.

The idea of reimbursement tried to assert itself in Maastricht, but Guido Carli, well aware of the effects, if not precisely the impossibility of doing so, agreed to converge the public debt towards 60% of GDP; Carlo Azeglio Ciampi marked the timing of the convergence with a specific agreement. Even this relative reduction did not materialize, despite some small progress made before the 2008 crisis, paid for by a loss of fiscal policy effectiveness and a structural reduction in our real growth rate.

The problem of public debt is therefore not that of repayment, but of the costs necessary to renew it and of the possible consequences, which depend on the state of trust; this, in turn, is linked to many factors, including, for Italy, the real or only perceived risk of its renaming from the euro to the old lira (or something similar) and the trend of real growth .

In the ongoing dispute over the use of public debt, it should be borne in mind that, if its destination is investments, the capital left to the children and grandchildren is increased, giving them a balance sheet where assets and liabilities are equal and, if real growth increases, even a little more. If, on the other hand, it is destined for assistance, in addition with an insufficient boost to GDP growth, as it seems to be happening, the expenses must be financed with taxes, non-repayable European contributions or the issue of irredeemable securities. If the current political debate does not examine in this way the intricate picture to be faced and will continue to lean on one side or the other, the country will not be able to get back on the path of development.

(taken from S cenarieconomici )

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/vi-svelo-un-paio-di-frottole-sul-debito-pubblico-firmato-savona/ on Tue, 15 Sep 2020 05:40:37 +0000.