Industrial districts, who exports the most and where. Reports

The markets in which district exports in the first nine months of 2022 recorded the greatest growth in value were the United States, Germany and France. The national monitor of districts by Giovanni Foresti and Romina Galleri, economists of the studies and research department of Intesa Sanpaolo

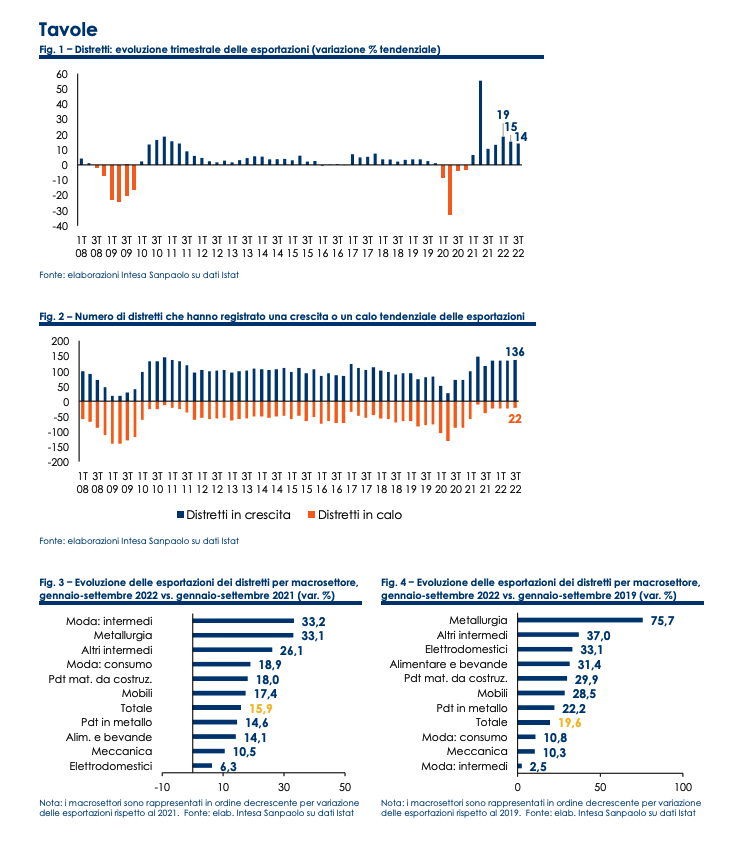

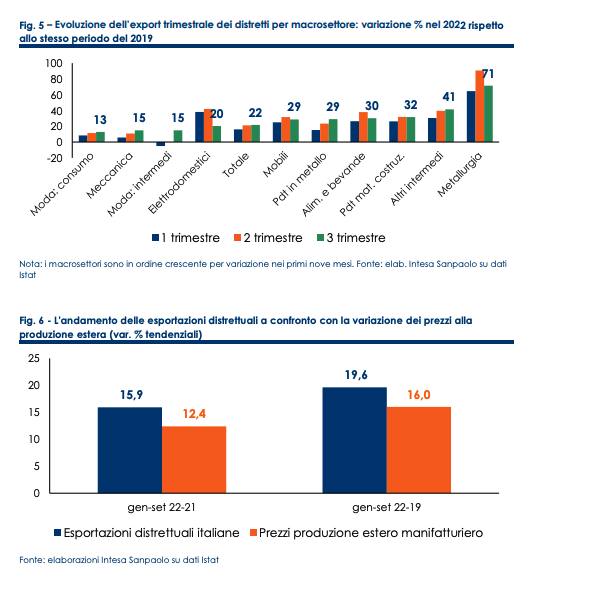

In the third quarter of 2022, exports from industrial districts recorded a trend increase of 14%. It is the sixth consecutive double-digit increase. Overall, exports rose by +15.9% in the first nine months of the year. The threshold of 110 billion euros was exceeded (at 113.4 billion), 19.6% more than in the first nine months of 2019 when district exports amounted to just under 95 billion.

These results partly reflect the rise in producer prices of manufactured products sold abroad (+12.4% between January and September 2022-2021 and +16% between January and September 2022-2019) and once again confirm the high competitiveness of the district areas which, in fact, once again beat the German competition. In the same specialization sectors as Italian districts, Germany exports recorded an increase of 10.8% compared to 2021 (vs +15.9% of the districts) and +15% in the comparison with the same period of 2019 ( vs +19.6%). Growth differentials in favor of Italian districts are present in most of the district specializations.

The recovery is widespread and has been completed by most districts: out of a total of 158 districts monitored, 138 are above the levels of the first nine months of 2019 and 128 districts are above the values of the same period of 2021.

All the district supply chains have exceeded pre-pandemic levels: the positive leap in Metallurgy stands out (+75.7% compared to the first nine months of 2019), the sector that more than any other has been affected by the rise in prices. Increases of between 30% and 40% were recorded by districts specializing in Other Intermediates (37%), Household Appliances (+33.1%) and Food and Beverage (+31.4%). The performance of the districts specializing in Building materials and products and Mobile was only slightly lower, up by 29.9% and 28.5% respectively. The export of metal products also closed with an increase of more than 20% (+22.2%). The results of the other district specializations were more contained, which compared to the pre-pandemic values still achieved an increase of around 10%: +10.3% for Mechanics and +10.8% for consumer goods in the fashion system. Good indications come from the producers of intermediate fashion goods who, thanks to an excellent third quarter (+15% compared to the same period of 2019), managed to close the gap compared to pre-crisis levels (+2.5%).

At territorial level, the performance of all macro-areas was positive: Lombardy in the North-West (+20% the change compared to the first nine months of 2019), Friuli-Venezia Giulia in the North-East (+20%, 2%), Umbria in the Center (+16.8%), Campania in the South (+23.1%).

Among the best districts for increase in exports (in value) compared to the first nine months of 2019 are: the metalworking supply chain with i Metalli of Brescia, mechatronics of Reggio Emilia, metalworking of Lecco, thermomechanical of Padua; the Fashion System with the Jewelery of Arezzo and Vicenza, the Eyewear of Belluno, the Leather Goods and Footwear of Florence, the Textiles and Clothing of Prato, the Sports Footwear and Sportsystem of Montebelluna, the Clothing of Empoli, the Gallaratese clothing-textile; the home system with tiles from Sassuolo, taps, valves and cookware from Lumezzane, furniture and panels from Pordenone and wood and furniture from Brianza. Within the agro-food supply chain, the results with the greatest export growth were obtained from the Parma food sector, the Nocera preserves, the Conegliano-Valdobbiadene Prosecco, the south-eastern Lombardy dairy products, the Neapolitan food , from fruit and vegetables from the Bari area and Tuscan oil.

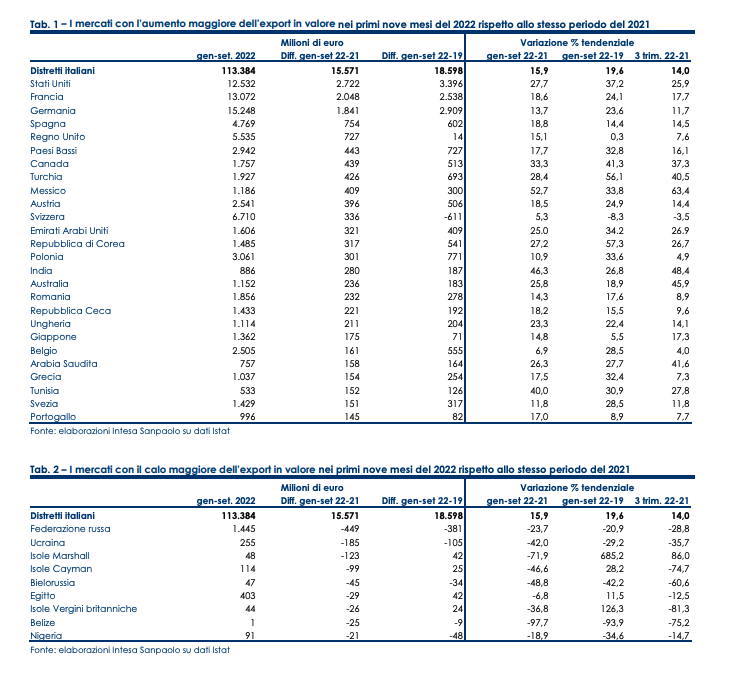

The markets in which district exports in the first nine months of 2022 recorded the greatest growth in value (compared to the corresponding period of 2019) were the United States (+3.4 billion euro), Germany (+2.9 billion) and France (+2.5 billion). Together these three markets explain just under half of the overall increase in district exports compared to pre-pandemic levels. A good contribution to the growth of the districts has also come from some distant markets such as Korea, the United Arab Emirates and Mexico. Significant declines were instead suffered in Russia, Ukraine and Belarus.

District exports should have maintained a good growth rate also in the autumn months. These are the indications that emerge from the foreign trade data available without the territorial breakdown. At the beginning of 2023, foreign district sales are expected to experience a slowdown, in a less favorable global demand scenario.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/distretti-industriali-chi-esporta-di-piu-e-dove-report/ on Tue, 24 Jan 2023 10:54:03 +0000.