Is tapering approaching?

"US labor market – July's improvement brings tapering closer … but without haste", by Antonio Cesarano, Intermonte's chief global strategist

The July data on the labor market show a homogeneous improvement in all the main sectors and, moreover, with an increase also in the workforce, i.e. of people who are actually returning at least to actively seek work

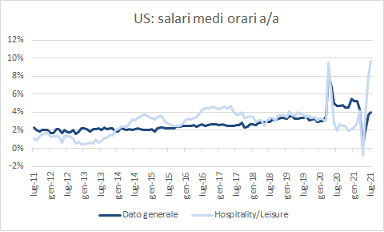

With reference to employees, the most anticipated sector for the possible positive contribution was that of the leisure / hospitality sector which did not disappoint with an increase of 380,000 units, just under half of the total number of new employees in July.

This sector also presented wage increases among the largest within the data.

On the labor force front, there was also an increase of 261,000 units, which contributed to the reduction in the unemployment rate from 5.9% to 5.4%.

IN SUMMARY

The signs of improvement that the Fed has said it expects from the labor market are starting to emerge. This allows the Fed to continue the tapering countdown, without speeding up the count too much.

This allows the central bank to reserve the right to intervene through tapering to try to moderate inflation in a non-hasty way, to also take into account the impact of the various bottlenecks and the evolution of the pandemic and therefore wait for further improvements, especially from the front of the participation rate which in July rose marginally to 61.7%, still far from the approximately 63% of the pre-pandemic phase.

The word is now on the July inflation data to be released next week

OPERATIONAL

STRATEGY: the scenario for the next 3-6 months currently remains marked by lower rates on average with a flattening curve, in view of the prospective slowdowns that could derive from the joint effect of bottlenecks / coexistence with the variant in autumn, with particular focus on the fact that much of the supply chain also uses lockdowns to control the virus

TACTICS: the month of August presents the possibility of a rebound in rates (first target area 1.40% of the US ten-year rate) and consequent steepening of the curve, especially if next week the inflation data will still confirm a positioning at high levels .

The scenario described is on average supportive for the equity sector in view of overall low rates and the Fed approaching tapering without haste + long-term accommodating ECB .

In the phases of a temporary rebound in interest rates, the value sector comes back into vogue and therefore more the Euro area. Over a longer horizon, or outlined scenario, it is overall more favorable to the US, given the greater presence of sectors that are more sensitive to falling interest rates.

On the foreign exchange front, the scenario of an average summer in favor of the dollar was confirmed (target area 1.16, without the pretense of accurately hitting the target) in view of a different attitude of Fed vs ECB, which is also welcome by a country like the US with a large trade deficit, to contain at least imported inflation

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/si-avvicina-il-tapering/ on Sun, 08 Aug 2021 06:23:43 +0000.