Is there really to be afraid of cost inflation?

Inflation from costs, threats and opportunities. The comment by Antonio Cesarano, Intermonte's chief global strategist

A set of factors is bringing the issue of cost inflation to the fore.

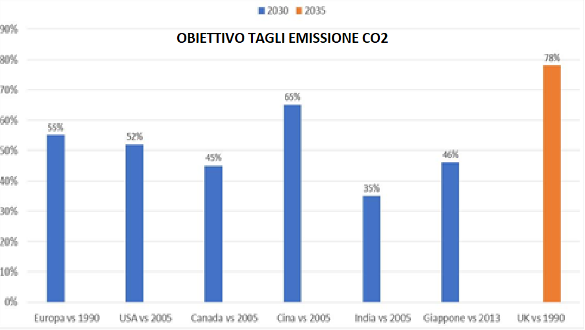

The most evident reason lies in the post Covid reopening; however, other factors are adding including the rising costs of the energy transition, in a context where the pressures for an accelerated process have become evident both in Europe (see the rise in polls by the Green Party in Germany) and in the USA (see the recent speech by the new president of the SEC who announced a consultation for the establishment of standard criteria for ESG reporting).

Cost inflation emerges as a much cited topic in US and European PMI surveys, along with delays in delivery of important components, including chips being predominant.

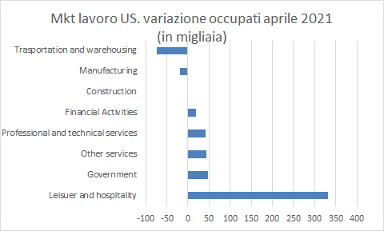

The April US labor market report also added the risk of temporary wage inflation, in a context of difficulty for US companies to find sufficient labor, partly a consequence of the large unemployment benefits that the last maneuver of 1900 billion $ extended until the beginning of September (300 $ per week). Not surprisingly, the job losses in April were recorded precisely in the sectors with the greatest difficulty in finding staff / bottlenecks, namely manufacturing and transport.

As evidence of how hot the topic is, I quote Bernie Sanders' Twitter comment on the figure: If $ 300 a week is preventing employers from hiring low-wage workers there's a simple solution: Raise your wages.

Central banks, for their part, continue to reiterate the hypothesis that it will be a temporary phenomenon. The point to clarify is what is meant by temporary, so as to then try to deduce the impact that cost inflation can produce on stock and bond markets.

The impression is that temporary should be understood not a few months but a few quarters, for the following reasons:

- Bottlenecks in the supply chain: some of them such as, for example, the issue of semiconductor shortages will take some time to be normalized;

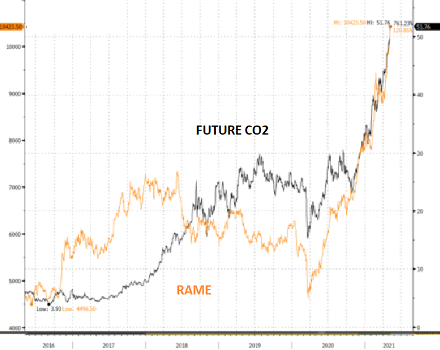

- Accelerated energy transition: the setting of increasingly ambitious targets for cutting net emissions by 2030 is leading to an increase in some industrial raw materials (including copper), together with the increase in the cost of CO2. That indication is growing even stronger as Germany's Green Party builds support ahead of the September 26 elections.

- Increase in Chinese demand: China is implementing the new five-year plan based on a goal of greater self-sufficiency both in terms of outlet markets and in the supply of raw materials, including agricultural ones.

What are the consequences on the markets?

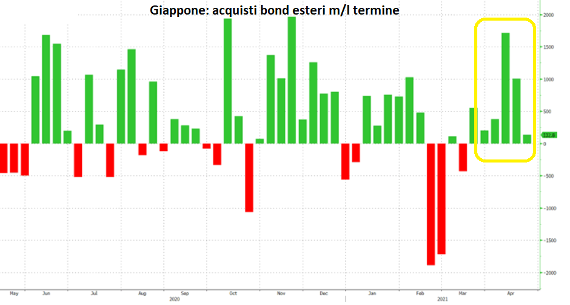

BOND: in the Euro area we are witnessing a progressive increase in rates, a phenomenon which, in part, stopped in the US since April at the start of the new Japanese fiscal year. It is probable that, progressively, the Japanese flow could decrease, giving rise to a progressive shift towards the 1.75 / 2% area between May and June in the ten-year sector, also in view of the Fed meeting on June 16.

EQUITY: The sectors that could best address the cost inflation scenario could be those that have the following two characteristics:

1) low presence of bottlenecks;

2) ability to offload the increase in costs downstream.

IN SUMMARY

MKT BOND: May still be under pressure from the government in the coming months. Some opportunities could emerge in the US high yield world (thanks to the recovery of oil and still attractive spreads despite the recent rate hike) or in the emerging world in local currency. In the latter case, the possible appreciation of local currencies could be supportive as a consequence of the restart of the rate hike phase that has already begun in some countries (Russia and Brazil in particular).

EQUITY: the themes / sectors that could best correspond to the two ingredients mentioned above could be those that benefit by definition from the rise in raw materials (basic resources), those that are best able to offload downstream cost increases without experiencing excessive bottlenecks (food) and / or facing rigid demand (luxury), as well as sectors that typically benefit from higher rates such as banking.

- The issues related to the energy transition could experience a setback due to the increase in costs which, if initially it was hailed as a signal of credibility of the intentions of governments, then the excess rise (see copper and CO2) it could insinuate fears that the transition could take place at a slower pace;

- Emerging markets should be kept under observation, in order to benefit from the anticipation effect on which operators could work when the pandemic peak is reached shortly in the face of greater availability of vaccines, especially in India.

CURRENCY MARKET: the scenario remains in the first half of 2021 with a stronger dollar on average: after the target of 1.18 in the first quarter (also achieved in excess with a minimum in the 1.17 area), the hypothesis is that in the second quarter the exchange rate returns to area 1.6 / 1.18 after a temporary recovery up to area 1.22 / 1.23. The recovery of the dollar in the quarter is mainly linked to the expectation of higher US rates by June.

In the third quarter, on the other hand, there could be a greater strength of the euro up to the 1.22 area, also following the greater flows that could derive from the issuance of recovery bonds at the start of the Next Generation Eu;

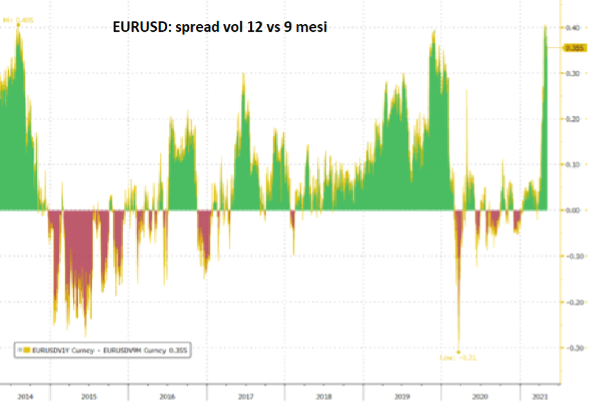

Finally, in the fourth quarter, the exchange rate could return to the 1.16 / 1.18 area in view of the possible fear of Le Pen's victory in the presidential elections in spring 2022, in view of the first more reliable polls at the end of 2021, similar to what it already happened in 2015, on the eve of the 2016 presidential elections. Operators are already starting to price a greater focus on this issue, judging by the marked expansion of volatilities to 12 vs 9 months on EurUsd.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ce-davvero-da-avere-paura-dellinflazione-da-costi/ on Tue, 11 May 2021 03:51:51 +0000.