Leonardo, here’s what Profumo leaves to Cingolani on helicopters, electronics, aeronautics and space

What emerges from Leonardo's latest quarterly report by Profumo on the performance of the main sectors of activity (Helicopters, Electronics, Aeronautics and Space)

The defense sector together with the helicopters supported Leonardo's growth in the first quarter of the year, the last one by Alessandro Profumo.

Specifically, the former Finmeccanica company recorded revenues of 3 billion euros, in line with the first quarter of 2022, as well as EBITDA of 1,192 million (+4.4%) and a net result of 54 million euros. This is what emerges from the results for the first quarter of 2023 approved unanimously on 3 May.

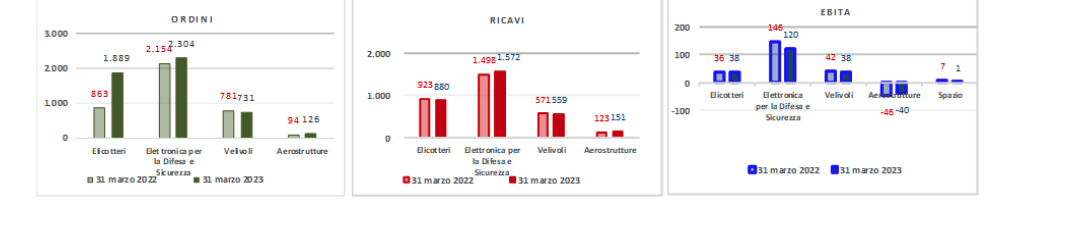

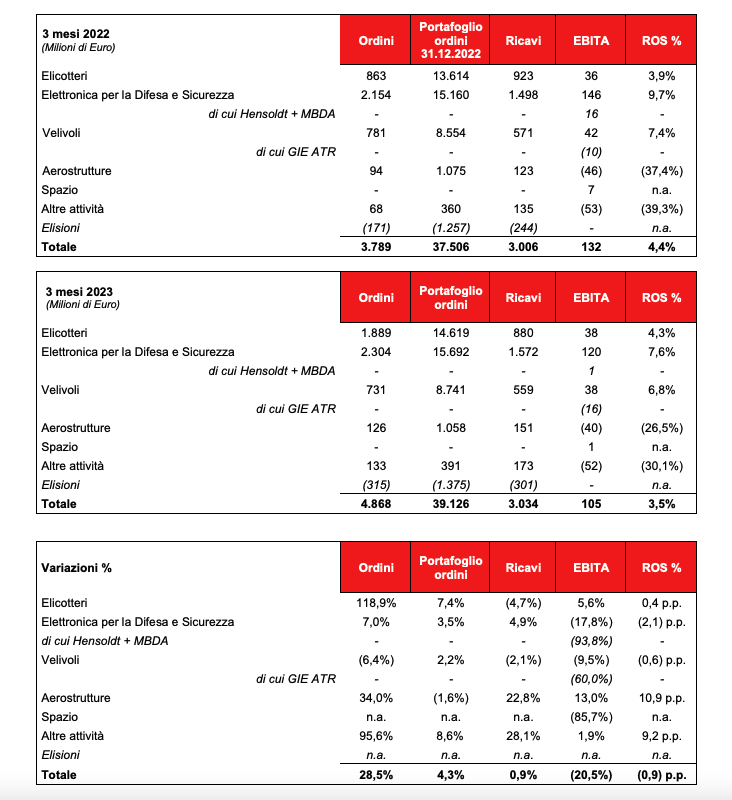

The helicopters sector is the protagonist of the commercial performance: orders at 31 March amounted to 4,868 million euros, a significant increase (+28.5%) compared to the first quarter of 2022, thanks in particular to the excellent performance of the helicopter sector , linked mainly to the orders of n. 18 AW 169 destined for the Austrian Ministry of Defense and n. 13 MH 139 for the US Air Force, with a constant growth of orders in Defense and Security Electronics.

“In the first three months we have once again demonstrated the competitiveness in the defense/government business and the continuous improvement of the Aerostructures performance. The Group is solid and sustainable in the long term, with the ability to seize future growth opportunities” commented Leonardo's outgoing CEO Alessandro Profumo, who was replaced on 9 May by Roberto Cingolani.

Leonardo's board of directors appointed by the assembly held the day before met for the first time on 9 May under the chairmanship of Ambassador Stefano Pontecorvo.

The board of directors of the Italian defense and aerospace giant (30.2% controlled by the Treasury) voted diplomat Stefano Pontecorvo as president and appointed the former minister of ecological transition Roberto Cingolani as new managing director and general manager. With regard to Leonardo's new top management structure, the board has conferred on CEO Cingolani all the related powers for the management of the company and the group, with the exclusion of specific powers that the board, in addition to those that cannot be delegated by law, has reserved for its jurisdiction. The board also approved the establishment, from 1 June 2023, of the new Business & Operations General Management assigned to Lorenzo Mariani with the role of co-managing director.

A sort of triumvirate for Leonardo's leadership with Mariani as co-director general, or "three-way governance" as the Republic defines it.

And with two new managing directors (Cingolani and Mariani), the departure of the previous general manager Lucio Valerio Cioffi was almost obvious. On 11 May, the company in Piazza Monte Grappa communicated that, “following the new organizational reorganization announced at the outcome of the Board of Directors held on 9 May 2023, which revoked the powers attributed to Ing. Lucio Valerio Cioffi as General Manager, the Company and Ing. Cioffi himself have identified a consensual solution for a progressive exit path” from the group.

Below are the details on the performance of the individual sectors as shown in the press release on Leonardo's first quarter 2023 accounts:

THE EXCELLENT COMMERCIAL PERFORMANCE FOR LEONARDO'S HELICOPTER SECTOR CONTINUES

The Sector continues to show an excellent commercial performance, highlighting a particularly significant increase in Orders compared to the same period of 2022. If we exclude the reduction in pass-through volumes, Revenues are up compared to the first quarter of 2022, with a substantially aligned profitability. During the period, deliveries of n. 28 new helicopters compared to the n. 19 recorded in the first quarter of 2022. New orders: up about 120% due to higher acquisitions in both the Government and Commercial fields.

Among the main acquisitions of the period, the Piazza Monte Grappa company reports: contract, signed as part of the amendment to the Italy-Austria Government-to-Government (G2G) Agreement signed last December 2022, for the supply of additional n . 18 AW169M LUH (Light Utility Helicopter) helicopters for the Austrian Ministry of Defence; the contracts for the Mid Life Upgrade (MLU) of 3 AW159 helicopters and n. 2 AW101 helicopters for export customers; the contract with Boeing for the supply of 13 helicopters relating to the start of the production phase of the MH-139 program for the US Air Force; various orders, mainly related to AW139 in the Commercial area Revenues: slight decrease due to the lower contribution from the NH90 Qatar programme, as planned. EBITA: slightly up on Q1 2022.

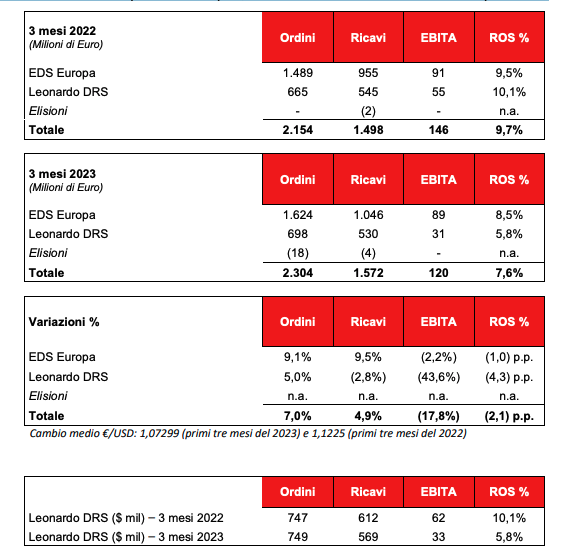

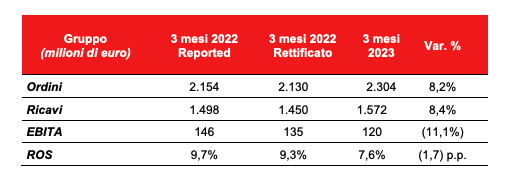

GROWTH IN ALL AREAS OF THE DEFENSE AND SECURITY ELECTRONICS SEGMENT

The first quarter of the year is characterized by a growing commercial performance in all business areas. The volume of revenues also recorded an increase in the European component. Profitability in line in the European component, while DRS is affected by the different production mix:

As noted previously, Q1 2022 data includes the contribution from the GES business and does not include Hensoldt's Q1 results. The sector indicators, adjusted for the comparative period, are therefore shown below:

Orders: Growing in all business areas, despite the different reference perimeter. Among the main acquisitions of the period we highlight the order for the supply of command posts on tents for the Brigade and Regiment for the Italian Army which falls within the scope of the broader program for the modernization of terrestrial multi-domain C2 Capacities in order to guarantee the aforementioned drives a modern, highly modular C2 capability for effective deployment across the full spectrum of Multi-Domain Operations. In the export field, we note the order for the supply of defense systems that will equip the OPV class vessels for the Philippine Navy and related logistical support.

For the Cyber Division, mention is made of the order for the establishment of the Joint Operation Center (JOC) of the Joint Operational Command of the Joint Forces (COVI) of Defense, through the setting up of Operations Rooms and Data Centers and the development of Joint Common Operational functions Picture (JCOP), Political Military Economic Social Information Infrastructure (PMESII) and Information Knowledge Management (IKM). Leonardo DRS, as part of the broader Ohio-submarine class Replacement Program (ORP), has received an additional order for the supply of integrated electric propulsion components for the new generation Columbia-class submarine for the United States Navy. Furthermore, we highlight the additional orders for the supply of infrared countermeasures for the protection of the rotary and tilt wing platforms, from the threats of infrared weapon systems, supplied to the armed forces of the United States.

Revenues: growing volumes in the EDS Europe component. Leonardo DRS volumes are down slightly mainly due to the different reference perimeter (last year the perimeter recorded the exit of the GES business which took place in August). Excluding this effect, the volumes of the subsidiary are substantially in line with the first quarter of 2022 (+6.6% on the figure Adjusted in Euro).

EBITA: in line in all the main business areas of the EDS Europe component. In DRS, there was a decline in profitability compared to the first quarter of 2022, which had benefited in particular from a favorable business mix and the lower absorption of fixed costs in the period.

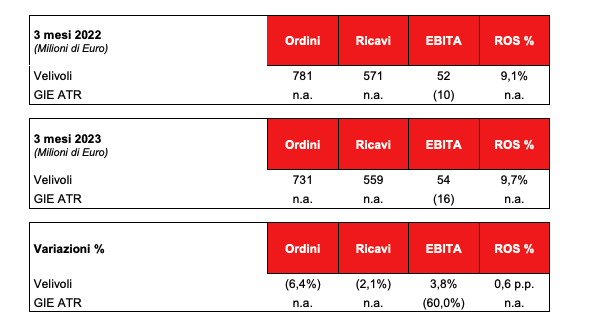

LEONARDO'S AIRCRAFT SECTOR CONFIRMS HIGH PROFITABILITY OF THE MILITARY BUSINESS

The GIE-ATR consortium – while confirming the deliveries made in the same period of 2022 – shows a decline in profitability. From a production point of view: • for the military programs of the Aircraft Division, no. 10 wings for the F-35 program (n.11 wings and 2 final assy delivered in Q1 2022). It should also be noted that 2 Typhoon aircraft were accepted in Kuwait at the Caselle plant compared to the 2 deliveries in 2022; • for the GIE there are 2 deliveries, in line with what was finalized in 2022.

Orders: the Aircraft Division recorded lower orders than the same period of 2022, which benefited from the important order for the first design phase of the Euromale remotely piloted aircraft system. In 2023 there were orders for the logistics component of the EFA, for two special version ATR aircraft and the anticipation of orders for the JSF programme.

Revenues: slightly down due to lower production volumes for the Kuwait programme.

EBITA: down due to the lower contribution from the GIE-ATR consortium. In particular: the high level of profitability was confirmed for the Aircraft Division, mainly supported by the international Typhoon programmes; the GIE-ATR consortium records a lower result than that of 2022 due to the slowdowns in the supply chain and in the different mix of deliveries made.

IMPROVE THE AEROSTRUCTURES DIVISION

Aerostructures confirm the improvement trend already recorded starting from 2022. In particular, there is an increase in production loads which reduce the effect of saturation of the Grottaglie site.

From a production point of view, n. 10 fuselage sections and n. 8 stabilizers for the B787 program (3 fuselages and 3 stabilizers delivered in 2022) and n. 6 fuselage deliveries for the ATR program (#2 in 2022). Orders: the sector shows an increase compared to last year, benefiting from orders from the customer Boeing for the B787 program. The demand in programs with customers GIE-ATR and Airbus was substantially stable.

Revenues: growing, thanks to higher deliveries to the GIE ATR consortium and the B787 programme.

EBITA: the profitability of the sector is positively affected by the reduction of unsaturation of the production sites, in particular Grottaglie.

THE SPACE SECTOR DOWN IN THE FIRST QUARTER OF 2023

Finally, the first quarter of 2023 shows a downturn due to the operating performance of the manufacturing segment, which in this phase is discounting a higher volume of research and development activities. The satellite services segment, on the other hand, confirms the positive trend, with growing results compared to the first quarter of 2022.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/leonardo-ecco-cosa-lascia-profumo-a-cingolani-su-elicotteri-elettronica-aeronautica-e-spazio/ on Mon, 22 May 2023 05:52:58 +0000.