Military export, Leonardo and Fincantieri continue the climb. Sipri reports

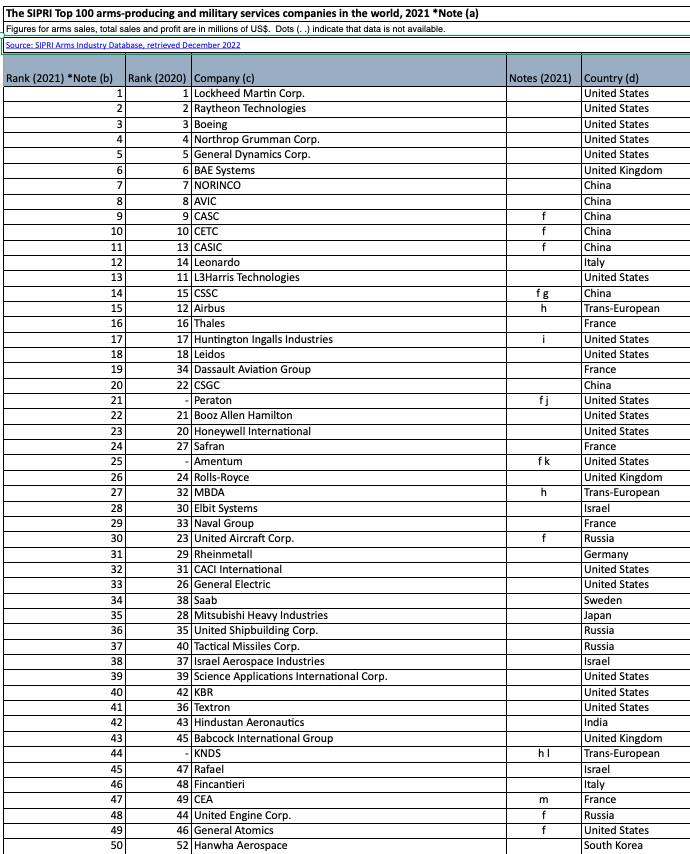

Leonardo stands out in the top 100 arms manufacturers drawn up by the independent Swedish institute Sipri, gaining 12th position. Fincantieri's share is also growing (from 48th to 46th place). All the details

Leonardo tops the world ranking of military sales drawn up by the independent Swedish institute Sipri.

According to data collected by Sipri from open sources, the Italian defense and aerospace giant achieved sales of approximately 13.9 billion in 2021 with an increase of 18% on the previous year, reaching 12th place in the world ranking of the top 100 ( 14th position in 2020). Fincantieri also climbs positions (from 48th place in 2020 to 46th) with an increase in sales of 5.9% to 2.98 billion dollars (36% of total revenues).

In the ranking of the top 100 world manufacturers of 2021 it is led by the US Lockheed Martin , followed by the Americans Raytheon, Boeing, Northrop Grumman, General Dynamics. But the institute also records the rise of Chinese companies, which grew by 6.3 percent in one year.

Worldwide arms sales last year, despite supply chain difficulties, grew by 1.9% to $592 billion. Even if the increase is lower than what was recorded before the pandemic.

Furthermore, Sipri observes that the Russian invasion of Ukraine last February has added new challenges to that of the supply chain for companies in the sector, also because Russia is an important supplier of raw materials used in the production of weapons. That could hamper ongoing efforts in the United States and Europe to bolster their militaries and replenish their stockpiles after sending billions of dollars worth of munitions and other equipment to Ukraine, according to analysts at the Swedish institute.

All the details.

JUMP IN MILITARY SALES IN 2021

Revenue of the top 100 global defense companies increased in 2021 by 1.9% year-over-year to $592 billion. This is what emerges from new data released by the Stockholm International Peace Research Institute (SIPRI). The increase marked the seventh consecutive year of global growth in arms sales.

However, although the 2020-2021 growth rate is higher than that of 2019-2020 (1.%), this remains lower than the average of the four years preceding the Covid-19 pandemic (3.7%).

The critical issues in the supply chains and the shortages in the offer have had an impact on the sector, which have slowed down production together with the lack of manpower, high inflation and postponed or canceled contracts. Now, due to Russia's war against Ukraine, the demand for armaments is on the rise, but supply chain problems continue to weigh on the defense sector, SIPRI underlines.

US COLOSSES DOMINATE THE TOP 100

US companies confirm their leadership in the sector, with a 51% share. For Chinese and German companies, the figure is 18 and 1.6%, respectively. As of 2018, the top five companies in the Top 100 are all based in the United States. Even in 2021 US giants dominate the Top 100, but sales are declining, Sipri reports. In 2021, the arms sales of the 40 US companies on the list totaled $299 billion.

HOW EUROPEAN COMPANIES DO IT

As of 2021, 27 of the companies included in the Top 100 are based in Europe. Total arms sales increased by 4.2% from 2020 to $123 billion. “For 2021, the majority of European military aerospace companies reported losses attributed to supply chain disruptions,” said Lorenzo Scarazzato, researcher of the Military Expenditure and Arms Production program at SIPRI. Dassault Aviation Group is bucking the trend with respect to the military aerospace sector (from 34th place it leaps to 19th). In 2021, the company's arms sales reached $6.3 billion, up 59%, thanks to deliveries of 25 Rafale fighter jets.

The Mbda consortium (in which Leonardo participates) also rises. In 2021, the European missile group earned 27th place in the ranking (from 32nd in 2020), with arms sales of $4.96 billion (99% of total revenues) up 15% on the previous year. Instead, Airbus collapses, down to 15th place (compared to 12th in 2020) with sales of 10.85 billion (-15%).

LEONARDO AND FINCANTIERI CONTINUE TO SCALE POSITIONS

As mentioned at the beginning, the Italian Leonardo is 12th and has gained two places with a military turnover of about 13.9 billion dollars. Leonardo's arms sales, according to the institute's calculations, represent 83% of total revenues. “However, the state-owned company's business is focused on helicopters and the Eurofighter interceptor, which do not appear to be among the priorities of tomorrow” observes Repubblica .

Even the Italian shipbuilding group continues its climb in the ranking. If in 2020 Fincantieri had made a leap from 55th to 48th position, in 2021 it will reach 46th position with an increase in sales of 5.9% to 2.98 billion dollars (36% of total revenues).

THE SPRINT OF CHINESE COMPANIES

Moving to the Asian continent, Chinese companies lead the rapid growth in arms sales: the eight Chinese arms companies on the list had total arms sales of $109 billion, an increase of 6.3%. According to Sipri, the combined arms sales of the 21 companies in Asia and Oceania included in the Top 100 reached $136 billion in 2021, 5.8% more than in 2020. “There has been a wave of consolidation in the industry arms market since the mid-2010s,” said Xiao Liang, a researcher in the Stockholm-based institute's Military Expenditure and Arms Production program. "In 2021 this saw Chinese company CSSC become the world's largest military shipbuilder, with arms sales of $11.1 billion, after the merger between two pre-existing companies."

THE CHALLENGE OF THE SUPPLY CHAIN (AND THE RUSSIA-UKRAINE WAR)

Finally, the demand for arms is experiencing strong growth this year and “We could have seen an even sharper increase in arms sales in 2021, were it not for the persistent supply chain problems,” highlighted Lucie Béraud- Sudreau, Director of the Military Expenditure and Arms Production program at SIPRI.

“The Russian invasion of Ukraine in February 2022 has added to supply chain challenges for the arms industry, as Russia is a major supplier of raw materials needed for manufacturing. This could hamper ongoing efforts in the United States and Europe to strengthen armed forces and replenish stockpiles after sending billions of dollars worth of munitions and other equipment to Ukraine. "Increasing production takes time," stressed Diego Lopes da Silva, senior researcher at SIPRI. “If supply chain disruptions continue, it could take several years for some major arms makers to meet the new demand created by the war in Ukraine.”

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/export-militare-leonardo-e-fincantieri-continuano-la-scalata-report-sipri/ on Wed, 07 Dec 2022 14:25:43 +0000.