NgEu, here are the ends and limits for the Pnrr

The analysis by Prof. Francesco Vatalaro, Professor of Telecommunications at the Engineering Department of the “Mario Lucertini” Company of the University of Rome Tor Vergata

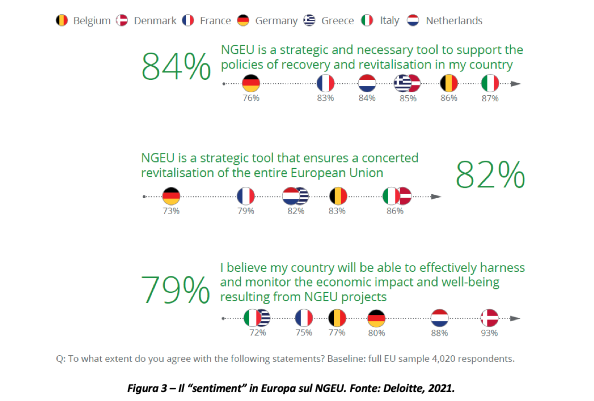

In the wake of the EU's change of course in the direction of greater levels of solidarity and a spirit of sharing among the Member States, albeit under the condition of establishing the introduction of strict controls on spending and on the reforms to be implemented, it was created among the European citizens a climate of trust and expectation on the usefulness of the economic plan launched by the European Commission. Recent market research carried out by Deloitte confirms widespread confidence among respondents in the ability of governments to make effective use of NGEU funds (Figure 3). [1]

More than eight out of ten EU citizens surveyed think the NGEU is a strategic and necessary tool to support the revitalization of both their country and the EU as a whole. It therefore seems evident that adherence to the extraordinary plan, the expectation that has been generated and the average degree of trust are now very high on the Continent.

When asked whether “ the NGEU is a strategic and necessary tool to support the recovery and revitalization policies of my country ”, in particular, 87% of the Italian respondents answered affirmatively, three percentage points above the European average. Furthermore, when asked whether " the NGEU is a strategic tool that ensures a revitalization of the whole European Union " 86% of Italian respondents answered yes, among the most optimistic in the Member States (four points above the European average) .

On the other hand, 72% of Italians answered affirmatively to the question whether " my country will be able to effectively exploit and monitor the economic impact and well-being deriving from NGEU projects ", down by as many as 14 points compared to the degree of trust on the instrument itself and, in this case, also placing itself below the European average of 79%, trailing by seven percentage points and among the lowest in the rankings. Therefore, even in the general climate of confidence following the approval of the economic measures, in Italy there is a certain degree of (relative) distrust on the country's ability to fully capitalize on investments in terms of economic growth and social well-being.

CRITICAL ANALYSIS OF THE INTERVENTION INSTRUMENT ADOPTED

In line with the general climate of confident expectation on the NGEU instrument (and in particular on the RRF), before we begin to see it actually in place, we can only make general assessments on the potential "pros" and "cons" that necessarily they will have to undergo a critical review based on the first results.

THE POTENTIALS TO BE EXPLOITED

The NGEU funding program represents a substantial financial intervention: the funds are aimed at strengthening three crucial pillars: digitization, innovation and sustainability. The European Commission is confident that these three pillars represent the essential foundations for building a prosperous Europe equipped with the necessary tools to ensure lasting growth. The plan pays attention not only to revitalizing the EU but also to bridging the gap between its most advanced and lagging national economies. It is evident, however, that the ability to regenerate economies after the COVID-19 pandemic should not be considered separately from a careful international comparison, between large continental blocs in competition, to establish Europe's ability to compete in the global arena one the recovery measures have been implemented, but at the moment there is insufficient data on this.

Some positive aspects of the European plan, at least on paper, are the following.

A first positive aspect consists in the possibility of launching large shared programs including that of promoting digitization on a European scale and that of sustainable innovation.

The drive towards increasing digitization will have to invest all sectors of European society: NGEU, the largest funding program ever implemented by the EU, creates a unique opportunity to bring growth and development everywhere. As it is set up, the plan aims to achieve the benefits of digitalization potentially in the areas and in the most difficult conditions (market failures), through tools that people should find accessible everywhere and easy to use.

The push towards sustainable innovation and the adoption of measures to mitigate the effects of climate change and environmental damage should also be considered favorably; however, it is necessary to implement them carefully to avoid waste and dangerous leaks forward in order not to penalize the European economy in a global context. Rather, it could be aimed at reaping benefits by aiming at the export of innovative solutions centered on “smart” and low-consumption digital technologies designed for environmental protection and sustainability.

Finally, another favorable aspect consists in the incentive for collaboration between the key actors of European society: public administration, universities, research centers, companies. Greater coordination between these actors will be important to ensure sustainability and stimulate innovation. The speed of innovation and economic-social-cultural change will depend on the extent to which organizations collaborate and integrate, through knowledge sharing and technology transfer initiatives to the market. The sharing of public administration data and, where possible, of private individuals themselves is the new frontier that can be reached by virtue of technologies such as artificial intelligence, big data analytics and internet of objects.

THE CONCERNS RELATED TO THE PLAN AND THE RISKS TO CONTAIN

If on the one hand it would be incorrect, and perhaps even unjustified, to fail to identify and appreciate the leap made by the EU – both in terms of a new and more sympathetic political direction and in preparing for the first time such a wide-ranging economic intervention – from other things can also be perplexed on the whole of the choices made. As the Cato Institute argues, [2] after examining the economic damage caused by COVID-19 in the United States: “ Growth policies will generally be needed to rebuild the economy. Nothing reduces poverty as much as economic growth, which is why policies that produce growth, such as lower taxes and less regulation, are the most effective anti-poverty programs . "

But this was not the approach given to the NGEU which does not seem to have started from the need to free the energies of the production system, especially today that precisely as a result of the pandemic, as we have seen above, private savings have skyrocketed. The European authorities underline the desire that the volume of public resources mobilized can generate a leverage effect on private investment, but there are reasons to believe that this will only be possible to a minimum, while this should have been the objective to be put at the center. political discussions and decisions of the Member States.

The objective could have been achieved more effectively through forms of tax incentives and deregulation and regulatory rationalization at both European and national level: [3] vice versa, it was preferred to build a "top-down" multi-year plan, managed centrally and assembled in a hurry, with the risk that Member States may have taken up projects never started before for reasons of low impact or dubious credibility (to better understand, " projects in the drawer "). To this is added the essential aspect of the European interventions that can be implemented in compliance with the founding treaties of the EU, in particular Art. 107 TFEU which prohibits state aid “ in any form that distort or threaten to distort competition by favoring certain companies or the production of certain goods ”, except for very limited exceptions. It is a principle, in its general abstractness, rational and acceptable in a standard economic regime but which, specifically of a recovery plan after a serious pandemic, requires investing the resources of the NGEU mostly in conditions of market failure. and, therefore, precisely where a virtuous economic operator could decide not to try even taking advantage of the facilitation provided by public funding.

There are also those who foresee that expectations may be disappointed for even more general economic reasons. Among them, the Bruno Leoni Institute (IBL) has carried out a shareable analysis of the NGEU plan which represents " a re- proposal of that combination of Keynesianism and welfare that we could define as social democratic and which has dominated the scene in the years since the end of Second World War in the mid-1970s ". [4]

More specifically, there are two critical elements to underline.

The first element is that " the possibility of predicting the consequences (…) of political decisions, currently claimed (at least implicitly) by the theory of economic policy, seems to be beyond the capabilities [of econometric models] ": in other words, the economic behaviors do not respond in a predictable way to the impulses given by governments, and therefore " the simulations that use econometric models cannot, in principle, provide useful information on the real consequences of alternative economic policies ". [5] We must therefore reject the ' hydraulic Keynesianism ' according to which the reactions of operators to economic policy measures can be predicted mechanically, since the conduct of economic operators depends on the changing context. Somaini writes that [6] " every concrete measure in the field of public spending or taxation is an element of a complex system of interactions between the political and economic spheres, in which the latter contributes to determining the former no less than this to turn face towards the second. Therefore, future interventions are unlikely to produce the effects experienced in different eras and contexts . "

The second element relates to the frequent overestimation of the effects of public spending. In fact, it cannot be said to be proven that it in general has a higher value than private spending, as it would be motivated by more far-sighted choices – for example regarding growth, respect for the environment, distributive equity, etc. In terms of growth, and therefore of investments, the superiority of the public solution can only be spoken of for investments that have a significant infrastructural nature, provided they are wisely committed, and for certain investments intended to produce public goods, by definition accessible to all. Private investments, on the other hand, are better able to meet the changing needs of the markets, strengthen the international competitiveness of companies and are usually more highly innovative in terms of the use of technologies and the provision of services.

In other words, if the PNRR had limited itself to making investments in public goods and infrastructures of proven economic and social value, even centrally managed by the public administration and totally financed with public funds, it would have been a shareable decision. Unfortunately, on the other hand, the PNRR consists of a long list of expenses that are almost never argued and therefore one can fear that they will often prove to be of dubious usefulness.

A related defect, also widely underlined, is that " it does not seem to consider the need to attract private capital as an integration of public resources through programs capable of accelerating virtuous forms of public-private partnership (PPP) " [7 ] , and where it also provides for it, it adopts mechanisms that are anything but incentive. The accumulated private savings, as we have seen, have never been so high but, unfortunately, it does not seem that there has been serious attention – neither in Europe nor in Italy – of how to stimulate their mobilization.

[1] Deloitte, “Next Generation EU funding and the future of Europe. A unique opportunity for growth ", October 2021.

[2] MD Tanner, “An Inclusive Post‐ COVID Recovery”, Cato Institute, September 15, 2020, https://www.cato.org/pandemics-policy/inclusive-post-covid-recovery

[3] It is well known that one component of the plan consists of the so-called "reforms": the national ones do not always aim at real simplifications and the problem of strong bureaucratization induced by European rules that are not called into question remains unsolved.

[4] Istituto Bruno Leoni, “PNRR and Keynesian hydraulics”, April 27, 2021.

[5] Robert E. Lucas, Jr., “Econometric Policy Evaluation: A Critique”, 1976.

[6] E. Somaini, “The socialism of the 21st century. The Return of 'Hydraulic Keynesianism'? ”, IBL Focus, 10 October 2015.

[7] V. Gamberale, S. Gatti, “Keynes is not enough, we need private capital and clear rules to attract them”, Il Sole 24 Ore, 26 May 2021.

(Second part, here for the first part)

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ngeu-ecco-fini-e-limiti-per-i-pnrr/ on Sat, 22 Jan 2022 07:41:06 +0000.