Poste, Gls, Brt and Ups: how is the postal market going. Agcom report

Poste, Gls, Brt, Ups and more: the mail and parcel market analyzed in the Agcom quarterly Observatory

The health crisis stops the growing trend in revenues from the postal service, a market still dominated, due to its historical presence, by Poste Italiane, according to what emerges from the Agcom quarterly observatory. Competition from GLS, BRT and UPS is growing.

Meanwhile, UBS reiterates the neutral rating on Poste, but claims that it is the most sensitive stock to potential news regarding new lockdowns.

All the details.

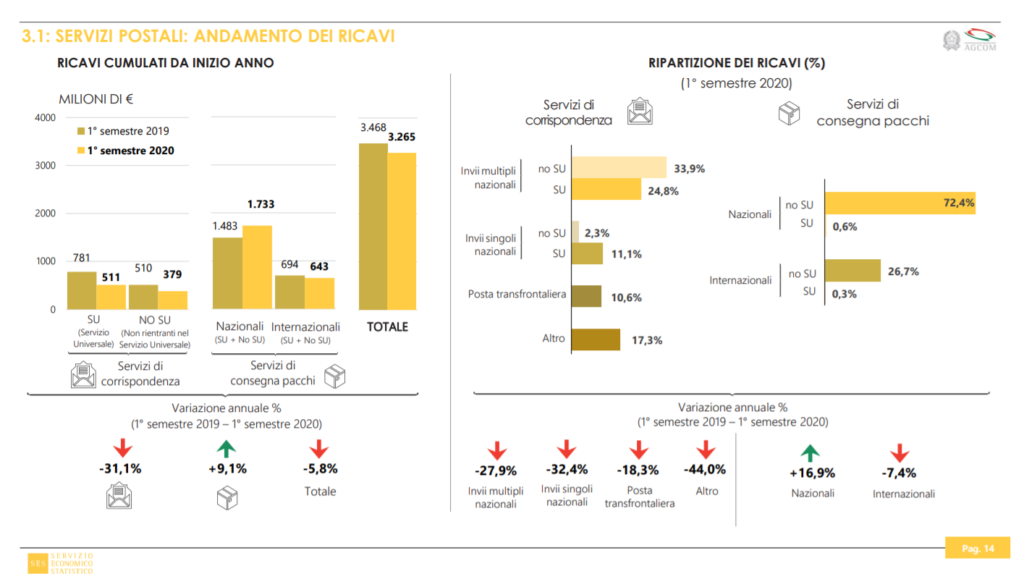

REVENUES

The numbers speak for themselves: in the first half of 2020, the overall revenues recorded in the postal sector decreased by 5.8% compared to the first half of last year. The negative sign is influenced by a 31.1% decrease in revenues from correspondence services. Parcel delivery revenues grew by more than 9% (with those from domestic shipments showing an increase of 16.9% and those from international shipments down 7.4%).

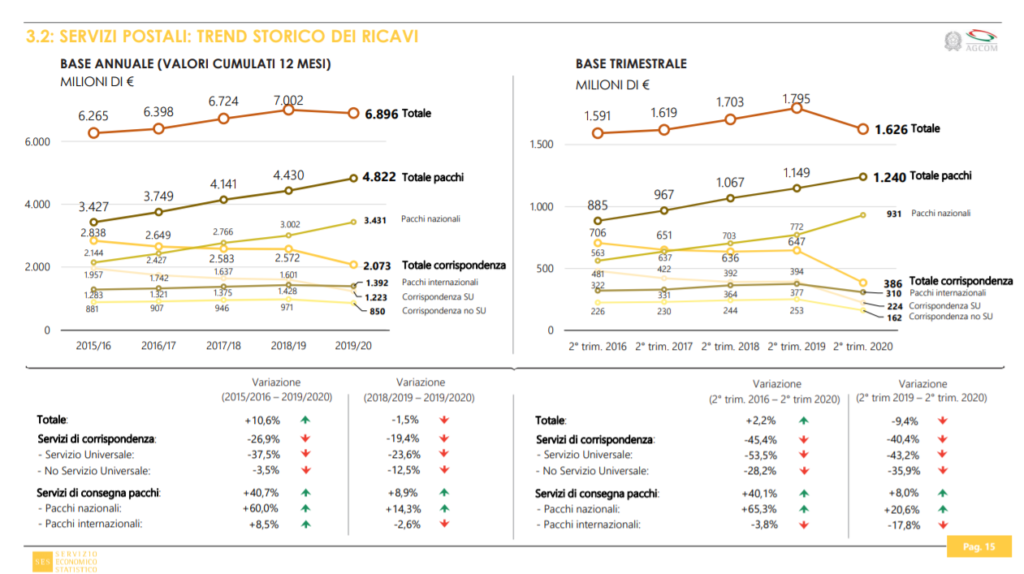

THE HISTORICAL TREND OF REVENUES

The historical trend of revenue growth stops: 6,896 million euros in 2019/2020, against 7002 million in 2018/2019. However, the figure remains higher than the € 6,724 million of 2017/2018.

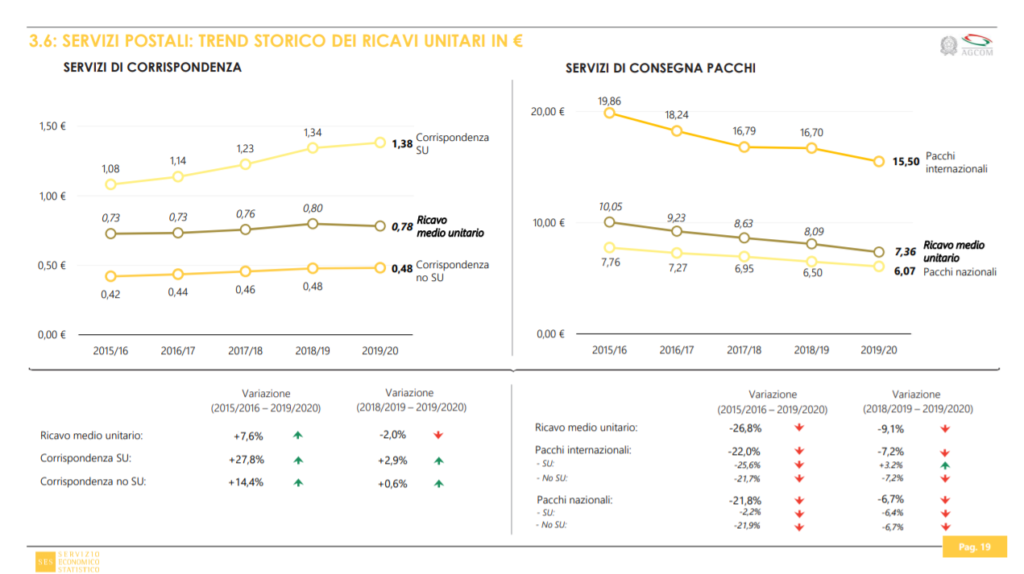

On an annual basis, the relative average unit revenues of correspondence services show a decrease of 2% while those relating to national and international parcel delivery services decreased by 6.7% and 7.2% respectively.

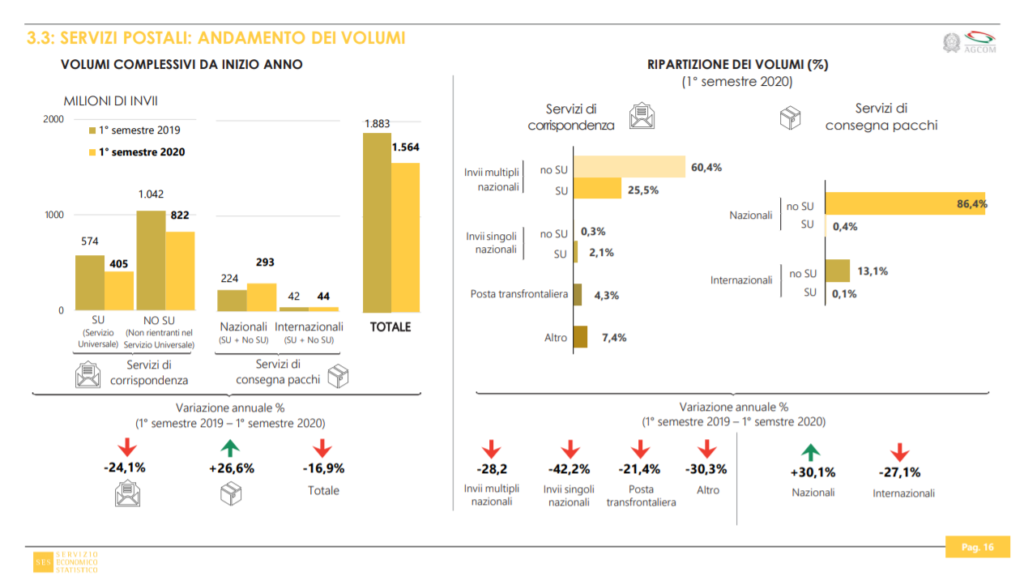

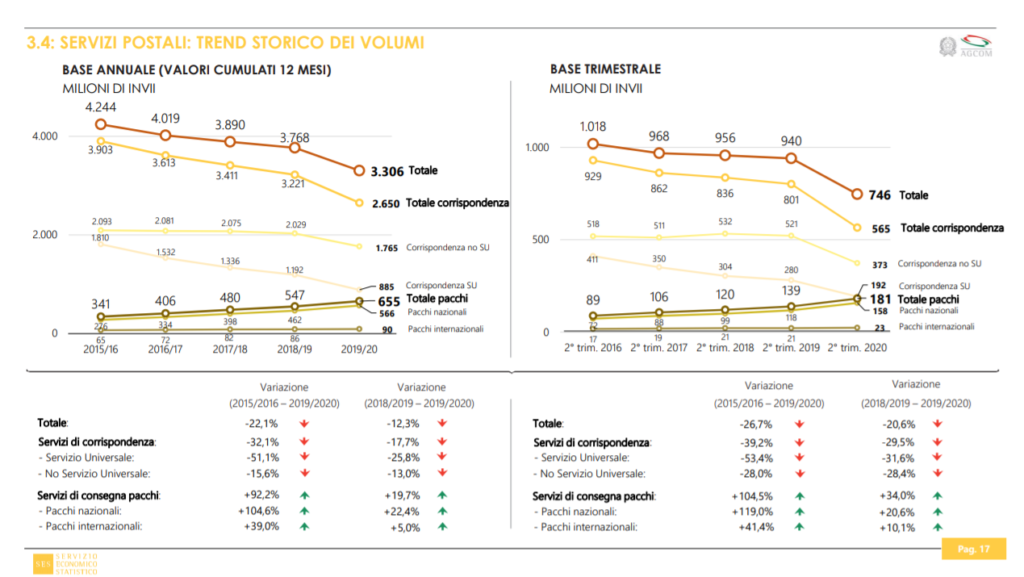

THE VOLUMES

The negative performance was affected by a decrease of 24.1 in volumes in correspondence services. The dynamics on the side of volumes, on the other hand, see a growth of 26.6% in the number of packages delivered.

SECTOR LEADING POSTS

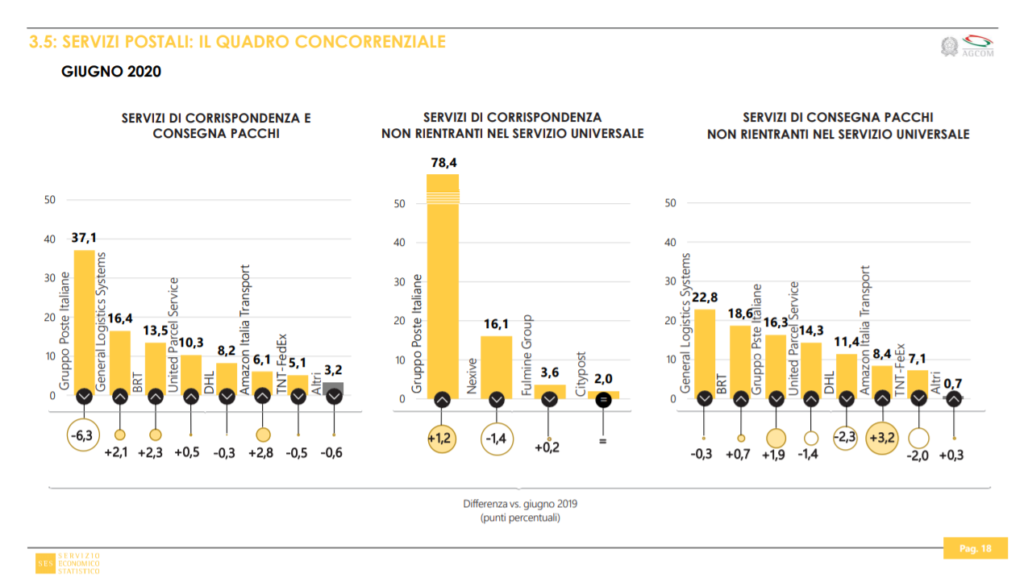

On the competition side, Poste Italiane, according to the Agcom report, remains the leader in the sector, confirming itself as the main operator with 37.1%, followed by GLS Italy (16.4%), Brt (13.5%) and Ups ( 10.3%).

Poste, however, saw its presence decrease by over 6%, with Gls and Brt increasing its presence on the market by over 2%.

UBS: POSTE

How much that less than 6% will weigh on the accounts of Poste Italiane? The board of directors of the company led by Matteo Del Fante will analyze the accounts for the third quarter of 2020 on 11 November.

The Swiss bank UBS, reports MF- Milano Finanza , confirms the neutral rating (with a target price of € 8.40) on the stock and believes that the company performed in line with what was expected in the third quarter, but that its balance sheet is the most sensitive about new lockdowns.

“We believe investors will seek greater visibility into postal volumes and revenues, the main obstacle in recent quarters. Furthermore, cost control is likely to continue to remain an area of concern given the challenging revenue environment, ”explains UBS. “Although we are 11% above the consensus estimates at the eps 2021 level and we see the stock trading at an attractive 2021 price / earnings multiple at 8x, visibility into future profits and losses remains limited as the business post office remains in difficulty, BTP yields at historic lows put net interest income under pressure and then the Poste balance sheet is the most sensitive, among the securities we cover, to potential news regarding new lockdowns ", added the bank Switzerland.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/poste-gls-brt-e-ups-come-va-il-mercato-postale-agcom/ on Mon, 26 Oct 2020 06:10:57 +0000.